Satephoto

I recently wrote an article on Peabody (BTU) and Transocean (RIG), explaining why I bought call options on each company as a small speculation. While the coal industry has had a good run in the last two years, the whole industry is still very cheap. If you are looking for a company in the coal industry and are interested in immediate dividends and a cheap valuation, Arch Resources (NYSE:ARCH) might be a better option than BTU.

Investment Thesis

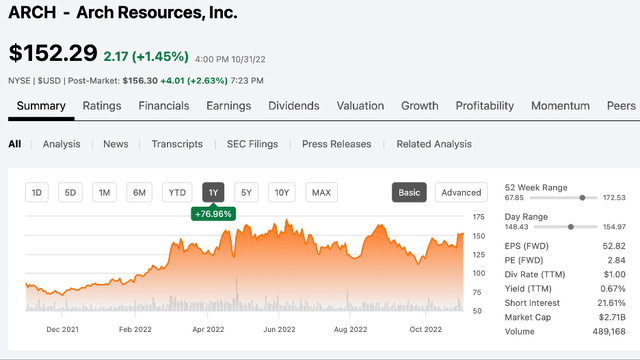

Arch Resources is a coal producer that focuses primarily on metallurgical coal. They recently reported an impressive Q3, and shares had a nice little pop over 10%. Despite that increase, shares remain dirt cheap, and the financials continue to improve. Shares still trade at a low single digit multiple. The company is buying back stock, reducing debt, and increasing cash levels all at the same time. Despite this, short interest remains high at more than 20%. With the policy of paying out half of the cash flow as variable dividends, I think shares are still attractive for new investors even after massive returns over the last couple years.

Q3 Earnings

Arch’s business tilts more towards metallurgical coal used in the steelmaking process. Arch reported earnings last week, and there was a lot to like. Revenues are still up as coal prices have remained high, and the company continues to see significant cashflows. While I don’t make bets on commodity prices, I wouldn’t be surprised if the coal price stays high over the next year. While I don’t know if Arch will see the same cashflows in 2023 and pay out over $20 in dividends, I think they should have a good couple of years ahead of them.

One of the things that popped out from the 10-Q was the buyback program. They bought back another $58M worth of shares at an average price just over $134. They now have $443M remaining on the current authorization, and I would assume they will continue to buy back shares at a decent clip at these cheap valuations.

Valuation

Anyone familiar with the coal industry knows that it is cheap across the board. This is the other piece from the 10-Q that stood out to me. In the first nine months of 2022, revenue is up to $2.85B and the earnings per share for the first nine months was $50.97 (or $41.00 for diluted share count). If you think Q4 is going to be similar, add on at least $10 to each of those. While I don’t know if they will be able to earn a similar amount next year, EPS that high is ridiculous for a $150 stock. The other thing that shows improvement is the balance sheet.

Feel free to look at the balance sheet for yourself, but I will keep this part short and sweet by focusing on the cash and debt levels. Cash levels are up $165M in nine months since year end, and now total $490M. That’s not an insignificant amount for a company with a market cap of $2.7B. Debt levels are way down at the same time. Current and long-term debt at year end was at $560M. Nine months later we are at $174M. Despite these improvements, short interest remains high.

20% Short Interest (seekingalpha.com)

I’ve said this before, and I’ll say it again: I’m not sure what the shorts are thinking. The stock is cheap and there is a massive dividend coming up. If you have to short something, I feel like you could find better candidates than Arch (Carvana (CVNA) anyone?). Throw in a decent buyback for good measure and the short interest being over 20% seems ridiculous.

The Dividend Policy

Like I mentioned in my previous article, the company is planning to pay out 50% of the previous quarter’s cash flow as a variable dividend on top of a small, fixed amount. While that means there won’t be any consistency with the dividend payout, I doubt you will find any shareholders complaining about the upcoming $10.75 payout. As long as the business keeps firing on all cylinders, investors can expect continued large variable dividends.

Conclusion

Arch isn’t the only game in town when it comes to coal, but the company continues to improve its financials and provide impressive shareholder returns via dividends and buybacks. Cash on the balance sheet is increasing and debt is decreasing, and the company has already earned over $40 per share in the first nine months of 2022. While I don’t know if the company will pay over $20 in dividends in 2023 like they have in 2022, the 50% payout policy means we should see a significant dividend next year. Throw in buybacks and you have an impressive capital return program. While short interest remains high, I still think shares of Arch Resources are a buy.

Be the first to comment