Morsa Images

Intro

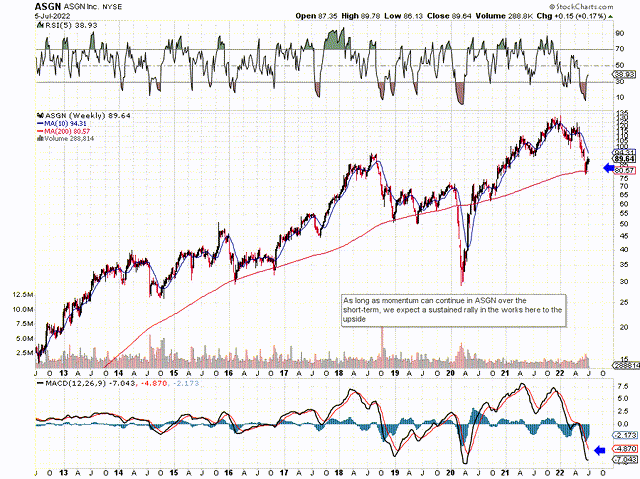

If we pull up a weekly chart of ASGN Incorporated (NYSE:ASGN), we see shares seem to be closing in on a MACD buy signal. The decline in the share price was finally halted by the 200-week moving average and the 10-week moving average of $94+ per share now looks to be in ASGN´s sights. We state this because of the rising histogram in recent sessions due to ASGN´s strong share-price performance in recent weeks. The best MACD buy signals present themselves when the crossover takes place well below the zero line so it will be interesting to see if momentum can continue in ASGN going forward.

ASGN Honing In On A Long-Term Bottom (StockCharts)

Earnings Growth Outperforming

Whereas the technician studies the effect of market movement, the fundamentalist focuses more on the reasons why ASGN shares have been in bullish mode over the past three weeks or so. On this note, the company´s forward-looking earnings revisions continue to gain traction. ASGN´s fiscal 2022 bottom-line estimate of approximately $5.40 per share has increased by more than 10%, for example, over the past three months alone. Since earnings growth is the principal driver of stock prices on Wall Street, shares will continue to rally if indeed forward-looking earnings revisions continue to get marked up.

The technician on the other hand believes human psychology plays a major role in how ASGN shares trade over the long term. What this means is that (as long as the company´s fundamentals have not been impaired in a major way), buyers should continue to step in when the company´s shares are on sale. We can see this on ASGN´s long-term chart in that shares more often than not have been able to bounce off long-term support (200-week moving average) due to buyers inevitably stepping in. This “market beat” or psychology (which may very well be playing itself out currently in ASGN) among investors who trade and invest in this stock tends not to change. Furthermore, we can see below that the stock has plenty of runway for growth from some encouraging trends in the company´s recent financials.

For the first-quarter earnings call, we witnessed better than expected top-line growth within the Commercial segment (Commercial Consulting, Creative Digital Marketing, Permanent Placement). As alluded to above concerning the company´s earnings revisions, ASGN´s numbers continue to come in ahead of target and the market is finally beginning to price this growth into the share price.

The company´s commercial consulting bookings (Funded work awarded) number for the first quarter of almost $300 million was a huge increase over the same period of 12 months prior, and this trend, in particular, brings positive ramifications to the table for the company.

Margin Expansion

For one, gross margins continue to expand due to strong growth in this segment. Commercial consulting sales rose by over 74% in the first quarter to hit almost $205 million and although comps are expected to be choppy over the next few quarters, management reaffirmed its bullish outlook for this segment. Suffice it to say, the higher mix of commercial consulting is also driving EBITDA margins growth further down the income statement. ASGN´s adjusted EBITDA margins are now expected to hit at least 12.2% in fiscal 2022 which is further evidence of the growing high-margin commercial consulting business. Furthermore, the encouraging aspect of this trend is that higher margins had already been flagged by management last year, so more upside is expected here based on the bookings which have been reported to date.

Digital Transformation

Tailwinds in consulting stem from a very strong account base from which ASGN can continue to add value through its ongoing solutions. Whether the value is added through the cloud, data analysis, etc., the key is that ASGN´s customers simply need to continue rolling out their digital footprints to remain competitive. This “need” limits downside risk in ASGN as IT spending will continue to grow irrespective of how economic conditions change going forward. Suffice it to say, we remain in the initial innings of the digital revolution, so plenty of runway for growth remains here.

Conclusion

Therefore, to sum up, with shares presently trading with a forward GAAP earnings multiple of 16.59 and a forward sales multiple of 1.02, shares continue to look cheap given the trends we have discussed above. Let´s see if the company can report yet another earnings beat in the second quarter. We look forward to continued coverage.

Be the first to comment