Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

ASML Holding N.V. (NASDAQ:ASML) delivered a solid FQ1 earnings report. Notably, the company suggested the possibility of raising its mid-term (through FY25) and long-term (post-FY25) guidance, with an update by FQ4. Therefore, if semiconductor investors require a clear view that the underlying demand is sustainable, hear it from ASML.

Given ASML’s market leadership in the wafer fab equipment (WFE) market, we have consistently paid attention to management’s commentary. Investors need to understand that fab equipment and fab construction are long-term projects. These are highly strategic and expensive undertakings to meet sustainable underlying end demand. Given the proliferation in the use cases of semiconductors and more silicon content due to the world’s digitization, we are not surprised by ASML’s bullish commentary.

But, we had a pleasant surprise as ASML telegraphed that its DUV systems (for trailing nodes) are also expected to drive its growth. Therefore, the company’s ability to leverage both the growth in leading and trailing nodes is set to broaden its outlook tremendously.

Nonetheless, the current macro uncertainties have also buffeted ASML stock. Furthermore, the supply chain disruptions and cost inflations have also affected its production. However, we view these challenges as transitory, given management’s commentary on the potential for raising guidance moving forward.

Therefore, we encourage ASML investors to capitalize on its recent weakness to add more exposure.

ASML Reaffirms Its FY22 Revenue Guidance

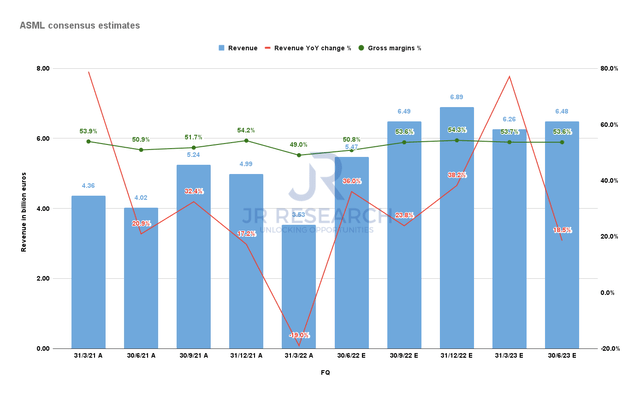

ASML consensus estimates (S&P Capital IQ)

ASML posted FQ1 revenue of 3.53B euros, down 19% YoY, but above consensus estimates of 3.48B euros. Notably, the company’s revenue could have been at least 800M euros higher, but was held back due to “fast shipments.” ASML has been using fast shipments to facilitate faster deliveries to its customers who are in urgent need of more foundry capacity.

Consequently, the company could only validate and confirm the final acceptance at its customers’ sites and recognize revenue after that. But, there should be no material impact on its full-year revenue as ASML reaffirmed its FY22 guidance of 20% YoY growth.

Nevertheless, due to the surge in raw material costs and higher logistical and fuel costs, ASML’s gross margin in FQ1 was impacted, down to 49%. Nevertheless, the company remains confident that impact is transitory, as it accentuated H2’22 gross margins to increase to 54%. Consequently, investors should expect H1’22 as the inflection point before revenue growth and profitability improves in H2’22.

ASML Is Keen To Raise Mid- And Long-Term Guidance

Notably, management accentuated that it has observed several growth drivers leading to “unprecedented demand” for its equipment. As a result, the company has consulted its supply chain partners on the possibility of raising capacity moving forward. CEO Peter Wennink accentuated (edited, with emphasis by author):

With multiple countries pursuing technological sovereignty, we are now seeing a number of announcements from customers for new fabs in the coming years in support of this global trend.

As this unprecedented demand is exceeding our capacity, ASML and its supply chain partners are planning to actively add capacity to meet future customer demand.

We’re also discussing with our supply chain partners to secure more capacity in the medium term. Once we complete this analysis, we also expect to revisit our 2025 scenarios and growth opportunities beyond 2025. (ASML’s FQ1’22 earnings call)

Notably, ASML intends to add capacity to its EUV (including High-NA EUV) and DUV systems. Therefore, the company is expecting broad-based growth across the semiconductor value chain. ASML expects to raise its DUV capacity to 600 systems (from 375) by 2025. It also expects to increase its EUV capacity to 90, from 70. Furthermore, it has also begun to see more High-NA EUV orders from its logic and memory customers already using EUV.

The company also added that it intends to build capacity for up to 25 High-NA EUV systems (post-FY25 timeline) as its customers move further into advanced nodes manufacturing. Notably, the company also maintained its outlook for high-volume manufacturing with High-NA EUV systems by 2025/26. Therefore, we think the semiconductor arms race will get even more intense moving forward. It seems to be even more aggressive than we had previously expected. As such, ASML will continue to be the critical beneficiary with clear revenue visibility likely towards the end of the decade.

Is ASML Stock A Buy, Sell, Or Hold?

ASML stock valuation metrics (TIKR)

Given ASML’s leadership position in the WFE market, it has consistently been priced at a premium against its peers. Therefore, investors should not expect its stock to be cheap, and it still isn’t cheap, despite the recent value compression.

For instance, its NTM FCF yield of 1.9% is markedly below its 5Y mean of 3.17%. Therefore, in a fast-rising rate hike backdrop, its relatively weaker FCF yields could impede its forward momentum. Furthermore, its NTM normalized P/E of 29.7x is significantly above its WFE industry median P/E of 16.4x.

However, investors should note that its P/E and EBIT multiples have normalized to its 5Y mean. Our fair value estimates also suggest that ASML stock seems fairly valued but not undervalued.

Hence, there could still be potential for near-term volatility. However, we think it looks well-positioned for long-term investors to add exposure in phases.

Therefore, we reiterate our Buy rating on ASML stock.

Be the first to comment