Editor’s note: Seeking Alpha is proud to welcome Marco Atzeni as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

ASOS | Nordstrom Pop-Up At The Grove In Los Angeles

Gonzalo Marroquin

Overview

ASOS (OTCPK:ASOMF) is an overly beaten-down retail company that Mr. Market has punished because of short-term headwinds. In 2022, despite the difficult conditions that the whole industry is facing because of inflation and supply chain bottlenecks, the online retailer has been profitable on an adjusted basis. At the current valuation, I have a great conviction on the company’s stock as I believe the ASOS stock could provide 2.3x-5.3x returns for the patient investor. This means that ASOS has a margin of safety in the range of 67-76%, which is a compelling cushion for investors who wants to generate above-average returns.

The business

ASOS Plc is a British and global online retail company, which operates in the fashion industry targeting the 20-somethings worldwide. The company was launched in London in 2000 by Nick Robertson, Andrew Regan, Quentin Griffiths, and Debora Thorpe under the name “AsSeenonScreen”. In 2002, the initial name of the company was replaced with the acronym ASOS to be more customer-friendly and simpler to keep in mind. ASOS’ initial aim of selling celebrities-inspired outfits shifted towards a broader customer proposition including over 850 brands and 85,000 items ranging from womenswear and menswear to accessories.

If we break down ASOS’ sales figures in the 2022 fiscal year, the company generated 44.7% (£1.703 billion) of revenues in England, 29.7% (£1.170 billion) in Europe, 13.5% (£531.4 million) in the US, and 12% (£472.3 million) in the rest of world. The largest shareholder in the company is the Danish entrepreneur Anders Povlsen with a 26% stake (also the second-largest shareholder in Zalando), the American investment management firm T. Rowe Price Group (9.5%) and among others ASOS’ co-founder N. J. Robertson with 2.88% of total shares outstanding.

ASOS is a vertically integrated business, and its supply chain can be broken down into two parts: the company sources its products primarily from global third-party brands as well as from its own-label brands. Thus, the products are shipped into their warehouse both by sea and air through a combination of long-term contracts with shipping companies and other agreements with air freight companies to reduce costs and supply bottlenecks. Then, from their fulfillment centers (Atlanta, Barnsley, Berlin, and the new one in Lichfield in H1 of FY22) their products are shipped globally.

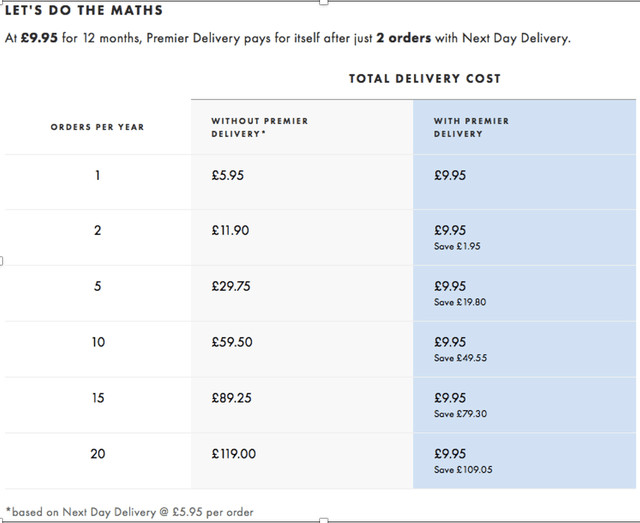

One of the main factors that better describes ASOS’ philosophy is its focus on constantly improving the loyalty of its customers through various initiatives ranging from Next-day delivery (now available to 85% of their customers) through an annual subscription of £9.95 with no minimum orders to free returns and lower shipping costs. This results in better optionality (i.e., early access to sales, exclusive offers, free subscription to ASOS magazine), customer stickiness, and savings, as demonstrated below:

Asos cost savings (Asos )

The aforementioned elements are reflected in customer satisfaction as shown by the following engagement metrics:

|

2022 |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

|

|

ABV |

£38.21 |

£39.75 |

£39.52 |

£36.76 |

£37.3 |

£37.8 |

£36.6 |

£38 |

|

ASP per unit |

N/A |

N/A |

£22.63 |

£23.34 |

£24.29 |

£25.16 |

£25.09 |

£24.63 |

|

AOF |

3.88* |

3.70* |

3.43 |

3.56 |

3.43 |

3.22 |

3.08 |

2.96 |

|

Active customers |

25.7 |

25.3 |

23.4 |

20.3 |

18.4 |

15.4 |

12.4 |

9.9 |

|

Total orders |

99.7 |

95.2 |

80.2 |

72.3 |

63.2 |

49.6 |

38.3 |

29.5 |

*Excluding Russia

Active customers and total orders figures are in million

As it is demonstrated by the average selling price figures, the benefits that the company is achieving through a more efficient cost structure and also the significant investments in the distribution and fulfillment centers automation are shared with its customers, so they can pay lower prices and have a wider breadth of product mix on the ASOS online platform. Similarly, customer response translated into a larger volume of goods sold with total orders more than doubled, as well as the number of active customers in the reported years.

Cost structure

With regard to the company’s cost structure, cost of goods sold as a percentage of revenue remained relatively stable between 2015 and 2019 ranging from 50% to 51%. In 2020, 2021, and 2022, COGS experienced a substantial increase reflecting supply chain shortage. Despite the significant growth in duty and delivery costs and a tighter labor market, which results in significant wage increases, operating costs declined as a percentage of sales by 220bps in 2021, reflecting a substantial downward trend from 46% in 2015 to 40.5% in 2021. Instead in 2022, operating expenses experienced a significant increase going from 40.5% of sales to 43% reflecting the pressures from inflation, negative return rates, and higher marketing costs. Nevertheless, these inflationary effects can be viewed as short-term effects, which will end as inflation is expected to ease over 2023 enabling ASOS to continue to scale its business over the long term.

Competitive advantage

A peculiar competitive advantage for a fashion e-tailer is the ability to tackle rapid changes in demand across the fashion apparel industry by proposing constant new offerings. Over the years ASOS has highly increased the number of new styles that are being introduced every week on its website ranging from 5,000 to 7,000. As the ex-CEO, Nick Beighton said: “Our focus is on newness and a full-price mix, (…). We’re going to continue that focus, as well increase our average buys and add more range of products through category expansion”. Differently from one of its competitors, Boohoo, ASOS sells products both from its private labels and from third-party brands giving it an additional advantage in capturing new demand as well as more flexibility in market positioning. Similarly, Zalando offers both solutions (private labels and third-party brands), but while ASOS’ brands account for approximately 45% of total sales, the former’s private labels produce only 10%-20% of total sales.

Mr. Market’s action

Mr. Market’s manic-depressive action during the last 4 years resulted in a 90% share price contraction, which was amplified by the poor financial performances that ASOS reported in 2022. Despite revenue increasing from £3.91 billion in 2021 to £3.93 billion in 2022 (less than 1%), cost of goods sold increased at a faster pace (4% growth) as a result of more tightened market conditions. The same pattern can be also seen in the company’s operating expenses which increased overall by 10%, bringing down ASOS’ EBIT margin from almost 5% to (0.25%). Also, as shown below, ASOS is having more difficulties converting its account receivables and inventory into cash as general financial conditions are getting worse.

|

2022 |

2021 |

2020 |

|

|

Days sales outstanding |

3.82 |

2.93 |

2.24 |

|

Days Inventory |

155 |

114.5 |

113.7 |

Morningstar data

Above figures represent number of days

The business has been reporting very volatile results over the last few years as a result of both the pandemic and the return to normalcy. Now the question is: in which ways the company can revert the negative trend and return to grow at a higher return over the next several years? To get a 15-20% annual return on their investments, they have different options: the online retail company can invest in sound business acquisitions such as Topshop, Miss Selfridge and Topman and establish strategic partnerships like the one with Nordstrom in order to increase ASOS’ brand awareness in North America. Moreover, the company should leverage its improved infrastructure such as the Atlanta’s new fulfilment center and the Eurohub distribution center so that it can further improve operational efficiencies.

Valuation

Considering an economic environment with rising rates and tougher financial conditions, it is fair to assume that 2023 will be characterized by sales being flattened. A sound approach when valuing companies is to look at their earning power, instead of using multiple valuations that can give us misleading representations of the company’s economic reality. Over the last 5 years, ASOS’ revenues have been growing at 15.4% CAGR with an EBIT margin 5-year average of 3.8%. Using conservative assumptions, I consider no growth for 2023 and I take into account two different revenue growth rates: 5% and 10%, which we can apply from 2024 to 2027. These two growth rates are very conservative assumptions since they are well below the previously mentioned historical average.

|

Assumptions |

2026 |

2025 |

2024 |

|

Projected revenue (at 5% growth rate) |

£4.557 |

£4.340 |

£4.133 |

|

Projected revenue (at 10% growth rate) |

£5.238 |

£4.762 |

£4.329 |

|

EBIT (with EBIT margin of 3.8%) |

173 |

– |

– |

|

EBIT (with EBIT margin of 3.8%) |

199 |

– |

– |

Figures are in billion excluding EBIT figures which are in million

| Shares outstanding | 100 | 100 | 100 |

| Current share price | £7.4 | £7.4 | £7.4 |

| EBIT multiple | 10x | 15x | 20x |

| Intrinsic value (at 5%* revenue growth rate) | £1.731 | £2.596 | £3.462 |

| Intrinsic value (at 10%** revenue growth rate) | £1.990 | £2.985 | £3.980 |

| Intrinsic value per share* | £17.3 | £25.9 | £34.6 |

| Intrinsic value per share** | £19.9 | £29.8 | £39.8 |

| Margin of safety* | 57% | 71% | 78% |

| Margin of safety** | 63% | 75% | 81% |

All figures are in billion excluding per share figures, multiples and percentages

As shown in the table above, there are three fair value targets for both 5% and 10% revenue growth rates. If ASOS is able to achieve the above-mentioned growth rates, I believe that an investment in the company could translate into a potential 2.3x-5.3x bagger. Moreover, this would deliver an attractive margin of safety in the range of 57-81% which would translate into a significant cushion for the conservative investor.

Risks

The company is expected to continue experiencing the negative effects of inflation and supply chains during the last quarter of 2022 and for the whole 2023. Moreover, there is still high uncertainty around China’s action against COVID with furious protests toward the Zero COVID policy. All these short-term factors are expected to affect ASOS’ business over the following year.

Since I don’t consider volatility as a risk factor for an intelligent investor, this share price decline should be considered as an opportunity that could translate into good returns over the following years.

Conclusion

In 2022, short-term headwinds have significantly impacted ASOS’ results and, as we enter into a recession in 2023, they will continue to influence the online retailer’s economic performance. Despite these negative impacts from inflation and supply chain bottlenecks, I believe that these negative factors are well priced in ASOS shares giving investors a good entry opportunity. Overall, after a 90% sell-off in the shares, I think that ASOS provides a robust margin of safety, which gives prudent investors downside risk protection.

Be the first to comment