Cunaplus_M.Faba

Thesis

Investors in mREITs have also suffered the brunt of the bear market over the past year, including in leading multifamily asset class leader Arbor Realty Trust, Inc. (NYSE:ABR).

As a result, ABR posted a YTD return of -28.6%, underperforming the SPDR S&P 500 ETF’s (SPY) -22.2%. Therefore, the market has justifiably de-rated ABR as its relative valuation was not sustainable in 2021.

With the housing market correction underway, investors should understand why the market staged a top in ABR in November 2021. We assess that the market had correctly anticipated the impact of the Fed’s aggressive rate hikes, affecting housing demand and loan originations. Coupled with the double whammy of rising mortgage rates and a potential recession, the market needs to de-risk ABR’s overvaluation through the cycle.

We deduce that ABR is at a critical juncture now, with its valuation attractive. However, we gleaned that its price action remains tentative, even though it could be at a sustained bottom if it could form a decisive bullish reversal.

Hence, we parse that the reward-to-risk profile is attractive at these levels, even though the housing market continues to come under significant pressure, given the hawkish Fed. We highlight the critical levels that investors should bear in mind if the market prices in a worse-than-expected recession.

We rate ABR as a Buy.

Arbor Realty Benefited From The Fed’s Interest Rate Hikes

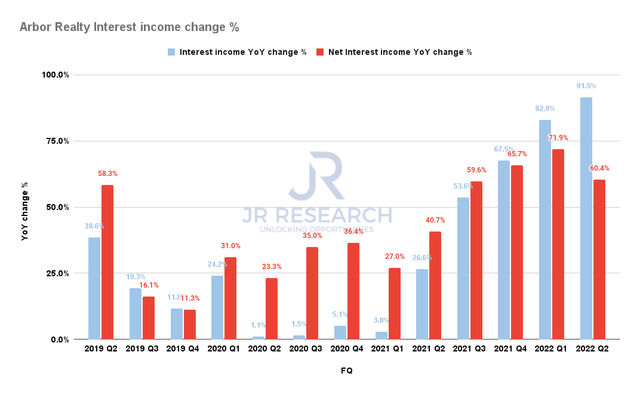

Arbor Realty Interest income change % (Company filings)

Arbor Realty highlighted in its Q2 call that 97% of its structured loan book is predicated on floating rate terms. Therefore, it has been able to leverage the Fed rate hikes remarkably as it turned increasingly hawkish to combat inflation expeditiously.

As seen above, Arbor Realty Trust’s interest income surged by 91.5% in Q2. The growth in its net interest income was also robust, as ABR posted an increase of 60.4%.

However, investors also need to be wary about expecting such massive growth rates moving ahead as we close in on the Fed’s terminal rate (potentially in the 4.5% to 4.75% zone for now). Therefore, the Fed could possibly be done with its rate hikes in December 2022 before pausing and moving into “data dependency” mode in 2023.

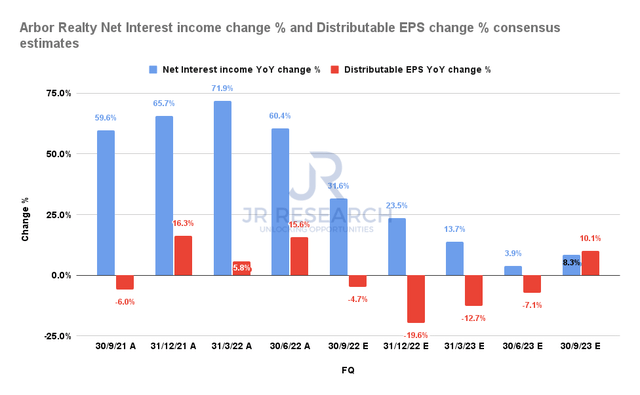

Arbor Realty Net interest income change % and Distributable income change % consensus estimates (S&P Cap IQ)

Therefore, we assess that the consensus estimates (bullish) are credible, as it sees a markedly slowing cadence in its net interest income growth through Q3’23.

However, despite the benefits from the interest rate hikes, Arbor Realty’s distributable EPS is expected to move into negative growth through H1’23. Nevertheless, we believe the analysts’ estimates are reasonable, factoring in potentially higher provisions for loan losses and a slowdown in originations.

Coupled with slower growth in net interest income, it would be unreasonable for investors to expect Arbor Realty to continue posting robust EPS growth rates through H1’23. Hence, we urge investors to expect some near-term challenges that could impact its profitability growth as the economy moves into a recession over the next twelve months.

But The Market Has De-rated ABR

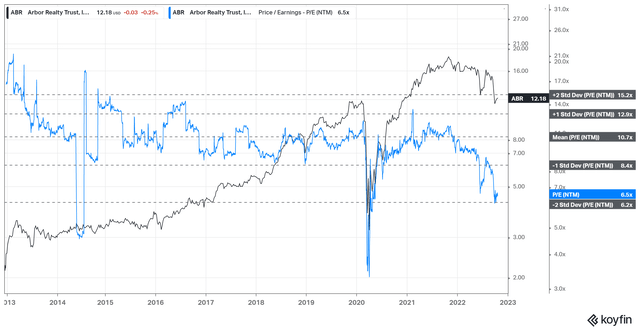

ABR NTM Distributable EPS multiples valuation trend (koyfin)

Of course, the market had already anticipated that the housing market’s remarkable rally in 2021 was unsustainable in the face of the Fed’s hawkish actions.

As such, the market sent ABR’s NTM Distributable earnings multiples spiraling down toward the two standard deviation zone under its 10Y mean. Therefore, we think it’s pretty clear that the market has de-rated ABR meaningfully, reflecting its execution risks through the recession.

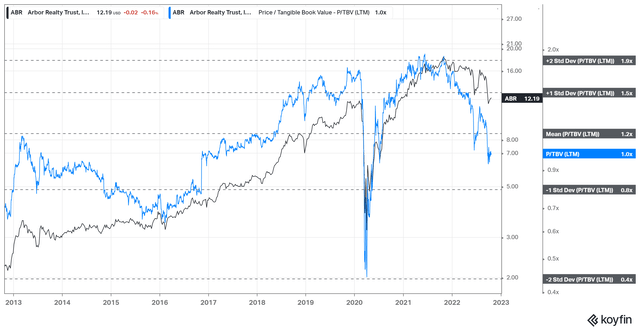

ABR TTM TBV multiples valuation trend (koyfin)

However, we gleaned that ABR’s TTM tangible book value (TBV) multiples have not yet moved into highly pessimistic zones. Hence, the market has likely reflected a mild-to-moderate recessionary impact on Arbor’s book value estimates, but not a severe one.

As seen above, ABR traded at unsustainable valuations in 2021 (in the two standard deviation zone over its 10Y mean). Therefore, investors are urged to pay attention to its TBV multiples to assess its relative valuation levels.

Is ABR Stock A Buy, Sell, Or Hold?

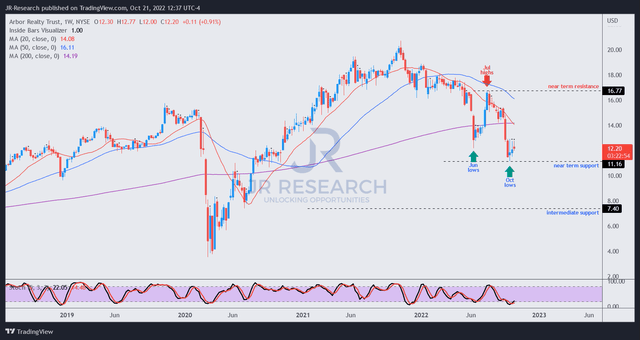

ABR price chart (weekly) (TradingView)

Two critical observations that investors need to note for ABR’s price action. It has moved into a medium-term downtrend, so the initiative remains with the sellers.

However, we gleaned a potential bear trap (indicating the market denied further selling downside decisively) predicated on its June lows, as ABR has attempted to retake that level after falling to its recent October bottom. Therefore, a successful re-test against its June bottom could indicate the early signs of a potential bullish recovery of its medium-term bullish bias.

Notwithstanding, if the market anticipates a worse-than-expected recession over the horizon potentially resulting from a “policy error,” investors need to expect further value compression. In that case, we postulate a further decline toward the gap above its intermediate support is possible.

That would likely send its TTM TBV multiples tumbling toward the two standard deviation zone under its 10Y mean. As such, it would improve its reward-to-risk profile tremendously. Hence, investors should consider adding aggressively if ABR falls to those levels.

Accordingly, we rate ABR as a Buy and encourage investors to layer in their exposure, given its bearish bias.

Be the first to comment