SrdjanPav

Co-produced with Treading Softly

I was just commenting to my wife about how quickly the year seems to be marching by. It may be that we’re all no longer stuck indoors, so my days are filled with more demands and activities than when we were all locked down. For this, I have no complaint.

However, it seems like just yesterday we were entering into 2022 bright-eyed and ready for another adventure! I entered 2022 with any number of goals and plans. One goal was to see my dividends coming into my account in 2022 exceed the amount received in 2021. I passed this mark in August, taking only 8 months to achieve what took 12 months last year. Currently, any dividends coming into my account are all increasing the growth I will see year over year. Exciting times to say the least!

So as we enter the final months of 2022, we should take a moment to review how we’ve approached the markets this year and evaluate what we want to achieve in these last three months.

First, we need to know our desired method.

Speculating or Investing?

Buffett famously said that there are two ways to approach the market.

One is that of a speculator, who buys shares and aims to sell them to someone else for a higher price. This is done irrespective of the value of the company or its output to the economy. This method merely transfers wealth from one individual to another.

The other is that of an investor, who buys shares and aims to receive value from the company’s output. This method generates wealth over the long term.

He was answering a question regarding how Berkshire (BRK.A)(BRK.B) views the market and how it interacts with it. Buffett via Berkshire has famously taken private multiple other companies and run them very effectively, if not passively – all while enjoying the profits they produce. GEICO and Clayton Homes are among some of its vast holdings.

Buffett isn’t looking to sell those holdings anytime soon. He didn’t buy them to flip them, but to hold them and reap the rewards for doing so.

I don’t know about you, but I cannot go out and buy a publicly traded company with my brokerage account balance. So trying to mirror Buffett is out of the question. I can, however, learn from this dual viewpoint in the market and recognize a few facts:

- As an income investor, I primarily buy holdings to reap the rewards of owning them – cash dividends.

- As an income investor, I am not looking to flip shares to profit from the next buyer.

- As an income investor, the output of my holdings is exceptionally important to me as that output pays my dividends.

I’ve repeatedly heard it said that receiving a dividend and selling shares to get money are identical in their outcome – you have cash. I would agree if that was all there was to consider. However, it ignores many other factors.

- Selling shares reduces my ownership of the company.

- Selling shares removes that money from my base of assets, unlike a dividend which adds to it.

- Selling shares requires active work and timing to ensure a “profitable” return which in reality is simply shuffling money from one investor to another instead of being paid from the output of a profitable business.

- Selling shares to pay for your retirement is not investing. It is the second stage of speculating in the market – at least according to Buffett’s description.

So as an income investor, I do not see selling shares to get money to pay for retirement as identical.

So once you’ve decided how you want to approach the market for the remainder of the year, we need to look at our current goals more closely.

Update or Adjust Your Goal

As I stated, one of my goals for 2022 was to see dividend growth in my portfolio – in my case, I saw dividend growth through organic growth via dividend raises and growth via reinvestment. I have met this goal as all dividends received from mid-August through the year’s end will be in excess of what I received in 2021.

So what were your goals for 2022? I will be honest, the most common goal I see is to “make money” or “get wealthier” which are often nebulous and hard to evaluate.

I personally like tangible and measurable goals. For example, if you want to see dividend growth in 2022 over 2021, how much? Does even $1 of growth make you happy or are you looking for a fixed percentage of growth like 5% as a target?

Perhaps it’s not the final number that matters but how much you’re reinvesting that interests you.

We recommend income investors who are in their retirement reinvest at least 25% of all their dividends received to keep their income flow growing.

So if you’re below this mark, your goal may be to reach 15% or 20% this year. You can tangibly see how you’re doing year to date and adjust your goal upwards if you have exceeded it, or adjust budgets to reach your goal if you’re below it.

Taking a moment to stop and evaluate your goals mid-year can work as an essential self-check. It also helps to put your near-term goals into the perspective of the bigger picture.

You May Live a Long Time, Or Not

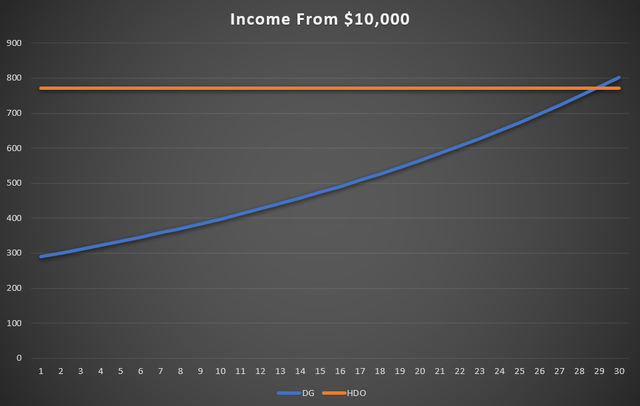

One big driver behind investing for dividend growth is that your income will grow organically over time – nothing by you needs to be done. While this is true often a low yield that is growing can take decades to catch a stable high yield.

Using two very conservative examples, we’ll take Coca-Cola (KO) which yields 2.9% and has a 5-year CAGR of 3.57% on its dividend, and compare it to the unchanging dividend of RLJ Lodging Trust, $1.95 Series A Cumulative Convertible Preferred Shares (RLJ.PA) which currently yields 7.7% at the time of writing.

If you were taking all your dividends in cash, without any reinvestment, it would take KO almost 30 years to catch up to the income output of RLJ-A.

That’s a long time horizon considering that the average lifespan is about 73.2 years! You’d need to buy KO young and keep on holding it!

I strongly encourage retirees to think with a long-term mindset, but low yields with organic growth like KO can often require or demand too long of a horizon to be beneficial for retirees creating a portfolio for income in the present.

So while I want you to plan with a future in mind, even in retirement, I don’t want you to forgo solid income now with the hopes of more of it coming down the pipes in the future.

Dreamstime

Conclusion

How’s the rest of the year looking for you? Have you hit your goal and need to readjust it to keep on striving further? Do you have some adjustments to make to help you reach your goal? Perhaps it needs to be more specific, more measurable, and less nebulous.

In that process, you need to know how you’re approaching the market and understand that not all “long-term” thinking is beneficial, especially if its payoff is too far in the future.

In retirement, you’ll need money to pay for things. If you need to sell shares to achieve it, that is one option. I recommend and invest using an alternative method, I buy great companies who pay me for my ownership. My portfolio is like my own little Berkshire. Although I cannot afford to take every great company I like private – I haven’t achieved Buffett status yet – I still like to reap the rewards of my ownership.

You can benefit from putting on an investor mindset and avoiding a speculator perspective.

Let’s get paid by putting our capital to work, that’s a wonderful way to enjoy every day, and that’s income investing!

Be the first to comment