Bilanol/iStock via Getty Images

Coal’s post-pandemic fate was not meant to be this rosy, it really wasn’t. The clear conclusion then was that the world was moving away from the worst polluting fossil fuel. Indeed, coal had formed a low-hanging fruit for policymakers around the world looking to decarbonize their electricity grid with a number of countries fully phasing out the fuel that once powered their entire energy needs in the long gone past.

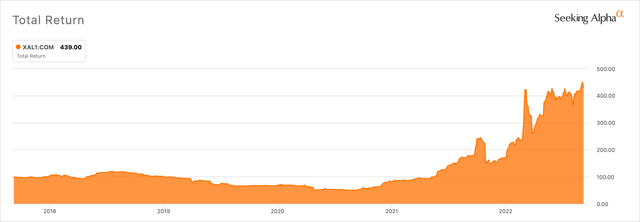

Arch Resources (NYSE:ARCH) together with Peabody Energy (BTU) formed some of the last redoubts of long declining American coal. With their futures seemingly set to a managed decline, the surge has come as a shock and surprise to bulls and bears alike. Arch Resources has seen its stock price increase by 81% over the last year as coal prices moved to generational highs on the back of Russia’s invasion of Ukraine. Europe, long dependent on natural gas pipelines from Russia for its energy needs, now finds itself facing an existential threat. Russia has closed the Nord Stream 1 pipeline, weaponising its gas supplies to the continent. This desperate response to the stream of EU sanctions was implemented just after an import ban on Russian coal came into place as part of the fifth package of EU sanctions. At 7% of the globally traded market, this was a material volume of coal that now needs to be sourced from alternative sources.

Seeking Alpha

The impact has been a sustained increase in the price of the commodity, proving a generational boom for Arch and its long-embattled shareholders. The global macro picture for the commodity is now rosy in a way that totally defies what was the previously established consensus on the death of coal.

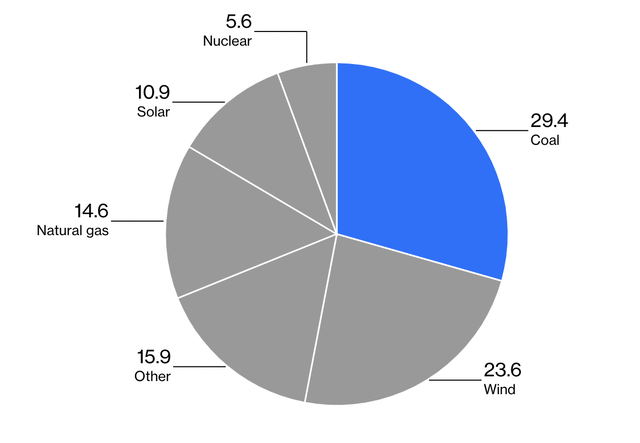

Coal accounts for 70% of electricity generation in India. The country was previously able to meet most of its demand internally but has had to ramp up imports in recent months. Germany, the foremost European economy, has proceeded with its shutdown of nuclear power plants and increased the coal component of its electricity generation. China is also planning on adding 270 GW of coal thermal capacity in the next five years through 2025, more than earlier estimates of 100 – 200 GW.

Bloomberg

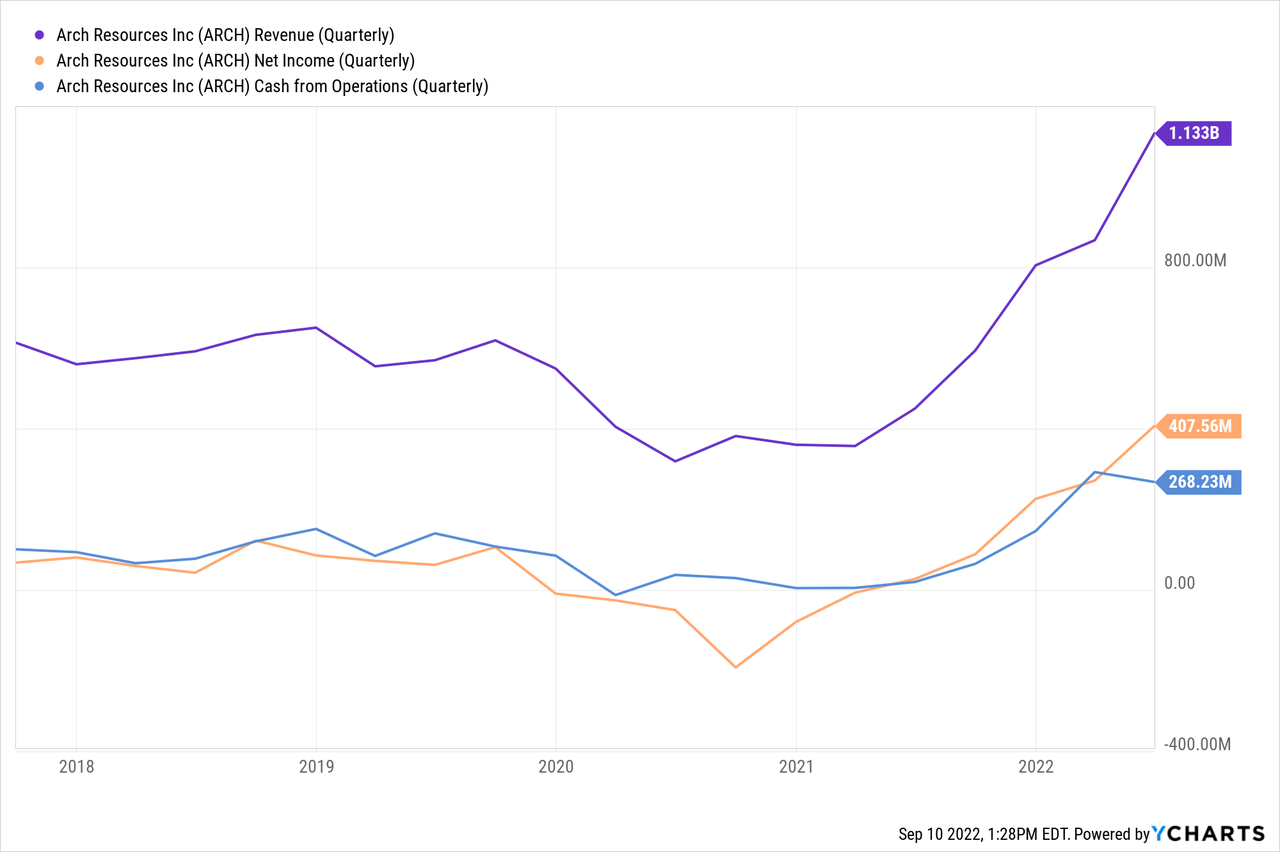

Revenue Reaches New Records As Cash Flow Surges

Arch last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $1.13 billion, up 151% year-over-year and a beat of $119.82 million on consensus estimates. Revenue has been going strong and rose to a record high during the quarter.

Net income also rose to reach $407.56 million with cash from operations at $268.23 million. This strong cash generation meant cash and equivalents at $282 million was up 51% from the year-ago quarter but down on a sequential basis as the company prioritizes debt repayments. Long-term debt has now declined from $522.6 million five quarters ago to $127.1 million as of the last reported earnings quarter.

The company also announced a quarterly dividend of $118.7 million, or $6 per share. Total dividends declared for the first half of the year now amount to more than a 10% yield. With the strong cash flows set to continue, the company’s common shareholders are looking at a continuation of this outsized and covered payout.

A Defying Resurgence As The New Energy Zeitgeist Takes Hold

The environmental costs of coal are well covered and known. This has been the core reason for its ongoing phase-out in certain nations around the world.

Our World In Data

However, this has clearly not been a convincing enough argument to dissuade nations like Germany to continue aggressively pursuing the commodity in lieu of nuclear power.

The last 12 months have totally upended the short, medium, and long-term outlook for coal. Whilst current high prices seem to be unsustainable with demand destruction still being realized in a number of countries that have proceeded with their shutdown, it has clearly not been as pertinent as the bears expect. Several policy decisions have meant that tales of coal’s death have been greatly exaggerated.

The current scenario can only really be described as a financial miracle as a company once on the precipice of bankruptcy with shares shunned by what was the growing ESG movement, has now staged a comeback like no other. Arch is set to print cash on a level it has never seen in its near history, rewarding long beleaguered shareholders who have held through the lows. With the new energy zeitgeist fully defined as a visceral need for energy security against Russia’s shutdown of gas supplies, coal is likely to see greater demand from European countries that have extended the life of their coal plants or are proceeding with the shutdown of nuclear power. Hence, Arch’s defiance of its death continues at pace.

Be the first to comment