jetcityimage/iStock Editorial via Getty Images

There has been great fanfare recently over the performance of FAANG stocks. They trade on high valuations and have held up the market for so long, participants appear to expect that these businesses are the market. We have been riding the waves of technology-driven prosperity over the past decade, and as a result, it has led many to forget industries that have been equally profitable business models.

What if I told you that there’s a business out there, that has outperformed Google (GOOG, GOOGL), Facebook (META), Amazon (AMZN), and a host of others since 2010? Not only that: it has done so with a 17.5% net profit margin, growing revenue at 22% YOY to July 2022, and trades at a discount to its peers with an undemanding 16x P/E ratio?

The equipment lending and leasing industry does not get enough attention and leads us to a gem of a business. The business that I believe will outperform both the wider market – represented by the S&P 500 index (SP500) – and its own industry is none other than Ashtead Group plc (OTCPK:ASHTF, OTCPK:ASHTY).

Ashtead Group

Ashtead is an equipment rental company that operates internationally with major networks in the United States, Canada, and United Kingdom. Their flagship brand is Sunbelt Rentals, which focuses on the non-residential construction market, renting out construction and industrial equipment across a very diverse customer base. They have 991 stores in the U.S., and that segment of the business represents 83% of group revenue, with a further 11% in the United Kingdom and 6% in Canada.

There’s more to this story than its ubiquitous brand, though – I intend to show why Ashtead Group is an established market leader that looks set to move from second to pole position in key markets over the coming decade.

Business Segments & Macroeconomic Environment

We are in the throes of a recession in the developed world and certainly that appears to be weighing on near term prospects. Ashtead Group is down 19.56% YTD and is in a similar position to the FTSE 250 index in the UK.

What investors fail to appreciate, however, is the nuance to that assertion; Ashtead Group is on the surface a cyclical company that is heavily reliant on the construction industry. That means that as the economy slows down and construction is impacted, Ashtead Group could be further impacted. However, as a late-cycle industry, the business is able to adapt to these changes by selling off fleet and preserving cash during slowdowns. In addition, construction now represents only 40% of the business in the U.S., and they have deliberately reduced their reliance on that area for their customer base.

What sorts of things do they do in the 60% of the business that sits outside of construction? The specialty areas that are key revenue drivers include Power and HVAC, Climate Control and Air Quality, Scaffold Services, Shoring Solutions and Flooring Solutions. They acquired ComRent recently in 2022 as a market leading load-bank provider that offers power testing equipment, services to data centers, wind farms, solar farms and an assortment of critical infrastructure assets.

Finally, in 2019, they acquired William F. White in Canada – the movie equipment rental giant that has a foothold as Canada’s biggest film, TV and digital production equipment rental business. The business has 13 locations across Canada and over 400 employees. Their customer base includes Walt Disney, Warner Bros, Universal studios, MGM and Lionsgate as US-based companies rush to move production towards the north where they can capitalize on the lower dollar and cheaper production costs.

Balance Sheet and Income Statement

Ashtead Group is a highly profitable, diversified equipment rental business with a fundamental growth story that benefits from their customers need to use property, plant, and equipment more efficiently and effectively.

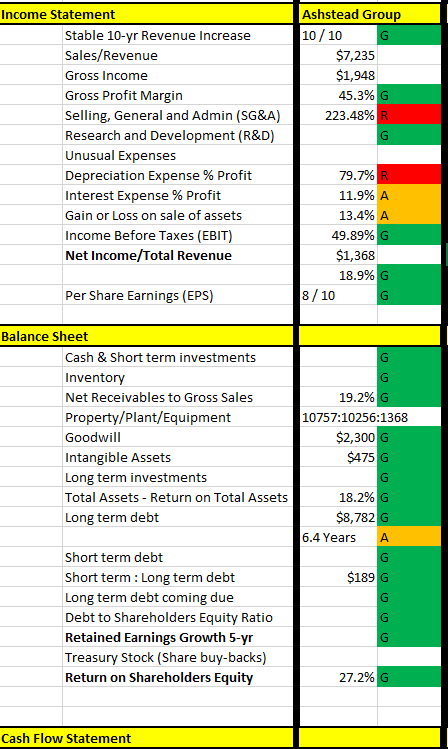

Let’s dig into the fundamentals further and assess Ashtead Group’s balance sheet using a forensic approach to determine whether this business has a wide-moat or not. For the purposes of saving space, here is a summary of the result of that analysis:

Source: David Huston

Ashtead Group is a capital-intensive business – which is no surprise – leading to fairly high SG&A expenses relative to gross income, as well as depreciation expenses on equipment and losses on sales of capital goods. That being said, it has an enviable 10-year revenue growth track record, delivers a commendable return on shareholder equity, and has no issues with debt.

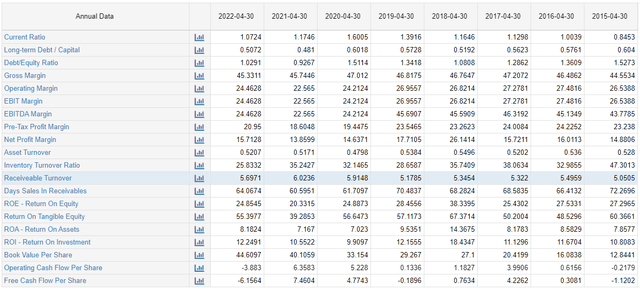

The key question is: does the company have a trend here whereby profit gets gobbled up by these expenses, and could this get worse during an economic downturn? Looking at the past 5 years including the pandemic, what is encouraging to see is that Ashtead Group has an excellent track record of revenue growth (top line) and profit and cash flow growth (bottom line).

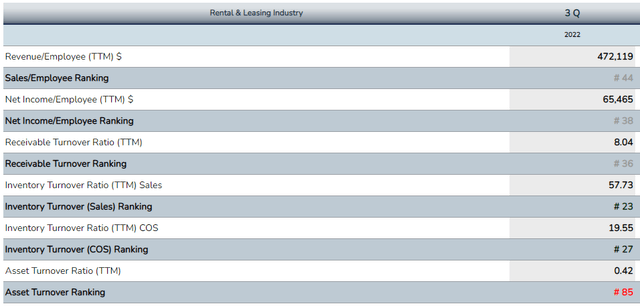

Looking deeper, one way to assess this business is to benchmark it against the wider equipment leasing industry. It is important in this industry to look at the ratio of sales per employee and their Receivable Turnover ratio, which measures how efficient the business is in collecting receivables from their customers and clients. First, let’s look at the overall Rental & Leasing Industry:

Source: CSI Market.com Rental Leasing Industry statistics

The industry average Receivable Turnover ratio is 57.73 and average Revenue per employee of $472,119.

Ashtead Group holds a very commendable Receivable Turnover ratio of 5.70 that has also, encouragingly, stayed stable for the past seven years through two economic slowdowns (including the severe Covid-19 induced lockdowns). This is crucial because it suggests that they have creditworthy clients, who are chased by the business to pay their bills, and the processes for doing so across the business are effective. Ashtead also has industry-beating Revenue per employee of $491,809, and a slightly higher asset turnover ratio at 0.52.

Ashtead Group ratios from Macrotrends 2022

It’s critical to view these numbers in relation to its own industry: a business that has better payment terms and manages its inventory well, with high gross and net margins demonstrates that it has a competitive moat.

Finally, when we look at Property, Plant, and Equipment and compare that to Total Debt and Net Earnings, we see that it takes approximately $10 of PPE, and $10 of debt, to produce $1.3 of net income across the entire business.

Overall, there are flags to watch for with regards to SG&A expense, depreciation expense, interest expense and gain and loss on the sale of assets. Provided these metrics stay in line with historical averages there are no major issues. This is counterbalanced by an extremely strong 10-year revenue history, an excellent 45% gross operating margin, 24.85% ROE, and favorable Receivable Turnover ratio and Revenue per Employee. The return on shareholder equity is a healthy 27.2%. Ashtead Group is a well-managed business.

Headwinds for Ashtead Group

According to the Equipment Leasing & Finance Foundation, there are six trends to look out for as we move into 2023 that suggest caution is warranted for the industry:

- Equipment and Software Investment: “Equipment and software investment growth fell sharply in the second quarter, though early indicators point to a modest rebound in Q3. “

- Momentum Monitor: “Momentum Monitor verticals are showing signs of peaking or weakening. Only railroad, aircraft, medical, and construction are still showing signs of expansion, suggesting that Fed rates hikes will weigh on investment in the months ahead.”

- Manufacturing Sector: “Higher interest rates are likely to drag on manufacturing output over time.”

- Small Businesses: “The dual impacts of high inflation and surging interest rates are likely to impact smaller firms first and hardest, (…) small business owners are likely to feel more pressure to slow or pause plans to expand and hire, particularly if consumer demand falls.”

- Fed Policy: “Fed officials have repeatedly emphasized the importance of reining in inflation and preventing expectations from becoming unanchored — even if this means sending the U.S. economy into a recession.”

- U.S. Economy: “The U.S. economy contracted through the first two quarters of 2022, amplifying recession fears. (…) The potential for rising consumer stress and higher energy prices are factors to watch.”

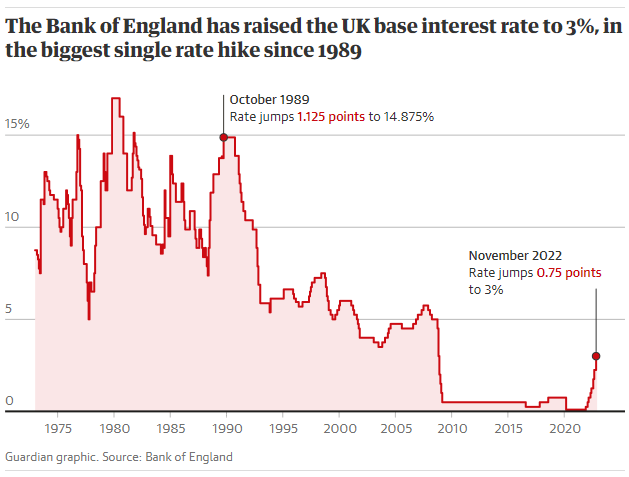

The Bank of England (representing a key market for Ashtead) has recently announced that the UK economy faces “a very challenging outlook,” and according to the Guardian may face a recession that lasts well into the middle of 2024:

Source: Guardian newspaper article November 2022

A key risk for the near-term prospects of Ashtead Group rests on whether the economy materially weakens to the point that it effects the rental market in the United Kingdom, U.S., and Canada more than the company expects.

Technical Analysis

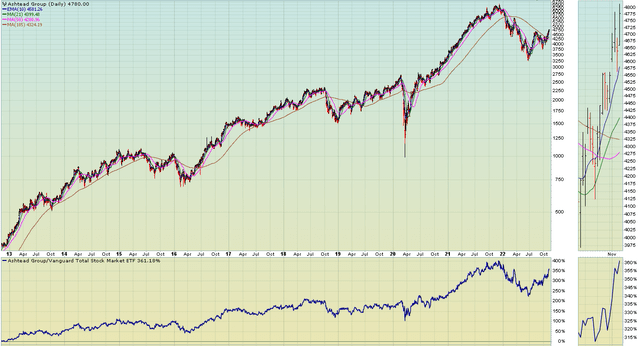

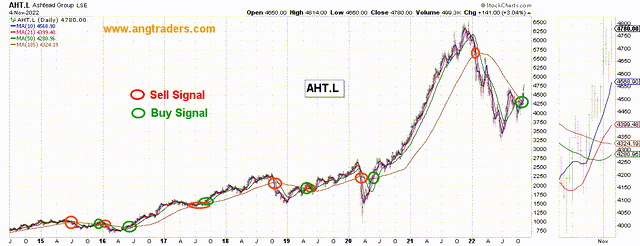

Ashtead Group has shown remarkable resilience since hitting a recent and local low in July 2022. The share price rests above its 10, 20 and 50 day moving averages.

Source: Stockcharts Analysis, Stockcharts 2022

The brown line represents the longer term 185-day moving average. Clearly, you can see a pattern where the business shows strong upward momentum during normal market performance, and sideways or downward trends during economic or market slowdowns.

Using Python, we have analyzed a model portfolio that is traded using the 185-day moving average (buy when above, sell when below). The results of that analysis are as follows:

- Ashtead (AHT.L) returned an astonishing 22,759.9% between 2003 and 2022 YTD for buy-and-hold investors

- Ashtead (AHT.L) when traded using the 185-day moving average returned 51,516.8% between 2003 and 2022 YTD (cash on sell signals)

- Buy and sell signals based on daily data, executed on open of next day, excluding transaction costs and taxes

This leads us to two interesting conclusions. The first is that Ashtead is great for buy-and-hold investors when it trends above the 185-day moving average, as it does now. The second is that an investor may consider buying when it crosses above the 185-day trend line, which it did on the 24th October 2022 (see below), but also selling when it crosses below that line. Doing so would historically have made a return of more than double the buy-and-hold strategy excluding transaction costs.

Therefore, one could make the case that buying Ashtead Group above that 185-day average and selling to cash below that line is the optimal momentum strategy for this security, excluding taxes and transaction costs. This would be particularly beneficial to those holding the security in a stocks and shares ISA (UK) or any IRA or 401K (U.S.), or TFSA (Canada).

Final Thoughts

Ashtead Group is a wonderful business trading at a compelling valuation and is certainly worth further investigation to determine whether it has a place in your portfolio. As a foreign business, it is dual-listed on the London Stock Exchange and New York Stock Exchange with significant operations in the U.S., United Kingdom, and Canada.

Fundamentally, it has produced extraordinary returns since 2003, and the share price has been hit recently due to wider economic weakness and a perception that this business will be heavily impacted by a recession and downturn. Ashtead has taken proactive steps to move away from being totally reliant on the construction industry and now has a healthy 60% of revenue coming from segments that are less impacted by the economic cycle.

Overall, the business is rated a buy and we recommend a two-pronged strategy for those interested in getting exposure to Ashtead Group.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment