oatawa

With economic risks rising and the United States potentially on the verge of a deeper recession, Ares Capital (NASDAQ:ARCC) is one of the best business development companies that income investors looking for high-quality dividends can buy right now, in my opinion.

Apart from Ares Capital covering its dividend with net investment income, the BDC has special dividend potential, and the stock price has recently fallen below net asset value, implying that investors can now purchase the BDC’s stock at a 5% discount to net asset value.

High Quality Investment Portfolio Selling At A Discount To Net Asset Value

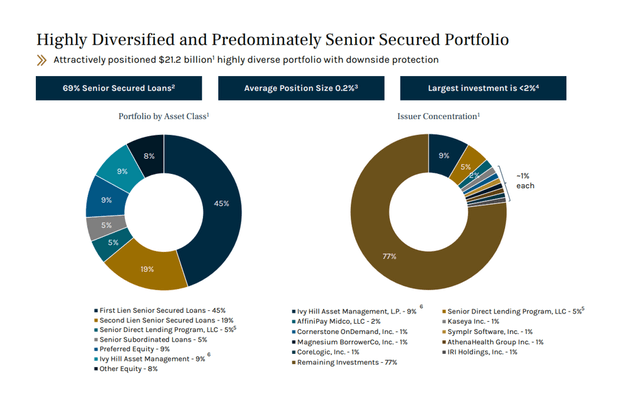

Ares Capital is a high-quality business development firm that is run by an experienced team of investment professionals. The BDC has developed an investment strategy centered on high-quality senior secured loans, which account for 69% of the debt portfolio.

First Liens, the safest type of debt, accounted for 45% of Ares Capital’s investment in the second quarter, with Second Liens accounting for 19% of the BDC’s portfolio.

Portfolio Overview (Ares Capital Corp)

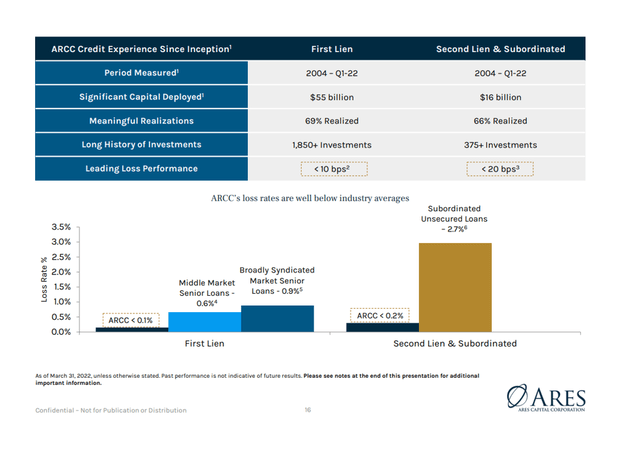

Ares Capital’s Competitive Advantage: Credit Managing Experience

Ares Capital brings decades of credit management experience to a company that manages $21.2 billion in debt investments.

Ares Capital’s loss ratio on First Lien debt has been less than 0.1%, which is significantly lower than the market average.

Because a recession is likely to increase borrowers’ financial stress, savvy debt investors with relevant credit experience have a distinct advantage over other companies in the sector.

Credit Management Experience (Ares Capital Corp)

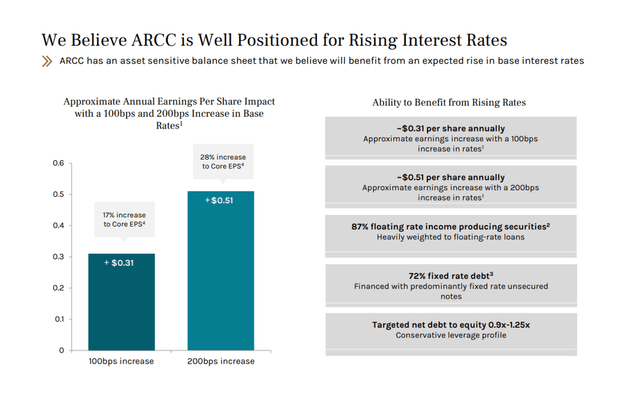

Floating Rate Exposure

Interest rates are a major topic in the BDC sector right now. Since June, the central bank has raised interest rates by 75 basis points three times, and persistently high inflation could result in another rate hike in the near future.

Ares Capital profits from higher rising interest rates because management has positioned the BDC accordingly. 87% of the company’s investments are made in floating rate debt investments, lending a significant amount of positive interest rate sensitivity to Ares Capital’s net interest income potential. An increase in interest rates of 100 basis points, for example, is expected to result in $0.17 per share higher annual core EPS.

Interest Rate Exposure (Ares Capital Corp)

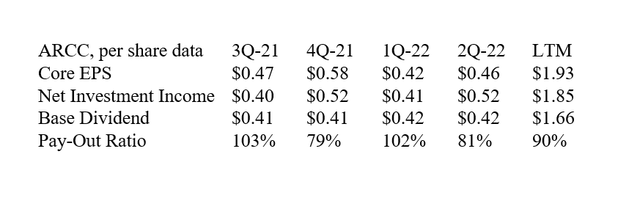

Dividend Pay-Out Covered By Net Investment Income

Ares Capital paid out 90% of its dividends in the previous year, so the business development company covered its regular dividend of $0.41-0.42 per share per quarter and a special dividend of $0.03 per share per quarter.

The dividend is extremely safe, and given Ares Capital’s long track record of managing debt portfolios with extremely low loss rates, I expect Ares Capital to continue paying its regular dividend even during a recession.

Dividend And Pay-Out Ratio (Author Created Table Using BDC Information)

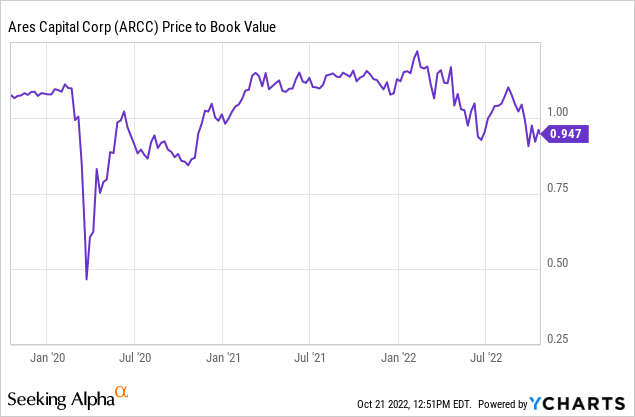

5% Discount To Book Value

Quality BDCs rarely sell at a discount to book value, but they do happen. ARCC is currently trading at 0.95x book value, making it an attractive opportunity for income investors.

Why Ares Capital Could See A Lower Valuation

Ares Capital, like most business development companies, will face a lower valuation multiple if the quality of its loan book deteriorates.

I am not concerned about a dividend cut or portfolio losses because the BDC is well-managed and its managers have extensive experience managing debt investments through difficult credit cycles.

Having said that, all business development companies face the risk of trading at a lower valuation multiple if the market anticipates a decline in credit quality.

My Conclusion

Ares Capital is a must-buy. The quarterly dividend of $0.43 per share is easily covered by net investment income, as is the special dividend of $0.03 per share.

Furthermore, Ares Capital is one of the best BDCs to invest in if markets consolidate, in my opinion, because management has the experience to deal with difficult debt markets, and its First Lien-focus undoubtedly helps.

Ares Capital has demonstrated its ability to manage credit instruments by maintaining a low loan loss ratio in the past.

Furthermore, Ares Capital’s stock is trading at a 5% discount to net asset value, making the business development company even more appealing from a margin of safety standpoint.

Be the first to comment