Michael Vi

Nobody wants to own semiconductors right now

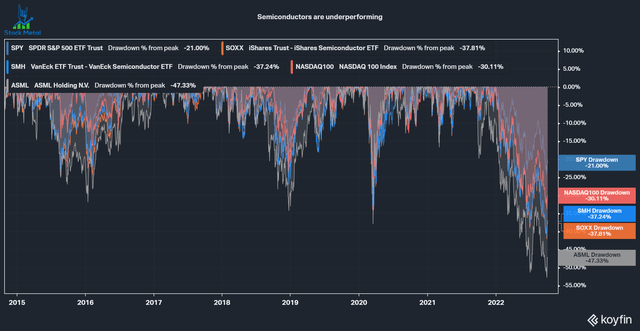

Over the last year, the semiconductor industry has been one of the biggest losers in the market. The S&P 500 (SPY) has entered a new bear market, down 21% from ATH. The Nasdaq 100 (QQQ) performed worse with a 30% drawdown. The semiconductor industry (benchmarked by the VanEck Semiconductor ETF (SMH) and iShares Semiconductor ETF (SOXX)) has fallen significantly more, down 37% from its high. Semiconductors are clearly out of favor after a decade of outperformance. Nobody seems to want to own the oil of the future anymore, as semiconductors are often called, especially ASML (NASDAQ:ASML) which has almost halved, down 47% from ATH. I believe that semiconductors will continue molding our economy over the next decade and that contrarian investing in this currently disliked industry can yield high returns, if one buys the right company. In the following article, I’ll make the case of why I believe ASML is one of those companies.

Semiconductor recent underperformance (Koyfin)

EUV lithography market

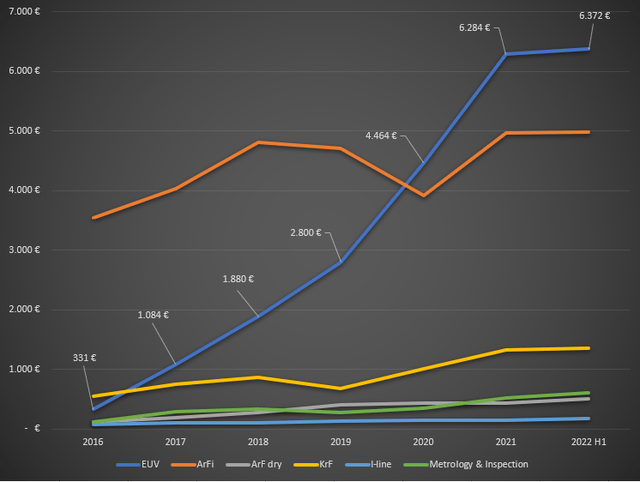

According to Vantage Market Research, the global semiconductor market is expected to grow from $429 billion in 2021 to $712 billion in 2028, an 8.8% CAGR. The semiconductor market is a vast industry with varying growth rates. The market for EUV lithography machines is expected to be one of the fastest growing segments of this industry, with an estimated 21.5% CAGR between 2022 and 2029 to reach a total value of $23 billion, according to Future Market Insights. Lithography is the most critical step in the semiconductor manufacturing process where the layers are imprinted onto the Wafer. ASML holds a monopoly in the EUV market after it solved the mystery of EUV after over a decade of research. ASML also dominates the previous lithography technology, DUV, with around a 70% market share before its competitors Nikon (OTCPK:NINOY) and Canon (CAJ). DUV is a much more mature technology and is expected to just grow at a moderate 4.4% CAGR, according to Digital Journal. In the chart below we can see ASML’s system sales by system type. Since the start in 2016 EUV rapidly gained in the company’s sales mix and finally overtook ArFI (Immersion lithography) as the largest part of the mix.

ASML revenue by system type (Authors model, Data from ASML 10-K)

ASML’s resilience

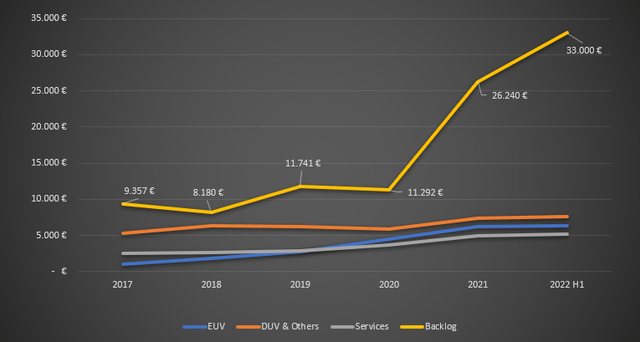

The semiconductor industry is widely known to be cyclical. This is a result of a sensitivity to consumer behavior in segments like consumer electronics, a recent example is Nvidia’s (NVDA) gaming segment plunging 33% YoY due to a rapid change in consumer sentiment. Often inventories that have been built up can’t get sold fast enough, resulting in a drop in sales. ASML is currently shielded from these cyclicalities due to its unique position in the EUV market with demand far outgrowing supply. It takes around a year to produce one machine and it’s hard to scale production because ASML has a network of 700 suppliers providing parts for the machine. Over the last years, in wake of the chip shortage, many countries provided large incentive packages for companies to build more semiconductor capacity. All of these fabs require Lithography machines and many need EUV to manufacture at the required level. This resulted in ASML’s backlog skyrocketing up to 33 billion in orders, with 85% of it being EUV and Immersion DUV. At the current run rate of 14 billion in system sales, this backlog accounts for over 2 years of revenue for ASML. Besides system sales, ASML also generates around 5 billion with services and software upgrades to its existing install base, further shielding it from cyclicality. All these reasons make me confident that ASML won’t be affected by this current semiconductor downtrend, even though the stock price would suggest as much, leaving an opportunity for investors. Of course, there is a risk of a prolonged bear market, if the semi-industry gets into a let’s say 5-year downtrend then, of course, ASML would suffer tremendously as well, but the chances of this are very low in my opinion and a 5-year downtrend in semiconductors would be detrimental to the whole global economy.

ASML’s resilience (Authors Model, Data from ASML 10-K)

Valuation

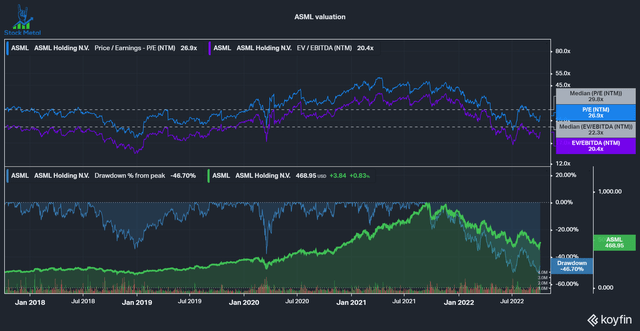

To value ASML I’ll take a look at two different ways: First based on historical multiples and then based on an Inverse DCF to find out what the market is pricing into the stock.

After a crazy run up close to a forward PE of 50, ASML came back to earth in recent months creating an opportunity. It currently trades below its 5-year median multiples, while being in a better situation with the large backlog.

ASML valuation based on historic multiples (koyfin)

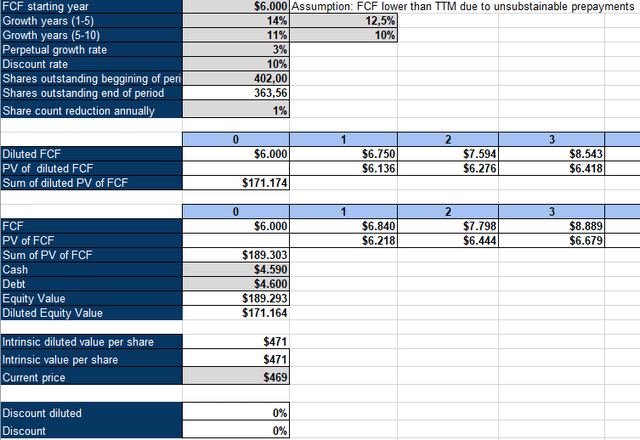

An inverse DCF model aims to find out what growth assumptions the market has for a company based on its current Free Cash Flow. I used $6 billion as an FCF, because the current numbers are inflated due to prepayments during the buildup of the order book. The current $12 billion FCF won’t be sustainable. I used a 10% discount rate as my normal return requirements, a 1% annual buyback yield and a 3% perpetual growth rate. Based on the current stock price of $469, the market assumes a 12.5% growth rate in the first 5 years, followed by a 10% growth rate in the remaining 5 years. Based on the 21.5% growth expectations for EUV I see this as a reasonable growth assumption.

ASML inverse DCF model (Authors model)

I am a buyer here

ASML offers a great opportunity to invest in the semiconductor market in a time where the industry is out of favor. The company has a very resilient business model inside of a cyclical industry and no competition in its EUV machines. ASML accounts for 7% of my portfolio and I’m looking to accumulate more in these levels.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment