Mauricio Graiki/iStock via Getty Images

Are We Entering A Recession?

Talk of a potential recession has been building for months, but many measures indicate that we might already be in recession. In April, I argued that we’re already probably in recession (at least in Texas) due to a subtle decrease in retail and restaurant traffic.

- US Q1 GDP shrunk at a 1.4% annualized pace, though pundits were quick to explain it away.

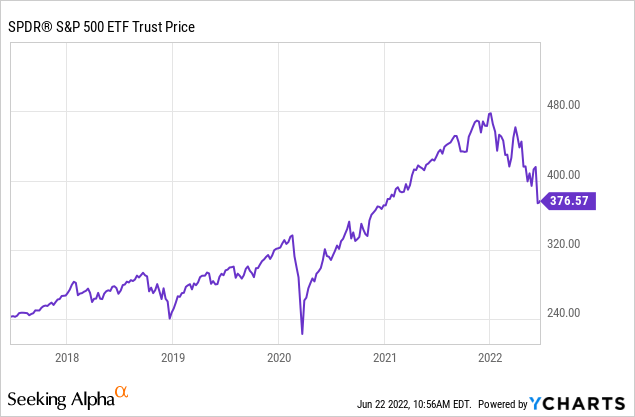

- The stock market is well-known as a leading indicator of the economy, and the broad S&P 500 index (NYSEARCA:SPY) is down about 22% for the year as of my writing this.

- US consumer confidence is at historically low levels for the post-war era, only matched by the pessimism during the 2008 recession and the late 1970s/early 1980s recessions.

- Google searches for “recession” are surging. Take from that what you will.

What Economic Models Are Saying About A Possible Recession

The rule of thumb for a recession used to be two consecutive quarters of economic contraction, although after the first quarter GDP came in negative, the arbiters at the NBER were quick to remind the public that there were other criteria that mattered as well, especially employment. Then, as if on cue, a bunch of tech companies started announcing layoffs.

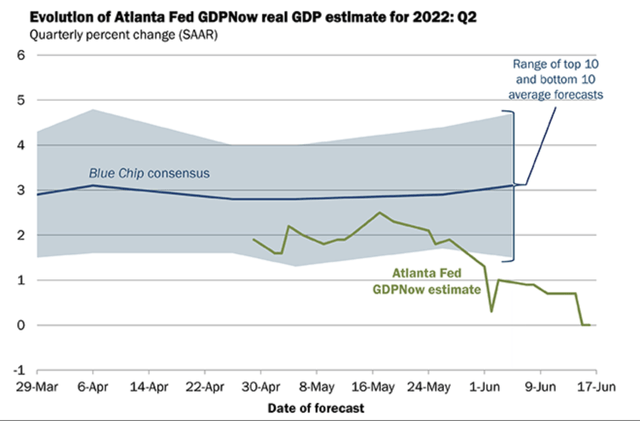

The Atlanta Fed has an econometric model that predicts what GDP is likely to be based on dozens of periodic data releases that are tallied before GDP is released. It’s called GDPNow (here’s the model’s methodology if you want to dive in).

GDPNow suggests that Q2 real GDP will come in at 0.0% after shrinking in the first quarter. Also, their estimate keeps falling with each new data release. With sharply higher rates on mortgages and gas prices higher, I don’t think Q3 is going to be any better. Student loans are another unresolved issue that will drag on the economy eventually, but we’re likely to see another extension of the payment pause in an attempt to influence the US midterm elections.

What The Market Thinks About A Possible Recession

Now that it’s down over 20%, the stock market is beginning to price in a reduction in earnings rather than just a change in valuations. Wall Street analysts still expect the best earnings ever for companies in 2022 and even better earnings for 2023. The market doesn’t really believe this anymore. After the huge bull market of 2021, stocks are closing in on their pre-COVID highs. If stocks do trade to around their pre-COVID highs (I think they will), the market would be telling you that the boom in earnings in 2021 was cyclical and not secular.

What I Think About A Possible Recession

To some extent, it’s irrelevant to the stock market whether we are in a recession or not. For a round number, if the typical household earned $70,000 last year, $60,000 from working, and $10,000 from free stimulus money, then we very well could find ourselves in a situation where the median household’s earnings increase to $63,000, but they’re $7,000 “poorer” because they’re not getting the extra free money from the government. Without running annual budget deficits of 10-15% of US GDP, consumers have to live off of what they earn, and that’s considerably less than they’re used to spending over the last couple of years.

This is true for corporate earnings as well. The previous record for S&P 500 earnings was $163 in 2019. The index smashed this in 2021, earning $209. Now analysts expect $225 for 2022 and $240 for 2023. But with stocks plunging–the market doesn’t agree with these forecasts. I handicapped earnings based on nominal GDP but subtracted out stimulus and think $190 is a reasonable baseline for 2022 earnings and $200 for 2023. It’s possible that consumers could use credit cards and spend down savings to keep the party going for another six months, but I’m basing the long-run earnings potential of the economy based on what households earn, not what they borrow.

We’re going to find out how corporate earnings releases are for Q2 throughout July and August. Based on all of the leading economic data, I don’t think earnings will collectively be very good. The S&P 500 likely has another 10% downside from here to fair value unless this earnings season somehow magically defies the broader trends occurring in the economy.

Bear Markets: Hope Is Not A Hedge

The economic problems that we’ve developed over the last five years are complex and varied, but they’re also quite simple in their cause. Millions of people have built crappy business models relying on zero interest rates and government stimulus rather than doing what they would do in a free market. With some of this stuff, truth is stranger than fiction. Questions I’ve seen people asking:

Will the government bail out the principal and interest payments for stablecoin investors?

No chance.

Should I bid 50k over asking for a house in a flood zone and waive inspections and appraisal?

No.

Will the Fed do more QE to bail out the NASDAQ (QQQ)?

Almost certainly not as long as inflation is high.

Will the government bail me out if my 8 Airbnb (ABNB) properties can’t cover their mortgage payments and property taxes?

No.

Will AMC (AMC) and GameStop (GME) stock hit $1,000?

No.

There are currently millions of people who have borrowed money to fund unprofitable or marginally profitable projects. Unprofitable businesses need to go out of business to balance supply and demand. There are no shortcuts to this. We’re going to have to have a bear market and recession to reallocate labor from crappy businesses to profitable and healthy businesses and to balance supply and demand.

The Fed isn’t really trying too hard to sell the soft-landing narrative anymore, now characterizing things as soft-ish. Former Treasury Secretary Larry Summers (who has been right all along about inflation) indicated that we need unemployment to rise from 3.6% to 6% to balance the economy. This seems about right. Take an honest look at your investments and look to sell anything that doesn’t have a solid use case or is cash flow negative! ZIRP was a unique time in history, and while there’s no guarantee that the government won’t intervene to help the economy in the future if the economy really tanks, I wouldn’t build a business model around it. Similarly, many people looked at the ballooning value of their tech-heavy portfolios and assumed they could forever base 4% annual withdrawals off of crazy 2021 prices–an assumption that is now in serious doubt.

Where To Invest Your Money In A Recession

You need to have a game plan for dealing with the probable recession and bear market, however deep it ends up going. Stocks can be a part of this game plan, but they’re not all of it. As long as stocks are in a downtrend, I wouldn’t be rushing to buy the broad market unless it gets cheaper. I don’t think the market is cheap right now because I don’t think earnings estimates are realistic. I have stocks trading for 18.5x likely 2023 earnings of $200, which is still on the high side of normal. There are a few stocks that are worth considering though.

Another 10% lower to around ~3300 on the S&P 500, and I think you’re at fair value. Whether stocks go lower than this will be mostly driven by liquidity, but I could see the index falling to 2800 in a bear market decline or even retesting the December 2018 lows around 2400 in an all-out panic. As I think stocks are worth around 3300, I don’t think the markets would stay that low, but 2800 is a 14x multiple on $200 in earnings, which wouldn’t be historically unprecedented in a bear market. So stocks are okay for the long run here, but not necessarily great. We are in a much better spot than we were in Q4 and early Q1 when the market cap of stuff that is objectively junk was much higher, but I don’t think the process of flushing out malinvestment is done.

How to invest right now:

- Pay down debt. If you have a mortgage at 2.75% then you might not worry about this as much, but a classic bear market move is to pay down debt. If the debt is personal and not deductible, then you generally get a tax-free return to your cash flow equal to the interest rate on the debt. For example, if you have a car that you haven’t paid off with a 4% interest rate, then that might be hard to beat in the bond market, plus you’d have to pay tax on your bond returns. This also helps keep you from having to sell stocks low. If you lose your job and have fewer payments, then you have more options than if you have high debt service.

- I Bonds. I Bonds are currently paying over 9.6% interest, guaranteed by the US Treasury. You have to hold for a year and you’re maxed out at $10,000 per SSN per year, but risk-free is risk-free.

- 401Ks. If your employer will match you, then it’s worth allocating to your 401k for whatever the match is and allocating to index funds. A 50% match is a 50% return here.

- Money market accounts. Vanguard offers a couple of good money market funds in their Federal Money Market Fund (VMFXX) and Municipal Money Market Fund (VMSXX). These funds essentially function like savings accounts with higher interest rates and can let you build cash to take advantage of future opportunities.

- I covered a few options hedges for high-net-worth investors recently.

- Finally, I have some stocks I think you could consider buying on a dip.

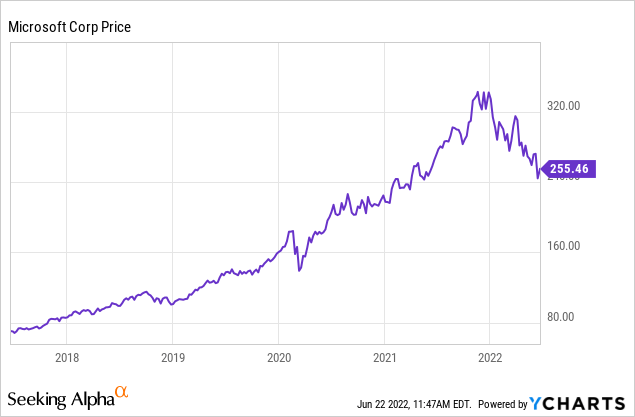

1. Microsoft (MSFT)

Big Tech isn’t cheap yet, but I think you can pick your spots if the market falls a little more. There are still stocks like Coca-Cola (KO) with limited growth prospects trading for similar P/E ratios to tech stocks like Microsoft and Google (GOOGL). This makes no sense.

I expect Microsoft to do well because of the recurring revenue that they have from Cloud and Office, which is a lot better in my mind than a company like Apple (AAPL), which has relatively fewer growth prospects. Microsoft is well-positioned for some of the known risks we face going forward, such as a possible energy shock or another wave of the pandemic – either would increase cloud demand and cement remote work as the default practice for big companies.

I’d snap up Microsoft if it gets to around $225, which is well in the range of where an earnings season downdraft in stocks could take us. That would be at a P/E multiple of roughly 24x.

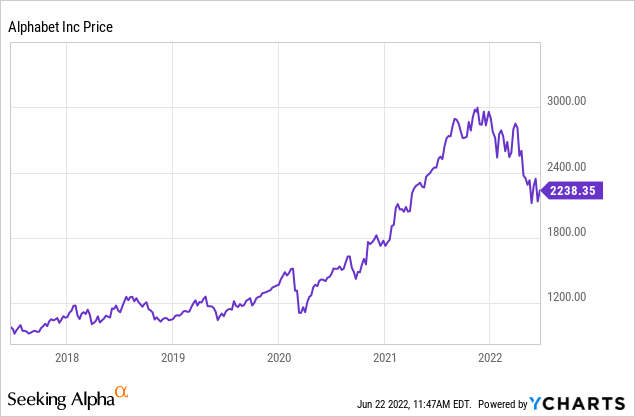

2. Google

In a similar vein, Google is relatively cheap. I don’t think Google’s earnings estimates are necessarily as solid as Microsoft’s in the short run, but I would look to pick up Google about 15% lower than it is here, or roughly around $1,900. I like Google because they provide great value to advertisers compared with traditional media and because the stock trades in line with the multiple of the market at large while having markedly better growth prospects. While they may suffer in the short run, the market is underestimating how much money Google can make in the long run due to its dominant position in search advertising and continual investment in research and development, whether it’s in Big Data, AI, or elsewhere.

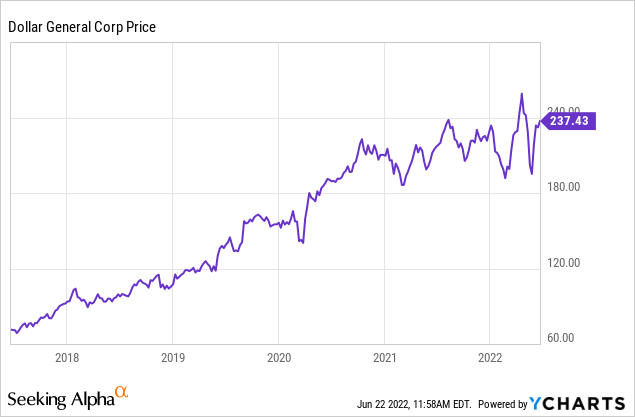

3. Dollar General (DG)

I touched briefly on some of the demographic trends facing America and the West in general in my past few articles, but the cold reality is that we have millions of people in their late 50s and 60s who have little to no retirement savings. As millions of these people age out of the workforce, they need to be able to buy stuff at rock-bottom prices, as their only source of income is likely to be $1,500 to $2,000 per month in Social Security. This is the core demographic group of Dollar General.

While it’s an extremely profitable company (low margins but very high turnover), Dollar General has an image problem. However, they’ve made some inroads in getting more fresh food and better quality goods in their stores.

With the demographic trends currently rolling down the tracks in America, Dollar General’s customer base is likely to increase, and increase by a lot. DG stock is a buy at current prices.

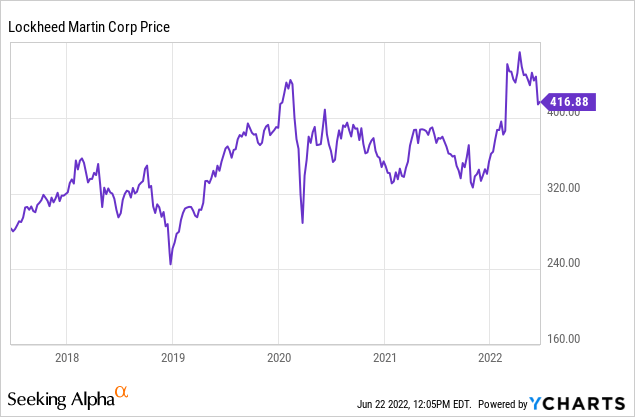

4. Lockheed Martin (LMT)

I would consider Lockheed Martin a value stock as the company trades for about 14.7x 2023 earnings. The world has obviously changed to become a more threatening place over the last six months, which is likely to boost Lockheed’s earnings for years to come. Lockheed won’t make you rich overnight, but with a 2.7% dividend yield, long-term government contracts providing revenue, and geopolitical tailwinds, I think double-digit total annual returns are likely for the next 10 years. Lockheed is a reasonable buy here, but if you can get LMT stock under $400 I’d snag some more.

5. Merger Arbs

One somewhat common strategy for professional investors in the markets is called merger arbitrage. It’s not technically “arbitrage” because you have some risk, but the idea is to buy stocks that have deals pending and wait for them to close. Because the acquirer generally bears the risk of market conditions changing, merger arbitrage delivers returns mostly uncorrelated with the direction of the market. If the world goes to hell in a handbag this isn’t necessarily true because financing can fall through or speculators can get squeezed (see the crash of 1987 for some examples), but it’s true in 99% of market environments.

The idea here is that there are a lot of deals that have been announced but are yet to close. Warren Buffett holds a large position in Activision Blizzard (ATVI), Twitter (TWTR) is offering a large premium if the deal does close, and Seeking Alpha author Chris Demuth Jr. has a few solid picks as well. With each deal that closes, you can pocket a premium that doesn’t depend on macro headaches like the ECB bailing out Italy, China easing lockdowns or imposing more, or the US consumer being healthier than it appears.

Key Takeaways

- The US economy is likely already in recession, as are other major economies around the world. This will initially suck but it is necessary to balance supply and demand and a recession will lead to a healthier economy after we emerge.

- Corporate earnings are not likely to meet estimates for Q2 or going forward into Q3 and Q4, meaning the broad S&P 500 index likely has another 10% downside to fair value. Stock returns 5-10 years out are likely to be positive but below long-term averages at current prices.

- Policymakers will likely be unable and/or unwilling to bail out speculators facing heavy losses in stocks, real estate, and/or crypto. Stocks could temporarily fall well below the fair value of S&P ~3300 if there is a run on liquidity from investor panic, margin calls, etc.

- Paying down debt and investing in risk-free securities like I Bonds looks attractive as long as the market remains in a downtrend.

- Caution is warranted, but there are a few stocks you can look to buy either at current prices or slightly lower than here.

Be the first to comment