© Reuters.

By Ambar Warrick

Investing.com– Most Asian stock markets sank on Monday as traders hunkered down ahead of more cues on monetary policy from key U.S. inflation data due this week, while Chinese stocks rose as investors continued to bet on a reopening-led recovery this year.

Japan’s index was the worst performer for the day, down 1% as markets also awaited more details from the government on the next Bank of Japan governor. Media reports suggested that the government will make an announcement on the matter this week.

The next BOJ governor will shoulder the burden of carrying out the bank’s ultra-loose policy amid rising inflation and slowing economic growth. The nomination of a hawkish candidate could spur further weakness in Japanese stocks.

Technology-heavy bourses also fell, with the index, South Korea’s and Hong Kong’s down between 0.3% and 0.6%.

Markets were wary of U.S. data due on Tuesday. While the reading is expected to show further easing in inflation in January, it is still expected to remain relatively high, which could invite more interest rate hikes by the Federal Reserve.

Rising U.S. interest rates are likely to weigh further on Asian markets as capital flows into the region dry up. Fears of a U.S. recession also grew amid a in the yield curve.

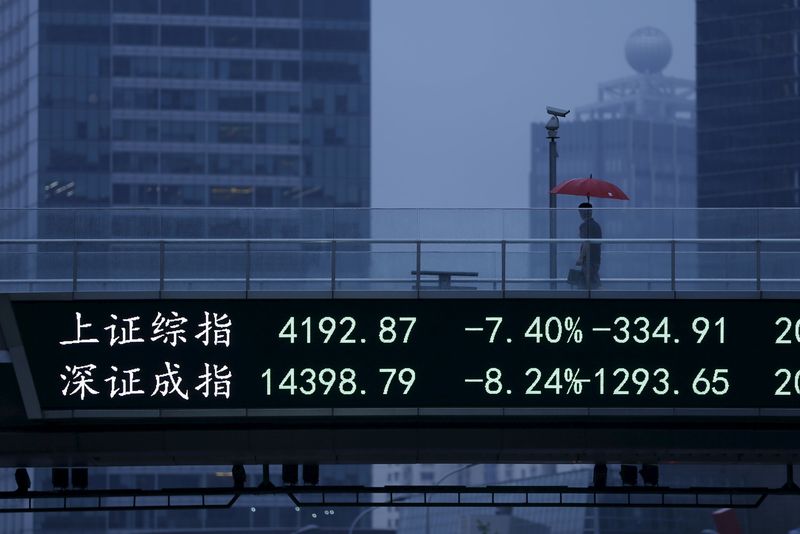

On the other hand, China’s and indexes rose 0.5% and 0.6%, respectively, vastly outperforming their peers for the day as industrial and real estate stocks led gains.

Data over the weekend showed that surged to record highs in January as the country relaxed most anti-COVID restrictions during the month. The reading could herald a bigger pick-up in activity over the coming months, with state media reports showing that the government was continuing to pump up liquidity.

But other economic readings for January, especially , painted a mixed picture of a potential recovery. The country’s massive manufacturing sector is still struggling from rising COVID cases and sluggish demand.

Indian stocks were muted, with the and indexes trending in a flat-to-low range ahead of from the country, due later in the day. Inflation is expected to have eased further in January, but is still set to remain above the Reserve Bank’s annual 4% target.

Be the first to comment