onurdongel

(Note: This article appeared in the newsletter on August 3, 2022.)

Antero Midstream Corporation (NYSE:AM) is a company that usually catches a lot of criticism for its skimpy dividend coverage. Missing from the conversation are the different calculations that occur when a non-GAAP measure is used. An adjustment to such a measure is a necessary requirement before a reasonable comparison can be made between companies. Otherwise, “apples and oranges” are being compared to the point that an investor can come to an incorrect conclusion.

The Calculation

Antero Midstream uses a very conservative definition of free cash flow, as shown below:

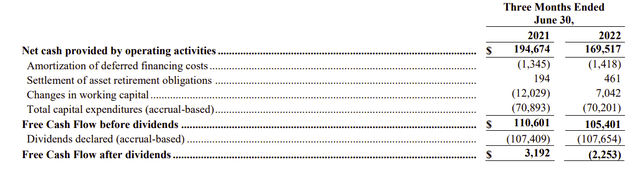

Antero Midstream Free Cash Flow Calculation (Antero Midstream Second Quarter 2022, Earnings Press Release.)

This management subtracts the total capital budget from net cash provided by operating activities. That is about as conservative as you can get in the industry. Many other companies simply subtract maintenance capital because they intend to borrow at least some money to finance the expansion capital budget.

This management has a goal to reduce an already conservative (for midstream companies) debt ratio. Therefore, any and all expenditures that are likely to increase debt are included in the free cash flow after dividends calculation. This management has demonstrated in the past that the dividend will not be raised if debt cannot be handled to the conservative goals stated.

That is very different from a lot of companies that do not cut dividends or distributions until there is trouble ahead. Since the debt ratio is comfortably below 4, there is unlikely to be any financial trouble because that is one of the lowest ratios in the midstream industry.

Free Cash Flow Guidance

The dividend is likely to be maintained because free cash flow is projected to grow considerably. That also implies that there will be dividend growth in the future.

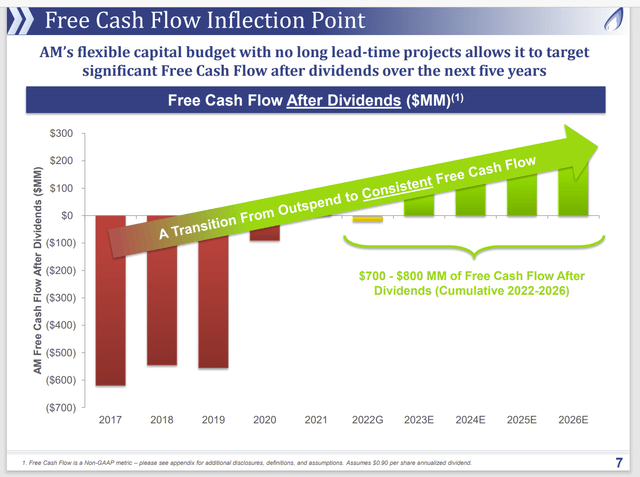

Antero Midstream Free Cash Flow Guidance And History (Antero Midstream Second Quarter 2022, Earnings Slide Presentation.)

Management is currently holding the dividend steady because they want to reduce debt from currently fairly conservative levels. The capital budget is projected to decline while volumes handled are likely to continue to grow slowly over time.

This midstream company does not service all of the parent company production. As long as that is the case, capital needs and midstream growth can differ from the parent company overall growth guidance.

Similarly, once the basic midstream structure is in place, then expansion of capacity as needed is often accomplished with small capital projects that tend to pay back quickly. That means that the chart shown above is plausible.

Now an acquisition of bolt-on midstream capacity or a major expansion into some production areas that were not previously covered are not factored into the guidance above. But the overall goal is to service the parent company, Antero Resources Corporation (AR), while maintaining considerable financial flexibility that one seldom sees in other midstream companies.

Self-financing of capital projects has been the rule here since the company went public. That means that a relatively high percentage of cash flow has been reinvested in the business. Therefore, the earnings growth should compound a little faster than is the case with many competitors.

Energy Transfer Distributable Cash Flow Calculation

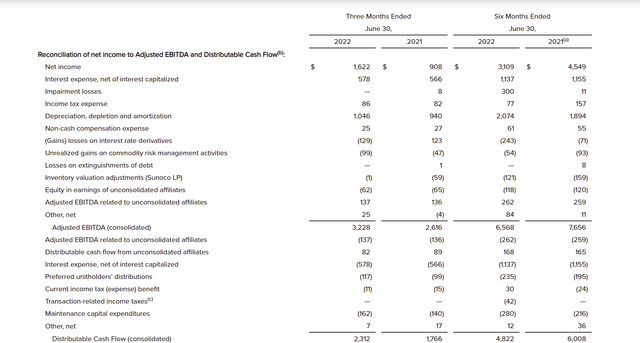

Energy Transfer LP (ET) has a fairly typical distributable cash flow calculation that nonetheless illustrates the pitfall of blindly comparing distributable cash flows:

Energy Transfer Second Quarter 2022, Distributable Cash Flow Calculation (Energy Transfer Second Quarter 2022, Earnings Press Release)

Since free cash flow and distributable cash flow are not GAAP numbers, managements are free to include or exclude anything they want in the presentation of these numbers. Even though there are some general agreements about what should be in the numbers, a motivated management can differ literally at will as long as there is a note somewhere disclosing how the number was calculated. For that reason, comparison of numbers without a GAAP definition can be a real challenge.

The difference between the calculation for Antero Midstream and Energy Transfer is clearly stated in the two calculations. Antero Midstream put the whole budget into the free cash flow calculation (and basically uses that also as distributable cash flow) whereas Energy Transfer clearly uses only maintenance capital.

Therefore, Energy Transfer is going to have robust coverage because maintenance capital is generally a fairly small part of the capital budget. In order to compare distribution (or dividend) coverage of the two companies either they both use maintenance capital, or they both use the whole capital budget. For the individual investors, that makes comparing non-GAAP numbers a real challenge if you want to compare several companies.

Similarly, if there is an acquisition, Energy Transfer is not as likely to enter the acquisition expenditures (except for income statement items) whereas a conservative competitor like Enterprise Products Partners (EPD) is more likely to consider that in a distributable cash flow calculation.

Debt Considerations

In addition to the different calculations, there is the balance sheet structure as well. Both of these companies have very different financial structures.

Antero Midstream has a leverage ratio that is under 4. No matter how one views the ratio, the fact is that the company can borrow to maintain the dividend for some time to come. Management has a goal to reduce that debt ratio to 3. That debt ratio would be among the lowest of the midstream debt ratios in the companies that I follow.

On the other hand, Energy Transfer has a leverage ratio that is calculated with $48 billion of long-term debt combined with $6 billion of preferred. Even with the guided EBITDA of at least $12 billion, the ratio of senior claims to the common unit is well on its way to 5 (though less than 5) which is far higher than the debt ratio of Antero Midstream.

A higher debt ratio carries with it a higher implied servicing obligation. Even though Energy Transfer debt has an investment grade rating, there could well be higher or sooner debt repayment obligations that a lower debt ratio would allow for 100% refinancing when it came due. Indeed, that may be the reason that Energy Transfer cut the distribution payment awhile back.

The Future

Free Cash Flow and Distributable cash flow (along with EBITDA or EBITDAX) have no standard definition that managements are held accountable for. As a result, comparisons of these numbers between companies can be a real challenge because investors may not be able to tell the differences enough from public information to get comparable numbers (easily).

Therefore, a very strong balance sheet is essential in order to use non-GAAP numbers the way many investors want to use them. Weaker balance sheets imply unpleasant surprises despite good distribution coverage ratios because weaker balance sheets may have things that take precedence over anything in the non-GAAP calculation (like debt payments).

Antero Midstream has a far simpler future that is easier to understand. The risk is less because of the strong finances of both the midstream and its major customer, Antero Resources (AR). Any distribution cuts here simply make finances more conservative. There really are no financial issues to speak of.

Energy Transfer really needs to get the debt ratios down and the preferred stock redeemed. This company has demonstrated that an investment grade rating will not prevent a distribution cut. But the need to bring the debt levels down and eliminate the preferred stock along with the potential future challenges make these common units a good deal riskier than is the case with Antero Midstream. Notice that the distribution or dividend coverage really does not factor as much into riskiness in the overall picture.

Be the first to comment