tataks/iStock via Getty Images

Seeking Alpha is bursting with articles that either praise ASML (NASDAQ:ASML) for its monopolistic position or stay super bearish towards its stock. The main bear arguments consider the ban on exports to China and oversupply risks. Plus, recent US chip sanctions contributed a lot to the uncertainty around semiconductor producers. In order to better understand how ASML is positioned toward potential risks, my team and I have decided to conduct our own research. After examining every convexity on Zeis mirrors, we came to the conclusion that ASML is well prepared for external shocks. My team persuaded me that ASML can digest further export sanctions and can go through lower demand as it has in the past. Moreover, its valuation is close to attractive levels. So, I am keen to share our view with you.

European technological king

Before we get to ASML fundamentals, let us better understand ASML’s unique technology. Otherwise, it would be difficult to catch the idea of what the company is doing. And why it costs so much.

A little insight on the bright surface of the gadget you are holding right now. It does not matter if you read the article on the laptop, on the tablet or on the smartphone - you look at it thanks to semiconductors. They are almost everywhere, even in the vehicle that will take you home today. The main aspect of each chip is its productivity, the amount of information it can obtain and handle in a period of time. The efficiency depends on the number of transistors you insert into a chip. However, while pursuing higher efficiency, it is important to keep in mind that, despite everything, size actually matters. Consumers want the utmost thin devices, and vehicles need to be as light as possible to increase mileage. Therefore, producers try to cram the biggest number of transistors possible into the smallest surfaces. Technically speaking, manufacturers are eager to decrease the width between the rows on the silicon wafer. Afterwards, they are able to put more transistors in an increased number of rows and enhance the chip’s productivity. The printing of the finest patterns on the microchip requires advanced ultraviolet machines. To manufacture the whole microchip, this process is to be repeated 100 times or more, laying patterns on top of patterns like slices of cheese on your sandwich. The size of the printed features varies depending on the layer. It means that different types of ultraviolet systems are used for different layers.

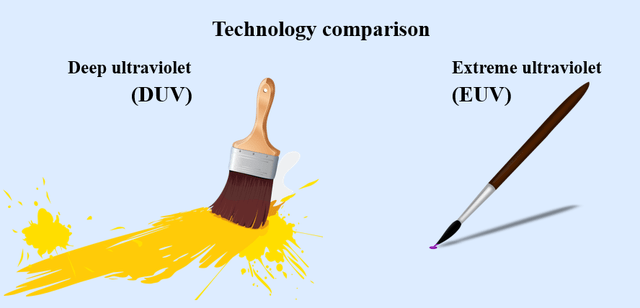

What ASML does is exactly the production of chip manufacturing machinery. Its tools can be broadly separated into two technologies: deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems. DUV systems are the workhorses of the industry, and are used for the production of less sophisticated layers in the most advanced chips or for manufacturing previous generations of chips. Conversely, EUV systems are more expensive and remain at the frontier of semiconductor technology. These roll out the finest and most sophisticated layers.

Let’s better visualize the difference between the two technologies. Imagine: DUV is like a thick-bristle brush. You can use it to paint the vast background of your piece, but it would be inconvenient for painting the detailed peculiarities of the portrayed face. You would need a thin liner or a tiny brush to transfer these details in the most efficient way.

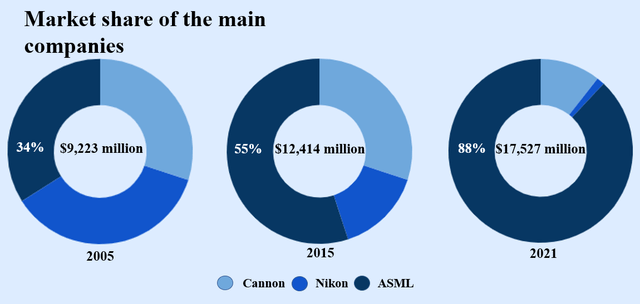

EUV was invented by ASML in 2016. The cost of the research and program development were evaluated at more than €6 billion. The competitors did not manage to produce and advance the EUV technology, and lost their market share to ASML. Nowadays, it would be too expensive for any non-Chinese rival to replicate EUV technology. Besides, its development would make little economic sense as customers have very high ASML loyalty. ASML also has an undisputed market share with competitors Nikon and Cannon enjoying extremely limited markets. Thus, we can really compare ASML with a monopoly from your Economics 101 course that sets prices significantly above marginal costs.

Prepared by author based on public data

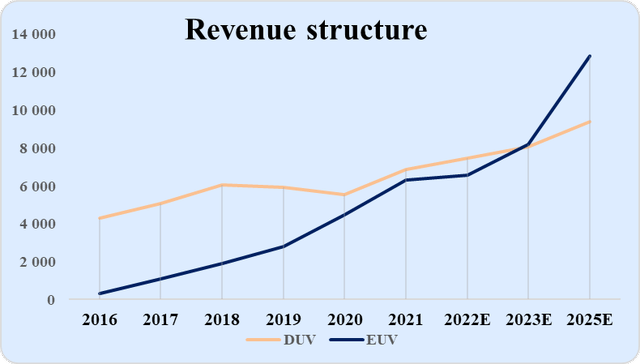

Although EUV technology is more expensive than DUV, the competition in the semiconductor sector is tough. Therefore, chip manufacturers are ready to spend a lot on top-notch equipment to be able to produce the most advanced units. For instance, the chips for the latest versions of the iPhone were created by TSMC (TSM) using the EUV ASML’s machinery. Intel is also applying EUV for manufacturing from 2022 onwards. We clearly see clients’ interest in the ASML’s revenue trend. From the beginning of the EUV technology invention, it started gaining traction, but since 2019 the trend has only accelerated and is expected to develop even further in the future.

Prepared by author based on ASML data

Despite the popularity of EUV, less advanced chips are still widely used in the booming electric vehicle industry. For the production of EV chips, DUV systems are sufficient enough. Therefore, ASML revised its initial view on the EUV adoption. At the Investor Day in 2021, the company decreased its 2025 forecast for EUV from 63% (as per 2018 estimate) to 58%. At the same time, it increased its revenue outlook by 25%. Thus, ASML expects its 2025 revenue to be in the range of €24-30 billion, much more than their current revenue of €20 billion. I believe that ASML has many chances to achieve its outlook given its solid track record in the past when ASML exceeded its outlook almost every year. You can see the exact data on “revenue surprises” here. Additionally, the decreasing trend of semiconductor prices has recently reversed which may further increase demand for ASML products.

We managed to grasp the idea of ASML’s monopolistic state. But, you may ask, what about the industry-wide risks? So, let’s switch gears and better examine potential threats.

Changing World Order: ban on exports to China

As predicted by Ray Dalio in his book Principles for Dealing with the Changing World Order, the competition between the USA and China intensifies every year. The semiconductors industry is not an exception.

In 2019, ASML stopped the sales of EUV machinery to Chinese semiconductor producers because the equipment was characterized as dual-use, or usable for both commercial and military applications. The dual-use export to China requires licenses that were not prolonged in 2019. At first, it significantly affected Chinese manufacturing capabilities. But over time, Chinese producers managed to roll out more advanced chips with the old DUV technology. Additionally, the Chinese also buy inspection machinery from ASML’s peers.

Recently, the US government introduced new chip sanctions on China that strictly control items destined for semiconductor development. The new legislation refers to any chips that are smaller than 16 nanometers and exported by US and non-US producers using American equipment. New measures brought a lot of uncertainty, because they can be read very widely and refer almost to any semiconductor producer. Initially, it was not clear how significantly new sanctions affected ASML. Initial company’s suspension of sales and services to semiconductor manufacturers in China made investors concerned. As DUV technology is used for production of chips under 16 nanometers, the potential effects seemed to be big. Surpassingly, management calmed down investors at the recent Q3 earnings call:

Our initial appreciation is that the direct implication for us is fairly limited. So why is that? First off, as you know we are a European company. So there is not a lot of US technology in our tools. That’s the first reason. Of course we will always adhere to the rule of law. So also the US export laws as they pertain to us, of course we will do whatever it takes to follow those. There is no doubt about it. But the fact that we are a European company with limited US technology in it of course creates this situation where a direct impact on us is fairly limited. We can continue to ship non-EUV lithography tools out of Europe into China.

So the direct impact on us I would say is fairly limited. Of course there could be indirect effects. Those indirect effects could be that Chinese manufacturers to the extent that they do not get other equipment that they need in their fabs for instance from the United States. Of course there could be an indirect effect on the demand for our tools. But there I would say, it is important to recognize that we are clearly still in a situation where the supply is below what the demand is.

I was pretty positively surprised by such an assessment. So did the stock market. The stock rose by 6% after results publication. Although the share price increase may be explained by the strong Q3 performance, I believe that the real reason lies in the low impact of the new sanctions.

As ASML continues exporting its products to China, the ultimate goal of postponing technological progress in China will not be fully achieved. It may intensify voices calling for the ban on DUV technology as well. Because ASML is located in the Netherlands, the US cannot introduce it directly. They would need the cooperation of the Dutch government. Although ASML tries to lobby against the ban as it will be a “lose-lose situation” for everyone due to possible pushback from China. While I deem a further ban highly probable, I believe that ASML digests any China related sanction much better than its peers.

Why can ASML withstand also further bans?

I believe the new sanctions may be introduced only at a later stage when ASML’s share of the Chinese business decreases. Otherwise, it would have been introduced already in the recent package.

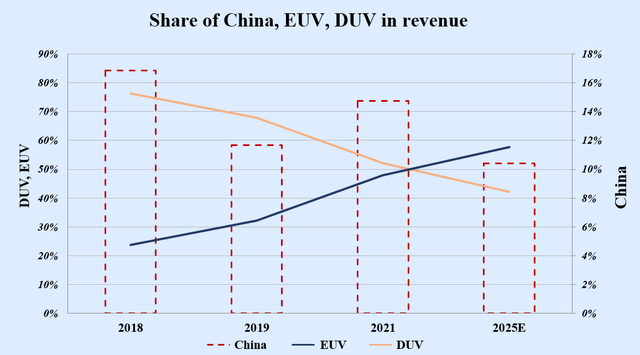

Currently, only DIV technology is sold to China. Thus, increasing the share of EUV sales would automatically decrease revenue contribution from China. Based on our calculation, if EUV expands to 55% by 2025, then the Chinese share will decrease to below 10%. Further restrictions on China will therefore have a more mild effect on the business.

Prepared by author based on ASML data

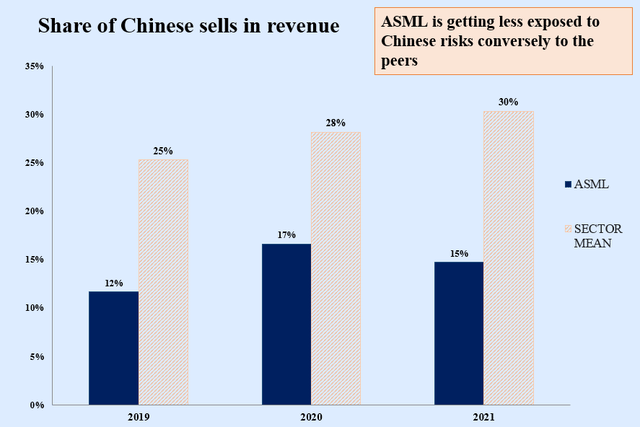

Moreover, after analyzing ASML’s peers – companies that provide equipment, methodology or solutions to the semiconductor industry – we can conclude that ASML has the lowest Chinese share in overall revenue. Also, Chinese sales decreased only by ASML. For example, it went down from 17% in 2020 to 15% in 2021. Lam (LRCX), KLA (KLAC) and Applied Materials (AMAT) increased their sales in China and TE Connectivity (TEL)maintained the percentage steadily. It is important to note that all the peers are American or American-European companies that are potentially exposed to recent sanctions. It still remains unclear to what extent they were affected.

Prepared by author based on public data

Oversupply risks

Recent supply shortages brought semiconductor issues to the limelight. To address it, governments worldwide announced subsidies for the sector.

These measures foster the demand for ASML’s machines which we can notice in a rising number of orders. They almost doubled and achieved €29 billion in 2021 compared with €13 billion in 2019.

But there is a catch. Governments speak very little to each other which may lead to a disproportionate growth of the sector, especially if an economic downturn occurs. Such a scenario may cause semiconductor producers to have spare capacity and stop ordering new machines from ASML. However, my team and I believe that ASML is much better prepared for an oversupply scenario than other players in the industry.

Why can ASML withstand it?

According to Deutsche Bank, roughly one-third of semiconductor turnover is generated in the market for computers and mobile phones respectively. Due to high competition among technological players, they need to constantly invest in production improvements. Therefore, they will be very reluctant to cut spending on the purchase of the most advanced chips manufactured by EUV.

Throughout economic recessions, the demand for new vehicles is greatly decreasing. But as 2020 showed, the demand mostly went down for combustion engine vehicles, not the newer electric cars. Auto producers are also unable to satisfy customers’ current appetite. Consumers have to wait a long time before they get their car. During the recession, some customers will postpone their purchases, which will decrease the demand and balance supply and demand. Since sophisticated electric vehicles need many chips, auto producers will continue buying semiconductors. Recent figures from Deutsche Bank support my argument. Despite stagnating vehicle production numbers in 2021, the demand for semiconductors for autos increased by 26%.

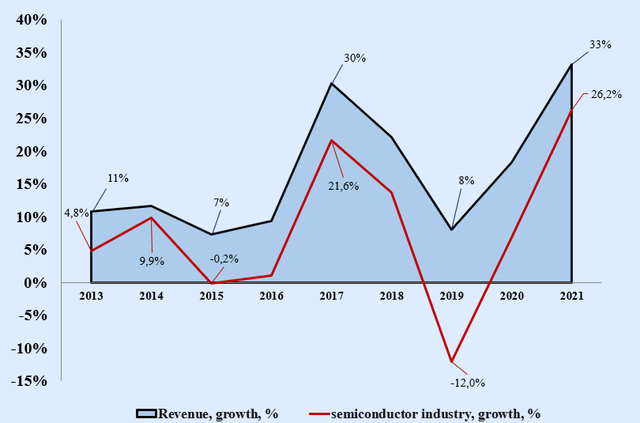

Although the semiconductor industry is strongly cyclical, ASML revenue growth considerably outpaced the industry trend. On average, it surpassed the industry by 10%. If we take the downturn of 2019 caused by the trade war between the USA and China, then we see that ASML topped the industry by 20%. The stress test was passed with flying colors. Granted, past performance is no guarantee of future results, but it may be still a good indication of future development.

Prepared by author based on ASML and Statista

Moreover, Deutsche Bank expects that the current cycle will last longer than the average historic one. Today’s chip inventories are at a historical low. The semiconductor manufacturing facilities are expected to be completed only in 2023 or later. Supply shortages may further delay the completion of factories. This would mean that the current cycle may well outdo the previous ones and last at least until the end of 2023.

This exact scenario was cautiously outlined by ASML in its forecast. If we assume the midpoint of the 2025 outlook, €27 billion, then it would imply zero growth in 2024. That is well below historic levels even during economic downturns.

Electricity blackouts in Europe

As Russia weaponized its gas exports to Europe, there are concerns over electricity blackouts in the entire continent. It could significantly affect ASML, as it strongly relies on Carl Zeiss, a German company that provides high quality lenses for lithography equipment and other optics staff. Lens are a high technology product, the manufacturing of which requires a lot of electricity.

We should observe the electricity costs in Germany, as they may help us estimate the risks of lens production properly. Carl Zeiss produces unique mirrors for EUV machinery and its factories are located almost exclusively in Germany.

Can ASML withstand it?

We believe that the concerns over energy blackouts are serious. However, if we look at the recent dynamic of energy prices, we can see that spot and future gas prices are off the August peak. It was mainly driven by the slowing of the Chinese economy. Although the prices are still high, experts do not expect a full blackout in Germany. However, electricity cuts are still probable in certain regions.

Plus, AMSL management provided a reassuring statement in its Q3 earnings call:

We are a very mild consumer of natural gas. So for us we have established that that risk profile is very low. We also looked at our tier 1 suppliers. Our key tier 1 suppliers and also there we have determined that either the risk is low or they are all very well prepared to deal with the situation and have developed alternatives.

Valuation

There are no direct peers to compare ASML to due to its monopolistic position in the field. Japanese companies specializing in DUV are not relevant for benchmarking primarily due to their wide presence across many industries (classical Japanese holding structure). Therefore, it is common to compare ASML with other equipment manufacturers in the semiconductor business.

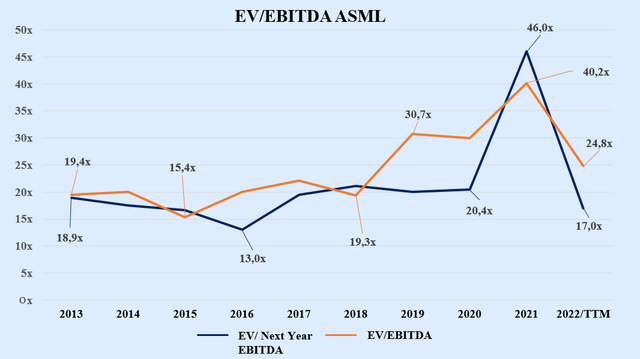

We compared current EV/EBITDA to its historic metrics. Additionally, we analyzed EV/ Next Year EBITDA. We can see that valuation based on the future EBITDA shows to us that current share price is in line with historic trends. EV/EBITDA remains higher than the average of the entire historic period, but in line with 2018-2019 when ASML was transforming into a technological monopoly. Thus, ASML is already trading at attractive levels.

Prepared by author based on ASML data

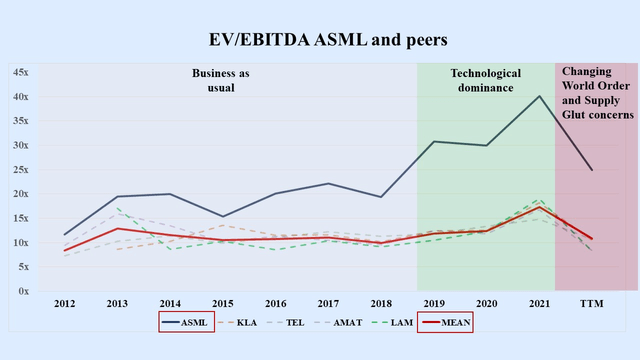

When we compare ASML with its peers, we can see that the ASML premium to the peer average increased over the last few years. It is well explained by its technological leadership. Therefore, I do not expect the premium to decrease to the average “business as usual” period.

Prepared by author based on public data

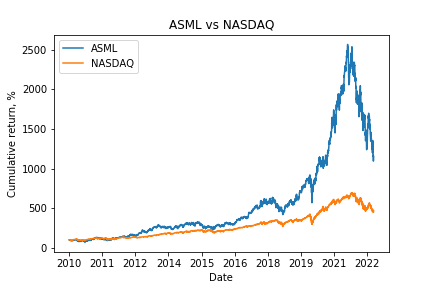

Our analysis shows that Nasdaq is quite highly correlated with ASML. The beta coefficient for ASML is 1.11. Thus, if the NASDAQ index rises by 10%, the stock will increase by 11.1% on average. As we consider a continued Nasdaq decline highly probable, we would expect to see better prices for ASML.

Nasdaq performance is driven by a fear of potential escalation of the Russian war in Ukraine and inflation in the USA and hence, federal funds rates. The higher the rate, the lower the index. If you would like to follow the changes in the federal funds rate, you can find the information here.

Prepared by author based on Yahoo Finance

Conclusion

We find ASML an appealing stock despite oversupply risks and potential further restrictions against China. Management’s confidence in the continued exports to China differentiates the stock even more from its peers.

As a cautious investor, I’d wait until I see the next leg of a bear market. But the stock presents a strong a buying opportunity at the current price.

Be the first to comment