Shannon Fagan/DigitalVision via Getty Images

By Alex Rosen

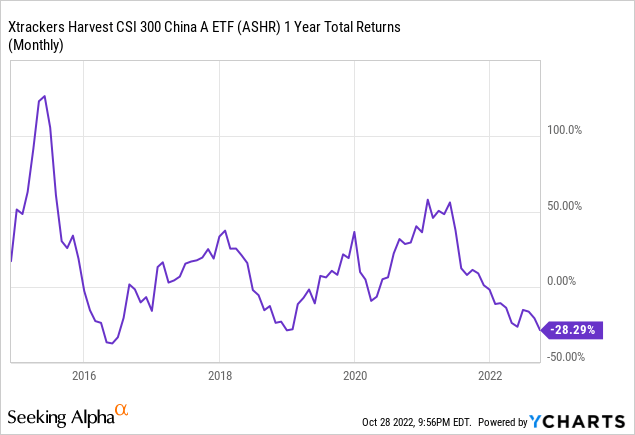

We rate the X-trackers Harvest CSI 300 China A-Shares ETF (NYSEARCA:ASHR) a sell, given the extreme volatility and questionable fundamentals of the underlying holdings. We do see potential once the current vicious inflation cycle reverses, but that is not likely to be any time soon.

An ETF that mainly focuses on the financial and manufacturing sectors in China is an extremely risky proposition right now. Until global supply chain issues are resolved and global inflation is tamed, this looks like a bad place to keep your money. The only possible upside is that a strong dollar could potentially increase demand for manufacturing goods coming from China, but if supply chain issues create prolonged delivery delays even that might not bear fruit.

Strategy

The ETF is able to offer foreign investors access to China’s A-share market directly. However, China has something called the Renminbi Qualified Foreign Institutional Investor (RQFII), which limits how much foreign investors can invest directly in stocks in mainland China. The RQFII quota limits the amount of shares available. As it is focused on mainland China A-shares, it tends to lean heavily toward finance and manufacturing sectors – two sectors that China has worked steadily to develop.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Non-U.S. Equity

-

Sub-Segment: China

-

Correlation (vs. S&P 500): Moderate

-

Expected Volatility (vs. S&P 500): Very High

Holding Analysis

ASHR’s portfolio holdings have turned over rapidly. The fund’s turnover ratio is close to 100%, which means the stocks held in it today might be very different a year from now. The fund is rebalanced every six months and, with a turnover ratio that high, essentially it reinvents itself semiannually. Currently, its three biggest assets are Kweichow Moutai Co., Ltd. (600519), maker of Chinese Spirits, particularly Baijo, Contemporary Amperex Technology Co., Limited (300750), maker of lithium batteries, and Ping An Insurance Group Company of China, Ltd. (OTCPK:PIAIF), seller of annuities and property and life insurance policies. These companies comprise about 10% of the entire portfolio.

Strengths

The diversity of investments and access to Chinese A-shares makes it unique. If you are a believer in China’s continued domestic growth and appreciate a dividend payout, then this is an opportunity to invest in that. Also, note that two of the three tickers for ASHR’s largest holdings cited in the previous section are expressed via a local numbering system. That’s because, as with many China A-share companies, ADRs or U.S.-traded versions do not exist. That drives home the uniqueness of ASHR. It accesses stocks that are not easily owned by non-Chinese investors.

Weaknesses

Because ASHR tracks the CSI 300 Index and has very little, if any, flexibility to look beyond those investments, its performance is strictly tied to the overall outlook for China. If China is up, ASHR is up. Right now, ASHR is down 34% YTD. Most ETFs are subject to the ups and downs of the index they track. But in the case of ASHR, since it’s so closely tied to the economic fortunes of China, it can be considered a very strong proxy for both that economy and the sentiment toward it from investors.

Opportunities

Like it or hate it, China is the world’s second largest economy. It has a centralized government that tries to control everything – even the weather is centrally planned. If Beijing decides to pump up the manufacturing sector, it has the capital reserves to do it. It is a clear market maker. Thus, if China suddenly decides to provide additional support to the finance sector or the manufacturing sector, it has the resources to do it.

The chart below shows the very wide range in one-year returns for ASHR since its 2013 inception. As you can see, volatility cuts both ways.

Threats

The Chinese economy appears to be trending downward, especially with the installment of Xi Jinping for a third term, who seems to be cracking down on dissension and thus stifling economic growth. Due to the strong dollar and the global supply chain issues, the Chinese manufacturing sector is set to face a serious decline.

Currently, the Chinese markets are in deep turmoil as investors try to assess how the Chinese Communist party’s five-year congress will play out. Xi has clearly consolidated his power and has yet to clarify which direction he will take China, whether it be continued crackdowns on dissension that inhibit the flow of capital from Hong Kong or a full-scale invasion of Taiwan.

Proprietary Technical Ratings

-

Short-Term Rating (next three months): Sell

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

ASHR is composed of China’s strongest companies listed on the Shanghai and Shenzhen markets. A bet on China is a bet on ASHR. And since this ETF is easily the largest of a trio of ETFs that access the China A-share market, it’s one we consider to be structurally solid.

ETF Investment Opinion

For all the reasons laid out above, we don’t see ASHR turning things around in the short term. Its heavy investment in tangible goods makes it difficult to see a short-term turnaround. Additionally, there are no indicators that this will change anytime soon. As a result, it appears to be a very toxic environment, and one not worth investing in right now. ASHR gets a sell rating from us.

Be the first to comment