maybefalse/iStock Unreleased via Getty Images

A data-centric juggernaut boasting high consumer mindshare, a diversified business model, a healthy balance sheet, compelling profitability gauges and cash flow generation capabilities, a collection of market-leading strategic business units, strong network effects and economies of scale, favorable valuation, and emerging growth ventures, constitute key reasons why the stock of Alibaba (NYSE:BABA) seems like a strong buy.

But the risks, both business and, more importantly, of all other sorts (regulatory, political, war, etc.) are no less paramount. I have wanted to write a bullish article on Alibaba for years, and only now am I finding the risk/reward compelling. The stock price is so low it will likely outperform the market over the coming months and years. The ADR thus qualifies as a serious prospect for top ex-US stock pick.

Still, it is critical we rate realistically, accounting for all risks – they abound. The most prudent or conservative investors may actually prefer to steer well clear of Alibaba stock.

Alibaba Is a Data-Centric Juggernaut with a Diversified Business Model

Alibaba’s China and international consumer segments combined to serve over one billion annual active consumers and generated US$1,239 billion in Gross Merchandise Volume (GMV) during the twelve months ended March 31, 2021. China consumer-facing businesses including China retail marketplaces, Local Consumer Services and digital media and entertainment platforms, served 891 million annual active consumers. Alibaba’s international retail marketplaces, which include mainly the AliExpress cross-border retail platform and Lazada in Southeast Asia, served approximately 240 million annual active consumers. The firm has a massive consumer footprint.

Per the Alibaba press release announcing March Quarter and Full Fiscal Year 2021 Results:

We also saw increasing engagement of the existing consumer base on our China retail app platforms. The longer a consumer has shopped on our platforms, the more they spend through more orders across more product categories. In fiscal year 2021, average annual spending per consumer on our China retail marketplaces reached over US$1,404. Consumers on our China retail marketplaces exhibit high retention across all spending levels (…).

A key to the success of our business is broadening product supply, including increasing the range of branded and imported products, going upstream to directly source agricultural products and expanding the breadth of selection of value-for-money and long-tail products. Consumption upgrading also helped to drive our business, as more consumers are purchasing from flagship stores of high-end brands and international retailers on our platforms. More than 200 luxury brands and retailers, such as Cartier, Farfetch, Gucci, IWC and Van Cleef & Arpels, operated their flagship stores on our China retail marketplaces, as of March 31, 2021 (…).

The Taobao app is the largest social commerce platform in China, offering rich, highly relevant and curated content and features that enable merchants to engage with consumers through live-streaming, short-form videos, interactive games and microblogs. (…)

The China commerce segment includes other market-leading retail businesses such as Tmall, Taocaicai, Freshippo, Sun Art, Alibaba Health, and wholesale businesses. Alibaba is a Big Data-centric conglomerate, with transaction data from its marketplaces and logistics units allowing it to accelerate the adoption of omnichannel retail, cloud computing, media and entertainment, and optimize online-to-offline synergies. A strong network effect helps spearhead other growth avenues. Alibaba’s >1 billion annual active consumers, versus the 1.4 billion population in China, means its internet services are ubiquitous. Alibaba can leverage this unique footprint – and source of data – to help merchants personalize mobile marketing and content strategies to expand their target audiences and increase online and offline transactions, thus bolstering top and bottom lines, and maintain e-Commerce and cloud services leadership in and outside China.

Alibaba exhibits robust fundamentals and financials

Per Alibaba’s March Quarter 2021 and Full Fiscal Year 2021 Results press release:

We surpassed our annual revenue guidance in fiscal year 2021 by achieving strong organic revenue growth of 32% excluding the consolidation of the newly-acquired Sun Art. This was driven by robust performance of our core commerce businesses as well as continued growth of Alibaba Cloud. Our adjusted EBITDA grew 25% year-over-year while we increased investments in new businesses and key strategic growth areas,” said Maggie Wu, Chief Financial Officer of Alibaba Group. “We expect to generate over RMB930 billion in revenue in fiscal year 2022. Given the market potential and our proven profit and cash flow generation capabilities, we plan to use all of our incremental profits and additional capital in fiscal year 2022 to support our merchants and invest into new businesses and key strategic areas that will help us increase consumer wallet share and penetrate into new addressable markets.

In the quarter ended March 31, 2021: Revenue was US$28,602 million, an increase of 64% year-over-year. Annual active consumers on China retail marketplaces was 811 million for the twelve months ended March 31, 2021, an increase of 32 million from the twelve months ended December 31, 2020. Loss from operations was US$1,170 million due to a US$2,782 million fine levied by China’s State Administration for Market Regulation pursuant to China’s Anti-monopoly Law. Excluding this one-time impact, income from operations would have been US$1,612 million, an increase of 48% year-over-year. Adjusted EBITDA, a non-GAAP measurement, increased 18% year-over-year to US$4,563 million.

In the quarter ended June 30, 2022, revenue was US$30,689 million and remained stable year-over-year primarily due to a decline in China commerce segment revenue by 1% year-over-year to US$21,190 million offset by revenue growth of Cloud segment by 10% to US$2,640 million. Income from operations was US$3,724 million, a decrease of 19% year-over-year. The resurgence of COVID-19 took a toll on overall short-term business performance, but revenue did not decline significantly, and net cash provided by operating activities and free cash flow managed to increase by 1% and 7%, respectively.

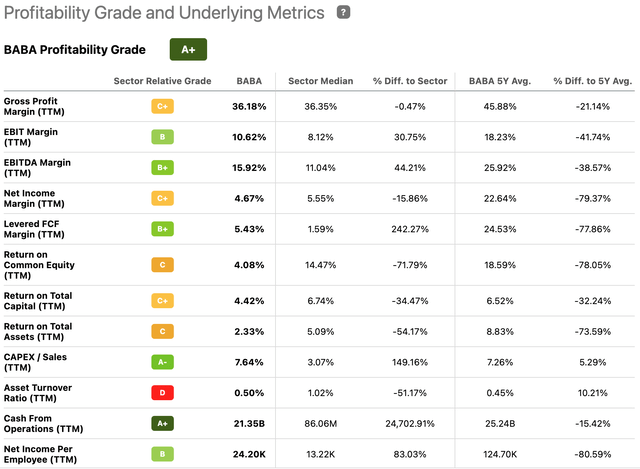

Alibaba’s profitability grade, as summed up below, speaks for itself.

Gross profit/net income margins and return on equity and capital qualify as decent, but EBITDA margin, levered FCF margin, CAPEX over sales, and cash from operations vastly outperform sector medians.

Still, expansion into non-physical-goods-marketplace businesses and new geographic areas may lead to margin contraction. The timing of profitability of these emerging ventures may remain uncertain for some time.

Alibaba’s Momentum Has Been to the Downside

If Alibaba’s business is dominant and exhibits rather strong fundamentals, the stock price surely reflects anything but, or rather just about… none of it.

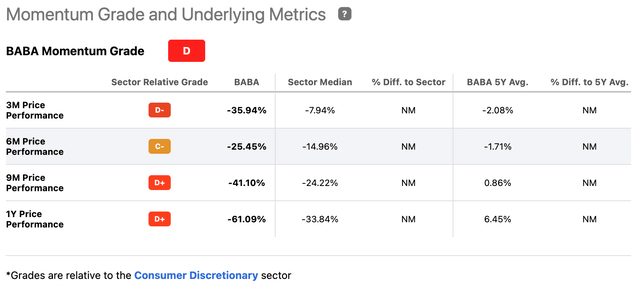

Check out the momentum grade for the Alibaba ADR.

The stock has underperformed its sector median by a wide margin in all aforementioned time capsules. It’s essentially back to where it used to trade 8 years ago, i.e., shortly after its IPO. No long-term shareholder is making real money; most are underwater, some by a wide margin, which is as painful as it is ironic, since we’re talking about a great-quality tech, cloud, and e-commerce business in the largest internet market in the world.

Who, indeed, wishes to own the following underperforming stock?

Valuation Is More Favorable

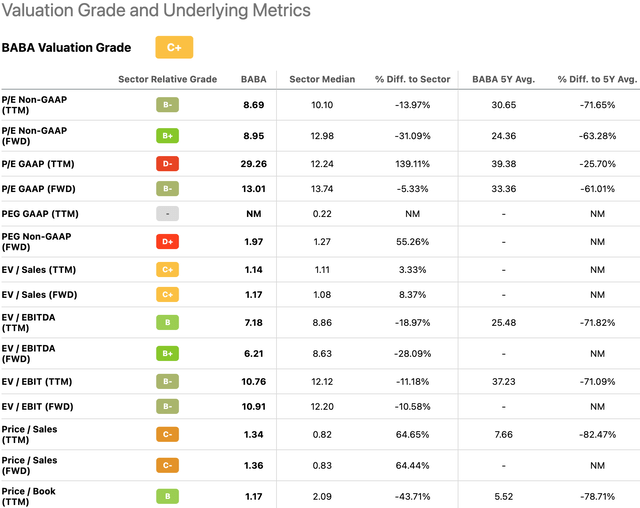

Of course, the collapse of shares means they are now cheaper than they’ve ever been. Valuation seems rather compelling, as illustrated in the table below:

An EV/EBITDA of 7.18 (trailing 12 months) and 6.21 (forward) well under 10 (and sector medians of 8.86 and 8.63, respectively) and price per book of 1.17 versus sector median of 2.09 suggest that the ADR is now outright cheap [even if P/E GAAP (trailing 12 months) and Price/Sales aren’t quite as convincing].

A P/E Non GAAP of 8.95 (forward) and P/E GAAP (forward) of 13.01 also signal steep undervaluation, if not outright depression, for such a tech, cloud, and e-Commerce behemoth. At today’s prices and given its underlying fundamentals, BABA trades at too low a multiple and seems like a real steal.

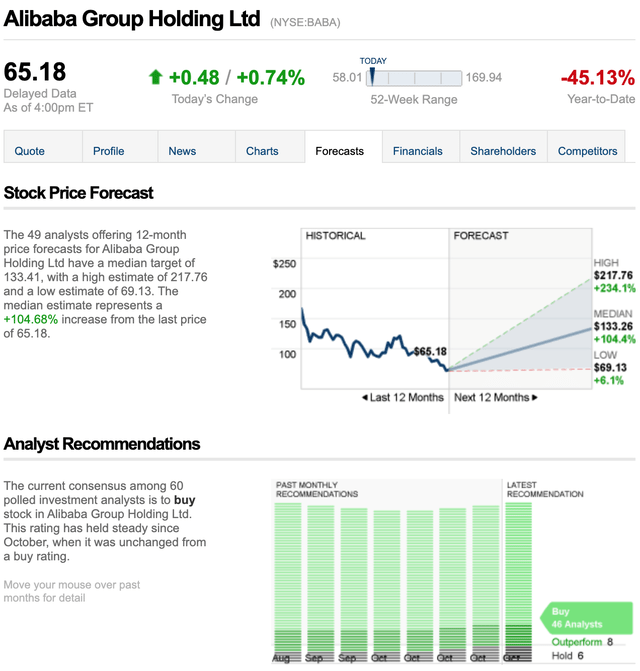

The 49 analysts offering 12-month price forecasts for Alibaba Group Holding Ltd have a median target of 133.41, with a high estimate of 217.76 and a low estimate of 69.13. The median estimate represents a +104.68% increase from the last price of 65.18. (Delayed quote: Nov 03, 2022, 4:10 PM ET).

Fair value estimates per ADR vary widely contingent on a number of assumptions. A model incorporating a reasonable revenue compound annual growth rate of 10-12% for the next five years, credible cost containment, some adjusted EBITDA margin compression due to shift toward lower-margin businesses (new ventures, physical stores, international sales), with consolidated non-GAAP adjusted EBITA margins declining to, and then stabilizing around, 10-12% in 2027-30 (versus 15% in 2022) (due to investment in new units, technology, logistics, user engagement, and building online/offline synergies, winding down over the long haul as Alibaba’s emerging ventures scale. Increasing e-commerce penetration in new categories, a growing Chinese middle class, and better technology for merchants to optimize their businesses on the platforms will all contribute to Alibaba’s top line growth. Factor in greater contribution from cloud computing (15% CAGR over the next five years, or close enough).

Even assuming no growth, Alibaba is pretty cheap based on a discounted cash flow analysis already. The firm had $4.34 in free cash flow per share over the last year (TTM). If you discount that amount at the 10-year treasury yield (4.1%) or at an even more aggressive rate of 4.8-5%, you arrive at a terminal value of $90-120, which still offers a significant upside to today’s price. These terminal value calculations assume no growth being modeled. If Alibaba manages to grow at all in the years ahead (as implied in the paragraph above), the ADR will go that much higher.

The problem is the ADR is cheap, and valuation favorable, for a number of reasons. They start with a litany of business challenges including credible competitors, revenue growth concerns and business deceleration off a large base, management challenges given complexity of operations, and risks of margin compression for new ventures. In sum, even before accounting for other (major, as we shall see soon) risks, business parameters challenge the bullish case.

Alibaba Is Facing Growth Challenges

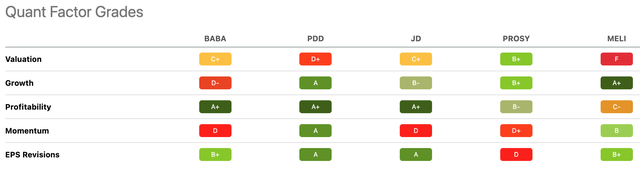

Check out the quant factor grades below. A comparison with peers including leader Pinduoduo (PDD) makes it clear that Alibaba is not growing nearly as fast as some of its key competitors. PDD has a much better track record for growth; so does MercadoLibre (MELI).

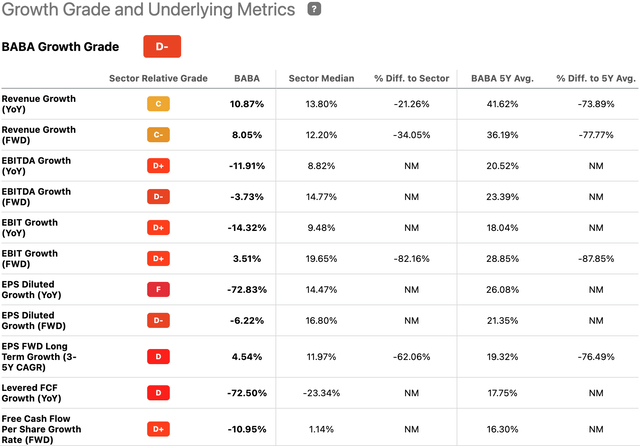

Indeed, as illustrated below, Alibaba’s revenue growth, EBITDA growth (year-over-year and forward), EPS diluted growth (year-over-year and forward), levered FCF growth, and other major growth metrics have underperformed Alibaba’s sector median by a significant margin.

Outside COVID-19 (i.e., resurgence and multiple variants), key growth impediments include adverse macros (i.e., slowing economic growth in China, a weak real estate market, etc.), but Alibaba has reached such a massive scale that it’s near-impossible for the firm to grow many of its metrics by the 20%-30%, if not 50% and above, growth threshold typical of fast growers anyway. Pinduoduo, JD.com (JD), and Tencent Holdings (OTCPK:TCEHY) also constitute formidable rivals. Pinduoduo’s active buyers started to exceed Alibaba’s in 2020, and the firm registers faster GMV and user growth than its peers.

Alibaba’s business empire includes logistics division Cainiao, cloud computing service Alibaba Cloud, and streaming platform Youku. These new ventures show great potential and, in the long run, may help diversify Alibaba’s revenue base. Some are also growing rapidly. For example, Alicloud – the leading cloud infrastructure company in China – grew revenue by 50% in fiscal 2021. Cainiao grew up even faster with revenue up nearly 70% over the same period. The problem with Alibaba’s new lines of operations is that some of these ventures have yet to turn profitable and require heavy investments before they can hit a profitable scale (although they seem to be getting close enough).

Meanwhile, challenges to the growth of its E-commerce arm may make it more difficult for Alibaba to direct the necessary cash to bootstrap all new units. For now, Alibaba can draw on its strong balance sheet. The company had close to $70 billion in cash, cash equivalents, and short-term investments as of March 31, giving it plenty of firepower to pursue its side bets. But even then, there’s no guarantee Alibaba’s new ventures will be long-term profitable. If they fail, Alibaba will ultimately have to retreat. Expansion into peripheral businesses may thus distract management and erode shareholder value.

Unfortunately, business execution risks including overcoming robust competition, growing off a large base, and maintaining strong margins in all or most areas of business including new ventures, merely constitute the beginning of the challenges lying ahead.

Non-Business Risks Abound – Starting with Regulation, Governance, Compliance

Regulation regarding data, security, counterfeit goods, anti-trust, ANT, trade, restrictions by US or China and audit inspections by the Public Company Accounting Oversight Board (“PCAOB”), constitute further risks to the bullish scenario. Some of these risks have been haunting the market for years and yet they never seem to go away.

Chinese regulators have been cracking down on homegrown tech giants focusing on data, privacy, and anti-trust issues, and there is little doubt they could face more regulatory scrutiny, thus be required to curb their anticompetitive behavior some more. Alibaba was slapped a record $2.75 billion antitrust fine, about 4% of Alibaba’s 2019 domestic revenues, after an anti-monopoly probe found the e-commerce giant had forced merchants to choose its platform exclusively and abused its dominant market power for years. Alibaba’s affiliate Ant Group has been asked to spin off some of its credit and lending businesses. Financial regulators in China cancelled Ant Financial’s IPO – anticipated to bring more cash than Saudi Aramco’s, the state-run oil giant.

Corporate governance offers another conundrum. In 2011, Alibaba transferred the ownership of Alipay to a new company controlled by Jack Ma (now Ant Financial, which is 33% owned by Alibaba), without the approval of key shareholders Yahoo and SoftBank.

There have also been concerns about the futures of Chinese stocks listed on U.S. exchanges, as regulators hope to make Chinese companies comply with U.S. auditing rules. Many Chinese firms have created shell companies in the Cayman Islands that control businesses in China. The Cayman enterprises can issue American depositary receipts, or ADRs, that trade in New York, but aren’t subject to some U.S. laws because the Securities and Exchange Commission and New York Stock Exchange often defer to a home country’s rules. Such Cayman firms aren’t allowed to list in China. One big implication for investors is less disclosure.

Under President Donald Trump, the United States passed the Holding Foreign Companies Accountable Act (“HFCAA”), which threatens to delist Chinese companies from the NYSE if they don’t meet U.S. auditing standards. In 2022, the PCAOB added large Chinese companies including Baidu (BIDU), Pinduoduo, and Alibaba, to the HCFAA. News of BABA’s inclusion prompted the stock to tank.

Following a ground-breaking deal, China has invited U.S. audit inspectors to evaluate its companies, and according to Bloomberg, inspections may be proceeding in Hong Kong. A successful review of Alibaba’s accounting could serve as a catalyst for the ADR by removing a key overhang on the stock. The elimination of such a risk factor would finally allow BABA, a discounted ADR, to trade based on fundamentals. If Alibaba passes the review, it will be the first Chinese company to do so, adding to the odds of a major rerating. The fact that Alibaba uses for audits PricewaterhouseCoopers (PwC) Hong Kong, a unit of well-trusted US-based PwC, seems to bode well for Alibaba. The group has always given Alibaba a clean slate of audit opinions.

Of course, there is a chance the PCAOB’s auditors review will trigger demands for more information that China won’t want to impart due to national security concerns (not that Alibaba, an e-commerce company selling to consumers, is exactly involved in national security) and/or ultimately lead to delisting. Or Alibaba’s management may elicit to delist from the NYSE voluntarily. Still, the fact that the U.S. and China managed to cut a deal and initiate audit proceedings suggests that both parties are willing to cooperate, a critical and promising milestone.

Macro shocks – More Risks Factors but in the End Investors Should Win

Alas, other risk factors abound that go well beyond business, regulation, and governance. Macro shocks like epidemics (COVID-19 and its multiple variants, more bugs, whoever knows what comes next?), the pursuit of a political and social agenda (making shareholders’ rights the least of the Chinese Communist Party’s concerns and current CCP general secretary Xi Jinping’s priorities), not to mention China’s war games vis-à-vis Taiwan, with the ever-so-remote (is it?) threat of a military conflict, add to the complexity.

The US and China have already sparred over sanctions against Russia. Tensions between the two countries have increased following U.S. Speaker of the House Nancy Pelosi and other U.S. politicians’ recent visit to Taiwan, despite the U.S.’s longstanding “One China” policy.

Before investing, ask yourself then, what if China invades Taiwan? After all, China has pledged to reunify Taiwan, which Beijing considers a renegade province, with the mainland, and hasn’t ruled out military force. I used to own a small position in Yandex (YNDX), the Russian search engine. Yandex’s trading has been suspended on the NASDAQ since February 28, 2022. The war in Ukraine, and a complex geopolitical and macro backdrop, can exact a terrible toll on portfolios. I love Alibaba but – Investors, beware.

Now, it seems unlikely that China will invade Taiwan (the same way it was deemed unlikely Russia would invade Ukraine a few months before the Russian invasion actually took place…). Even Intel’s CEO Pat Gelsinger believes China won’t invade the country within the next five years. Sure, the U.S. and China have been locked in a dispute over semiconductors and their mission-criticality to national security, with some worried China could invade Taiwan over the matter – Taiwan being home to one of the world’s largest semiconductor foundries, Taiwan Semiconductor, which manufactures chips for Nvidia (NVDA), Apple (AAPL), etc.

But soldiers managing a high-tech venture or coercing personnel into doing so seems like a tall order. Not that China is exactly prone to war either. The country last fought a major war against Vietnam in 1979. Further, China would have to incur a steep cost preparing for an invasion. A complex daylong war game, played out a few weeks ago at a Washington think tank, demonstrated how destructive any attempted Chinese invasion of Taiwan had the potential to be. China would have to conduct the largest and farthest amphibious invasion in modern history. No walk in the park, even after accounting for China’s military advances of recent years. Plus, Russia’s unexpected early setbacks in its invasion of Ukraine may sure give Chinese leadership pause.

The war in Ukraine has exacted a catastrophic human toll. But it sure has benefited Putin in at least one critical way – reinforcing the energy edge Russia enjoys, the one and only competitive advantage the otherwise rather weak economy (#11 by GDP behind Brazil, Italy, and Canada – yes, that low) boasts, by triggering an oil and gas crisis. China and the United States play on a whole different level – tech, fintech, biotech, and more. (A weakened Europe trying to find cohesion after Great Britain’s exit only gives that much more leeway to the two leading economies of the world.) But the US and China seem to be playing nice and fair on a rather level playing field in the end. Isn’t Li Qiang, now the second-ranking member of the 20th Politburo Standing Committee of the Chinese Communist Party, the man who opened the Shanghai Stock Exchange STAR Market and oversaw foreign investment in Shanghai including Tesla’s (TSLA) Gigafactory? The same man who, on top of being perceived as a close ally of Xi Jinping, is most often regarded as pro-business, having close ties to entrepreneurs such as Jack Ma of the very same Alibaba we are writing about?

A ruthless economic war, for sure. But Alibaba shall thrive in a high-risk yet well-controlled environment. That Xi and Li are having top priorities beyond shareholders’ very own (i.e., accelerating the implementation of their common prosperity vision with the newly elected Standing Committee) does not have to mean they’re pursuing Alibaba’s equity holders’ ruin. In the end, the prosperity of the Chinese requires a prosperous economy; social justice comes on top. Xi is no Putin; he may not need a war to win it. He’s not after shareholders – just pro-social; there is a difference, which has key implications for Alibaba owners. It is quite possible, and in the end desirable, that Chinese ADRs including Alibaba’s see a major rerating over the next 1 to 5 years, even from Xi’s perspective. Powerful businesses spawn wealth.

There was a time when I thought one of the biggest risks facing Alibaba was the issue of counterfeit goods on its marketplaces. How naive it now all seems. I’d nearly add a lol if I dared. Sure, if the Chinese currency continues to devalue, we will see Alibaba’s revenue growth and profit numbers drop when converted to USD. How come I don’t care nearly as much as I used to or even should?

Institutional Ownership Shows the Extent of the Damage, But May Also Constitute a Blessing in Disguise

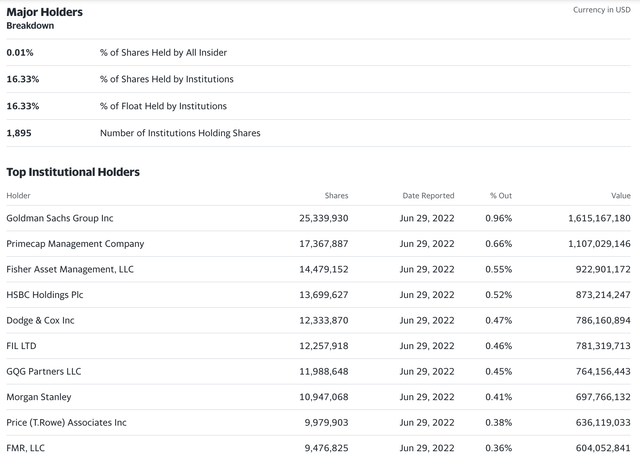

It is of at least some concern and, given the aforementioned risk factors, no wonder, that institutions don’t own the ADR in any significant fashion.

Japan’s SoftBank is believed to be Alibaba’s largest shareholder, owning around 24% of the company. Its stake used to be larger, and there are rumors it may sell even more in the near future. SoftBank sold part of its stake in 2019, booking over $11 billion in pre-tax profits. Then in July 2020, in a deal not expected to be finalized until June 2024, the company is said to have sold an additional $2.2 billion of its stake. Likewise, Jack Ma, Alibaba’s co-founder who retired as the company’s executive chair in 2019, reduced his stake from 6.2% to 4.8% in 2020. Overhang of the remaining stakes of pre-IPO strategic investors may be an issue.

Meanwhile, Alibaba has rather poor institutional sponsorship. No major US fund or institution owns more than a 1% stake (see table below for detail). Global investment bank Goldman Sachs owns 0.84% of the firm, as of Q1 2022, worth roughly $2 billion. Next comes Primecap, which owns around 0.64% of outstanding shares. That institutional investors aren’t buying may have some think twice before investing.

Of course, more institutions may join the fray and initiate a position if they see a bull coming after the recent collapse, thus driving demand for the ADR. Now may indeed be the best time to accumulate.

Conclusion

Alibaba may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- A data-centric juggernaut boasting high consumer mindshare, a diversified business model, a healthy balance sheet, and compelling profitability gauges and cash flow generation capabilities,

- A collection of market-leading strategic business units with strong network effects and economies of scale, favorable valuation, and emerging new growth ventures.

- Negative momentum and market sentiment have punished the stock, presenting bargain hunters with an opportunity.

- But risks abound – from business to regulatory, political, social, war, invasions.

Solid appreciation potential exists within the next one to five years. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for the next bull market in Chinese stocks and/or greater visibility into Alibaba’s future sales, cash flow, and earnings – might prefer to dollar average.

All the while hoping that China does not invade Taiwan. Of course, if it does, the price of the Alibaba ADR may qualify as the least of our concerns. Hey, Google, where’s the bunker?

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment