Zolnierek/iStock via Getty Images

The current environment leaves almost nowhere to hide in equity markets. Discount rates are rising, causing technical devaluation, but so are uncertainties in end-markets, which is much greater cause for the risk-off sentiment in markets. The ideal investment is one that is safe and can also withstand inflation so that regardless of the direction of monetary policy in response to consumer trends, the investment wouldn’t be impaired. While you can roll over investments in the money market, you’d rather go with something that offers some more punch. REITs, which are resilient late in the cycle, are a great pick, and we focus on casino REITs in particular with our pick.

How Do REITs Perform in a Recession?

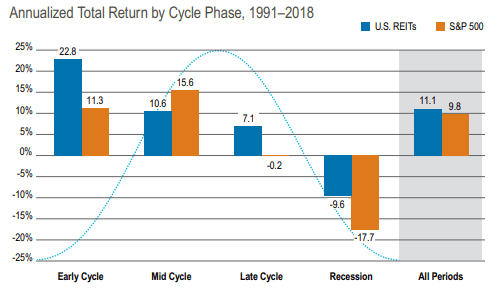

REITs are historically a rather resilient asset class in a late cycle market from a price perspective. They recover aggressively as the cycle turns while also staying relatively put in the down-cycle, so historically they’ve been the right pick to sit on during the downturn and to ride the beginning of the next wave.

REIT Returns (Cohen & Steers)

While previous crises have not focused on a situation where rates needed to rise, which gets into a scary deleveraging territory, the historical data is consistent with some of the properties of REITs which make them appropriate for an uncertain macroeconomic environment.

Property values will decline as real estate is levered to interest rates, but REITs real portfolio are their leases, and with so many options in the REIT market with tenants that provide a lease income akin to a bond, valuing REITs as fixed income is more correct. Often lease agreements will feature elements that allow the cash flows to flex with inflation thanks to annual rent increases meaning duration risks can be avoided, and it is just a matter of picking REITs where tenants are assured to stay. As such, REITs can act as a proxy to a corporate inflation-indexed bond, providing returns, allowing for a conviction on tenant health and markets, and also avoiding duration risks while looking for a clear yield.

Paying out at least 90% of their net income as dividends, REITs also offer investors a clear yield to assure returns in what could be a depressed-return environment as the high amounts of leverage taken on by the private sector has to be serviced at a higher rate. With many REITs leasing to strong tenants, and most including rent increase clauses and being relatively long-term (5-10 years in the corporate space), the asset class broadly has the properties to deal with the current and historical macroeconomic threats, justifying its resilience in price as well.

Our REIT Picks

Some REITs will be peculiar and diverge from the broad class, perhaps working with clients whose interest in the property is more at risk, or agreements that don’t feature clauses to react to inflation, or that have rent increases built in to avoid a perpetuity devaluation on a higher discount rate. So selectivity does matter to make sure your REIT portfolio is skewed towards the stalwarts that typically perform.

We think that a good area for investors to consider are casino REITs, and in particular Gaming and Leisure Properties (NASDAQ:GLPI) could be interesting. Most of its leases are with Penn National Gaming (PENN) which has a cult following on the market due to its Barstool Sports exposure. It’s relatively solvent, and it is benefiting from the reopening while also having the Barstool exposure to deal with any COVID-19 resurgence, although mandates to control COVID-19 are no longer economically tenable given the macroeconomic backdrop and their unpopularity will be a reason for them to not come back in full force given approval polling and election cycles.

GLPI’s leases with tenants are with built-in annual rent increases, that admittedly took a pause during COVID-19 due to the tenants’ sensitivity to the lockdowns, but continue to be in force now. Most importantly, casinos are tenants that are least likely to voluntarily leave leases. Firstly, online gambling is rather nascent in the US which was long a grey market, and its spread depends on partnership with land-based casinos. This means that there isn’t much scope to pivot to online models rather than continue land-based. Secondly, the reopening benefits land-based casinos after a period of depressed mobility. Thirdly, the triple-net leases that GLPI has with tenants means that tenants are the ones that have been investing in their properties for years to suit their needs, and wouldn’t want to abandon their developed assets. Fourthly, licenses are associated with the location, which means that they can’t bring their casino license elsewhere. With operating casinos being the tenants’ business, they will not leave their leases unless they become insolvent. Finally, GLPI owns casino real estate in regional US markets, not marquis markets exposed to tourism or to corporate convention revenue. It is a bet on regional interest in gambling, where regional property competition also tends to be a lot lower due to the lacking tourism factor, with fewer licenses being issued.

Bottom Line

For all these reasons, the GLPI dividend at 6% is sustainable as is their income, and capable of growing over time. With REITs as a class generally performing well late in the economic cycle, and GLPI having properties that make it extra safe, we see it as an attractive pick in the current market. While all prices could decline due to the broad impact of rising rates on markets, it should be more anchored, and the dividend in any case provides investors returns despite market risks.

Be the first to comment