As my long-time followers know, I have always been a deep value investor. Like most deep value investors, often you find yourself buying a mediocre business at what you perceive to be a very good price or you try to buy a relatively good company that has a leveraged balance sheet but a tangible pathway towards a turnaround.

In today’s piece, I write to share why I have a five percent-sized portfolio allocation in shares of Ascena Retail Group, Inc. (ASNA). Now, in the interest of full transparency, given the exceptionally challenging market backdrop, largely due to coronavirus, let me be clear and state that my cost basis is in the low $3s on this high flyer.

Ascena is a women’s apparel retailer that operates four segments:

- Premium Fashion – Ann Taylor and Loft

- Plus Fashion – Lane Bryant and Catherines

- Kids Fashion – Justice

- Value Fashion – Owns 49.6% JV interest in Maurices, and it completely wound down Dressbarn at the end of Q2 FY 2020

Due to fierce price competition (weaker gross margins), industry overcapacity, a secular decline in mall traffic, expensive occupancy costs, and a highly leveraged balance sheet, Ascena and its stock have been stuck in quicksand.

Looking at a five-year chart, the stock peaked around $345 per share back in June 2015. Also note that the company had a 1-for-20 reverse split that took effect on December 19, 2019. Looking at a two-year chart, ASNA shares crested at $97 per share back in August 2018. So, despite yesterday’s 30% rally, shares of ASNA are down 98.7% from their August 2018. If you were a technical analyst, you would immediately conclude that this company is destined for the dustbin of history. Good thing I’m a fundamental value investor and not a lover of pretty stock charts.

(Source: Seeking Alpha)

Moreover, if you actually get in the weeds and do the fundamental work, including reading recent earnings conference calls, you realize that Ascena’s management burned the proverbial escape boats and is ready to fight to the death. The company is well within all of its debt covenants, its term loan isn’t due until August 2022, it has significant Adjusted EBITDA power, COVID-19 notwithstanding, and its pro forma debt, post the second term loan buyback disclosed on its Q2 FY 2020 conference, was just north of $900 million.

Read the subtext within the company’s recent Q2 FY 2020 conference call:

Our Board and management team remain committed to taking proactive steps to position Ascena for long-term success and we will continue to evaluate opportunities that create shareholder value.

As we indicated on the last earnings call, we continue to work on optimizing our balance sheet. As a reminder in Q2, we repurchased $80 million of term loan debt for $49 million in cash. Subsequent to the second quarter, we opportunistically repurchased an additional $42 million of term loan debt for $29 million in cash.

Notwithstanding the coronavirus temporarily shutting down most of retail, in early March, Ascena appears to be leveraged at less than 4 turns. If you do a little more digging, you will work out that its term loan, again not due until August 2022, will have a lower FY 2020 interest expense.

As we indicated on the last earnings call, we continue to work on optimizing our balance sheet. As a reminder in Q2, we repurchased $80 million of term loan debt for $49 million in cash. Subsequent to the second quarter, we opportunistically repurchased an additional $42 million of term loan debt for $29 million in cash.

Source: Ascena Q2 FY 2020 Conference Call

This is because the company retired $122 million of its term loan on two occasions in fiscal year 2020: $80 million face value for $49 million (61.25 cents on the dollar), and post closing of Q2 2020, an additional $42 million face value for $29 million (69 cents on the dollar).

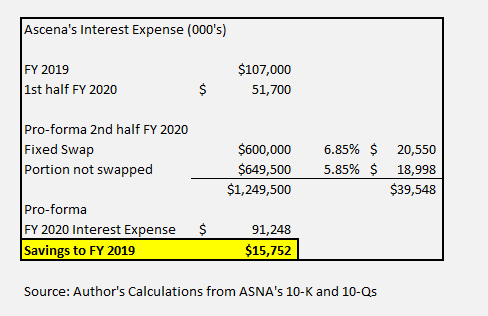

Per the company’s 10-K for fiscal year 2019 ending August 3, 2019, only $600 million of its debt was tied to a fixed-rate swap. In FY 2019, ASNA’s effective interest rate was 6.79%, which translated to $107 million of annual interest expense.

As of August 3, 2019, we had $1,371.5 million in variable-rate debt outstanding under our borrowing agreements. To protect against future increases in interest rates, on March 22, 2019, we entered into an interest rate swap contract, which was designated as a cash flow hedge. This interest rate swap became effective on March 29, 2019. It has a notional principal amount of $600.0 million, a swap rate of 2.35%, and matures on March 31, 2021.

Source: Ascena FY 2019 10-K

Given the state of the world, governmental base borrowing rates – think Fed Fund Rate, LIBOR, Eurodollar etc. – have plunged. Therefore, ASNA’s effective interest rate in FY 2020 will decline, as more than half of the principal balance on its term loan isn’t tied to a fixed 2.35% swap. And variable debt tied to LIBOR or Eurodollar base rates have declined. And again, just to reiterate, the principal balance on its term loan has declined by $122 million, from $1.371.5 billion to $1.2495 billion as of mid-March 2020. Per my calculations, ASNA’s FY 2020 interest expense should decline by $15.8 million due to reduced principal and a lower variable interest rate.

To understand Ascena, you need to know its history. And we need to discuss two key items: the company’s majority interest stake sale in Maurices (which is straightforward) and the wind-down of Dressbarn.

Maurices

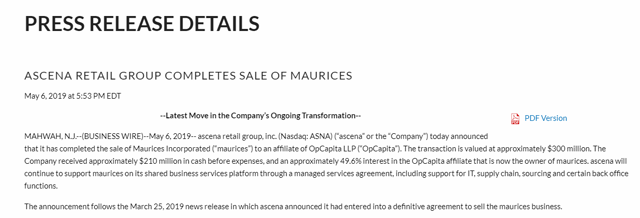

In terms of Maurices, Ascena sold a majority stake and controlling interest in the business to private equity. The deal officially closed on May 6, 2019, and as a result, Ascena received $210 million in cash and retained a 49.6% equity interest.

(Source: Ascena IR)

Dressbarn

A rolling stone gathers no moss, and Ascena’s management was super-busy in fiscal year 2019. Soon after closing the Maurices deal, literally two weeks later, management announced the wind-down of Dressbarn.

MAHWAH, N.J.–(BUSINESS WIRE)–May 20, 2019– ascena retail group, inc. (“ascena” or the “Company”) today reported that its Dressbarn brand has announced plans to commence a wind down of Dressbarn’s operations. This decision has no impact on the operations of any of ascena’s other brands and will strengthen the Company’s overall financial performance.

Let me be crystal clear, Dressbarn was a financial anchor that was burning so much cash flow, it would make any CFO blush. The fact that Ascena’s management team took the bold action of notifying landlords that they were going to wind this business down, six months in advance, is empirical evidence for investors – at least investors any good at deductive reasoning – that Ascena’s management is here to fight!

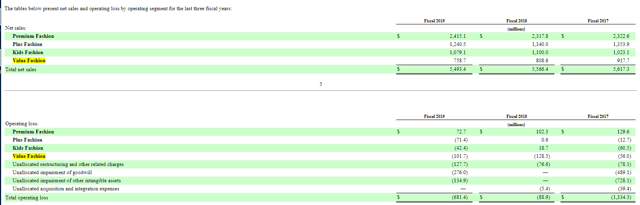

If you look at Ascena’s FY 2019 10-K, you quickly work out that Value Fashion, only reported as Dressbarn, as Maurices is reported under discontinued operations, had a negative sales trajectory and had negative operating income of $101.7 million in FY 2019. Yikes!

Think about that for a second. In FY 2019, the Dressbarn business generated negative $101.7 million of operating income. Going forward, that business no longer exists, and it can no longer lose any money from Q3 FY 2020 and beyond.

(Source: Ascena FY 2019 10-K (page 6))

Specifically, on February 19, 2020, we officially learned that Ascena completely exited its financial albatross business, Dressbarn. Despite fear-mongering from short-sellers, Ascena successfully eliminated $300 million of shadow debt in the form of Dressbarn store operating leases, and the financial damage associated with this wind-down was only $60 million. Moreover, it was implied that the working capital proceeds, and selling of the Dressbarn trademark and brand name, offset a decent portion of that $60 million tab.

Again, as I can’t emphasis enough, Ascena no longer has the baggage and associated cash flow burn from Dressbarn.

MAHWAH, N.J., Feb. 19, 2020 (GLOBE NEWSWIRE) — ascena retail group, inc. (Nasdaq: ASNA) (“ascena” or the “Company”) today announced that the Dressbarn brand has completed the orderly wind down of its business operations, closing over 650 stores and successfully eliminating over $300 million of lease liability.

Favorable sales performance by Dressbarn since the announcement fully offset the costs incurred in the wind down of approximately $60 million. All Dressbarn stores have now been closed, and the Dressbarn intellectual property assets and its ecommerce business have been sold and transitioned to its new owner.

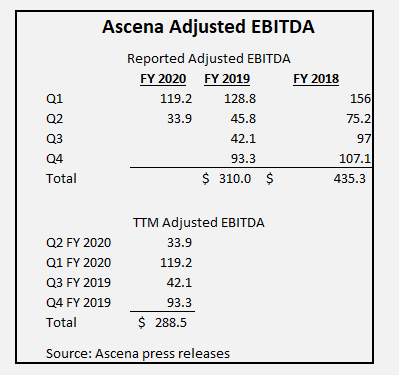

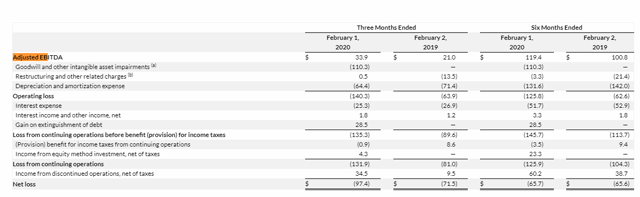

See below Ascena’s reported Adjusted EBITDA.

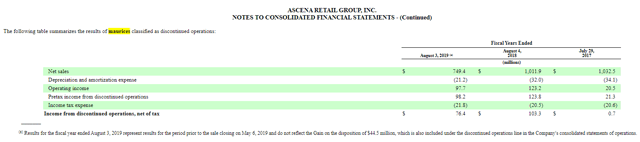

However, there are nuances here, because as of Q4 FY 2019 (period ending August 3, 2019), Maurices is reported as a discontinued operation. Ascena has restated past results to exclude Maurices. In FY 2019, Maurices generated $749.4 million of revenue and generated operating income of $97.7 million.

(Source: ASNA FY 2019 10-K (F-9))

So now we understand why private equity paid $210 million for a 50.4% controlling stake in Maurices.

Going Forward

Given the heightened uncertainty, associated with the temporary forced store closures from COVID-19, it is nearly impossible for investors to forecast the second-half fiscal year 2020 EBITDA power of Ascena. That said, the company’s wind-down of Dressbarn looks downright masterful, as going forward, its occupancy and SG&A no longer create such a headwind. And again, Dressbarn will no longer generate $101.7 million in operating losses.

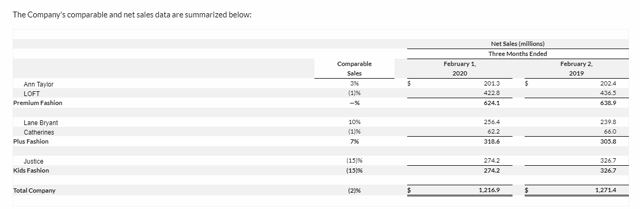

In terms of recent results, notwithstanding a horrible Q2 FY 2020 comp at Justice, although they were lapping a tough comparison, Ascena’s comps are stable. And gross margins were relatively stable at 55.6% (first-half FY 2020) vs. 55.9% (first-half FY 2019).

In addition, the trajectory of Ascena’s Adjusted EBITDA is finally moving in the right direction, at $119.4 million (first-half FY 2020) compared to $100.8 million (first-half FY 2019).

The opportunity

So, although I readily admit that Ascena’s second half FY 2020 Adjusted EBITDA power is unknowable due to the fallout from COVID-19, Ascena’s market capitalization as of April 6th is only $12 million. Moreover, per the WSJ, and as of March 13, 2020, there were 3.17 million shares of Ascena sold short. That means that nearly 32% of the company’s entire share count was sold short.

I would argue that we are simply one 5% or 10% activist holder away from sparking a massive short squeeze (a 10%-sized stake by an activist might only cost $2 million – as quietly acquiring a million-share stake would lead to upward stock price pressure. Again, it is an unrealistic to think an activist could acquire 1 million shares without moving the price).

Also, because Ascena’s pro forma cash as of February 1, 2020 was $344.7 million (post buying back $42 million face value of term loan for $29 million, after the quarter ended), Ascena could easily afford to launch a modest $10 million equity buyback campaign, if forced by an activist. Alternatively, management very well could be opportunistically looking to buy back more of its August 2022 term loan at $0.60 on the dollar (or less), especially given how dislocated many sections of the high yield credit markets were in March and into early April.

Putting it all together, I love the upside potential in Ascena. That said, this is a high flyer and super-high octane bet. So, if you play, size it with great care, as there is real risk of a wipeout, should the COVID-19 crisis last longer than excepted.

Disclosure: I am/we are long ASNA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment