peshkov/iStock via Getty Images

The Update:

This past week, the Wall Street Journal published

Commodity prices have been firm for months. Whether it be energy, agriculture, or metals, supply and demand have been out of balance due to capacity underinvestment and/or naturally occurring limitations such as weather (in the case of agriculture).

In an article I wrote a little over a month ago, I speculated that a Russian invasion of the Ukraine would exacerbate these imbalances to the point where many commodities would be in severe shortages worldwide and there would be commensurate price spikes. That has come to pass in many commodities to levels that have surpassed even my wildest expectations.

I called out in the Russia/Ukraine piece that wheat, natural gas, oil, and fertilizers as potentially susceptible to price spikes from an interruption in normal course of business of Russia and Ukraine production/distribution. The red lines denote February 24th, the date of the invasion.

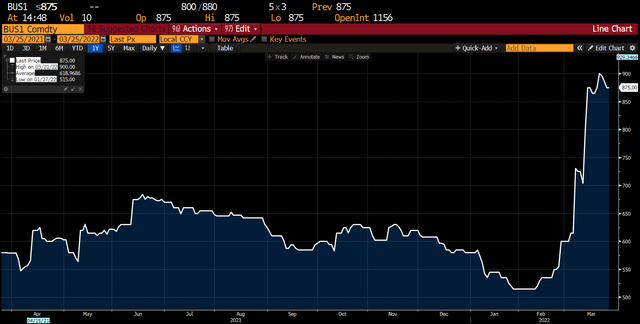

Wheat

Export Price Wheat EU (France Standard) (Bloomberg)

Natural Gas

Netherlands Natural Gas Price $/mmbtu (Bloomberg)

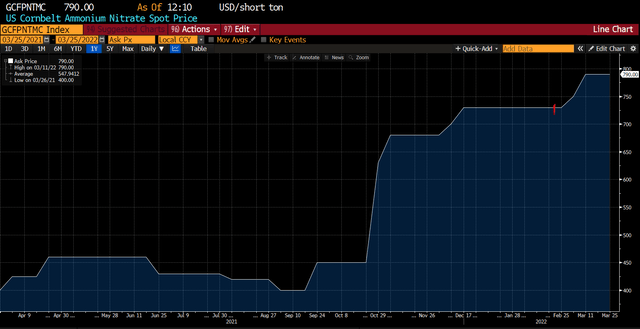

Ammonium Nitrate

Ammonium Nitrate Fertilizer (Bloomberg)

Brent Oil

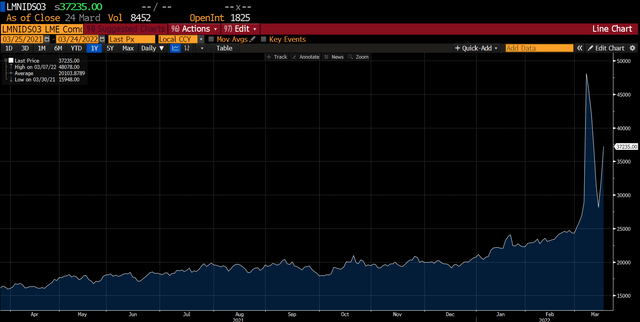

While these prices have moved up meaningfully, they pale in comparison to things like Nickel (which is used in stainless steel production) and scrap steel.

Nickel

Scrap Steel

US Scrap Steel Prices (Bloomberg)

The strength of these prices is not going unnoticed. The Wall Street Journal recently published an article calling commodities as the new FANG trade composed of “Fuel, Agriculture, Natural Resources, and Gold”. I think there is some merit to those sectors continuing to outperform, but as always one has to pick one’s spots between quality of industry, management, individual assets and valuation.

I have written about EQT (EQT), Enterprise Products (EPD), Equinor (EQNR), Crestwood (CEQP), Darling Ingredients (DAR), California Resources (CRC) and mentioned Bunge (BG), CF Industries (CF), Mosaic (MOS), Chesapeake (CHK) and Archer Daniels (ADM). All of these stocks have risen, but if you ask me I think EQNR, EPD, CEQP, BG, CF and DAR have the most to go. They are the most steady base cash flow generators giving them floors if commodity prices fall but should still participate in the strong commodity price environment.

Barring a remarkable detente post Ukraine, Europe is diversifying away from Russian gas. That impacts EQNR and CF most directly and most immediately. While Europe will build LNG regassification and sign LNG supply deals with the US and other natural gas producers, EQNR can bring the most natural gas online to Europe the fastest without major increases in infrastructure. They just need more rigs in place. Even then, unless natural gas collapses in Europe, CF will maintain a structural price advantage via its access to cheaper US natural gas and proximity to North and South American farming.

The two stock that have moved the least, EPD and CEQP, have amazing upside from here and limited downside thanks to their high payouts that they have flexibility to increase. Moreover, given the tax advantaged nature of their distributions, I can see people fleeing bonds and being MLP’s as income generating inflation hedges.

Risks:

While many of the companies whose stocks I have listed above have wind at their backs and low valuations. They have suffered many years of low valuation and they are in industries where capacity and demand have not been so well aligned for years. Moreover, they are still cyclical so unlikely to ever garner the high multiples of the original FANG companies. A peace accord in Ukraine is likely to lead to lower prices of the stocks even if their underlying commodities do not move much over any extended time frame.

Conclusion:

There are many structural reasons why I think many commodities, especially agriculture and energy related, have several years of good pricing in front of them. I have been writing about these factors since July, before Putin moved a single gun to the Ukraine border. Inflation is running hot and interest rates are responding. At the very least, commodity exposed names should have a place in almost everyone’s portfolio.

Be the first to comment