Seiya Tabuchi/iStock via Getty Images

There are companies that as much as you like them, you cannot justify paying the valuation at which they are trading. That is the case for us with Atlassian Corporation (NASDAQ:TEAM), which is a company we admire but find grossly overvalued.

For those that are not familiar with the company, Atlassian is the developer of several popular software tools, mainly for team collaboration. In fact Atlassian aims to “unleash the potential of teams” by improving planning, project management, and workflows. Atlassian’s original product is Jira, which was developed as a workflow solution for SW developers. Other popular software tools that Atlassian offers include Confluence, a collaboration tool, and Trello, an Agile planning tool.

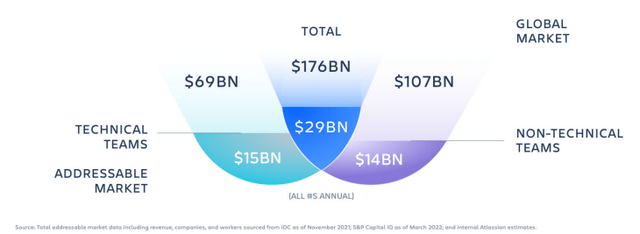

Addressable Market

Over 75% of the Fortune 500 use Atlassian products, and growth in its largest customer cohorts is outpacing overall revenue growth. The company believes its total addressable market is ~$29 billion, made up by about half from technical teams like software developers, and the other half from non-technical teams, such as HR, accounting, etc.

Atlassian Investor Presentation Atlassian Investor Presentation

Business Model

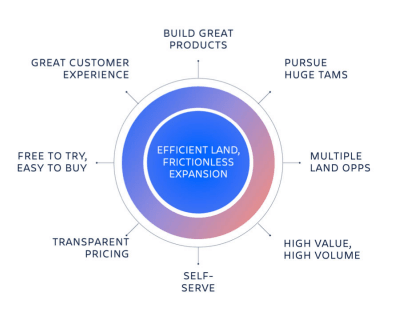

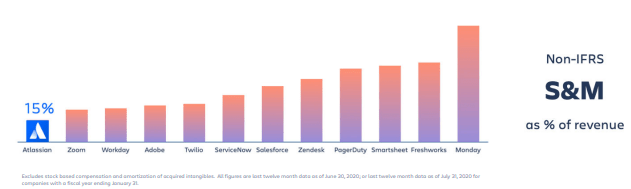

To target this market Atlassian makes use of a direct go-to-market strategy that favors low-cost self-serve options over having a traditional enterprise sales force. Thanks to this strategy its sales & marketing expenses are among the lowest among its enterprise software peers. The company believes that making a great product that is also easy to use is the best marketing, and that this drives word-of-mouth and viral adoption. In fact, Atlassian likes to say that they believe software should be bought, not sold. This belief drives their flywheel business model, which starts with more investment in R&D compared to their peers. Early on, rather than building out a traditional sales organization, Atlassian decided to invest in building a self-service purchase experience. By removing points of friction, Atlassian lands customers of all sizes at scale, having added over 50,000 net new customers in the past year alone.

Atlassian Investor Presentation

Another key part of Atlassian’s business strategy is to make products sticky. One way in which they accomplish this, for example, is by enabling integration with third-party tools and apps from the Atlassian Marketplace. When customers add at least one app or integration in Jira Software, for instance, dollar churn reduces by approximately half. That’s because integrations and apps create a network effect. With every new connection their products become further embedded in the customer’s workflows.

Financials

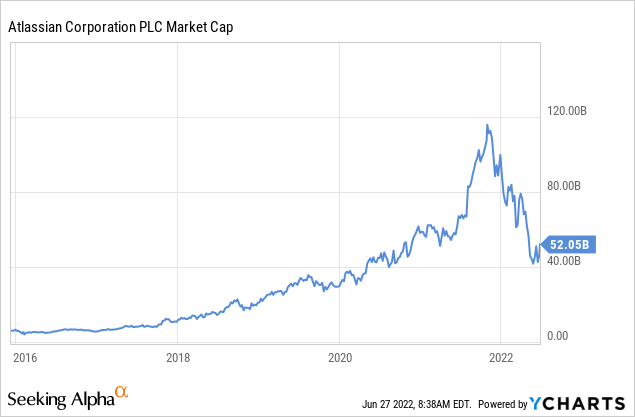

Atlassian is no longer a startup, it has a massive market capitalization of ~$52 billion. It is quite remarkable that this enormous valuation is being placed in just a handful of enterprise applications, as popular as they may be.

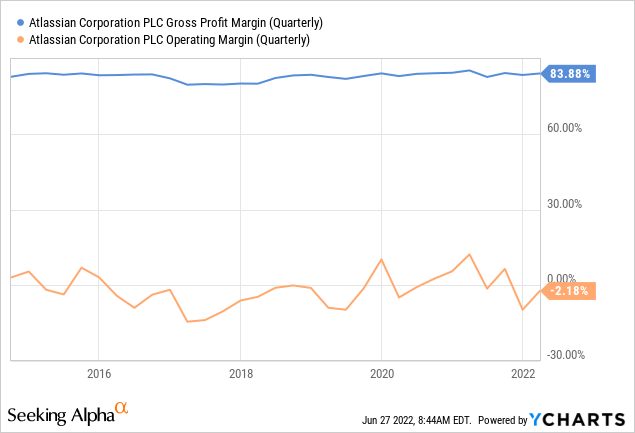

Atlassian has a very attractive gross profit margin of more than 80%, but despite of this it has shown relatively little operating leverage. There has been some operating leverage in general & administrative expenses, but sales & marketing and R&D have remained basically at the same percentage levels relative to revenue.

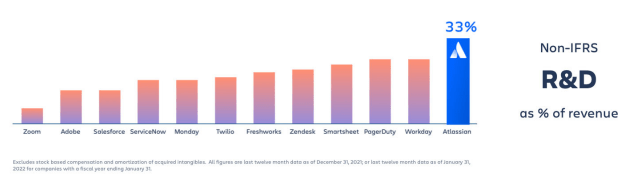

We admire that Atlassian is spending so much in R&D, and that is why we are optimistic that its growth rate will remain high for a long time. Compared to a group of its peers which includes Adobe (ADBE), Salesforce (CRM), and Zoom (ZM) among others, Atlassian is by far the company that spends the most in R&D as a percentage of revenue.

Atlassian Investor Presentation

The opposite is the case for sales & marketing, where Atlassian is the company with the lowest spending as a percentage of revenue of the entire group.

Atlassian Investor Presentation

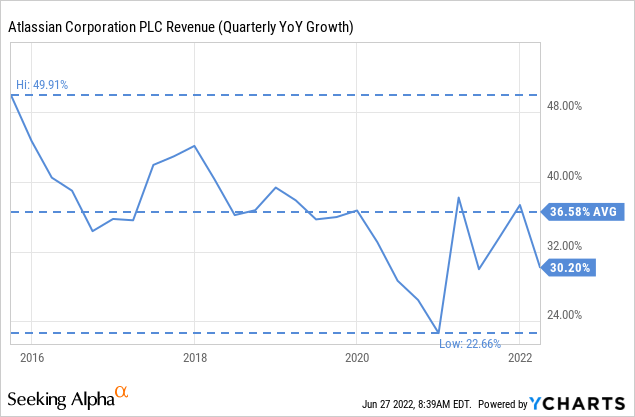

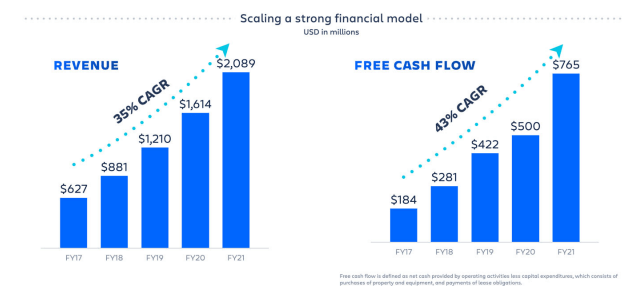

It is impressive that despite this low spending in sales & marketing, the company has still managed to deliver very attractive revenue growth rates. Since it went public, revenue growth has averaged ~36%, but has been a bit lower recently – closer to 30%.

Free cash flow has grown even a bit faster than revenue, with free cash flow growing at an impressive 43% CAGR. We would caution investors that we would subtract stock-based compensation from the free-cash flow numbers. Despite stock-based compensation being a non-cash expense, we believe it is a very real expense and should be considered when evaluating “owner earnings”.

Atlassian Investor Presentation

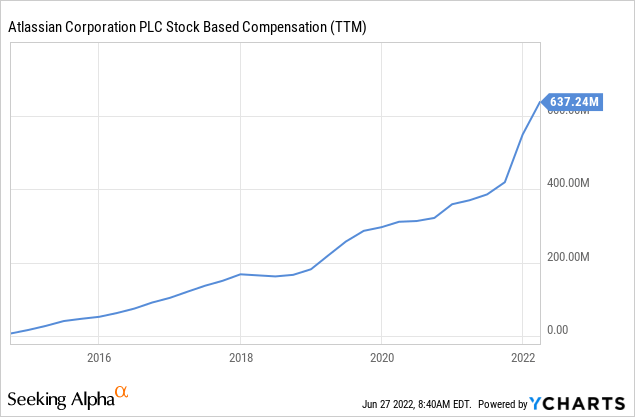

Unfortunately for Atlassian stock holders, stock based compensation has been incredibly high, reaching $637 million in the trailing twelve months. This would erase most of the free cash flow generated by the company for the last year if subtracted.

Valuation

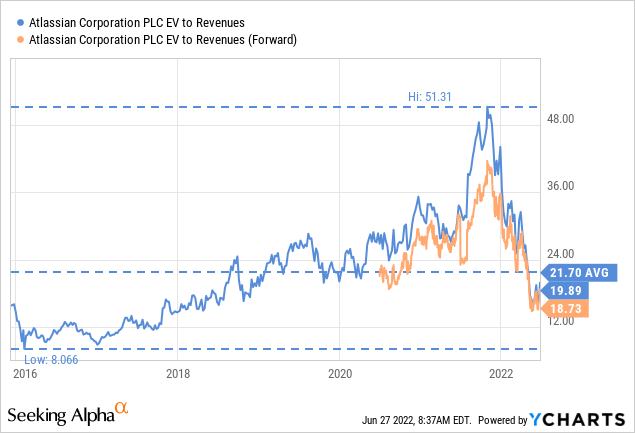

Despite the share price decline, shares are still trading at a very high EV/Revenues ratio. This is EV/Revenues, not EV/EBITDA. Investors are willing to pay about 20 times sales for the company, despite it no longer being a hyper-growth startup.

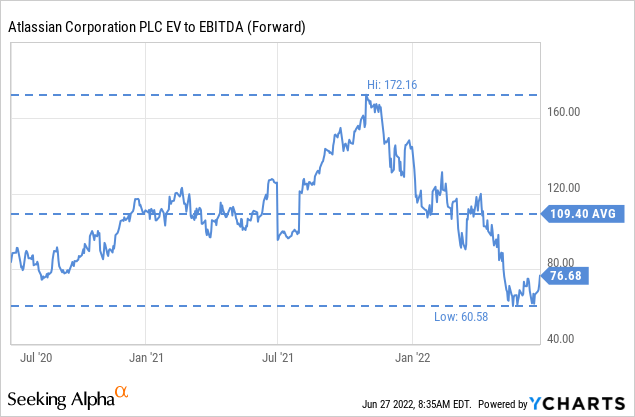

Forward EV/EBITDA is no longer in the triple digits, but still remains quite pricey at ~76x.

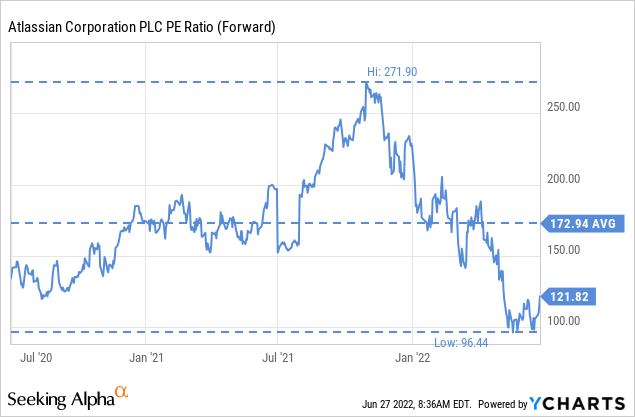

The same cannot be said about the price/earnings ratio, which even the forward P/E remains in the triple digits at ~121x.

Conclusion

We believe Atlassian has one of the strongest and most attractive business models in the enterprise software sector. That said, investors really have to pay up if they want to purchase the shares. With a forward P/E still in the triple digits, a market cap that exceeds $50 billion, and an EV/Revenues multiple close to 20x, we believe it is better to avoid the shares despite the attractiveness of the underlying business. Especially when considering the massive amounts of stock-based compensation. We’ll have to leave this one on the watch list, and we do not expect it to reach our ‘Buy’ price any time soon.

Be the first to comment