da-kuk/E+ via Getty Images

When Arcimoto (NASDAQ:FUV) went public in 2017 it did so against a market that was still somewhat skeptical of EV companies. This would transpire in the subsequent years as a meagre common share price, anemic revenue, and a precarious cash position. Going concern was only maintained by a combination of dilutive equity raises and promises. Hence, Arcimoto faded into obscurity even as organic demand for EVs was rising gently and ESG was becoming a dominant force in the investment industry.

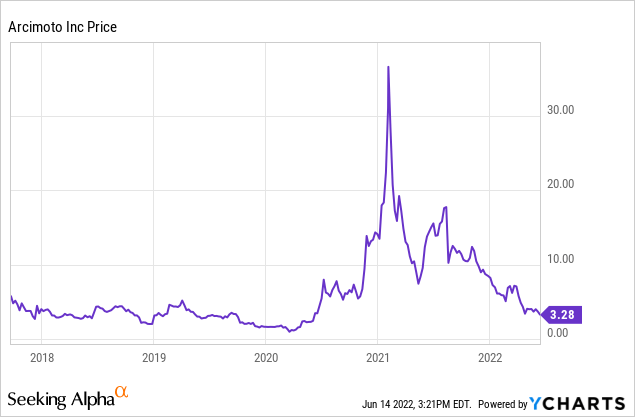

A lot changed during the pandemic that would see the intersection of record amounts of retail liquidity, leverage, and the pinnacle of ESG sentiment drive Arcimoto to extreme heights. The stock would peak at just under $32, up over 1,000% from its pre-pandemic averages as if overnight the pandemic sparked deep soul searching and made investors cognizant of the imperative need to transition away from the internal combustion engine.

EVs were and still are going to be the foremost technology in the world of automobile transportation. Indeed, positive government policy to encourage the uptake of EVs has worked and the automobile sector now stares down a ban on new sales of ICE cars in key markets like California by the middle of the next decade.

A New World With Old Antics

The transition to zero-emission vehicles continues at pace and is still very much in its early innings with just 4% of new cars sold in the United States being all-electric in 2021. This market backdrop for Arcimoto is positive but poses an inherently contradictory reality. Arcimoto faces the very real prospect of bankruptcy against the undeniable material level of wealth creation that awaits companies that will come to dominate the space.

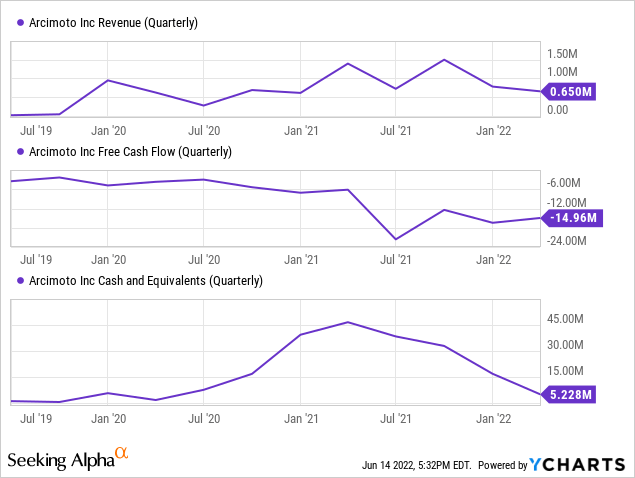

The company recently reported its fiscal 2022 first quarter earnings results which saw revenue come in at $650,000. This was a 53.2% year-over-year decline and a miss of $740,000 on consensus estimates. This came on the back of 24 new fun utility vehicles sold during the quarter.

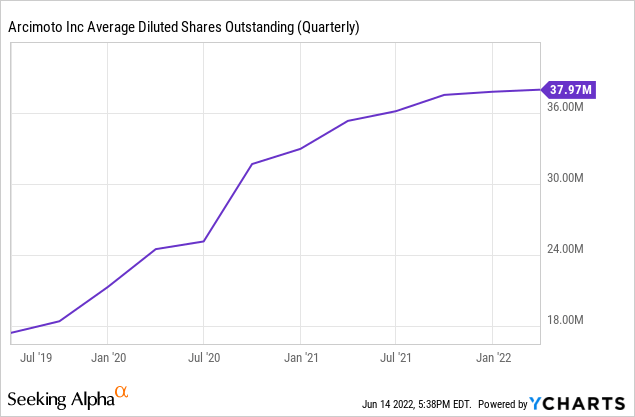

Free cash flow during the quarter was negative at $14.96 million, an increase from a loss of $6.1 million in the year-ago quarter despite revenue having halved. The company ended the quarter with cash and equivalents of $5.23 million, placing the runway in no uncertain terms in months. Arcimoto has in the past leaned on the sale of new shares to plug its liquidity gap with average diluted shares outstanding more than double the figure from fiscal 2019.

Arcimoto should be able to sell shares to expand its runway as it has been able to retain an impressive trailing twelve months revenue multiple of 40x against the stock market collapse. The company currently has a market capitalization of $128.75 million with revenue for fiscal 2022 likely not to be larger than $3 million. However, worsening macroeconomic conditions could bring the party to an end and draw a line in what has been uninterrupted years of high cash burn, precarious cash positions, and equity raises. The tightening equity market backdrop will create material bottlenecks for companies looking to raise more capital and has already seen industry peer Electric Last Mile Solutions file for bankruptcy.

The road to hell is paved with good intentions. Years of Arcimoto’s management promising to ramp up production have not panned out and the goodwill that has supported previous stock sales now faces the hammer of a recession and a rising interest rate environment.

Bulls Really Have To Ask Where The Sales Are

The world has changed a lot over the last few months with heightened inflation on the back of high energy and commodity prices wreaking havoc on the capital markets and economy. The collapse of a public EV company has opened up a new dichotomy. EV manufacturers can and will fail. The endless money tap that came before from equity fundraises and convertible debt sales are likely about to switch off. Arcimoto finds itself in a difficult spot as sales of its flagship fun utility vehicles have failed to materialize even as demand for zero-emission transport grows. This fundamentally highlights their poor value proposition and intrinsic niche. Shareholders need to understand that demand for three-wheeled single-passenger vehicles might simply never materialize.

The list of defunct US automobile manufacturers is almost endless. What are now names on a list to scroll through for readers of this article were once promises of growth and prospect of riches. Arcimoto now fights an uphill battle to keep itself off this long list. This is a solemn reality for investors who were drawn into the starry goal of decarbonizing human transportation for the better.

Arcimoto cannot say it was never presented with a favourable market backdrop, it was. This allowed millions of dollars worth of share sales to fund a runway from IPO that still shows no near-term signs of becoming self-sustaining. The company now unfortunately stands on the brink of joining the long list of defunct automobile manufacturers.

Be the first to comment