Chung Sung-Jun/Getty Images News

Investment thesis

I believe Archer Aviation (NYSE:ACHR) is significantly undervalued. Due to issues like urban traffic congestion, electric power grid efficiency and cost savings, and the demand for zero-emission transportation solutions, experts expect a market for Urban Air Mobility [UAM] that exceeds $1 trillion by 2040. If ACHR is successful in putting its strategy into action through coordinated efforts with influential allies, it stands to gain significantly.

Business overview

ACHR is creating an electric vertical takeoff and landing [eVTOL] aircraft for UAM that can travel 60 miles at 150 mph with minimal noise and zero emissions.

Large potential market supported by key partnership to ensure execution

I believe there is a sizable international market for the UAM. I believe several underlying secular drivers, such as those listed below, are responsible for the massive size of the TAM in the global UAM industry, which is projected to exceed $1 trillion by 2040.

- Traffic congestion as people move to cities

- Enhanced efficiency and decreased overhead in electric power grids

- Minimize environmental impact through zero-emission transportation

Moreover, I expect that ACHR will be able to fully utilize United Airlines’ (UAL) knowledge and experience as an aircraft fleet operator to assist in the development of system applications and operational processes thanks to the agreement with UAL. I think Archer Direct also has the potential to diversify its revenue streams beyond the airline industry by expanding into other verticals, such as OEM sales in the cargo and logistics sectors and forming strategic alliances with global logistics players and major retail chains. Aside from traditional commercial avenues, ACHR can also offer its services through the military and emergency services.

Vertically integrated model to capture the full ecosystem

ACHR’s approach to the market, which involves selling planes to existing operators while also starting up their own operations and going straight to the consumer, is a smart strategy to expand their customer base. I believe this vertically integrated model, which combines the forces of these two revenue streams, will strengthen the ecosystem as a whole.

The key thing that will drive adoption is lowering the cost. However, flying fast (over 100 mph) over crowded cities is the only way to provide a low cost-per-trip and time savings (10 to 60 miles). Hence, I think it’s essential to maximize load factor while still reducing the cost of energy and maintenance in order to keep operating costs low. Therefore, ACHR’s beginning go-to-market strategy relies on pre-existing and repurposed facilities; however, in order to achieve profitability, the company will need to operate its own fleet of eVTOL aircraft (thankfully, this is ACHR’s plan according to the prospectus). Management plans to work with infrastructure development partners to construct high-throughput vertiports capable of supporting hundreds of takeoffs and landings per hour as the company grows. I think all of these are essential steps to take in getting ready for a possible adoption down the road. In my opinion, autonomous operations will eventually be widely accepted because they reduce expenses, boost productivity, and may significantly increase profits once widespread adoption and industry regulation are in place.

In conclusion, I think ACHR’s planes will be a more practical, faster, and cheaper alternative to current ground-based transportation options for large groups. Archer UAM needs to create a sustainable time-saving solution for its users if it is to succeed as a business.

ACHR has strategic agreements with partners

The company has commercial and strategic partnerships with UAL and Stellantis (STLA). My opinion is that ACHR can gain invaluable advantages from these partnerships, which will allow it to better implement its long-term strategies and initiatives. To give further context, ACHR sees UAL as an essential partner in speeding up the FAA certification process, training pilots and maintenance staff, and developing a comprehensive go-to-market strategy for new launches and airport networks. Meanwhile, the STLA partnership will speed up the time it takes to bring the ACHR’s product to market by making use of established commercial supply chains. Because of the OEM’s global presence and economies of scale, ACHR will be able to increase production volume while decreasing per-aircraft costs thanks to these agreements, giving it, in my opinion, a significant competitive advantage. Both partnerships bolster ACHR’s OEM strategy, which will facilitate and fund the company’s growth into the urban air mobility market.

Aircraft is designed for rapid certification

In my opinion, getting the appropriate credentials is critical to success in this industry. This not only guarantees conformity but also reassures customers and the public that ACHR’s offerings are genuine and not for show. During the preliminary stages of a production vehicle’s design, ACHR collaborates closely with regulators to establish certification requirements and reach consensus on methods of compliance. In my opinion, this coordination is essential for the design process in order to shorten the certification period and cut down on expenses associated with redesigning the product. I think this cooperation with authorities gives ACHR an edge in the market because it lessens the likelihood of costly redesigns and accelerates the certification process.

Valuation

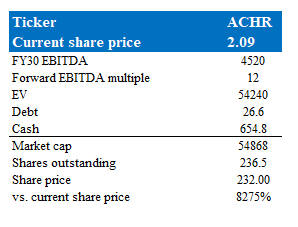

Based on current management’s long-term guidance, I believe the upside from here is significant. My model suggests ACHR could be worth a lot more than its share price today in FY29.

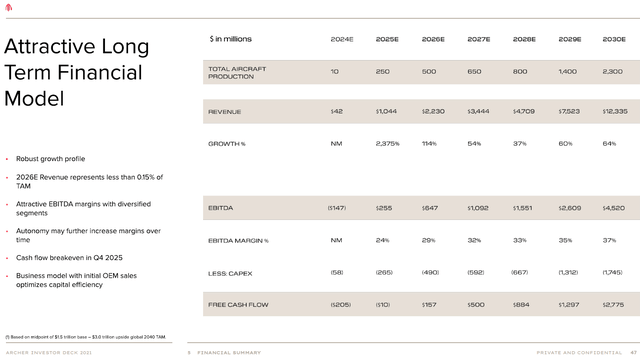

Management expects $12 billion in revenue and $4.5 billion in EBITDA in FY30. While I think that trajectory would present no issues, the precision of these figures is up for debate.

Model walkthrough:

- Revenue is expected to continue growing at a high pace as ACHR continues to innovate and gain share

- EBITDA margin will expand to 37% in the long-term

- For conservative sake, I simply assumed that ACHR would trade at the S&P forward EBITDA multiple of 12x. Readers can input any reasonable multiple, and the upside would still be significant.

Own calculations

SPAC Deck

Risks

No revenue and profits yet

Because ACHR has yet to generate revenue, this is the most significant risk that investors must take today. Investors need to take a big leap of faith to believe that eVOTL and UAM will take off in the future and that there will be a big enough demand to sustain the growth and profit pool of all the players in the industry, including ACHR.

Equity dilution

ACHR is burning through cash rapidly as it develops aircraft and technology, increasing the likelihood that they will need additional funding, either in the form of equity or debt. The stock price of ACHR may react to both of these factors.

Conclusion

To conclude, I believe ACHR is significantly undervalued. I believe there is a large potential market for UAM, which is projected to exceed $1 trillion by 2040, due to several factors such as traffic congestion in cities, the efficiency and cost savings of electric power grids, and the need for zero-emission transportation solutions. If ACHR is able to execute its plan, by working with it key partners, and eventually hitting the long-term guidance, the upside is significant.

Be the first to comment