CinemaHopeDesign/iStock via Getty Images

2021 was a year to forget for investors in the Gold Juniors Index (GDXJ), but one of the rare sanctuaries was Argonaut Gold (OTCPK:ARNGF). Heading into December, the stock had gained 30% vs. a 20% decline in the GDXJ, with the company enjoying a re-rating with Magino construction well underway. Unfortunately, this outperformance abruptly ended, following Argonaut’s announcement that upfront capex estimates were up more than 55% vs. Q4 2020 levels. At a fully diluted market cap of ~$570 million, Argonaut is very reasonably valued, but I see more attractive bets elsewhere in the sector given the risk of a royalty/stream sale or additional share dilution to fund Magino.

All figures are in United States Dollars and converted at an exchange rate of 0.80 CAD/USD.

Magino Project Construction

Company Presentation

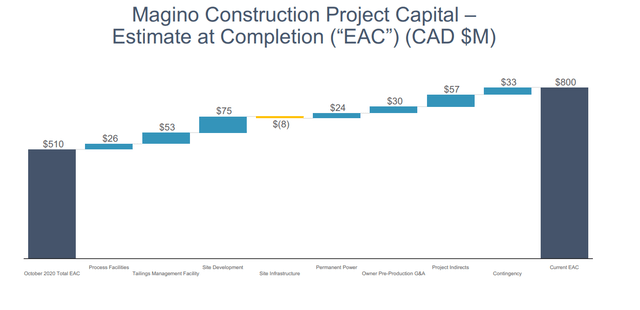

Argonaut Gold was finally on track to put together two consecutive decent years in a row, following years of under-delivering in 2017-2019. This improved track record (Q1-20 to Q3-21) included the timely acquisition of Alio Gold (ALO) during the COVID-19 Crash, a high-grade discovery at La Colorada, and green lighting/financing most of its Magino Project with minimal share dilution. Unfortunately, this period of solid performance came to a screeching halt in mid-December, with Argonaut announcing a massive capex blowout at Magino. This was evidenced by estimated construction capital at completion [EAC] costs increasing to $640 million, up from an estimate of $360 to $380 million in October 2020.

As discussed in my most recent article on Argonaut, I did not see any reason to pay up for the stock at US$3.00, with the stock arguably fully valued at 0.90x P/NAV, and with capex risk at Magino. This capex risk which the company had warned about turned out to be much worse than expected, and this now has led to a meaningful funding shortfall, with the company having $230 million in liquidity (cash & revolver), but needing $370 million to complete construction at Magino. While Argonaut should generate some cash flow from its operating assets this year at current gold prices, this will not be nearly enough to cover the funding shortfall of nearly $140 million.

“However, with Argonaut trading above 0.90x P/NAV, I believe much of this re-rating has already occurred. For this reason, I believe there are more attractive ways to play the sector currently.”

– Inflationary Pressures Continue To Impact Magino Capex – November 15th, 2021

As discussed by the company, the sharp increase in capex was related to cost increases, inflationary pressures, COVID-19 impacts, and changes in scope for site development. Some of the major items were the tailings management facility, which is expected to cost $104 million, up from $62 million previously, and site development, where the company saw increased earthwork quantities and logging and higher labor rates for required work.

Argonaut Updated Capex Estimate

Company Presentation

Overall, the increase in capex should not be a surprise in the slightest given the inflationary pressures we’ve seen sector-wide and with companies like IAMGOLD (IAG) already reporting massive capex blowouts in Canada at the Cote Gold Project. However, the magnitude of the upfront capex miss is what hit the cost, given that Argonaut will now have a meaningful funding shortfall that it will need to make up somehow.

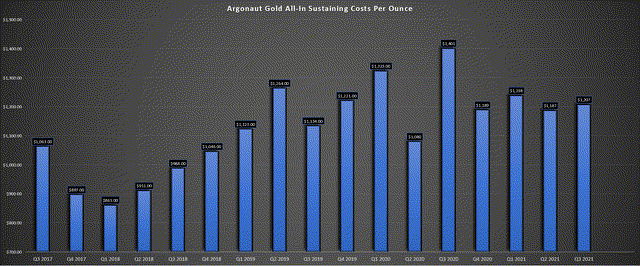

In addition, the technical report will now need to be restated, and as I noted in my previous update, the all-in sustaining costs from the 2017 study of $711/oz already looked far too conservative. With increased upfront capex, increased sustaining capex, higher power costs, higher labor rates, higher fuel/consumables costs, these costs are likely to be revised much higher. We should get more clarity on the exact project economics by Q2, with a company noting that a technical report is due out at some point this quarter.

Argonaut Gold – All-in Sustaining Costs

Company Filings, Author’s Chart

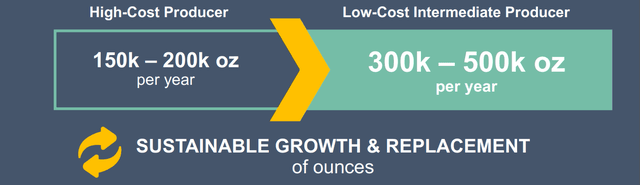

As the chart above shows, the attractiveness of Magino (outside of its optionality, underground potential) was that it was projected to be a very low-cost project in a Tier-1 jurisdiction. This meant that not only would Argonaut grow production by more than 50% year-over-year (~150,000 ounces of production in the first five years at Magino), but it would see an improved jurisdictional profile and massive transformation in its massive profile.

Company Presentation

Company Presentation

This would have been a big deal for Argonaut, transforming it from a low-cost producer in mostly Tier-2 jurisdictions to a low-cost producer with nearly 50% of production from Ontario/Nevada (Tier-1 jurisdictions). However, these increased cost inputs should dramatically affect all-in sustaining costs at the project, which will increase substantially vs. $711/oz previously (2017 study).

Even if costs were to increase 35% from previous estimates, this would still make Magino a very profitable operation. In addition, there will be upside to the NPV (5%) figure from an increased throughput scenario (expansion required) and the underground opportunity. That said, my previous view was that was Argonaut could see sub $900/oz AISC at Magino, and I no l longer see this as likely. So, while the addition of Magino will lead to strong production growth, the margin expansion post-2023 will be much less significant.

Therefore, Argonaut will not be a low-cost producer on a consolidated basis but instead more of an average cost producer, suggesting it shouldn’t receive any premium relative to most mid-tier peers. These estimates are based on the fact that I expect Argonaut’s consolidated costs post-2023 to come in above $1,100/oz, which is slightly above the industry average (H2 2021) of ~$1,080/oz currently. Hence, the company’s claim that it will transform into a low-cost producer appears incorrect.

A Potential Takeover Target?

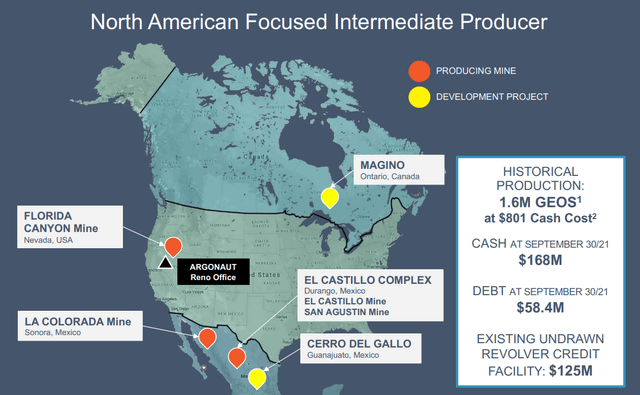

Over the past two years, we have seen considerable interest in Tier-1 projects/mines from larger gold companies, with multiple companies acquired, including Bateman, Corvus, Monarch, Pretium (PVG), Spectrum, Balmoral, and GT Gold. With Magino having the potential to produce ~150,000 ounces per annum and having significant excess permitted capacity, Argonaut is certainly a company that larger producers might consider acquiring to help grow production.

However, while Magino is attractive, I don’t see much allure in the rest of Argonaut’s portfolio to a large producer. This is because its other mines (Florida Canyon, El Castillo, San Agustin, La Colorada) are relatively small and would not fit with most portfolios, producing barely 50,000 gold-equivalent ounces per annum, and having relatively high costs. This means that if Argonaut were to be acquired, the only real attractive asset I see worth going after would be Magino.

Therefore, a suitor would have to acquire the whole portfolio and then spend the work divesting most of it later on in the hopes of recouping some of the price paid for Argonaut. In addition, a suitor would have to take over halfway through construction and sit through the ramp-up period, meaning that it wouldn’t generate any meaningful free cash flow from the asset until FY2024. So, while I think Argonaut would be a high probability takeover target if Magino was nearing production and this was a single-asset company, I believe there are more likely takeover targets out there.

Argonaut Portfolio

Company Presentation

One name that I would argue makes more sense would be Victoria Gold (OTCPK:VITFF), which is already in production, also has upside to its production profile, and has what appears to be a 15+ year mine life. Like Argonaut, Victoria trades at less than 0.7x P/NAV. However, a suitor acquiring Victoria would see immediate free cash flow generation from the asset and can be comforted by the fact that we’ve seen what two years of actual operations looks like. So, while a case can be made that Argonaut may be a takeover target if weakness in the stock persists, I think there are more likely takeover targets out there.

Valuation

Based on ~322 million shares fully diluted and a share price of US$1.77, Argonaut trades at a market cap of ~$570 million, or an enterprise value of closer to $750 million when factoring in debt and the capital it will draw on its existing revolver. I have not given any value to cash held on the balance sheet since this will also be required for construction at Magino following the recent capex blowout. This leaves Argonaut trading at less than 0.70x P/NAV, a very reasonable valuation for a ~400,000-ounce producer by FY2024.

However, I don’t see any immediate upside catalysts for a re-rating outside of a takeover offer. This is because there is added uncertainty on the horizon, with investors waiting for an updated Technical Report at Magino and news on how the company will take care of the funding shortfall. Hence, we cannot rely confidently on this share count figure until we see whether the remainder is funded by debt or equity.

So, is the stock a Buy?

In my September update on Argonaut, I noted that dips to US$1.90 would present a low-risk buying opportunity. However, this view baked in a minor capex miss at Magino, not a complete blowout similar to what we saw with Iamgold at Cote Lake. This blowout could lead to an equity raise, a royalty/stream sale, or looking at a gold pre-pay agreement. Argonaut noted that it is also looking at an extension to its revolver, term debt, or convertible debt, as well as asset sales. While taking on additional debt is a possibility, I see a low likelihood of generating much cash from an asset sale, with none of the assets (development or operating) in its portfolio being that exciting.

Given this downgraded outlook, I have revised my low-risk buy zone to US$1.50, and if I had bought the stock at US$1.90, I would be exiting the stock for a small loss here at US$1.80. This is because I see much more attractive opportunities elsewhere in the sector that may have higher P/NAV multiples but less uncertainty, no risk of share dilution, are paying dividends, and boast better margin profiles. One example is Agnico Eagle (AEM), which enjoys industry-leading margins, pays a ~3.0% dividend yield, is likely to buy back shares once the merger closes, and has multiple positive catalysts on the horizon.

The recent capex blowout at Magino is disappointing, and it certainly adds some uncertainty to the Argonaut story (project economics, possible royalty sale/equity raise). The silver lining is that this is still a solid asset if gold can remain above $1,700/oz, and Argonaut could be a takeover target given the massive haircut. The bad news is that while this has occurred, some intermediate/senior producers have also become much cheaper following the sector-wide pullback but have been posting exceptional operational results, not reporting negative surprises. To summarize, I remain on the sidelines with Argonaut despite the decline, favoring other names in the sector.

Be the first to comment