Avalon_Studio

Dear Investors,

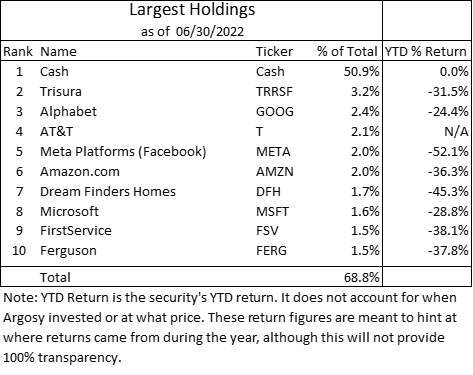

2022 year-to-date performance was -25.4% in select accounts. The S&P 500 by comparison returned -20.0%. We ended the quarter with 50% of the portfolio in cash and equivalents, which means that these results would have been worse without the allocation to cash. Looking into why our performance lagged the market in the second quarter (and providing the same table from the first quarter for comparison), some of our worst performers continued to be our largest positions.

With all of the positions except Arlo (ARLO), I feel confident in the businesses long-term despite some potential headwinds this year. Clearly Meta Platforms (META, formerly Facebook) is contributing quite a bit to our underperformance this year.

| Rank in Portfolio by Position Size | Company Name | Second Quarter 2022 Position Performance | Contribution to Argosy Investors’ Second Quarter 2022 Performance |

| 2 | META PLATFORMS INC-CLASS A (META) | -27.5% | -1.6% |

| 4 | DREAM FINDERS HOMES INC – A (DFH) | -37.7% | -1.4% |

| 5 | ARLO TECHNOLOGIES INC (ARLO) | -31.6% | -1.0% |

| 13 | AMAZON (AMZN) | -34.8% | -0.8% |

| 6 | ALLIED MOTION TECHNOLOGIES (AMOT) | -23.4% | -0.7% |

| Top 5 | -5.5% |

| Rank in Portfolio by Position Size | Company Name | First Quarter 2022 Position Performance | Contribution to Argosy Investors’ First Quarter 2022 Performance |

| 8 | GRID DYNAMICS HOLDINGS INC (GDYN) | -62.6% | -2.7% |

| 2 | TRISURA GROUP LTD (OTCPK:TRRSF) | -27.5% | -2.5% |

| 3 | META PLATFORMS INC-CLASS A (META) | -32.3% | -1.8% |

| 17 | VIZIO HOLDING CORP-A (VZIO) | -53.4% | -1.2% |

| 4 | FIRSTSERVICE CORP (FSV) | -26.5% | -1.0% |

| Top 5 | -9.2% |

Meta is a great business that investors believe could be threatened by TikTok, saw Apple (AAPL) roll out an ad privacy measure that made users harder to track, and faces advertising headwinds as a result of a weakening economy and the belief that venture-backed start-ups were pumping money into Google and Facebook to show growth. Now that venture capitalists are pulling back as a result of the significant market declines among software and other venture-backed industries like Buy Now Pay Later, online gambling, and cryptocurrencies, companies are being forced to focus on profitability to survive.

What this could mean for Meta is companies could spend a lot less with them (and other forms of advertising) for a period of time (how long is the other big question). Are we in a dot-com bubble bursting phase that will take years to play out, or has most of the carnage already happened and we will soon see more venture capital dollars put to work? It’s hard to say, but at a 9x EV/EBITDA multiple and 16x 2023 earnings, some relatively severe outcomes are already built in.

Dream Finders is a major addition to this infamous list of poor performers. Clearly interest rates have risen and with some people concerned about recession, home builders have fallen significantly, and DFH is no exception. It now trades for ~5.5x 2022 earnings and 6x 2023 earnings. While I do not know how severe the future could be, I believe DFH will be cash-generative during even poor economic times and that in general, the homebuilding industry is healthier financially than in the 2005-2007 period.

The only reason I believe this business isn’t valued more highly is that the management team owns nearly 75% of shares and the business is still relatively new to investors and they have not seen how the business performs through a crisis. To be fair, I have not either, but management is very adamant about their land-light strategy providing advantages similar to those that NVR (NVR) enjoys. I believe them, and I will continue to hold and may purchase more shares in the future.

Allied Motion also appears in the 2Q “Dogs of Argosy Investors” list. Dick Warzala is the CEO of this business and Dick has decades of experience in the precision motion industry, having sold his motion control business to well-known conglomerate Danaher for $250 million in 2000. Dick has revived Allied Motion’s fortunes in the last 20 years by selling off underperforming divisions and then building through acquisition and the application of Lean management.

AMOT has been very active in the last few months, acquiring three companies in about 60 days. I believe AMOT will provide attractive returns as Warzala manages these businesses to provide integrated solutions that provide higher value to customers. There has been significant noise in their cash flows despite strong revenue growth throughout the pandemic, and I believe 2023 may reflect $2+ per share of cash flows, which would imply the stock is trading at ~16x 2023 cash flows today.

EXISTING PORTFOLIO ACTIVITY

Sold: ARLOBought: CURV, FTV, VNT

This quarter, similar to the period early in the COVID pandemic, I scoured the portfolio for companies that might have challenges funding their growth plans. During that period, I sold Modine (MOD) and Covetrus (CVET) because I became concerned about those businesses’ debt levels. In the case of ARLO, they are a money-losing business that I previously had stated was developing a highly profitable SaaS offering for its security cameras.

In the context of greater inflation and potential economic recession, I decided to reduce risk, as I believed ARLO could decline significantly if investors’ focus shifted to capital preservation. I still very much like ARLO but it was always a higher-risk, higher-reward investment, and I decided to sell to preserve cash.

During the quarter, we added to some beaten-down stocks whose businesses we like and that offer very attractive valuations. Torrid Holdings (CURV) is a great example as we believe it is trading at a mid-single-digit multiple of cash flow. CURV is a plus-size womens’ retailer that, like many retailers of late, reported that its sales and profits will be lower this year due to excess inventories which will need to be discounted to sell. This phenomenon is repeating itself throughout the retail world, from companies like Torrid to Walmart.

What appears to have happened is that the supply chain bottlenecks that plagued many companies in 2021 began to relieve themselves sometime after the holiday season. As a result, some merchandise that was ordered for holiday season 2021 arrived late, and orders for spring merchandise may have shown up in larger quantities than was planned based on lead times that existed late in 2021, but dramatically compressed as supply chain issues eased.

On top of that, the merchandise assortment at companies was skewed more towards work-from-home (‘WFH’) where comfortable clothing was in vogue. This shifted as more people felt comfortable going out again, which required “going-out” attire these companies had not planned for. These are more generalized comments about retail in general, but it seems these concepts led to weakness for CURV specifically.

While some believe the market for plus-size women’s clothing has become more competitive recently, evidenced by the Yitty clothing line released by musical artist Lizzo, I believe CURV’s true commitment to this category provides it an enduring place in the hearts and minds of its customers. CURV’s returns on capital are terrific, and its growing Curve shapewear line should provide years of mid-single digit growth, while we were buying at ~5x steady-state FCF.

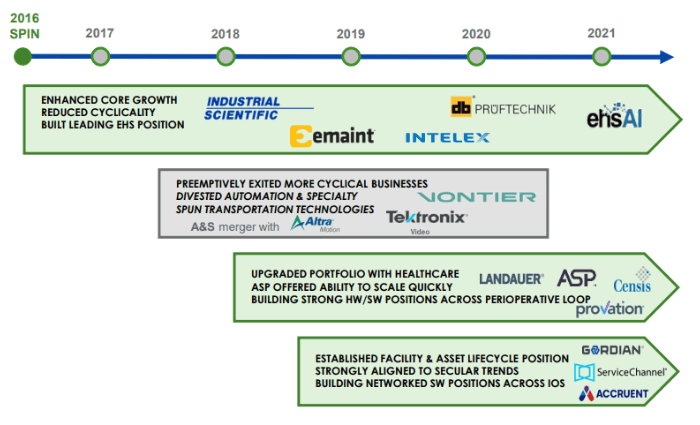

Fortive (FTV) is an industrial conglomerate with lineage to Danaher, perhaps our favorite industrial conglomerate, and one of the most successful businesses of all time. Fortive has continued to shift its orientation towards recurring revenue and industrial software applications, as you can see below. We added to FTV early in the first quarter at high-teens multiples of FCF. We believe FTV will continue to execute on its transformation to an industrial software-focused business with attractive recurring revenue characteristics.

They have opportunities to accelerate the growth and margins of their business, gain greater appreciation by the investment community over time, and ultimately be valued at a higher multiple in line with other premium industrial growth companies such as TMO, DHR, and ROP.

Vontier (VNT) is an industrial business focused on mobility with large exposure to retail gas stations and the automotive aftermarket. Trading at 9x estimated 2023E cash flows, VNT is priced for terminal declines in cash flow due to its exposure to internal combustion engines (‘ICE’). Meanwhile, I believe Vontier is successfully pivoting its business towards higher-growth market segments, evidenced by its acquisition of DRB Systems, a point-of-sale (‘POS’) and operating system used by car washes. In more recent comments, VNT has doubled down on its interest in the car wash space, so we expect to see additional investments here.

There is a very successful example in Sonny’s, a vertically integrated provider of equipment, service, POS, training, consulting, etc. that has existed in private markets for years. This very well could be a model that DRB, under VNT’s control, attempts to emulate. Given the mission-criticality of these systems to car wash operators, and their small cost relative to total car wash revenues, there is significant pricing power for operators like DRB and Sonny’s.

I believe that investors are overly and unnecessarily skeptical of the capital allocation decisions happening at VNT, but we believe recent repurchases reflect management confidence in the long-term of the business and appear to be opportunistic based on the business’ attractive valuation.

NEW PORTFOLIO ACTIVITYAT&T/WARNER BROS. DISCOVERY

I purchased shares of AT&T (T) prior to its spin-off of Warner Brothers Discovery (WBD). Most people are probably familiar with AT&T. They are a major cellular service provider, and until recently owner of the Time Warner media assets, which include HBO, CNN, TNT, TBS, Cartoon Network, DC Comics and the Batman content brands, and more. At the time of my purchase, I estimated that the combined T/WBD assets traded at a 15% levered FCF yield, or 6x FCF.

I also believe that WBD, which now has HBO Max, has future growth in front of it which was previously in doubt when Discovery was primarily tied to the declining cable television bundle. Since then, Netflix reported disappointing subscriber growth, which threw all streaming companies into disarray. WBD followed that news with a disappointing outlook on its business during its own quarterly earnings.

As a result, shares of WBD have declined nearly 40% since the spin-off. WBD now trades for 7x 2023E FCF and there is great potential for returns over the next few years as WBD pays down debt used to finance its merger combining Warner Brothers and Discovery and grows. We do not own a large position in WBD at present, but we may add to it over time.

CONCLUSION

We have weathered a significant contraction in the market and in the portfolio so far this year. I’m not convinced that the worst is over. Right now, stock valuations have only declined while earnings have not begun to fall. The second leg of this bear market could very well occur if the magnitude of earnings declines is worse than expected.

There are a number of businesses adjacent to the residential real estate market that seem attractive today if their results can merely stay flat through 2023, but I am trying to exercise caution in what could be a challenging industry. Given existing exposure levels to homebuilding through DFH and adjacent exposure through FERG and LESL, I am proceeding with caution on optically cheap industries.

The pandemic has produced once-in-a-generation demand shifts, many of which have proven transitory and are in the process of returning to normal, so I need to exercise even more caution than normal in reviewing recent financial results. Your patience, a necessary attribute in a long-term game, makes all of this possible, and I appreciate it immeasurably.

Until October,

Argosy Investors

APPENDIX

| Note that the above chart shows the concentration of all assets managed in all accounts. The performance reflected within the body of the letter only includes a subset of all accounts, but should be representative of investor experience over time. Many investors still hold high levels of cash because they are relatively new clients to Argosy. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment