bombermoon

In this article, I examine the investment opportunities in Atlantica Sustainable Infrastructure plc (NASDAQ:NASDAQ:AY). It is an investment that should be on the radar of investors with an ESG or sustainability focus, as it is a relatively pure renewable energy play. Atlantica focuses on the acquisition and management of renewable energy sources. They have a mix of conventional power, as well as transmission infrastructure and water assets. Recent management moves have been to reduce debt, and they have been raising their dividend. Does this make Atlantica a worthwhile utilities investment at this price?

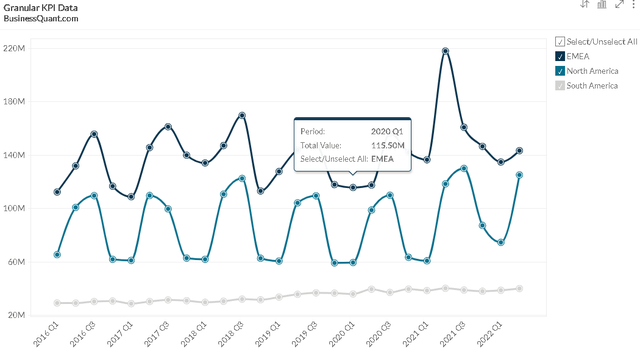

Atlantica benefits from reasonable diversification over its projects and geography. They focus primarily on North America and Europe, Middle East, and Africa (EMEA) region (Figure 1).

Figure 1. Atlantica Sustainable’s revenue by geography (BusinessQuant)

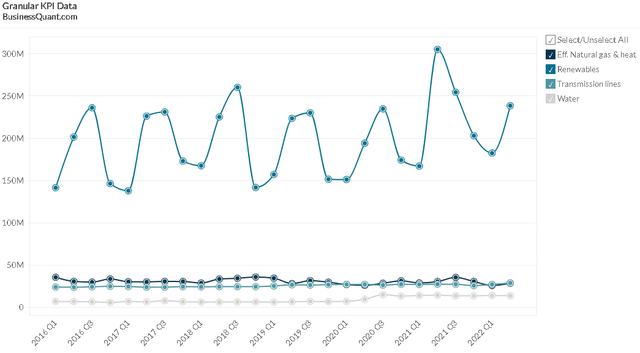

Atlantica Sustainable has other segments, despite the name suggesting an entire sustainability focus. However, as Figure 2 shows, most of the revenue and, therefore, the overall narrative for the company, is indeed in the renewables space.

Figure 2. Atlantica Sustainable’s revenue by segment showing the strength of renewables focus (BusinessQuant)

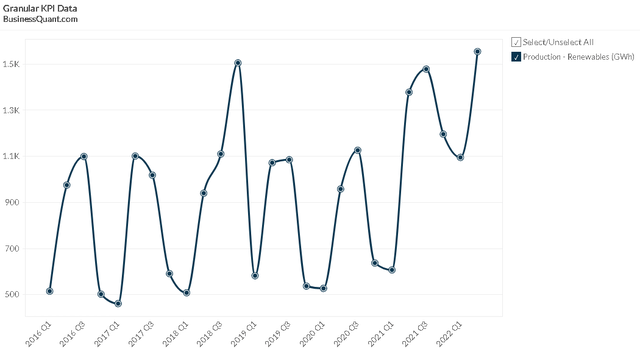

If this will be a play on long-term shifts to renewable energy, we would expect to see an increasing production in the Atlantica Renewables segment. Figure 3 shows the quarterly data from 2016, with the expected seasonal cycles but also showing a clear upward trend. It is also important to note that the increases in the first half of 2022 were substantially higher than in 2021 because of a recent acquisition.

Figure 3. Increasing renewables production levels at Atlantica Sustainable (BusinessQuant)

The Q2 2022 results were encouraging. The H1 2022 results showed that revenue in renewables was down 11%, while adjusted EBITDA was marginally improved by 1%. The overall margin, however, lifted from 63% to 71%. In both the North America and EMEA regions (the primary regions for Atlantica), margins improved.

Risks and challenges

There are several company-specific issues that I can identify, as well as wider sectoral trends.

For Atlantica Sustainable, I have identified:

- They carry a high level of intangibles on the balance sheet. This presents a valuation risk. They are about 4/5 of the company’s assets and I consider this to be high. However, I do note that they have been building up other assets and reducing this level over the last three years.

- Debt is always something to watch for Atlantica, as it is for many utilities. Atlantica has interest coverage hovering at just 1.0, which is not encouraging. However, Fitch affirmed the BB+ rating with Stable Rating Outlook, providing some confidence.

- The operating margin is reasonable, at 28.1% at the end of 2021. However, this has been declining since 2014, when it was 47% and, it held steady in the 40% range before the 2019 result of 46.1% at which point it dropped to 32.8% in 2020 before heading to 28.1% in 2021.

Wider macroeconomic risks are likely in the EMEA geographic region, such as the European states’ changing regulations. For example, Spain’s Royal Decree-Law 6/2022 is a collection of measures focused on the electricity industry that may impact prices. However, it also brings benefits, as it includes measures to enhance and speed up the application procedures for new renewable projects, which might make it easier for Atlantica to consider expanding in the region.

Things I like about Atlantica

On the flip side, it is not all negative and there are several attractive elements when looking at this utility firm. Atlantica has maintained a healthy current ratio of 2.1 and a quick ratio of 2.0. They have a Price /FCF of 8.0, which is reasonably valued (Source: Stock Rover).

The Q2 2022 earnings presentation notes the improvements in the debt load. Project debt was $4,501.8 million at the end of 2021 and had been lowered to $4,190.4 million by 30 June 2022. This was a rapid improvement in the debt position.

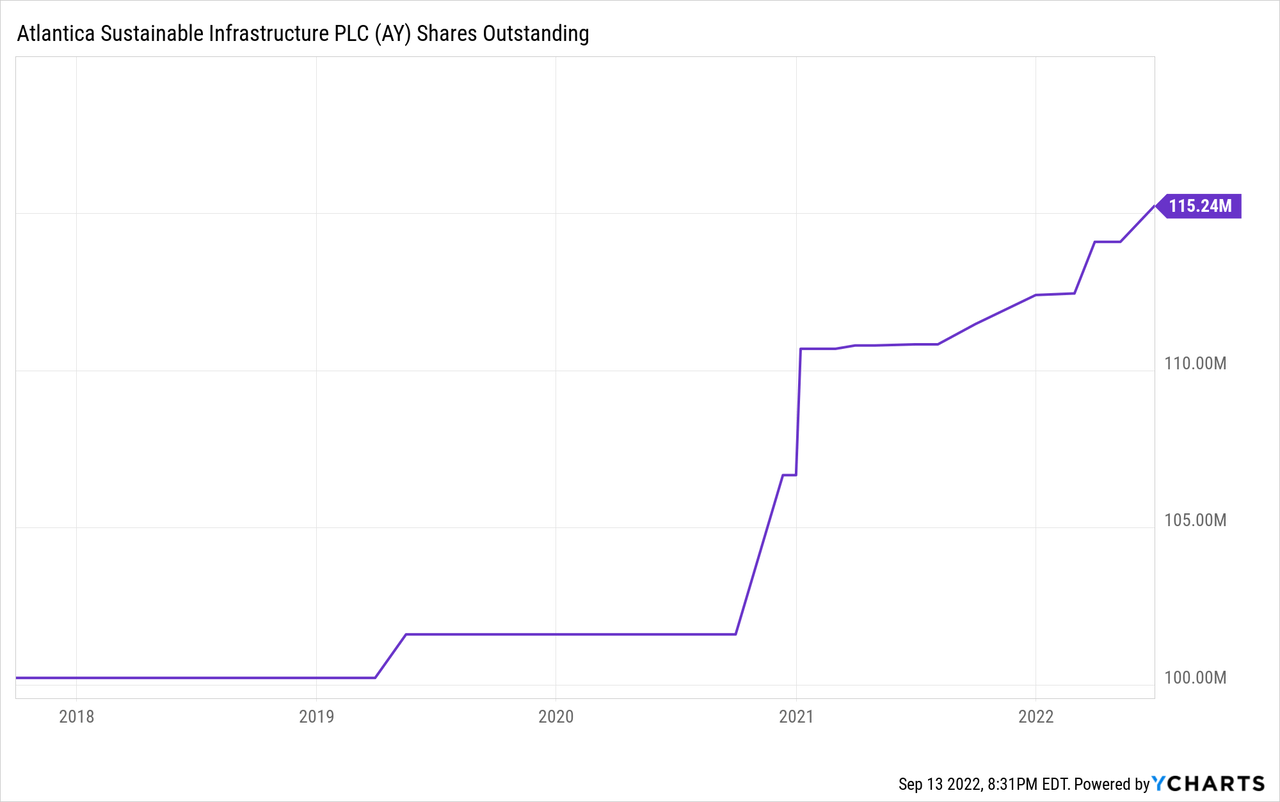

The cash available for distribution (or CAFD) lifted 6.7% YoY, while the CAFD per share lifted 4.0% YoY (Source: Q2 2022 results). There has been a significant expansion in the shares issued, particularly over the 2020-2021 period (Figure 4). While not unusual with a utility, this is something I monitor. The efforts being made to lower the debt levels should, over time, provide a buffer and allow the CAFD per share to increase.

Ultimately, they are most likely to be valued as a dividend-paying utility. In this respect, Atlantica has a forward dividend yield of 5.29% with a five-year DGR of 13.78%. This is strong and will be attractive to many investors. The Q2 2022 results also suggest that CAFD comfortably covers dividends.

The Q2 2022 earnings show that debt is also largely hedged and fixed, with 100% of the corporate debt and 93% of the project debt falling into this category, easing analysis and management and buffering against external shocks. The contracts also have some escalation factors built in, but not, perhaps, as much as I expected. 40% are indexed to inflation or based on inflation and 12% are fixed. This leaves 48% not indexed. So the company has some ability to manage the rising inflationary environment.

Fitch puts it this way (emphasis added):

Atlantica’s portfolio of assets produces stable, predictable cash flows underpinned by long-term contracts with a weighted average remaining contract life of 15 years. Most counterparties have strong investment-grade ratings. The contracts are typically fixed-price with annual escalation mechanisms. Atlantica’s portfolio does not bear material resource availability risk or commodity risk and does not depend on any single project for more than 15% of its project distributions.

Overall, Atlantica’s management has done an admirable job of managing the risk.

Valuation and opportunity

So there appear to be some challenges with Atlantica, but it has strong dividend payments and CAFD. We have seen that Atlantica has been working to reduce the debt load and expand its renewables. But we do not invest in the past – we need to look to the future.

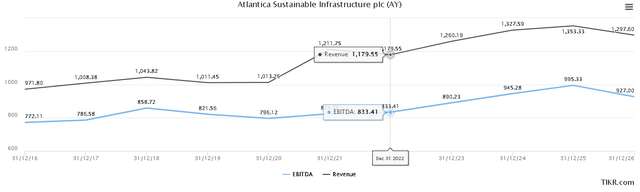

Analysts estimate some robust revenue and EBITDA growth in 2023 through to 2025 (Figure 5; the values on the left are historic values while the values on the right are estimates). This should enhance the vigor of Atlantica’s investments in new projects while also ensuring dividends continue.

Figure 5. Atlantica’s EBITDA and Revenue data for recent past and estimates for several years (TIKR Terminal)

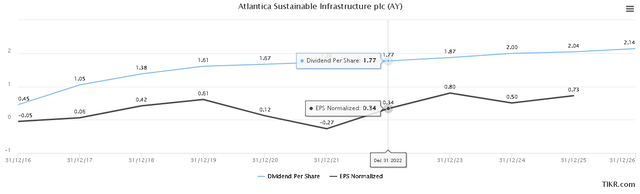

I like companies with rising EPS values and dividends. Figure 6 presents both historic and analysts’ estimates (beyond the 2022 value) for Atlantica. They estimate the dividends to continue rising, though at a steady rate. Analysts estimate the EPS values to mostly stabilize at a level higher than they are now.

Figure 6. Atlantica’s Dividends and earnings per share figures for past and estimates for future (TIKR Terminal)

This leaves me with the question, is there an upside to an investment at this price?

This is now a dividend play. Atlantica is facing a rising interest rates environment which may make debt more challenging to take on to finance further projects. It may limit them by how much they can grow revenue and squeeze out further dividends.

Given the relative increases in revenue forecasted (Figure 5), I’ve opted for a five-year discounted cash flow (“DCF”) Revenue-Exit model. I’ve used a conservative 10% for the discount rate and an exit multiple to revenue of 7.8x, which Atlantica has historically traded at 7.8x. However, I’ve looked at (BEP), (CWEN), (NEP), (OTCPK:BRLXF), (OTCPK:NPIFF), (OTCPK:TRSWF), and (OTCPK:ALRCF) and taken their average EV/Revenue (LTM) multiples as 10.7x, with quite a wide range of 7.3x to 16.7x. I feel that my use of an 7.8x exit multiple for Atlantica is, therefore, conservative, and lower than the peers. The fair value from this DCF computation is $38.98, suggesting an upside of about 17%.

I note that this fair value estimate provides an outcome that is comparable to analysts’ price targets shown on the TIKR Terminal, with the most recent mean target of $37.45. The targets have been dropping from 30 June 2021 with a mean target of $43.60 through to the mean target on 12 September 2022 of $37.45, with a tight range from $35 to $43. Two analysts give it Buy, one an Outperform, and eight a Hold.

While Figure 5 suggests an expansion of future revenues and EBITDA, the debt and the environment facing Atlantica are changing, particularly with uncertainties in Europe and how electric utilities and prices may continue to be regulated there. A counterpoint to regulating prices may be that the market extends a greater premium to renewable producers like Atlantica, which would present greater upside potential as it presently appears to be trading at an EV/Revenue multiple lower than peers.

Thesis and thoughts

Atlantica Sustainable has successfully grown its business and is now reducing debt levels while continuing its investments. The focus on growth and debt reduction is admirable, and the continued BB+ credit rating from Fitch is encouraging.

I see Atlantica Sustainable as a dividend play that will interest investors with a strong sustainability or ESG focus. It is a company to watch.

But is it a buy at this price?

I believe there is an opportunity for downward pressure, as there is no substantial margin of safety at these prices. Further, I pause when I see analysts’ price targets barely above the present price; given analysts’ eternal optimism, I might expect to see their targets higher if Atlantica was in value territory.

Given that renewables seem to have a greater premium than Atlantica does, this suggests some upside here. The dividend is attractive and should continue to grow. The efforts at diversification in geography and projects and the efforts to reduce debt increase the opportunity here, with changes being made in the directions that address my concerns.

For these reasons, I rate Atlantica Sustainable as a tentative Buy at this price. However, recognize that Atlantica is not in deep value territory and assess whether it fits your risk profile and represents a good fit with your portfolio.

Thank you for taking the time to read this analysis. Let me know if you have questions or if there are any other companies you think I should examine.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment