Morsa Images/DigitalVision via Getty Images

Though fear of growth stocks has hit a fever pitch, it’s a great time for opportunistic and strong-stomached investors to pick up shares of former high-fliers at the steep discount.

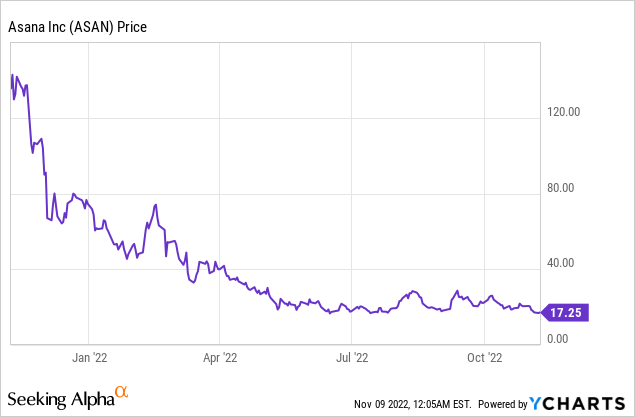

Take Asana (NYSE:ASAN), for example. This collaboration software company has seen its stock price decline by more than 75% this year. Investors have priced in growth deceleration as the macroeconomy worsens and competing SaaS companies comment on a slowdown in enterprise spending. While these factors are all risks worth considering, we do have to wonder if the selloff has gone way too far.

I remain solidly bullish on Asana for the long term. Near-term results will be choppy as FX headwinds and elongation of deal cycles in the enterprise SaaS space (all headwinds that are shared among Asana’s peers, by the way), but investors who are willing to embrace a little bit of volatility in the near term have a chance to purchase this stock at a sharp discount.

Asana’s CEO is also in line with this thinking. In early September, CEO Dustin Moskovitz (also a co-founder of Facebook (META), which is where his initial fame and fortune came from) purchased $350 million of stock in a private placement at $18.16 per share, or about 5% above where the stock is sitting today. Asana will use the proceeds from the sale to fund working capital – but more than the capital injection, the purchase is a huge vote of confidence from management that the stock is undervalued and has upside momentum.

Outside of this insider purchase, here is a refresher on what I view to be the key bullish drivers for Asana:

- Asana’s long-term demand will be bolstered by the ongoing shift to remote and distributed teams. More and more companies are embracing a distributed working model, if not a fully remote one. With fewer in-person touchpoints, software tools become critical to keeping teams together and in sync.

- Massive global TAM. Asana believes it has a $51 billion TAM by 2025, and is applicable to the global base of ~1.25 billion information workers. By that metric, Asana’s current user base represents only <5% of the global eligible workforce.

- Land and expand. Asana adopts the classic software go-to-market playbook, which is to prove its concept and value with smaller teams at first, but eventually expand to entire organizations and companies. Dollar-based net retention rates are clocking in above 140% for companies spending more than $50,000 annually on Asana, a leading indicator that Asana’s traction among larger enterprises is growing.

- Continuous innovation. The company added over 200 new product features in calendar year 2021, and in February 2022 unveiled a new workflow tool.

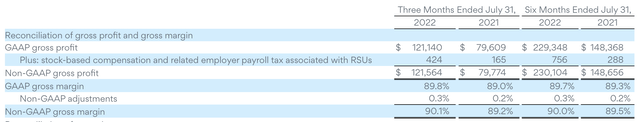

- Huge gross margin profile. Asana’s pro forma gross margins hit 90%, making it one of the highest-margin software companies in the market. While the company isn’t profitable today, that gross margin profile gives Asana plenty of leeway to scale profitably when it’s larger, as nearly every dollar of incremental revenue flows through to the bottom line.

Though Asana was previously valued like a high-flying growth stock, the year-to-date collapse has reduced it to a value stock. At current share prices just below $17, Asana trades at a market cap of $3.31 billion. After we net off the $239.0 million of cash and $32.0 million of debt off Asana’s most recent balance sheet, as well as add in the $350 million of CEO purchase proceeds that did not yet hit the Q2 balance sheet, the company’s resulting enterprise value is $2.75 billion.

Meanwhile, for next fiscal year FY24 (which for Asana is the fiscal year ending January 2024), Wall Street analysts are expecting the company to generate $705.2 million in revenue (data from Yahoo Finance), representing 29% y/y growth. This puts Asana’s valuation at just 3.9x EV/FY24 revenue – a true bargain for a company still currently growing revenue at >50% y/y (expected to decelerate to ~40% y/y in Q3) and one that was once valued at a high-teens multiple.

The best advice here: I think the “smart money” in the room is CEO Moskovitz. I’d advise investors to follow his lead and use this dip as a well-timed buying opportunity. It may take several quarters for sentiment to turn around, but eventually the company’s long-term thesis will shine through.

Q2 download

Let’s now go through Asana’s most recently-released quarterly results for the Q2 (July quarter) period. The company will next release Q3 earnings in early December, which is when we’ll expect to see the same deceleration bake into the company’s results (which are already priced into the stock, given read-through from other similar SaaS companies like Atlassian (TEAM)).

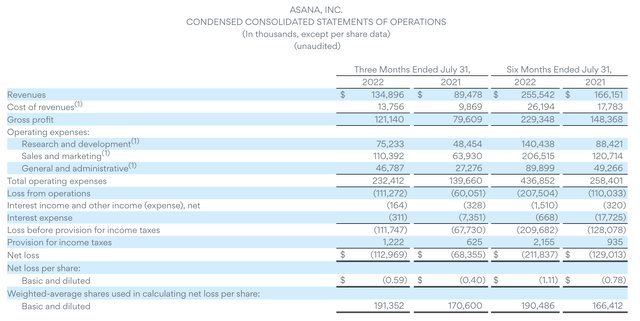

The Q2 earnings summary is shown below:

Asana Q2 results (Asana Q2 earnings release)

Asana’s revenue grew 51% y/y in Q2 to $134.9 million, beating Wall Street’s expectations of $127.3 million (+42% y/y) by a massive nine-point margin. Revenue did decelerate, however, six points relative to 57% y/y growth in Q1, and Q3 guidance has the company’s revenue growth decelerating further still to 38-39% y/y growth. Note, however, that Asana’s confidence in its Q2 results prompted the company to slightly raise its full-year FY23 outlook to $544-$547 million, or roughly two points of y/y growth versus the prior outlook (though sharpening FX headwinds post-July may compress this down in the next earnings release).

Anecdotally, at least through the July quarter, management has expressed bullishness in the company’s results (though we’ll see if this color commentary shifts more in-line with other SaaS companies in the third quarter release). Per COO Anne Raimondi’s prepared remarks on the Q2 earnings call:

Overall, we continue to see strong demand, and we are closing deals with large customers and we have strong engagement across our user base.

As I look across our customer base, we are seeing broad cross-industry adoption with significant traction in Fortune 100 customers, of which over 80% use Asana. Some of the most important companies in the world are adopting and expanding with Asana this year […]

While it’s hard to predict how the current macro environment is going to impact our various customers in the short term, we believe the long term secular trends in digital transformation remain intact and the importance of work management software will continue to grow. We remain committed to our long term strategy. We believe we can win the category as the awareness grows and our unique capabilities meet customer needs, providing time to value in weeks, not years, and high ongoing return on investment.”

On the margin front, Asana boosted its pro forma gross margins by 90bps to 90.1% this quarter, boosted by economies of scale. As a reminder, this 90%+ margin is among the highest in the SaaS industry (most competitors have margins in the high 70s to low 80s).

Asana margins (Asana Q2 earnings release)

Pro forma operating margins, meanwhile, declined by -3 points to -46% in the quarter. The company cited a front-loading of hiring, especially in its sales department, for the margin decay – but also indicated that pro forma operating margins should see a two-point improvement in Q3 with further improvements in Q4 and next year. Given that high operating losses are one of investors’ biggest gripes with Asana, upside trends here will be a big comfort to the stock price. Note that Asana’s relatively smaller scale and high growth rates warrant its current large margin gaps; many software companies are highly unprofitable while in hyper-growth phase and then gradually taper down sales and marketing spend naturally over time.

Key takeaways

Given how hot Asana traded earlier on in its lifespan as a public company, no rational investor could have ever predicted that Asana would devolve into a value stock – but that is exactly what it is now. In my view, the market has already priced in substantial bearishness and macro headwinds into the stock price. Follow the CEO’s lead in loading up on this stock at bargain-basement prices.

Be the first to comment