Sundry Photography/iStock via Getty Images

Investment Thesis

Arbor Realty (NYSE:ABR) is a mortgage REIT that operates through two business segments: structured loan origination and agency loan origination. The structured loan segment mostly focuses on originating bridge loans (short-term financing that is typically used for a property acquisition), while the agency loan segment originates, sells and services government backed loans (e.g., Fannie Mae and Freddie MAC) and private label loans. With an aggressive growth plan and effective use of capital (ROE of 195), Arbor’s total shareholder return has been one of the best in the industry for the past 5 years. Given their effective management of credit risk and steady growth in cash flow, I expect Arbor to remain a strong dividend investment for a while. I believe Arbor is a great choice because:

- Since I wrote the previous article, they reported 4Q 2021 earnings, which were outstanding. Their portfolio grew substantially, and they raised their dividend for the 7th consecutive quarter.

- Arbor has a very diversified portfolio, and are managing credit risk very effectively.

- Arbor has strong cash flow to support a growing dividend in the future.

Strong growth trajectory

Arbor reported 4Q 2021 results in mid-February, with outstanding earnings. They originated over $16.1 B of loans in 2021, which was a 76% increase from 2020. A large portion of the increase came from the bridge loan segment, and the overall portfolio performed very well. Also, they closed four non-recourse collateralized loan obligations (CLO) and two private-label securitizations, and raised $1.7B of accretive capital to fund portfolio growth. The results were brimful with revenue growth, profit growth, and capital growth. All of this was great to see as a shareholder.

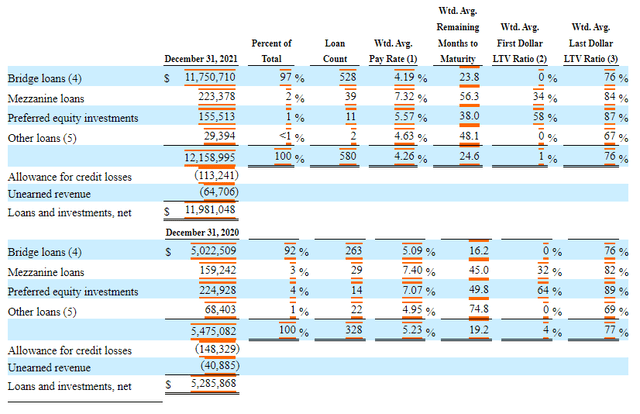

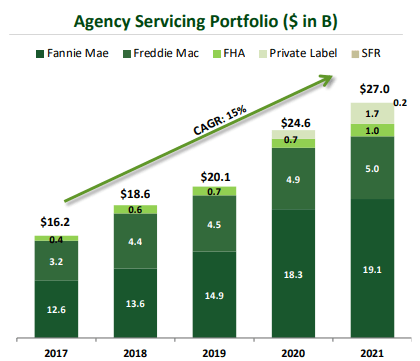

Looking at the structured business loan segment, you can see their bridge loan portion more than doubled from 2020, increasing from $5.0 B to $11.7 B. I believe the strong housing market and overall real estate investment boom in 2021 contributed to this trend. The agency servicing portfolio grew substantially as well, increasing from $24.6 B to $27 B. This large increase in portfolio led to a substantial increase in distributable earnings ($2.01 per share, 15% increase from 2020). Overall, it was an exceptional year for Arbor. Given their portfolio growth and strengthening funding sources, I expect them to continue to grow.

Breakdown of Structured Business Portfolio (SEC Filings) Agency Servicing Portfolio (Arbor Realty Investor Relations)

Effective Credit Risk Management

One of the main concerns as an Arbor shareholder relates to how they manage credit risk. A substantial portion of their portfolio consists of bridge loans and mezzanine loans to acquire multifamily properties, so it is critical to manage the credit risk of each loan as well as risk of the whole portfolio. In my opinion, Arbor is doing a great job at managing this credit risk through diversification and their credit risk rating process.

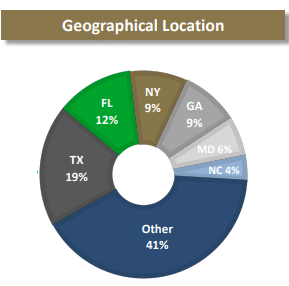

According to their SEC filings, Arbor does not carry any single loan or investment at a level that represents more than 10% of their total assets, and no single investor group generates more than 10% of their revenue. So their borrowers are diversified. Also, their assets are geographically diversified, with no single state representing more than 20% of the portfolio.

Geographical Location of Portfolio (Arbor Realty Investor Relations)

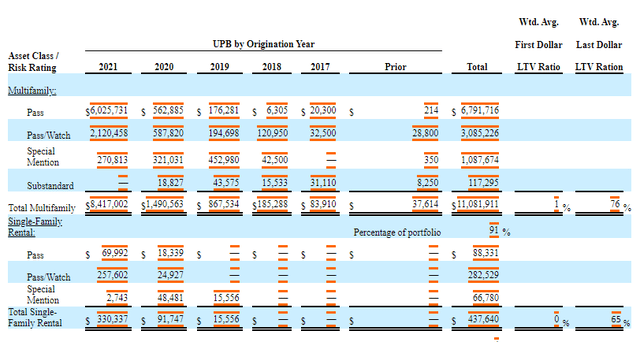

Additionally, Arbor maintains a strict system for rating credit risk that considers each investment as well as monitors overall portfolio risk. They assign a credit risk rating of pass, pass/watch, special mention, substandard (doubtful) to each loan, and they evaluate and review this quarterly. Combining their diversification and credit risk management system, I believe Arbor is doing a great job at managing credit risk, and they are growing their portfolio without exposing capital to any overly risky assets.

Credit Risk Management of Portfolio (SEC filing)

Strong cash flow to support dividend growth

Reflecting their strong portfolio growth, revenue (5 year average, 31%) and cash flow has been growing at a rapid pace. Also, their distributable earnings grew substantially as well. The distributable earnings of 2021 was $2.01 per share, which was a 15% increase over 2020. Also, they raised the dividend last quarter, and it was the 4th increase in 2021 and 7th consecutive quarterly increase. All these results represent an industry leading ROE of 19% in 2021.

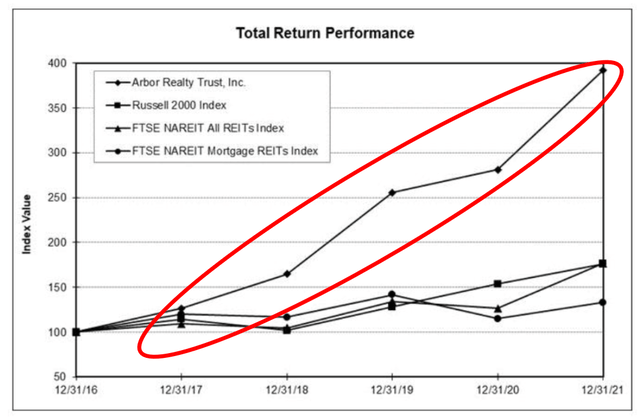

Based on this strong operational performance, it’s not surprising to see that Arbor’s total return performance is far superior compared to benchmark indexes (Russell 2000, FTSE NAREIT All REITs Index, FTSE NAREIT Mortgage REITs Index). Also, the dividend payout ratio was around 60% during 4Q 2021, and 70% for the full 2021. Given the strong growth trajectory of their portfolio, and the nice cushion between distributable earnings and dividend payment, I expect Arbor to keep increasing their dividend payment for the foreseeable future.

Total Return Performance (SEC filing)

Fair Value Estimation

Due to the recent drop in price, the P/E ratio of Arbor (8.57x) is below the sector median (10.78x). Given their strong growth trajectory, high profitability, and well managed credit risk, I don’t see any good reason to believe that Arbor should be traded below the sector median. During the last earnings call, the CEO shared his opinion that “we feel strongly that our current stock price is no way reflecting the true value of our franchise, presenting investors with an unparalleled buying opportunity.” I agree with management’s perspective, and I expect Arbor’s share price to rise at least to match the sector median. That would represent about 15-20% stock price appreciation in the long run, causing dividend yield to drop slightly into the 7.5% range. Therefore, the total return would be similar to their 5 year historic return (26%).

Risk

To fund the growth of their portfolio, Arbor’s debt level has been rising. The total debt rose from $3.3 B in 2018 to $12.2 B in 2022. Also, they just closed a public offering of 6.5M shares of common stock, which will dilute the earnings per share in the future. Therefore, the shareholder should monitor their debt level and overall capital structure, to ensure that they continue to manage growth effectively without over-stretching their balance sheet.

The Federal Reserve announced the interest hikes to fight inflation (9 times total this year and next year). The interest rate hikes will result in increasing mortgage rates, and this may cool the real estate market substantially. The slowdown in real estate transactions may negatively impact Arbor’s revenue growth trajectory. Therefore, the investor should continue to gauge the health of the real estate market.

Conclusion

Arbor has been an outstanding investment for a dividend investor in the past several years. Given their rapidly expanding portfolio, revenue, and cash flow, I believe they will remain a superior investment in the future. Rising debt level on the balance sheet and the potential for the real estate market to slow down may present challenges for Arbor, so an investor should keep an eye on their balance sheet and the overall real estate market. Overall, I expect around 25% total return (combining dividend yield + stock price appreciation).

Be the first to comment