NicoElNino

Asana, Inc. (NYSE:ASAN) is a leading project management platform used by an elite customer base which includes; Uber, Facebook, Google, Spotify, Deloitte and many more. The company was founded in 2008 by Dustin Moskovitz, who co founded Facebook (META) along with Mark Zuckerberg and Justin Rosenstein, who invented the Facebook “Like” Button (yes really!).

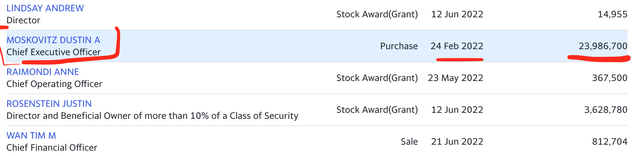

Moskovitz is the CEO today and owns approximately 49% of all outstanding shares, he even purchased nearly 24 million more shares in February 2022, as the stock declined. Wall Street has many concerns about the company’s “cash burning” situation, but they are overlooking that the CEO can support the company or even just buy the whole company. A quick calculation shows that would cost him “just” $1.68 billion (at the current $3.36B market cap), which is a nickel relative to his $9.6 billion net worth.

CEO Insider buying (Yahoo Finance)

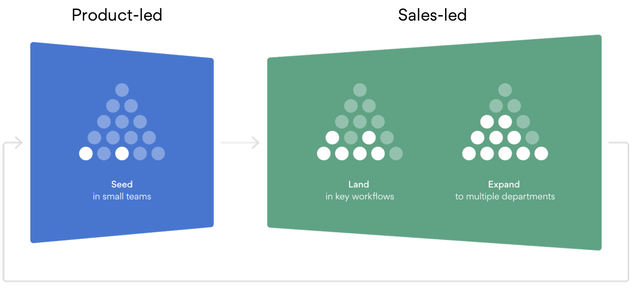

With such strong and well connected management, it’s no surprise that Asana has been an incredibly successful company with revenues and customers up substantially since its founding. Asana IPO’d in 2020, and the stock price increased by over 446% in the tech bull market of 2020/2021. However, since the high inflation numbers were released in November 2021, the growth stock market has been decimated and Asana’s share price has plummeted by over 87% from the $137 all time highs to just ~$17/share. The stock is now undervalued intrinsically and relative to historic multiples. Let’s dive into the Business Model, Financials and Valuation for the juicy details.

SaaS Business Model

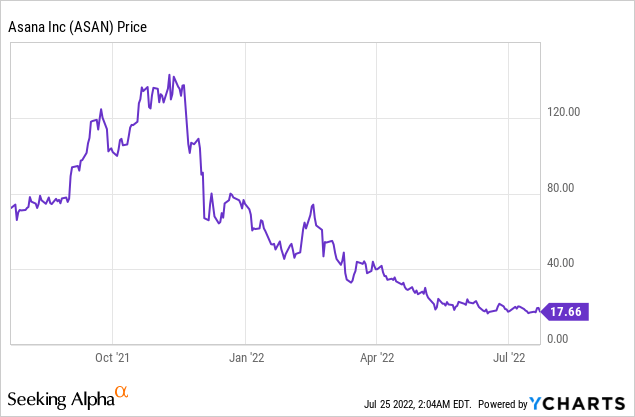

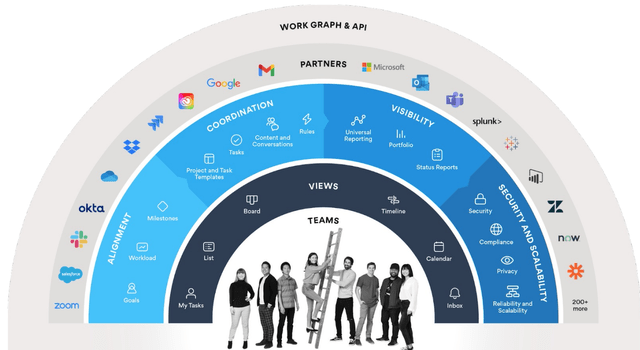

Asana’s goal is to help make “Work, work for you” through the use of its software platform for project management and team collaboration. The platform allows teams to start with a business “Mission” and then segment this down into actionable Objectives, “Portfolios” and then Projects and individual tasks. The beauty of the platform is that teams can see a unified view of the tasks and how close they are to completing an objective. This makes the platform popular with creative marketing teams, Go to Market teams, and much more.

Asana Work Graph (Investor presentation)

According to Asana, 58% of our work time is spent on “Work about Work,” which includes emails, unnecessary meetings, and duplicated work. As Asana keeps all project notes in one place and integrates with work chat tools such as Slack, it saves teams time and makes them more efficient. Popular Video Conferencing company Zoom (ZM) reportedly saves “133 work weeks per year with Asana,” Dow Jones Marketing saves “10% of their workday” through the use of Asana, and the Autodesk events team is 50% more efficient due to using the tool.

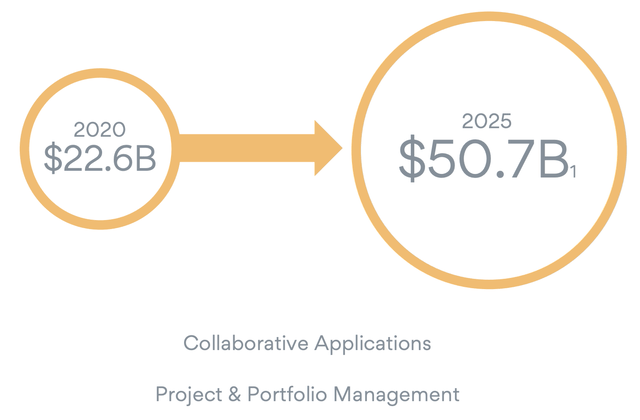

Despite already racking up an elite list of customers, Asana still has vast total addressable market (“TAM”) across Collaborative Applications and Project & Portfolio Management. According to an IDC report, the market was valued at $22.6 billion in 2020 and it is expected to more than double to $50.7 billion by 2025.

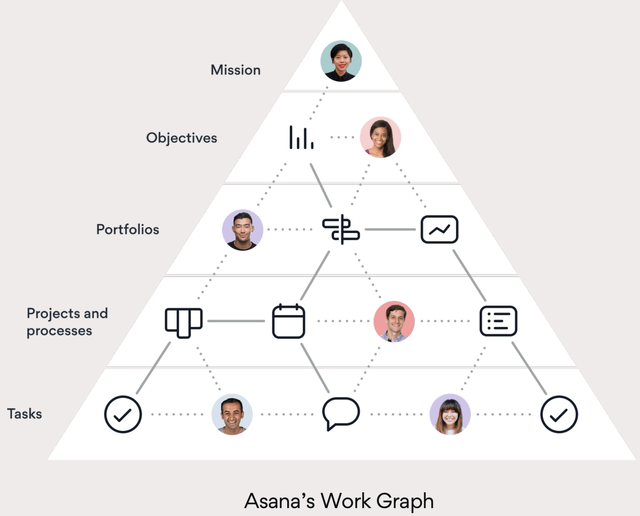

Asana’s plan is to attack this market opportunity with a classic software as a service (“SaaS”) go-to market strategy, that includes Product Led Growth, Account Based Marketing and a “Land and Expand” Sales led approach. “Product Led” is a Product Marketing strategy, which basically allows users to see the value in the product through a demo or free trial before a purchase is made. The “Land and Expand” approach “lands” in a key account (business), solves a small use case such as for single teams campaign and then this is “Expanded” to multiple departments of an organization.

Go to Market (Investor Presentation)

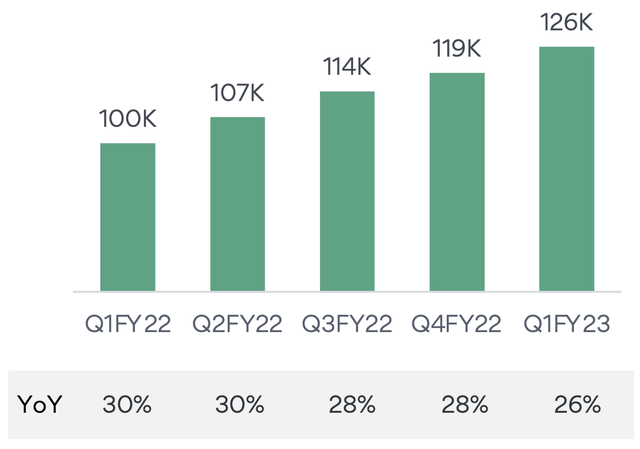

Asana’s strategy has been working well so far, as they have grown Total Customers to a staggering 126,000, up 26% year over year.

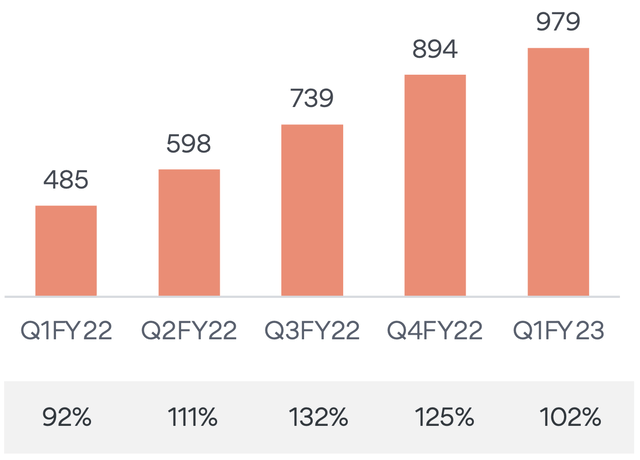

Asana has also been “expanding” upmarket well with the number of customers spending over $50,000 was up to 979, which is an increase of a substantial 102% year over year. The beauty of these larger customers is they tend to be more “sticky” and spend more over time. For instance, the dollar-based net retention rate for customers with $50,000 or more in annualized spend in Q1 was over 145%, which was greater than the 120% average for the company.

Asana customers spending over $50k (Earnings Report Q123)

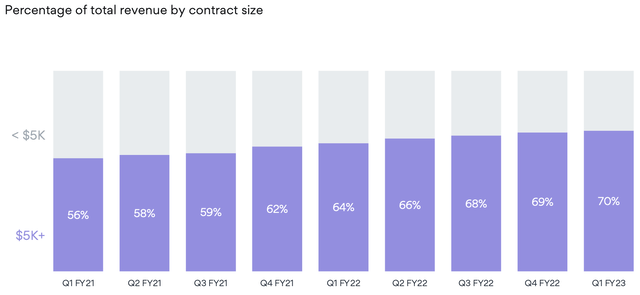

The Average Contract size has also “expanded” from 56% of customers having over $5k spend in Q121, to 70% of customers in Q123.

Revenue by contract size (earnings report)

Growing Financials

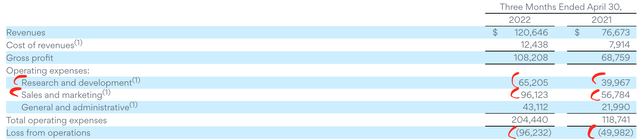

Asana generated strong financials for Q123, revenue was $120.6 million up a blistering 57% year over year.

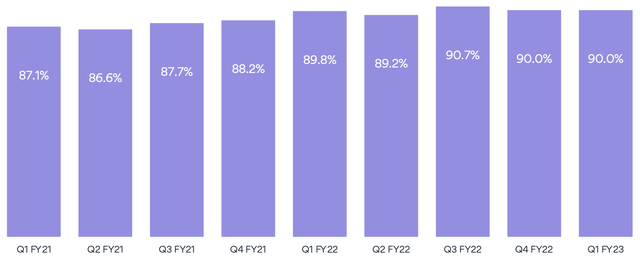

The company has a super high gross margin of 90%, which is up by 12.9% year over year. A high gross margin is a major characteristic of SaaS companies which invest a lot to build the product up front and then reap the benefits of high operating leverage moving forward.

SaaS Gross Margin (Earnings Q123)

The negative with Asana is it’s operating at a heavy loss of $96.2 million, or 80% of revenue. This is actually much worse than the $50 million loss, or 65% of revenue, produced in the equivalent quarter last year. Most “traditional” investors would view this lack of “profitability” as a dealbreaker, but I think it makes sense to dive into the income statement for clarity.

As we can see from the screenshot below, the company invested $65 million into Research and Development (R&D), up 65% year over year. They have also increased their investment into Sales and marketing by ~69% year over year, as the company aggressively grows. Therefore Asana could easily reduce these investments and thus be “profitable” on a traditional basis, however with their current strategy, they can carry over past operating losses and operate in a more tax efficient manner. Now of course longer term I would like to see revenues growing much faster than R&D and S&M spending, so it is still a trend to watch.

Asana also has negative free cash flow of 42.2 million, which is substantially worse than the negative $7.7 million produced in the equivalent quarter last year.

Moving forward, Asana’s management is guiding for $127 million in revenue, up 42% to 43% year over year. This includes a Non GAAP Operating loss of $74 million to $72 million.

Advanced Valuation

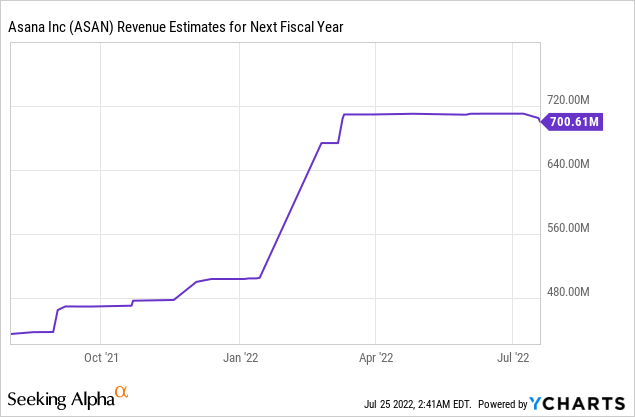

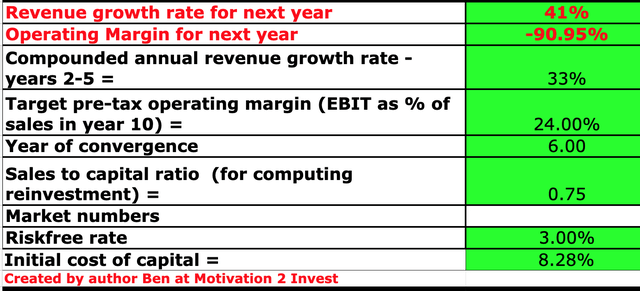

In order to value Asana, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 41% revenue growth for next year and 33% for the next 2 to 5 years, based on analysis estimates of a gradually decreasing growth rate, which is partially due to a larger revenue base.

Asana Stock Valuation 1 (created by author Ben at Motivation 2 invest)

I have forecasted the operating margin to gradually increase, to 24% over the next 6 years, which is the average for the software industry. This margin increase is expected to be driven by the high recurring revenue base and larger contract value which is already the current trend discussed prior. In addition, I have capitalized the company’s R&D expenses to increase the valuation accuracy.

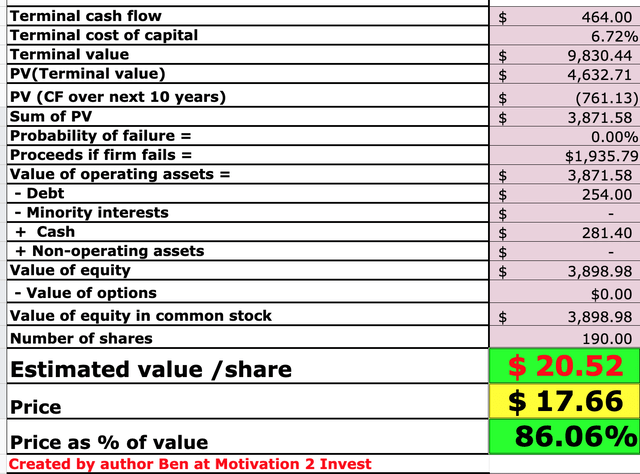

Asana Stock Valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $20/share, the stock is currently trading at $17 per share and thus is ~14% undervalued at the time of writing.

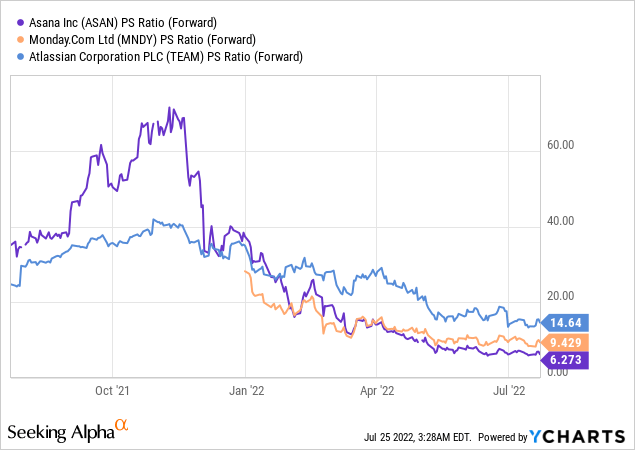

As an extra datapoint Asana is currently trading at a Price to Sales (forward) ratio = 6.3, which is cheaper than other team project management stocks such as Monday.com (MNDY) which trades at a P/S (forward) ratio = 9.4 and Atlassian (TEAM) which trades at a P/S (forward) ratio = 14.7.

Risks

Competition

The competition for team project management tools is intense. Asana is most similar to Monday.com, which is currently investing a substantial amount into Sales and Marketing. We also have Airtable, Zoho and even Atlassian, which is famous for software development platform ((Jira)). Although the competition is strong the market opportunity is huge ($50 billion by 2025) and thus it makes sense companies are pursuing a “land grab” strategy of aggressive growth, as most customers tend to stick with a platform once they have made a decision.

Cash Burn

Asana is burning a lot of cash at a rate which doesn’t seem to be slowing down yet. Although I believe this is for a good reason in many respects, Wall Street is extra sensitive to “money losing” companies right now and are looking for stable profitability. Given the high inflation, rising interest rate environment and forecasts of a “shallow but long’ recession starting in the fourth quarter of 2022. Many companies may cut back on new application spending temporarily. An analyst from RBC has even downgraded the stock recently due to similar issues mentioned such as competition and cash burn. In addition, the analyst estimates Asana will burn through over 60% of its cash in the next four quarters, which is a worry.

The Founder is the Secret Weapon

The only consolation to the “cash burn” is the founder and CEO Dustin Moskovitz, who I mentioned co-founded Facebook and has a net worth of a staggering $9.6 billion, which limits the risk for investors as he could support the company (or even buy the whole thing). The CEO pays himself a measly compensation of just $1, and thus it shows he is truly motivated by the company’s success. Investing with great founders who have “Skin in the Game” is a key characteristic I look for when investing. The only negative is the large founder holding may make some institutional investors cautious about the lack of governance or control should the business strategy stop working.

Final Thoughts

Asana is a tremendous company which offers a great product that saves teams time and improves efficiency. The company has been executing its growth strategy well and have grown revenues at a blistering pace. The macroeconomic environment has caused a decline in share price and Wall Street is fearful of the “cash burn” situation.

However, the stock is undervalued intrinsically and relative to historic multiples, thus this could be a great long term opportunity if you have faith in the founders’ strategy. I would expect volatility for at least the next year until inflation starts to cool and Wall street starts to become less cautious.

Be the first to comment