RomoloTavani/iStock via Getty Images

To say that alternative energy names have been highly volatile so far in 2022 has been an understatement, particularly in solar names. In addition to the inflation and supply chain worries reverberating across the market in general, solar names have had to deal with a nuclear bomb level Commerce Department investigation.

In this article, I will discuss why the recent announcement from President Biden of a 24-month tariff waiver for the solar industry is a massive win for Array Technologies (NASDAQ:ARRY) and why the company is set up well to thrive from current levels.

Overview

In March of 2022, the solar industry was rocked by news of a Commerce Department investigation into the manufacturing of solar panels and modules from the countries of Cambodia, Malaysia, Thailand, and Vietnam. The reason for this investigation stems from a complaint made by California-based solar panel manufacturer Auxin Solar, claiming that panels manufactured in these countries are part of a Chinese tariff dodging scheme.

The reason why this is so vitally important for the industry is the fact that nearly 80% of solar panels used by U.S. based utilities are manufactured in the four countries in question. If tariffs of 50% or higher were placed on these panels, the solar industry in the United States would virtually grind to a halt.

The solar industry, when this was announced, was driven into complete turmoil. Given that, only the threat alone of the tariffs that the investigation presented caused nearly all producers in the four countries mentioned to literally shut down production and cancel orders for US customers.

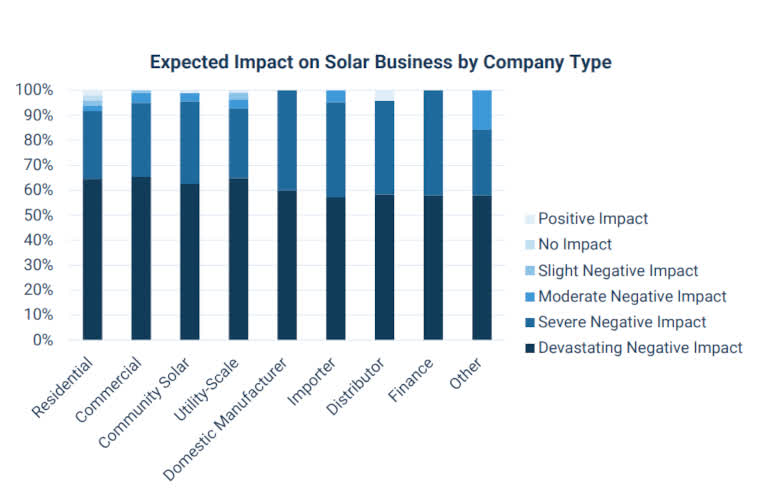

A poll was conducted by the Solar Energy Industries Association (SEIA) of over 200 member companies to gauge the impact of the potential tariffs across the solar landscape. The results were overwhelming in predicting a severe or devastating impact to American companies across all sectors.

Solar Power World

Array Technologies, which manufactures the market’s leading single axis solar tracker for the utility solar energy market, was directly in the crosshairs of these tariffs as naturally a solar tracker needs a panel to track.

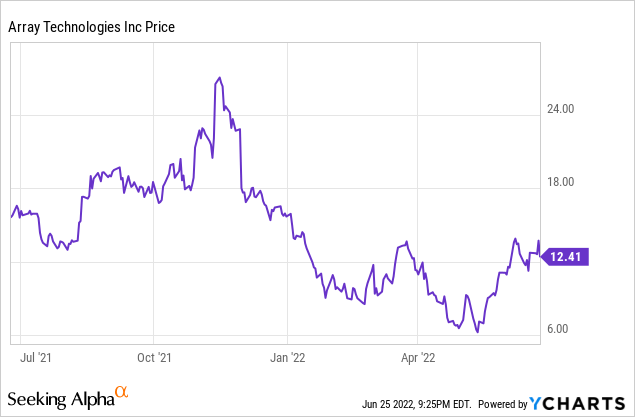

As you can see, from March 2022 to the middle of May, the share price dropped over 55% from $13.65 all the way down to $6.20, which was a new all-time low.

On June 6th, however, it appears that the industry was granted an executive pardon from this death sentence by President Joe Biden. The President issued an executive order waiving tariffs for 24 months to allow for further investment in domestic supply of solar panels, thus making the Commerce Department investigation largely irrelevant in the immediate future.

This news from President Biden came at a very important time for the US energy market, given the skyrocketing cost of both gasoline and natural gas. Utility solar installations had been a consistent bright spot for the current administration, and any disruption to this trend could have upended his plans for renewable energy driven energy policy.

With this announcement from the President, the tariff overhang appears to be largely gone, opening the sector back up to investment and stabilization.

Array’s Advantages

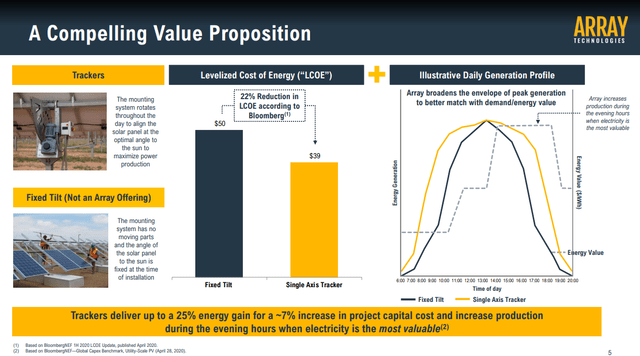

Array Technologies holds a special place in the utility solar market, given that the company believes that its trackers allow for industry-leading power capture, the greatest terrain adaptability, require 25% less labor to install, have zero scheduled maintenance and hold by far the fewest number of components in the market today.

Solar trackers are quickly becoming vital components of nearly all utility scale solar projects, given the extensive benefits they provide, particularly in evening power production.

Array, given its lower maintenance costs, 99.996% uptime and installation advantages, has become a vital partner for utility projects across the country. To this end, in April, Array announced an agreement to supply 1GW worth of trackers to what will be the largest solar project in the United States, the Gemini solar project in Overton, Nevada.

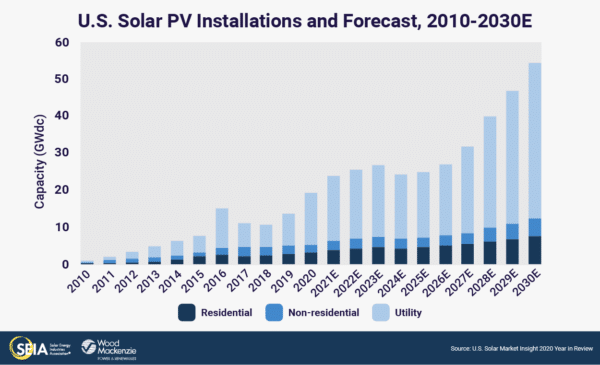

It would appear that projects such as these are only scratching the surface of what is to come in the industry.

SEIA

Utility scale projects, such as Gemini, are set to explode over the coming decade as more and more utilities take coal plants offline and move forward with renewable energy projects, with solar likely to be the largest focus going forward.

What really gets me excited about Array is that the trackers that they provide are completely panel agnostic, which means that the panel chosen by a utility company simply does not matter at all to Array, making the company primed to benefit from any future panel making policy or company that emerges long term. They are in essence a picks-and-shovels play for the gold rush that is the utility scale solar market.

Valuation

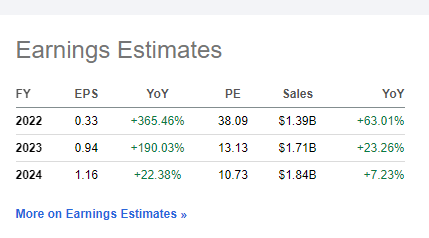

Array has rebounded off of the all-time low of $6.20 per share, to the current price of $12.41 given the news of the tariff waiver, however, the company still appears to be valued attractively given the expected boom over the coming years.

Seeking Alpha

The company is currently working through a massive hit to margins, given extreme cost inflation of its most vital input, rolled steel. The company dramatically changed its contracts in Q3 2021 with customers to take into account fluctuations in both steel and shipping costs and the company expects to burn off any old (and less profitable) contracts during 2022, making the current year estimates a bit of an anomaly going forward.

The company also closed its acquisition of STI Norland in early 2022, which they expect to be accretive to margins going forward into 2023 and beyond. STI Norland is largely focused on the Brazilian and European markets and greatly expands the company’s manufacturing footprint.

The greatest concern that I have with Array is in regard to the debt profile. The company took on a sizable debt load to complete the $610 million STI Norland acquisition. The company currently has $778 million in long-term debt and $282 million in 6.25% preferred shares as of the most recent 10-Q filing.

While this debt load does concern me, on the Q1 earnings call, CFO Nipul Patel reiterated that the company is forecasting positive free cash flow for 2022 even with the Commerce Department investigation overhang, with significant increases in 2023 and onward, making the de-leveraging of the business a much easier task going forward.

This is certainly an area to keep an eye on, however, the company appears to be well positioned going forward with the tariff overhang off of the table.

Bottom Line

I am not sure that many investors fully appreciated the dire straits that the Commerce Department investigation placed the entire U.S. solar industry in, including Array. Without Presidential intervention in the form of the tariff waiver, many in the solar industry would have been unlikely to survive this massive disruption.

However, with this waiver now firmly in place, the solar industry has been given a green light to thrive once more. Array Technologies is highly levered to utility level solar projects and with a panel agnostic platform, the company is able to operate under just about all scenarios going forward, either domestic or imported production. In addition, with STI Norland now in the fold, the company is considered a worldwide leader in the utility scale solar tracking market.

Debt levels and de-leveraging need to be monitored going forward, however, the company is set up well in the second half of 2022 and into 2023, along with trading at very reasonable valuations currently. Array Technologies, in my opinion, is finally ready to shine.

Please let me know your thoughts below in the comments section. Thank you for reading and good luck to all!

Be the first to comment