zavatskiy

While the Volkswagen (OTCPK:VWAGY) board approved the Porsche maxi IPO, Aston Martin Lagonda Global Holdings plc (OTCPK:AMGDF) launched a capital increase at a maxi discount. Both of these operations are carried out under difficult market momentum, however, for the British luxury car manufacturer, this was one of the last chances to survive.

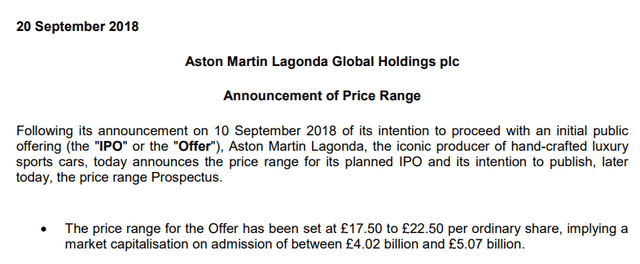

Our internal team still remembers Aston Martin IPO details with a price range between £17.5 and £22.5, valuing the entity at a market cap of more than £4 billion.

AM IPO details

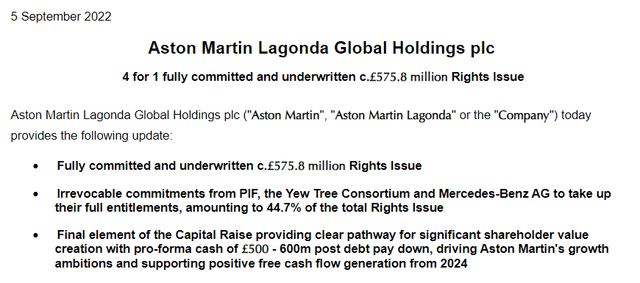

Almost four years later, the company announced a £575.8 million capital increase. In the last three years, three different shareholders have taken turns at the helm of the car manufacturer. Firstly, it was the time of the Italian investment fund called Investindustrial which then passed the hand to the Canadian Formula One tycoon Lawrence Stroll that is the current president. And now it’s the turn of the Arabs. The sovereign wealth fund of Saudi Arabia will lead the company’s capital increase and it is set to be one of the largest future shareholders.

AM latest capital increase numbers (AM corporate website)

AM current main shareholders (TIKR)

Before commenting on the capital increase in detail, we should say that the award-winning carmaker has 109 years of history. The company designs, engineers and sells luxury performance sports cars. It also provides racing activities in Formula 1, spare parts and after-sales solutions. The company engages its activities thanks to a network of dealers. Moreover, Mercedes-Benz AG (OTCPK:DMLRY) is not only an important shareholder but also a strategic technology partner.

As we already mentioned the Rihyad Public Investment Fund will lead the capital injection. However, what the market did not expect was the price of the recapitalization. Indeed, the British car house has stated that it will issue new shares at 103 pence each with a ratio of one new share for every four existing. This represents a 75% discount. The capital increase will have the support of the Yew Tree consortium led by President Lawrence Stroll as well as by Mercedes-Benz AG.

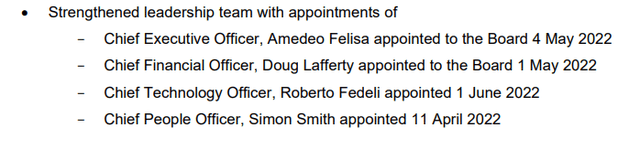

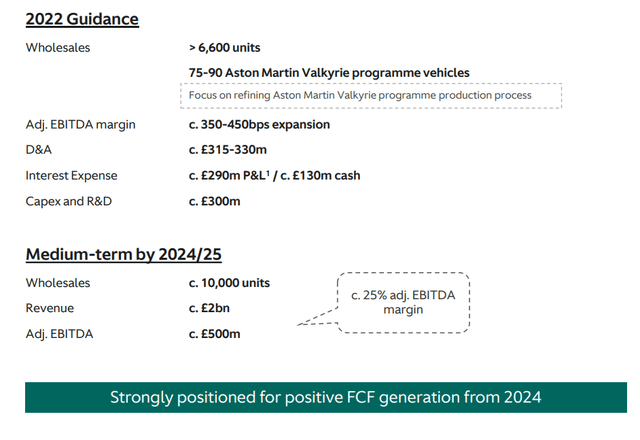

Yet another cash injection will be used to reduce debt and finance long-term growth. According to executives’ expectations, the cash injection will sustain Aston Martin’s long-term aim. In the plan presented to the financial community, the company is aiming for 10,000 cars sold in the medium-term horizon with top-line sales of £2 billion and an EBITDA of £500 million. Aston Martin is also planning to be cash-positive starting from 2024. Having recently analyzed Volkswagen, these numbers look very similar to Lamborghini and Ferrari (RACE) accounts. This recapitalization is the same story as the IPO that took place four years ago and burned almost 95% of shareholders’ value. The steering wheel has already been changed recently to the Italian Amedeo Felisa, a former Ferrari employee that is being appointed as CEO, and this was the third CEO change in the last three years.

AM changes in the leadership team (Aston Martin Q2 press release)

Despite the numerous announcements and promises, however, the glorious car brand, which became famous thanks to the James Bond films, struggles to find a way of recovery. Many hopes were placed on the DBX 707, one of the most powerful SUVs in the luxury category, but the numbers have not been able to reverse the negative development.

Conclusion and Valuation

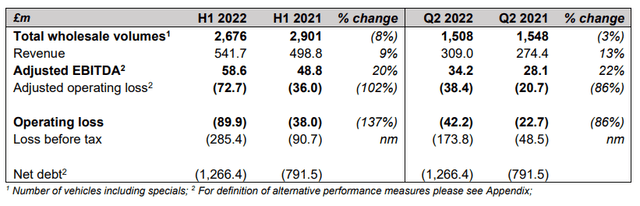

Aston Martin is continuing to burn cash and internal difficulties represent a further problem, in addition to the supply chain issues between Brexit and the global crisis. Last July, the half-yearly financial statements recorded a financial loss.

AM Financial Results (Aston Martin Q2 press release)

Concerning the valuation, the company is currently trading at a multiple on EV/EBITDA of 3x. However, looking at the medium-term guidance and Aston Martin’s previous track record, we find it very hard to justify a buy rating. As we did for Nissan, Aston Martin is also a show-me story. Within the sector, we prefer Ferrari.

AM Guidance (Aston Martin Q2 results)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment