Khaligo/iStock via Getty Images

Introduction

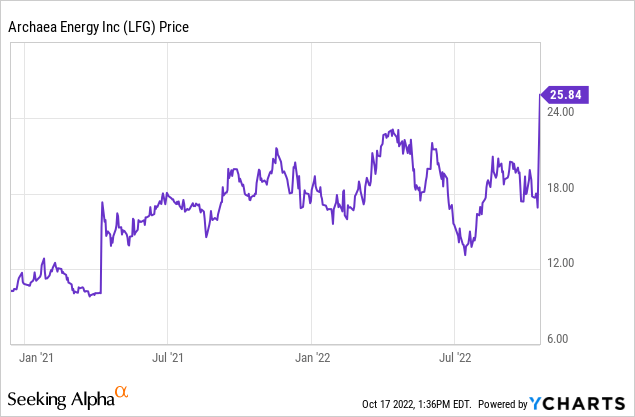

In April 2021, almost exactly 18 months ago, I wrote an article on a SPAC deal. Rice Acquisition, the SPAC from the Rice brothers which were running one of the world’s largest natural gas companies EQT (EQT), announced it entered into an agreement to simultaneously acquire two companies in the Renewable Natural Gas space. The business model was simple: Archaea Energy (NYSE:LFG) (the new name of the company after deSPAC’ing) captured the gas flows from landfills (and manure) and sold it at a premium thanks to the “green” label.

While the company is still in the growth phase as it had outlined a multi-year growth plan, British energy giant BP (NYSE:BP) didn’t want to wait for Archaea to execute on its growth and has already pulled the trigger to acquire Archaea. In this article, I’ll discuss the details of the offer, what it means for BP and what I will do with my Archaea shares.

What’s on the table?

BP’s offer is actually very straightforward. The company is offering a straight cash deal to acquire all outstanding shares of Archaea Energy for $26/share. As BP is almost drowning in cash, it can easily fork over the $3.3B in cash, so there’s virtually no doubt BP will be able to complete the transaction. The company also will assume the existing $800M in net debt, which means it’s acquiring Archaea Energy for a total enterprise value of $4.1B.

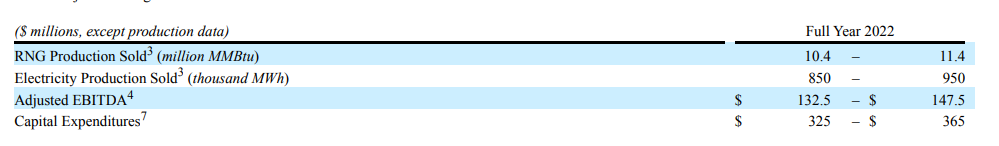

That’s quite a hefty price tag for a company with an adjusted EBITDA of just under $51M in the first half of this year, and even if we would use the higher end of full-year guidance of $147.5M in adjusted EBITDA, BP is paying almost 30 times EBITDA.

Archaea Energy Investor Relations

That being said, given the expected strong EBITDA result in the second half of this year, the run-rate EBITDA would increase to $200M in 2023. In this case, BP is paying approximately 20 times the FY 2023 EBITDA. And that’s still pricey.

Why is BP willing to pay an enterprise value of $4.1B?

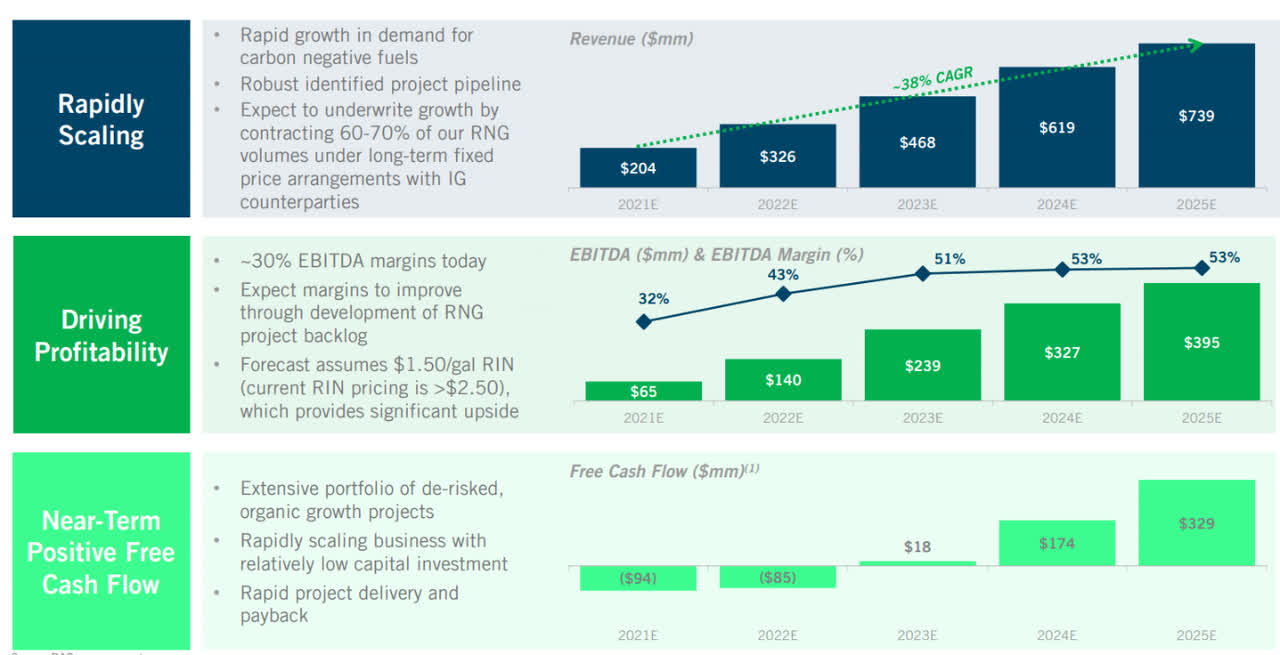

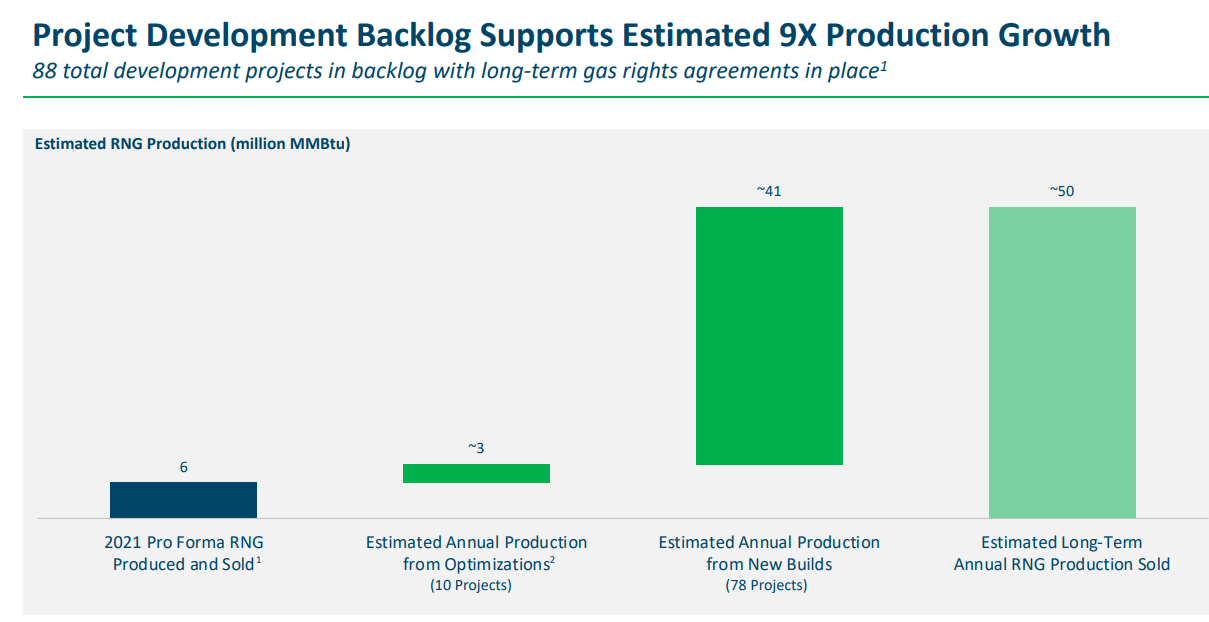

So why is BP paying a multiple of 20 times the 2023 EBITDA? Mainly because 2022 and 2023 are still just the first few years of an expansion plan. Archaea appears to be completely on track to deliver on its promise it made in 2021 to generate $140M in EBITDA this year (and likely is one of the very first SPAC deals where projections are actually coming true). This also means we can trust the $239M in anticipated EBITDA in 2023 ($200M run rate plus the completion of new projects coming online in the next few quarters). The image below comes from the April 2021 presentation of the company. Most SPACs don’t meet their targets, but Archaea has a shot at exceeding the $140M in adjusted EBITDA this year.

Archaea Energy Investor Relations

And once the cash flow and EBITDA snowball gets rolling, it’s understandable Archaea expects almost $400M in EBITDA in 2025. This means BP is buying a growth story and paying 10 times EBITDA based on the anticipated 2025 results is pretty acceptable, especially because BP has access to low-cost capital which will convert a higher percentage of the EBITDA into free cash flow.

In its announcement, BP expects Archaea to grow to an EBITDA result of $1B by 2027 as BP claims it is paying just 4 times the 2027 EBITDA. While that’s a bold statement, let’s not forget that the financial backing of BP will allow Archaea to scale up its development plans, potentially at a faster pace than it originally anticipated.

Meanwhile, this acquisition is more than just a “numbers game” for BP. It will help give itself a greener image as it will become one of the largest renewable natural gas producers in the US with a current production of 18,000 boe/day (and increasing fast). It also fits in the company’s strategy to invest in biogas as it expects to generate $2B in EBITDA by 2030 from biogas activities.

Archaea Energy Investor Relations

So while you could argue the price tag is pretty steep for BP, it wouldn’t be fair to Archaea Energy to solely look at the current EBITDA profile as LFG was planning to triple its EBITDA within the next 30 months. And once you bring that into the equation, BP is actually not overpaying for the acquisition if the long-term guidance can be met.

Investment thesis

For Archaea investors, the proposed $26 sale provides an excellent exit strategy. While I do think the company’s share price could be higher five years further down the road, let’s also not forget LFG would have had to raise additional capital (likely a combination of equity and debt) if it wanted to meet its aggressive growth profile. The deal with BP removes this financing uncertainty. And if you use a discount rate of 8% per year, $26 in today’s dollars is the equivalent of $33/share in three years.

So while it’s not a “knock-out” offer, it does seem to be fair for all parties involved. BP can deploy its cash into “green energy” while LFG shareholders get an immediate payout which they can deploy elsewhere. The stock is up 47% since my article was published in April 2021, and that represents an outperformance of the S&P 500 (which is down by almost 11% in the same time frame) by almost 58%. I’m happy to take the cash and deploy it elsewhere.

Be the first to comment