golero/E+ via Getty Images

Lately, European real estate stocks have become very attractive, and as I have mentioned multiple times in my portfolio updates, I have been accumulating (and continue to accumulate) shares in this sector. Some of the companies in the sector are well known, such as Vonovia (OTCPK:VONOY), but not a lot of people have heard about Aroundtown SA (OTCPK:AANNF). In this article, I will lay out the case for Aroundtown and explain why I think that the current discount is unjustified.

Company Overview

Portfolio

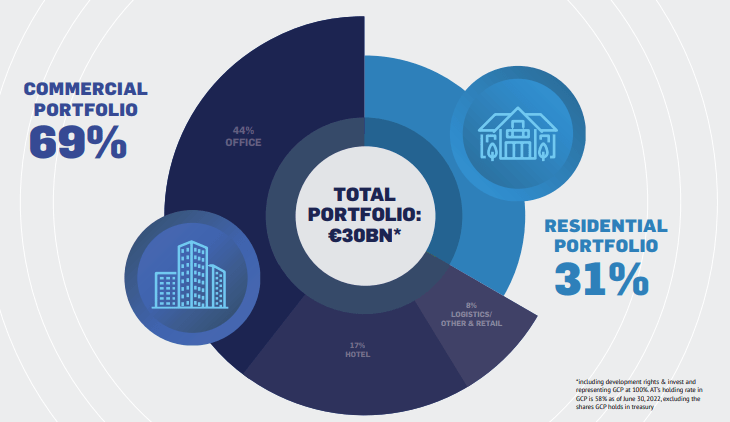

To fully understand why the discount is unjustified, we first need to understand the company. Aroundtown is a commercial and residential real estate landlord that primarily owns properties in Germany and the Netherlands. The majority of the portfolio (44%) consists of office properties, which are located in top-tier cities such as Berlin, Frankfurt, and Amsterdam.

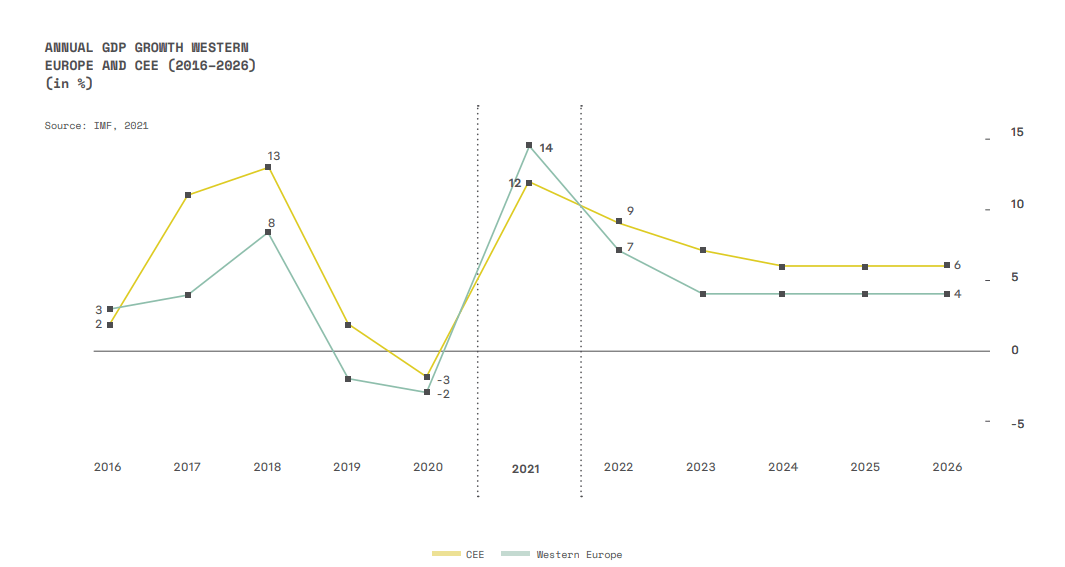

The company also has a majority stake (approximately 60%) in Globalworth Real Estate through a joint venture with CPI Property Group (AT owns around 50% of the joint venture). Globalworth Real Estate is the largest office landlord in the Central Eastern Europe region and owns properties in top-tier cities such as Warschau, Bucharest, and Krakow. I think that ownership of real estate in Eastern Europe is a positive for the company as this region tends to grow faster than Western Europe and real estate prices in this region will most likely increase faster than in Western Europe.

Growth rates Europe (CTP annual report)

The company’s second-largest sector is residential assets. The residential assets are owned through a majority stake in Grand City Properties (OTCPK:GRNNF), in which it has a 58% ownership (excl. shares held in treasury). Grand City Properties was founded by the same owner as Aroundtown (Yakir Gabay) and focuses on residential units in top-tier cities in Germany and London.

The third-largest sector is hotel buildings (and other tourism-related properties), which have been a drag on portfolio performance over the past few years. The main problem was that during the pandemic hotels were either closed or were allowed to operate with limited capacity and that traveling came to a standstill. This has also led to lower revaluations for these properties. Currently, this part of the portfolio is still underperforming as the hotel sector is having a hard time with the prolonged levels of high inflation. The company expects collection rates to remain around 70-80% for this year. This has a negative effect on the value of the real estate, and thus I would expect the new valuations to come in lower than last year.

Portfolio overview (H1 2022 report Aroundtown)

Tenants

One of the most important things of being a landlord is picking the right tenants. Unfortunately, the company does not provide its investors with a tenant list. It does give some information with regard to its tenant structure. In its latest quarterly report, the company mentioned that it has approximately 3,500 tenants for its commercial portfolio, while its residential portfolio has a very granular tenant base (due to privacy concerns and the small size of one apartment as % of the total portfolio, it does not specify anything else regarding residential tenants). Furthermore, the company mentions that its top 20 tenants account for less than 20% of its total rental income. The company has also tried to limit its exposure per sector, but the public sector represents approximately 30% of the company’s office portfolio. I don’t think that investors should worry about this as the majority of governments (and local governments) will have the ability to continue to pay the rent.

Some of the other tenants of Aroundtown include multinationals such as Nike (NKE), Deutsche Telekom (OTCQX:DTEGY), and International Business Machines (IBM).

Tenant overview (H1 2022 report Aroundtown)

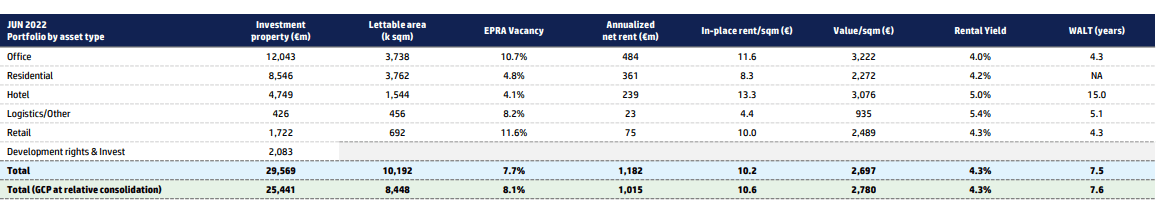

When it comes to vacancies, the company is seeing some weakness in office, logistics, and retail, which have vacancies above 8%, while the total portfolio has a vacancy rate of approximately 7.7%. Retail and logistics only represent a minor percentage of the company’s total portfolio and thus aren’t that problematic. Office, on the other hand, is the company’s largest segment with a vacancy rate of 10.7%, and could therefore have a large impact on the performance. The vacancy rate of the company is also above some of its peers such as DIC Asset (OTCPK:DDCCF), which has a vacancy rate of 8.1%, alstria office (OTC:ALSRF) with a vacancy rate of 7.9%, and NSI which has a vacancy rate of 6.6%. If the company is unable to fill the vacancies, the value of the properties will decline and this can have a negative impact in the coming years. Nevertheless, the strategy of Aroundtown is to buy properties, improve them, and rent them out at a higher rate, which can also have a negative impact on the company’s vacancy rate.

Information per asset type (H1 2022 report Aroundtown)

Fortunately for the company, its portfolio’s average lease won’t expire for at least 7.5 years. The company’s hotel portfolio even has an average lease term of another 15 years. If the tenants pay the full rent (see comment above about the hotel sector) this is advantageous for the value of the property and lowers costs, as the company does not need to look for a replacement tenant.

Performance

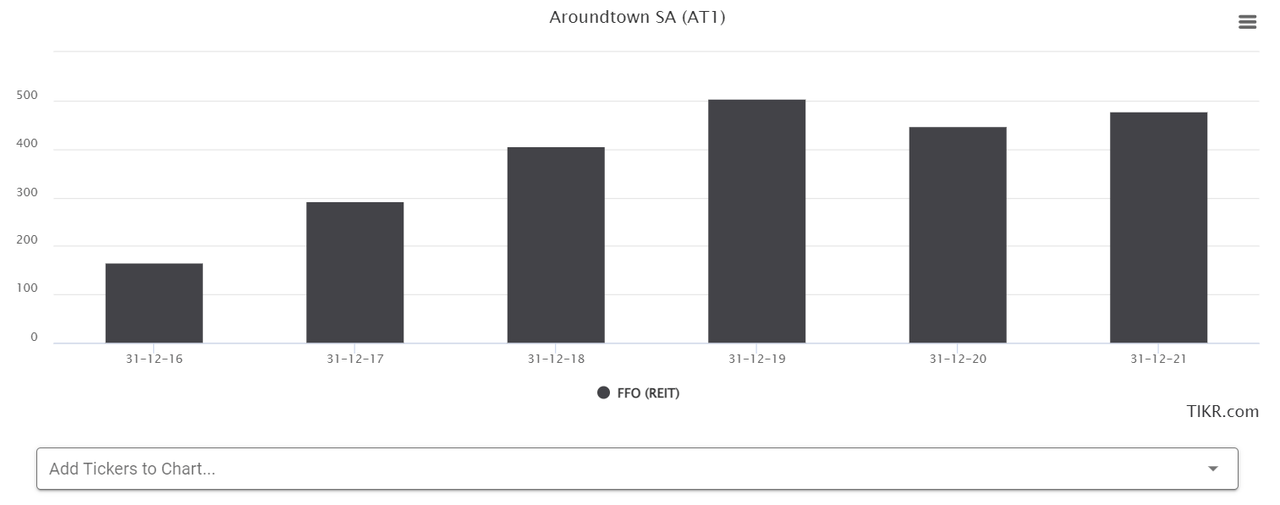

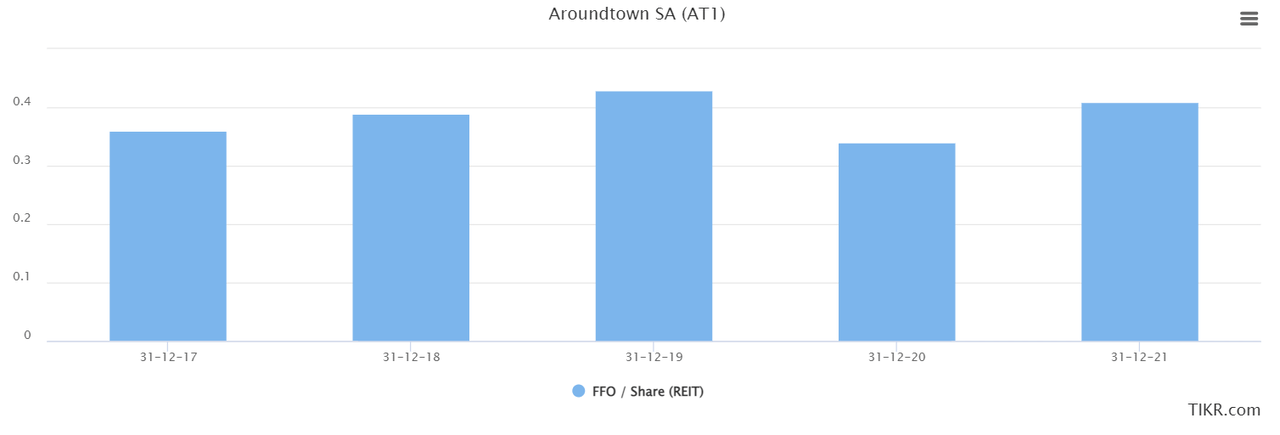

Besides the company’s portfolio, it is also important to see how it has performed over the past few years. The best way to look at a real estate company’s performance is to look at its funds from operations (FFO). The company grew FFO very fast until 2020, which is when the pandemic started.

Aroundtown FFO (TIKR.com)

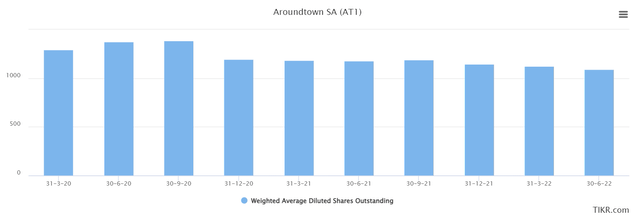

Besides the pandemic, there is another major reason that FFO has declined during this period, which is that the company has sold multiple properties in order to buy back its own shares.

In my opinion, this is a great move, as the company is severely undervalued compared to the NTA calculation. Thus, by buying back shares, the company increases the ownership and performance per share and no longer has to pay a dividend on the shares it bought back. The boost in performance can be best explained by looking at AT’s FFO per share.

FFO per share (TIKR.com)

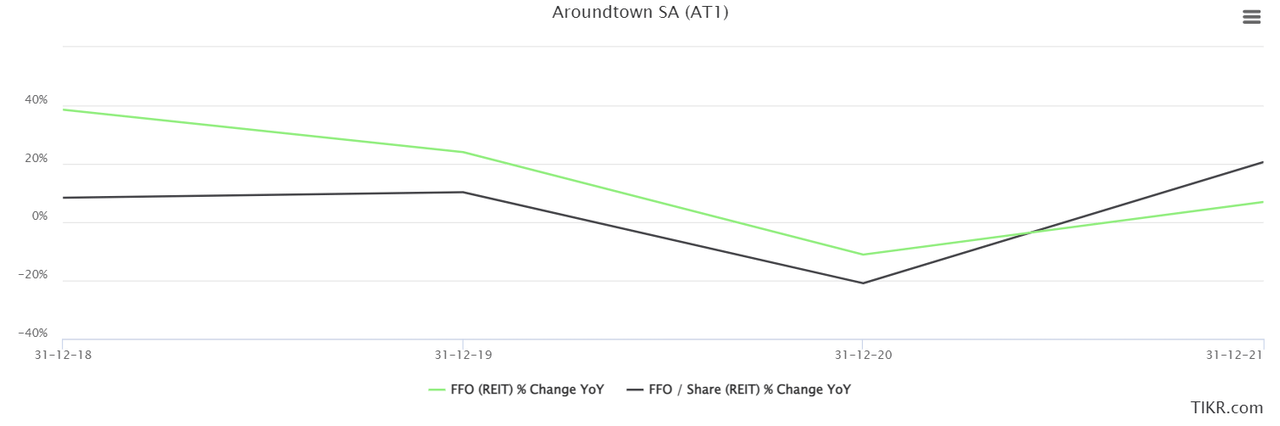

If we look at the graph above, it looks similar to the graph for normal FFO. However, if we look at the growth rates, we see a significant increase in per share performance in 2021.

FFO/share growth rate (TIKR.com)

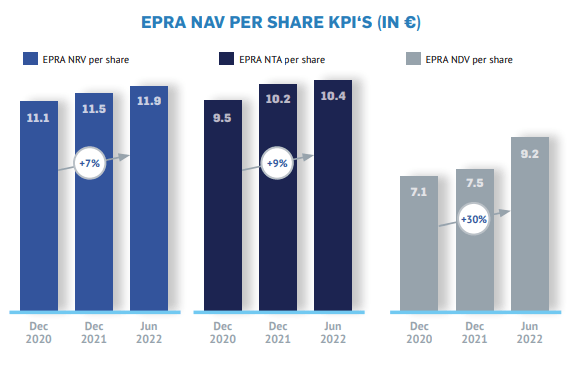

The company’s NTA per share is a lot more stable. One reason for this stability is that a lot of real estate is based on the cash flows it can generate over a longer period of time (usually 5-10 years), and that doesn’t change that much year-on-year. Nevertheless, with the buybacks, the company has seen a nice increase in per share value of its real estate.

NAV per share calculations (Aroundtown H1 2022 report)

Based on this, we can conclude that performance-wise the company has been doing relatively well, with the main exception being the pandemic year in which its tenants struggled with the coronavirus measures and did not always pay rent. This should all be behind us by now, although you can never exclude the possibility of a new or renewed pandemic.

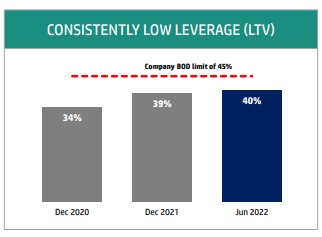

Given the fact that the performance hasn’t been nearly as bad as the stock price performance might have indicated, it is a good idea to also check the company’s debt levels and maturities. In real estate, there are a few debt ratios that you can use. One of my favorites is the loan-to-value ratio or LTV. The LTV shows how much of the real estate is paid for by a mortgage. To give an indication, most people borrow around 80% of the value and pay approximately 20% themselves. Aroundtown had an LTV ratio of 40% at the end of Q2. In my opinion, this is safe, and unless the value of the real estate will be adjusted downwards significantly, this should not worry investors.

LTV Aroundtown (H1 2022 report Aroundtown)

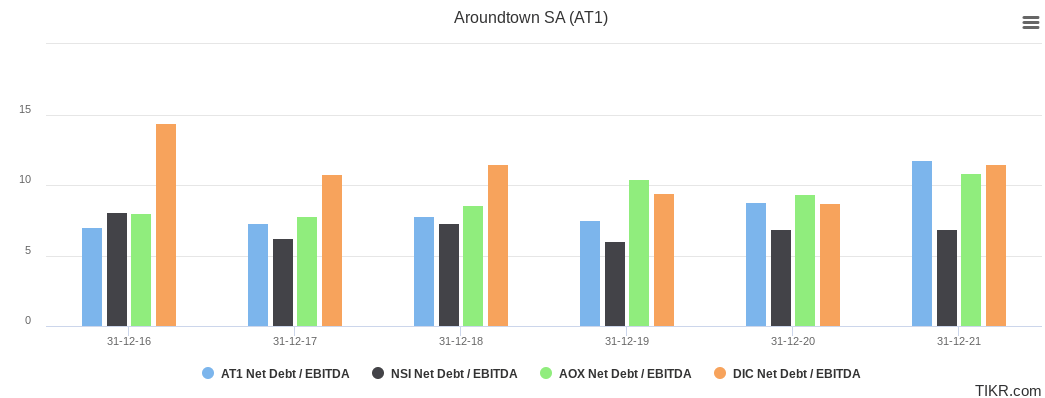

Another metric that we can use is the company’s net debt to EBITDA ratio. Compared to its peers, Aroundtown is on the higher end, and this is something that we do not like to see when the interest rates are going up.

Net debt to EBITDA ratio (TIKR.com)

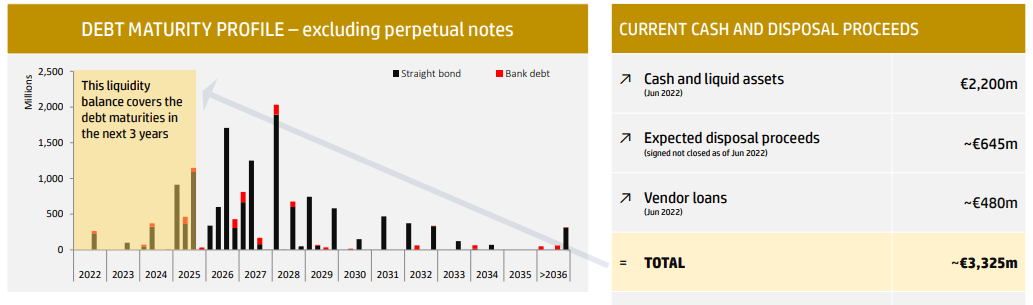

Maybe even more important than the company’s LTV and net debt to EBITDA is the company’s maturity schedule. AT’s debt maturity looks very good with no significant debt maturity up until 2025. The company’s liquidity balance also covers all debt maturities till 2025 and unless inflation remains in the high single digits (and rate hikes continue at the current pace) over the next 3 years, there is no need to worry about the company’s ability to repay the loans.

Aroundtown’s debt maturity (H1 2022 report Aroundtown)

Based on this, we can conclude that even though there are some problems when it comes to financial leverage, especially the company’s net debt to EBITDA, they do not justify the fact that the company trades at approximately 1/5th of its NTA.

Catalyst

Rental increases

One of the main arguments against real estate stocks is the current high level of inflation and subsequent hikes in interest rates. High levels of inflation are only partly negative, due to the fact that many contracts are adjusted on an annual basis by either a step-up rent or CPI clause. In case the company’s rents are adjusted by CPI, the company will increase rent by a significantly higher percentage than the current interest rates, and this will be a huge positive. Another thing that could work in the company’s favor, at least in the short term, is that the majority of their leases will be adjusted in the second half of the year, as noted on the Q1 conference call.

It is hard to estimate the indexation impact on ’22. Note that many leases are adjusted in the end of the year, so we expect to see most of the impact on our income statement for the beginning of 2023.

For its residential assets, it’s a bit different, as rent increases are done by either inflation or the “mietspiegel,” which is a calculation to determine an average rent per square meter which includes the size, region, and year of construction, among other things. Usually, this calculation trails the actual inflation rate, and it could take some time for it to catch up. Nevertheless, if rental increases are relatively high, this could see some upward revisions for the company and lead to a higher share price.

Share buybacks

An additional catalyst could be an increase in the share buyback program of the company. As mentioned before, the company has been buying back its shares since the end of 2020. If the company announces an extension of the program or announces that it will increase its buyback program this could increase the company’s share price, lower its dividend cost and improve future performance.

Risks

Increased cost of debt

Many real estate firms use debt in order to acquire new assets and due to the low cost of debt many real estate firms in Europe have been doing exactly that. Unfortunately, this also means that if they look to refinance the debt they will most likely pay a higher rate. Additionally, as rates are hiked by the ECB, the company’s properties will also become less valuable as potential buyers are willing to pay less due to higher financing cost. Do keep in mind that there are a lot of different countries in the EU, and all of them have different economies. Therefore, hiking rates is a bit harder than in other countries/regions.

Tax-exempt status

Part of Aroundtown’s portfolio is located in the Netherlands and recently the Dutch government announced that companies that have a tax-exempt status (kind of like a REIT in the U.S.) are no longer allowed to invest in real estate. Unfortunately, this would mean that the tax rate would go from 0% to 25.8%. At this moment there is no clarity if this rule will go through (it has been announced for 2024) and if Aroundtown is affected in any way. Thus, it remains to be seen what the effect will be on the company.

Valuation

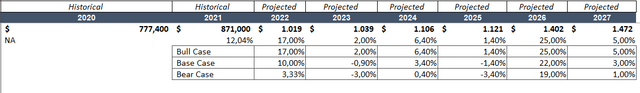

To estimate the value of Aroundtown I use a discounted AFFO estimation and the company’s NTA valuation. My estimation is based on the company’s adjusted EBITDA and accounts for all the adjustments as stated in the annual report. The estimated growth rates in the base case are based on the growth rate estimates of analysts. This led to the following growth rate assumptions:

Growth rate assumptions (Author, TIKR)

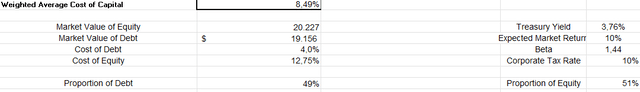

In order to discount the future recurring cash flows, we need to calculate the weighted average cost of capital (WACC). To do this we need to know the company’s beta, tax rate, and risk-free rate among others. I used my own estimations as well as information retrieved from the company’s annual report and Yahoo Finance:

WACC calculation (Yahoo Finance, Annual Report, Author)

Do note that I used a cost of debt of 4% while in reality, the average rate is much lower. The reason I used 4% is to err on the safe side and to account for potential future rate increases.

In the end, this gives a price estimate of €4.24 if we assume a growth rate in perpetuity of 1% and a price estimate of €5.75 based on an exit P/AFFO multiple of 15.

In the latest quarterly report, the company reported an NTA per share of €10.40. This calculation is based on cash flows 10 years into the future. I think that from a real estate perspective the calculation is good, but we are trying to estimate the perceived value of the company. Therefore I think it is a good idea to make some adjustments. Aroundtown is a diversified real estate owner and these tend to trade at a (larger) discount to NAV and lower P/FFO than more specialized peers. In my opinion, you could argue that Aroundtown is specialized when it comes to the region as the majority of its properties are located in Germany and the Netherlands and these two countries combined are smaller than states such as Texas, and California, and only slightly larger than Montana. Nevertheless, other real estate companies that are diversified and specialized in a certain region, such as Armada Hoffler Properties, Inc. (AHH), also trade at discounts to more specialized peers. For this reason, we will adjust the valuation downward by 20%. Additionally, given the high net debt to EBITDA, I would like to take an additional 5% off. I only take off 5% as the company’s debt maturity and LTV both look good. After taking off 25% the adjusted NTA is €7.80.

If we take the average of all the calculations, we are left with a value of €5.93. This is more than double the company’s current share price.

Conclusion

Aroundtown is a diversified real estate company that performed very well until the pandemic. Since then the company has been recycling capital and has bought back shares, which has boosted per share performance. The debt profile of the company also looks decent, even though the net debt to EBITDA is above its peers. On the other hand, this doesn’t justify the significant discount to fair value, which I estimate to be €5.93. In order to close this gap, there are two catalysts which include rental increases and additional share buybacks. Nevertheless, the company is not risk-free, and increases in the interest rates as well as losing its tax-exempt status in the Netherlands can impact its future performance.

Be the first to comment