da-kuk

Thesis highlight

I recommend going long on AST SpaceMobile (NASDAQ:ASTS) ($6.63 as of this writing). The company aims to achieve substantial global mobile coverage after the launch of a total of 110 satellites by the end of 2024 and MIMO capabilities by 2025 after the launch of 168 satellites. Its global partners are building what they think is the first space-based cellular broadband network. It’s called the SpaceMobile Service, and it’s meant to give users who travel to and from places without mobile service on Earth global coverage.

Company overview

ASTS is an innovative satellite company. They are working with international partners to build what they hope will be the first cellular broadband network in space. Users who are entering or leaving an area where terrestrial mobile services are unavailable on land, sea, or in the air can rely on the SpaceMobile Service to keep them connected wherever they go. Beginning in 2023, ASTS plans to regularly launch commercial BB satellites through 2025. By the end of 2024, when the company has launched a total of 110 satellites, it plans to have a large amount of mobile coverage around the world. By the end of 2025, when it has launched a total of 168 satellites, it plans to have MIMO capabilities.

Investments merits

The SpaceMobile Service addresses a big market

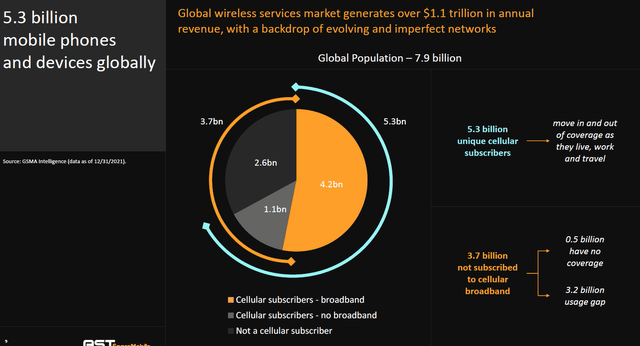

With an estimated 5.3 billion mobile subscribers constantly bouncing in and out of coverage, the global market opportunity for ASTS services exceeds $1.1 trillion. ASTS S-1 data shows that about 3.7 billion people don’t have access to cellular broadband, and another 450 million live in places where there is no connectivity or mobile cellular coverage.

Current plans call for a constellation of 168 low-Earth-orbiting satellites to provide the SpaceMobile Service. High-throughput Q/V-band links between the SpaceMobile constellation and gateways will direct international mobile data traffic to the gateways, where it will be forwarded to the respective national mobile network operators’ [MNOs] core cellular network infrastructure. ASTS believes they do not need to require any sort of involuntary spectrum sharing or additional mobile spectrum allocations. Instead, their technology is designed to increase the value of licensed mobile terrestrial spectrum to MNOs with the approval of participating MNOs and the national regulator, without negatively impacting the experience of other users thanks to the participation of the same licensee in satellite-terrestrial coordination. The goal of the SpaceMobile Service is to create the first global space-based mobile broadband network that can be accessed by any 2G/3G/4G LTE/5G and IoT-enabled mobile phone that hasn’t been changed or any 2G/3G/4G LTE/5G and IoT-enabled device that can connect to the internet.

The mobile satellite services industry will continue to experience growth driven by the increasing awareness of the need for reliable mobile voice and data communications services and the lack of coverage of most of the Earth’s surface by terrestrial wireless systems. ASTS believes only satellite providers can offer global coverage.

What’s better is that the satellites are being designed to distribute the functional capabilities of conventional satellites across many small, functionally independent, and patentable modules called Microns. Micron modules use a unique modular design and are mechanically deployed in space to create a solar panel for energy storage and a beamforming antenna for communication. Even if some Microns fail in the area, the SpaceMobile Service is still expected to be able to continue operations.

Attractive go-to-market strategy that maximizes profitability

ASTS formed alliances with companies like Vodafone, Rakuten USA, American Tower, and others that have innovative technologies and products, highly skilled personnel, or potential end-user customers that complement its strategy. ASTS’s business model with MNOs is designed to allow the MNO to augment and extend their coverage by using their spectrum resources without having to build towers or other infrastructure, including where it is not cost-justified or is difficult. This could allow it to sell SpaceMobile Service to the end-user customers of MNOs without any direct contract with ASTS.

The SpaceMobile Service is designed to offer global broadband internet connectivity under its wholesale business model of revenue-sharing agreements with MNOs. Through these agreements, ASTS will gain access to their existing customers, who will be the ultimate end-users of the SpaceMobile service. ASTS has entered into over 20 preliminary agreements and understandings with MNOs, which collectively cover approximately 1.8 billion mobile subscribers. ASTS will offer the service at a different price than the current terrestrial range.

Industry has multiple barriers to entry

The mobile satellite services industry at large is highly competitive. Still, it has significant barriers to entry, including the cost and difficulty associated with successfully developing, building, and launching a satellite network. Getting the necessary licenses, building the satellite constellation, and sending it into space all take a lot of time.

In my opinion, regulation is a crucial barrier to entry. New players will need to cross multiple hurdles of checks before they can even start testing their products. This gives incumbents like ASTS a considerable advantage in terms of experience and time-to-market. Below are some regulatory hurdles that a new player needs to consider.

ASTS must comply with the laws and regulations of, and often obtain approval from, national and local authorities in connection with its services. As the company launches service to additional countries and regions, it will become subject to even more governmental approvals and regulations. As ASTS goes commercial, it will provide several services that rely on the use of radio-frequency spectrum, and the provision of such services is highly regulated.

Valuation

Price target

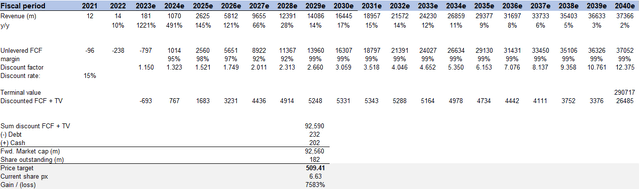

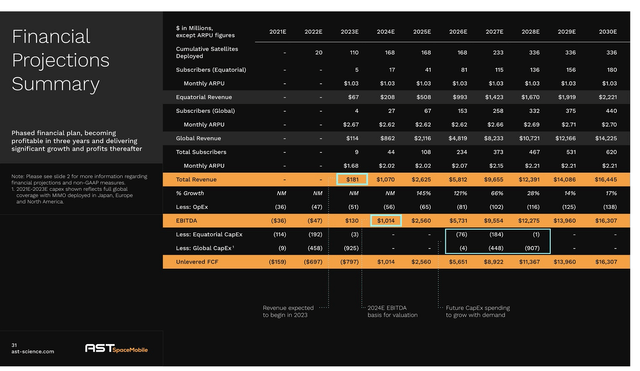

The model suggests a significant upside from what the stock is priced at today, which could seem illogical to the reader at first glance. Given the massive leap of faith that an investor needs to believe in management’s guidance, the vast valuation gap is warranted. This is akin to a venture capital-like investment where results can only be seen far in the future, which also means there is a higher risk of failure compared to investing in Microsoft (MSFT) today.

Nonetheless, suppose ASTS meets management’s guidance and the business grows at 2% over time due to market maturing. One can expect a significant upside.

Image created by author using data from ASTS’s filings and own estimates Aug 22 Investors presentation

Risks

The industry is rich in competitors and innovations

The SpaceMobile service could be rendered obsolete or less competitive by satisfying customer demand more attractively or introducing incompatible standards. The satellite communications industry is subject to rapid advances and innovations in technology. We may face competition from companies using new technologies and satellite systems.

Growth is heavily dependent on third parties

ASTS intends to partner with MNOs and, accordingly, will rely on them to market and sell its products and services to end-users. Such commercial partners will operate independently, exposing ASTS to significant risks. Because of this, most of ASTS’s revenue will come from how well ASTS’s retail partners do.

Execution risk

ASTS and its suppliers rely on complex systems and components for the operation and assembly of ASTS’s satellites, which carries a high degree of risk and uncertainty in terms of operational performance and costs. When these parts break down unexpectedly, they may need maintenance and replacement parts that aren’t always easy to find.

Conclusion

To conclude, I believe the upside for ASTS is worth a lot more than it is today if it can hit management’s FY30 guidance. The global market opportunity for ASTS services is more than $1.1 trillion, representing approximately 5.3 billion mobile subscribers constantly moving in and out of coverage. The SpaceMobile constellation will use high-throughput Q/V-band links to send mobile traffic from all over the world to gateways. This is the company’s competitive advantage.

Be the first to comment