Brett_Hondow

Atmos Energy Corporation (NYSE:ATO) is one of the largest regulated natural gas utilities in the United States, serving customers in multiple states throughout the central part of the nation. The utility sector in general has long been popular among conservative investors due to the financial stability of the companies in the sector. It is also a popular sector among income-seeking investors due to the high yields boasted by many of these firms. Atmos Energy is certainly included in this category as the stock yields 2.35% as of the time of writing, which is higher than many other things in the market. As of late though, electric utilities have proven to be much more popular among investors but this creates a very big opportunity that we will discuss in this article. This opportunity is purchasing shares of Atmos Energy, which currently boasts strong growth prospects, a very strong balance sheet, and an attractive valuation. In short, there is a lot to like here so let us investigate and see if Atmos Energy can be a good fit for your portfolio.

About Atmos Energy Corporation

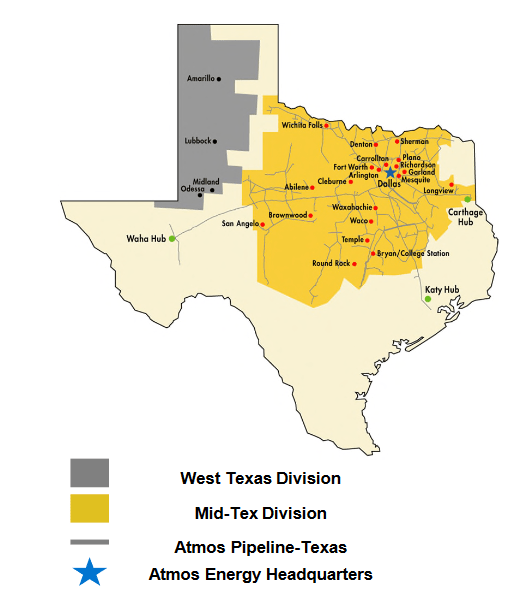

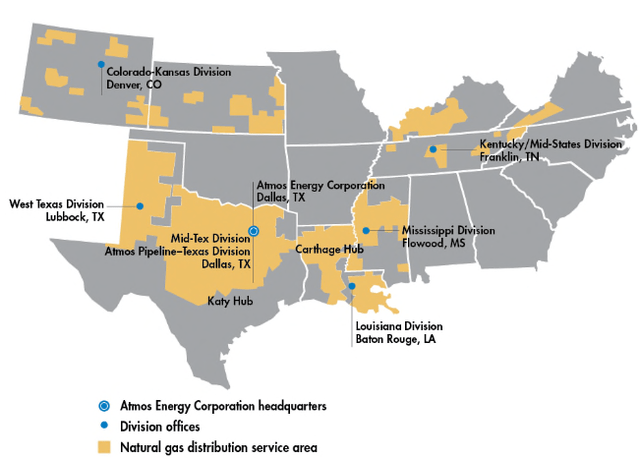

As mentioned in the introduction, Atmos Energy Corporation is one of the largest regulated natural gas utilities in the United States, serving approximately three million customers across eight states in the south-central part of the country:

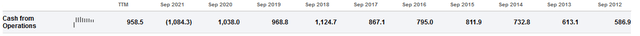

Admittedly, pure-play natural gas utilities do not enjoy nearly the same market attention that electric utilities do. This is likely due to the widely promoted belief that Atmos Energy and similar companies will become obsolete in the near future. As we will see later in this article, that is unlikely to be the case anytime soon. Unfortunately, though, Atmos Energy may not have the best service area for its product. This is because the primary use of utility-supplied natural gas is space heating and the states in which Atmos Energy operates are among the warmest ones in the continental United States. This certainly does not stop Atmos Energy from enjoying the general cash flow stability that investors typically appreciate in utility companies. We can see this stability by looking at the company’s annual operating cash flows over time:

(all figures in millions of U.S. dollars)

As we can clearly see here, Atmos Energy’s cash flows are remarkably consistent over time, although 2021 was an exception. We can overlook the company’s negative operating cash flows during that year though as they were caused by Winter Storm Uri, which was a once-in-a-century event. As that storm was severe enough to freeze natural gas pipelines and forced Atmos Energy to pay incredibly high prices for natural gas, is unlikely to occur again during our lifetimes, we can safely disregard it as a one-time problem. It should be somewhat obvious why Atmos Energy enjoys such remarkable cash flow stability. After all, the company provides a product that most people consider to be a necessity so they will likely prioritize paying their natural gas bills ahead of making discretionary purchases during times when money gets tight. This is a characteristic that may become increasingly attractive over the next several months since it now appears certain that the United States will soon be in a recession if it is not already. As many people have lower discretionary income during recessions than during strong economies, Atmos offers a more attractive proposition than a company that depends on discretionary spending.

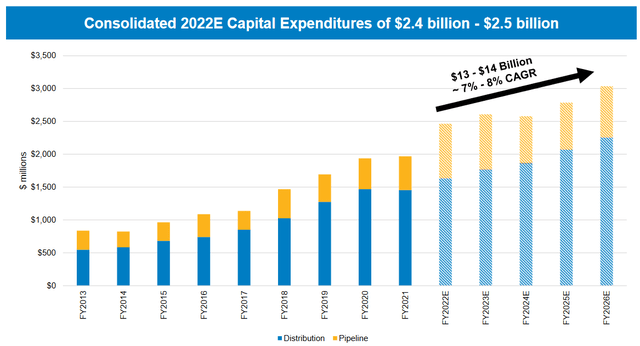

Another thing that we notice is that the company’s operating cash flows tend to grow over time. This is very nice to see since it is a critical factor that allows Atmos Energy to consistently grow its dividend over time. Fortunately, Atmos Energy is likely to be able to continue this streak going forward. Atmos Energy will accomplish this primarily by growing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return (9.8% on average in this case). As this rate of return is a percentage, any increase in the size of the company’s rate base allows it to increase the price that it charges its customers in order to earn that specified rate of return. The usual way that it will grow its rate base is by investing money into upgrading, modernizing, or possibly even expanding its utility infrastructure. Over the 2022 to 2026 period, Atmos Energy intends to do exactly this and will be investing $13 billion to $14 billion into its network:

This should be sufficient to allow Atmos Energy to grow its earnings per share at a 6% to 8% rate over the period. When we combine this with the company’s 2.35% dividend yield, investors should be able to generate a total return of 9% to 11% annually over the period, which is quite attractive for a conservative utility company.

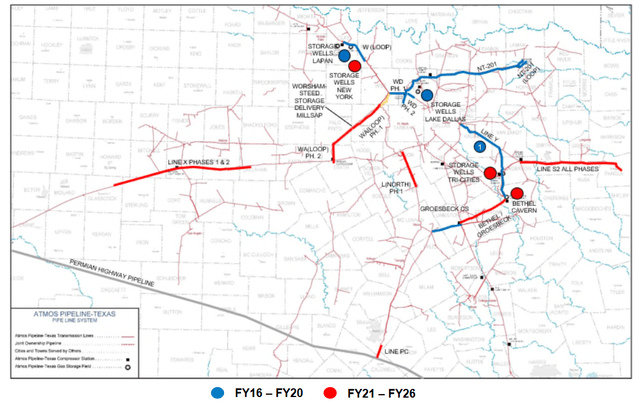

Atmos Energy only generates about 68% of its net income from its utility business. The remainder comes from a midstream business that the company operates in the state of Texas:

Atmos Energy Corporation

In total, the company’s midstream business owns and operates 5,700 miles of natural gas pipelines along with 46 billion cubic feet of storage capacity. The company’s ownership of this business might be concerning to the traditional risk-averse investors that might otherwise be interested in buying Atmos Energy. After all, we can all recall how the market prices of pretty much everything in the midstream sector collapsed alongside energy prices when the COVID-19 pandemic broke out. However, that poor market performance belies the actual fundamentals of the sector since these firms enjoy the same general stability that utilities do. Essentially, Atmos Energy enters into long-term (typically five to ten years in length) contracts with its customers under which Atmos will provide either pipeline transportation or storage of the customer’s natural gas. In exchange, the customer compensates Atmos Energy based on the volume of resources that Atmos handles, not on the value of the resources. This prevents Atmos Energy from being affected much by changes in resource prices, especially since the contracts specify a certain amount of resources that must be sent through the company’s infrastructure or the customer has to pay for that volume anyway. This, overall, gives the pipeline business the same type of cash flow stability that the utility business enjoys.

Atmos Energy has been fairly aggressively growing its pipeline business, which may be a move to capitalize on the fact that the rich Permian Basin has been suffering from insufficient takeaway capacity for quite some time. As we can see here, it has five major pipelines and three new storage facilities scheduled to come online over the 2021 to 2026 period:

The nice thing about these projects is that Atmos Energy has already obtained contracts from its customers for the use of this new capacity. This is nice because it ensures that Atmos is not spending a great deal of money to construct new infrastructure that nobody wants to use. Atmos also knows in advance exactly how profitable the project will be so it knows that it will earn a sufficient return to justify the investment. Admittedly though, Atmos has not divulged exactly how profitable any of these projects will be. However, the impact that they are expected to have on the company’s earnings is included in the total return figure that we calculated earlier. The fact that we see that at least some of the company’s growth is guaranteed by contracts that it already has increases our ability to be confident in those projections.

Fundamentals Of Natural Gas Utilities

As approximately 68% of Atmos Energy’s earnings come from its regulated natural gas utility, it makes some sense for us to take a look at the macroeconomic fundamentals of this business. The utility sector as a whole has been attracting a surprising amount of attention lately, including from young aggressive investors that would not normally be interested in such a low-growth sector. However, the overwhelming amount of this attention has been on electric utilities. In contrast, pure-play natural gas utilities like Atmos Energy have been almost completely neglected. This is likely due to the widespread belief in electrification, which has been heavily promoted by politicians, activists, and the media. At its core, electrification is the conversion of things that are historically powered by fossil fuels to the use of electricity instead. The two most commonly targeted areas for conversion are transportation (electric vehicles) and space heating but there are other things that could be converted as well. As space heating is the most common use of utility-supplied natural gas, the belief is that this transition will make companies like Atmos Energy obsolete.

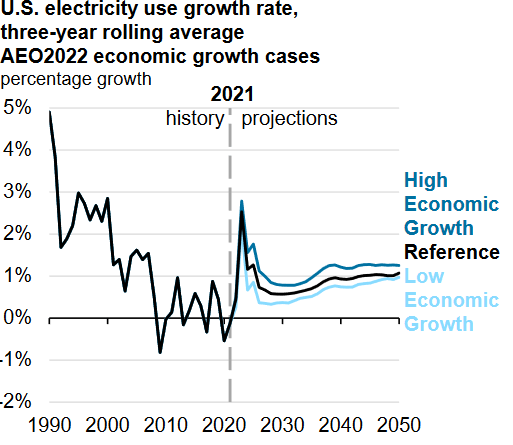

However, the United States Energy Information Administration does not believe that this trend will be anywhere near as powerful as its promoters do. According to the agency, the national consumption of electricity will only grow at a 1% to 2% rate over the next thirty years:

EIA 2022 Annual Energy Outlook

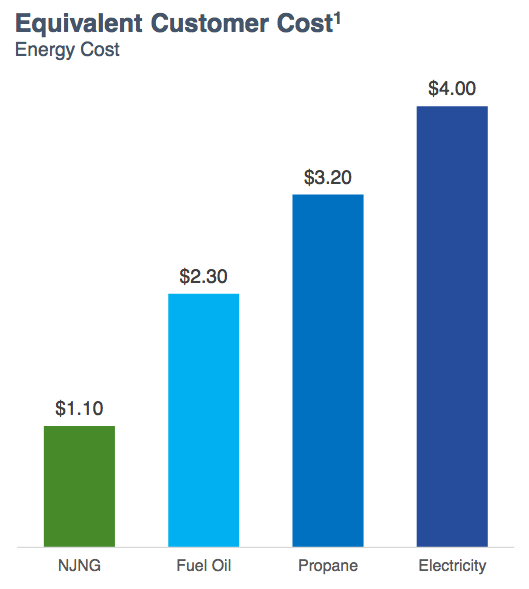

This is nowhere close to the consumption growth that would result if wide swathes of the economy were converted from fossil fuels to electricity. Indeed, I discussed the consumption increase that would be caused by electric cars alone in a previous article. There are quite a few reasons to believe that the agency is correct here, particularly when it comes to space heating. This is because fossil fuels are far more efficient at producing heat than electricity so they are considerably more affordable to use. In fact, it can cost nearly four times as much to heat a house with electricity as with natural gas:

New Jersey Resources/Data from EIA

It is highly unlikely that many people will be willing to have their heating costs go up to this degree simply to reduce their natural gas consumption. This is particularly true for people of limited means. While it might be possible to eventually overcome this problem through technology, that is obviously not expected to happen until after 2050. Overall then, there is little reason to believe that natural gas utilities will be rendered obsolete in the near future.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt to repay the maturing debt, which can cause the company’s interest costs to increase if it has too much debt. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a decline in cash flows could push the company into financial distress if it has too much debt. Although Atmos Energy has remarkably stable cash flows, bankruptcies are certainly not unheard of in the utility sector so this is still a risk that we should keep in mind.

One metric that we can use to evaluate a company’s debt load is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to equity. It also tells us the degree to which the company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of March 31, 2022, Atmos Energy Corporation had a net debt of $7.2666 billion compared to $8.9832 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.81, which is very impressive for a utility. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity |

| Atmos Energy Corporation | 0.81 |

| New Jersey Resources (NJR) | 1.56 |

| NiSource Inc. (NI) | 1.29 |

| South Jersey Industries (SJI) | 1.51 |

| Northwest Natural Holding (NWN) | 1.45 |

As we can clearly see, Atmos Energy is the only company on this list that has a lower debt load than it has equity to support that debt. This is something that is nice to see, particularly given that the company’s service area is not the best in the nation for a pure-play natural gas utility. This is because it greatly reduces the risks that the company will encounter financial distress in the event of some economic downturn. Overall, any conservative investor should appreciate this since there is minimal risk with regard to the company’s debt.

Dividend Analysis

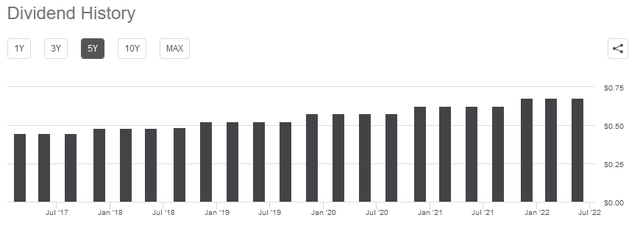

One of the biggest reasons that someone would invest in a company like Atmos Energy is because of the dividend that it pays out. Indeed, as of the time of writing, Atmos Energy yields 2.35% compared to the 1.52% yield of the S&P 500 index (SPY). The company also has a long history of consistently increasing its dividend every year:

The fact that the company is steadily growing its dividend is quite attractive during inflationary times, such as what the United States is going through today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that we receive from the company, which can make it feel as though we are constantly getting poorer and poorer. The fact that the company is steadily increasing the amount that it pays us helps to offset this effect and ensures that our standard of living can remain relatively steady. As is always the case though, it is critical that we analyze the company’s ability to afford the dividend that it pays out. After all, we do not want it to suddenly be forced to reverse course and cut the dividend since that would reduce our incomes and most likely cause the stock price to decline.

The usual way that we analyze a company’s ability to afford its dividend is by looking at its free cash flow. The free cash flow is the amount of money that is generated by the company’s ordinary operations that is left over after the company makes all necessary capital expenditures and pays all of its bills. This is therefore the money that it can use for things such as reducing debt, buying back stock, or paying a dividend. In the trailing twelve-month period, Atmos Energy reported a negative levered free cash flow of $3.3650 billion, which was obviously not enough to pay out any dividend. Nevertheless, the company actually paid out $348.5 million to its shareholders. This is something that will almost certainly be concerning to many readers.

However, it is not uncommon for a utility company like Atmos Energy to finance its capital expenditures through the issuance of debt and equity while using its operating cash flow to finance its dividend. This is due to the incredible expenses involved in constructing and maintaining utility-grade infrastructure. In the trailing twelve-month period, Atmos Energy reported an operating cash flow of $958.5 million. This was more than enough to cover the $348.5 million that the firm paid out in dividends with a significant amount of money left over to cover other expenses. Overall, the dividend is likely to be reasonably secure.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. One metric that we can use to value Atmos Energy is the price-to-earnings growth ratio, which is a modified version of the familiar price-to-earnings ratio that takes the company’s earnings per share growth into account. Generally, a price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings growth and vice versa. However, there are very few companies that have a ratio that is that low, particularly in a low-growth sector like Atmos Energy’s. Therefore, it will make the most sense to compare the company’s ratio against its peers to see which offers the most attractive relative valuation.

According to Zacks Investment Research, Atmos Energy will grow its earnings per share at a 7.36% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 2.78 at the current price. Here is how that compares to its peer group:

| Company | PEG Ratio |

| Atmos Energy | 2.78 |

| New Jersey Resources | 3.05 |

| NiSource Inc. | 2.76 |

| South Jersey Industries | NA |

| Northwest Natural Holding | 4.83 |

As we can see, Atmos Energy has nearly an identical ratio to NiSource Inc. and the two companies together have by far the lowest valuations of these pure-play natural gas utilities. This supports the statement that I made earlier in the introduction about the firm being very reasonably valued at the current price. Overall, investors appear to be getting a lot of value for their dollar today.

Conclusion

In conclusion, Atmos Energy Corporation appears to have a lot to offer. Although the company’s yield is not the highest in the sector, its projected total return should be more than sufficient to make up for this. The firm also offers one of the strongest balance sheets in the industry and a very attractive valuation. The fact that the company grows its dividend over time helps to combat the impact of inflation as well. Any investor would be wise to consider adding Atmos Energy to a portfolio today.

Be the first to comment