Byrdyak/iStock via Getty Images

Introduction

I’ve covered two lithium-ion battery recycling companies on SA so far – Li-Cycle Holdings (LICY) here, and American Battery Technology Company (OTCQB:ABML) here. Today, I want to talk about a company from this sector in which I was an investor briefly back in 2016 – Aqua Metals (NASDAQ:AQMS). I think that its lead-acid battery was a failure, and I doubt that the pivot to lithium-ion batteries is going to work. The company doesn’t have the funds nor the partnerships to compete with industry leaders like Li-Cycle and Redwood Materials. I’m bearish but it could be dangerous to open a Short position as the share prices of microcaps sometimes increase for spurious and unknown reasons. Let’s review.

Overview of the business and financials

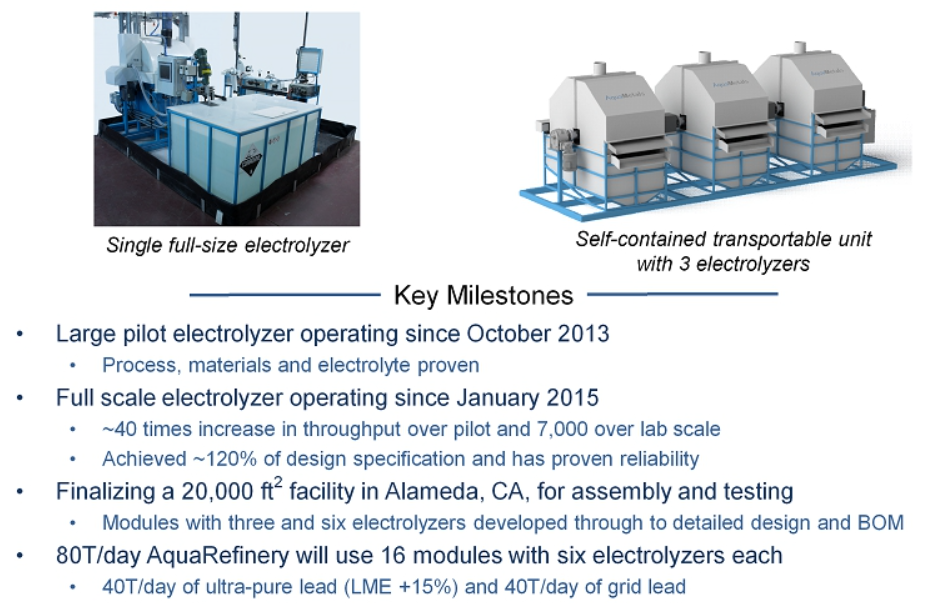

To explain why I think Aqua Metals doesn’t have a bright future, I have to go back to the beginning and how its lead recycling business failed. The company was founded in 2014, and it has developed a closed-loop, water-based process for the recycling of lead-acid batteries called AquaRefining. It was touted as the first commercially viable alternative lead-acid battery recycling technology and won the Rising Star category in the 2016 Platts Global Metals Awards program.

In 2015, Aqua Metals raised $30 million in an IPO on NASDAQ, and it started building its first facility which would have a production capacity of 80/t per day

Aqua Metals

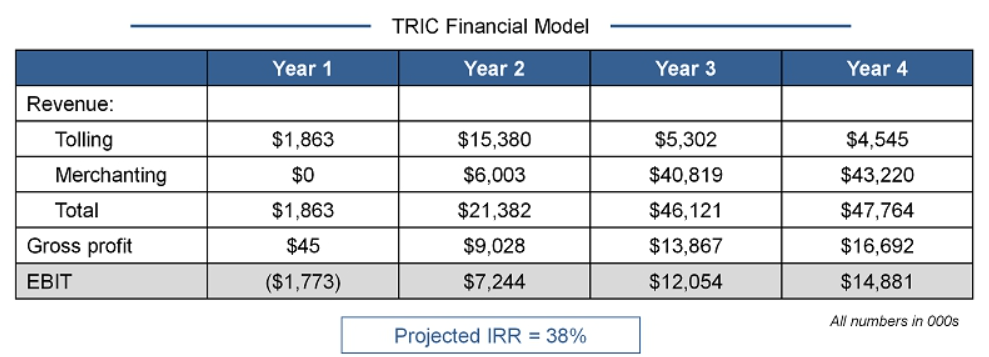

The projected financials looked great as the initial CAPEX was just $28.5 million and the project was expected to start generating annual EBIT of almost $15 million by its fourth year. The reason these figures looked so good was because the process was supposed to be less energy-intensive than smelting and half of the produced lead would be ultrapure, which sells for a premium of about 15%.

Aqua Metals

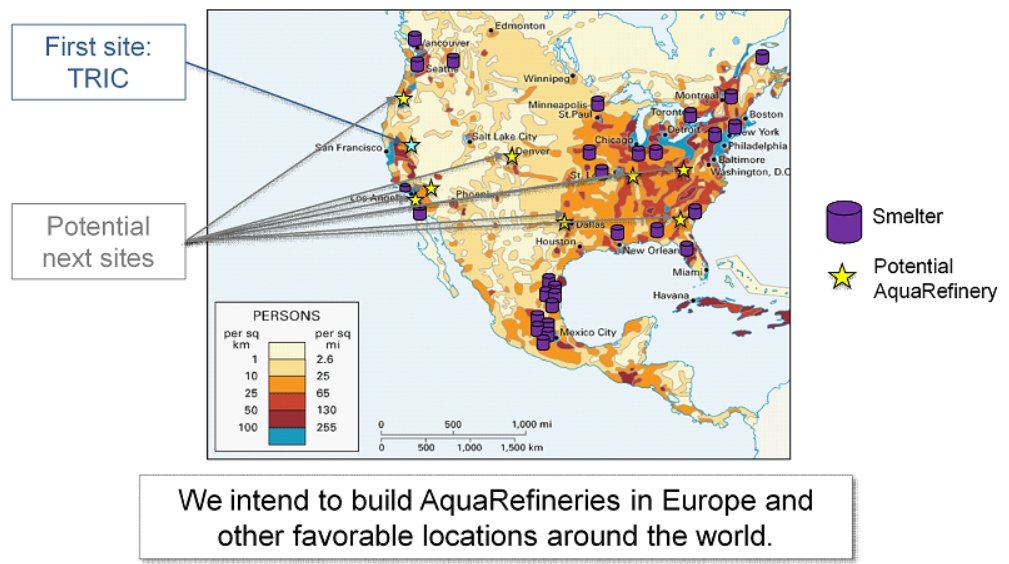

Aqua Metals was thinking big, and it had already picked 8 potential AquaRefinery sites in the USA alone at the time of its listing. The lead market is worth over $20 billion and the company was aiming to revolutionize it.

Aqua Metals

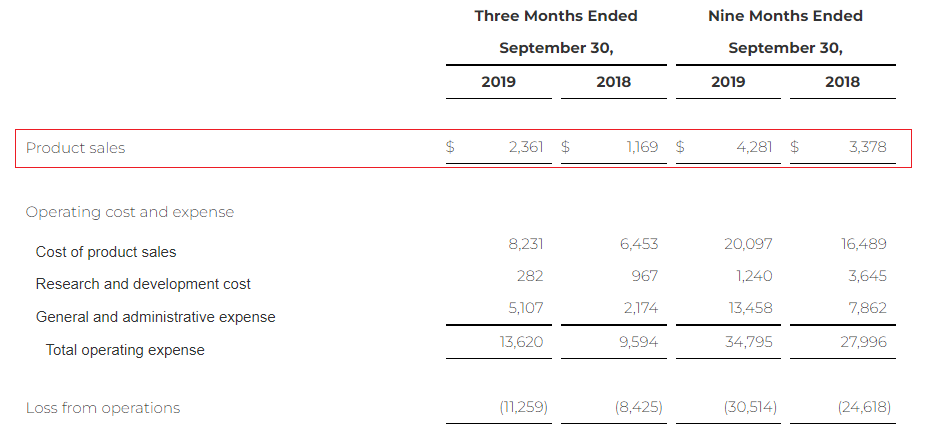

However, it just didn’t work out. There were technical issues, including recovered lead hanging up on the exit chutes of the modules, and the company was already talking about a retro-fit in December 2017. And this took time as 24/7 production on more than 1 module was achieved in April 2019. However, the financial performance of the recycling facility was nowhere near the initial forecasts, and Aqua Metals had quarterly revenues of just over $2 million by the time the plant burned down.

Aqua Metals

Yes, you read that right – the plant burned down in December 2019 and Aqua Metals didn’t put it back into production. At least, it collected $30.25 million in insurance payments. So, what did the company do after that? Well, it decided to pursue a strategy of licensing its AquaRefining technology, but it didn’t manage to find buyers. In light of the issues experienced by Aqua Metals itself, I find this unsurprising. Yet, this doesn’t stop the company from saying in its latest corporate presentation that it’s leading a revolution in lead recycling. And now, it also has lithium-ion batteries in the mix.

In February 2021, Aqua Metals bought a 10% stake in a company named LiNiCo for $2 million in shares and said that it planned to apply its intellectual property to lithium-ion battery recycling. LiNiCo is a small company that claims to have developed recycling technology based on a co-precipitation process and control system which can produce 99.9% pure battery cathode. The remaining 90% of the company is owned by Comstock Mining (LODE), which has a market valuation of less than $50 million as of the time of writing.

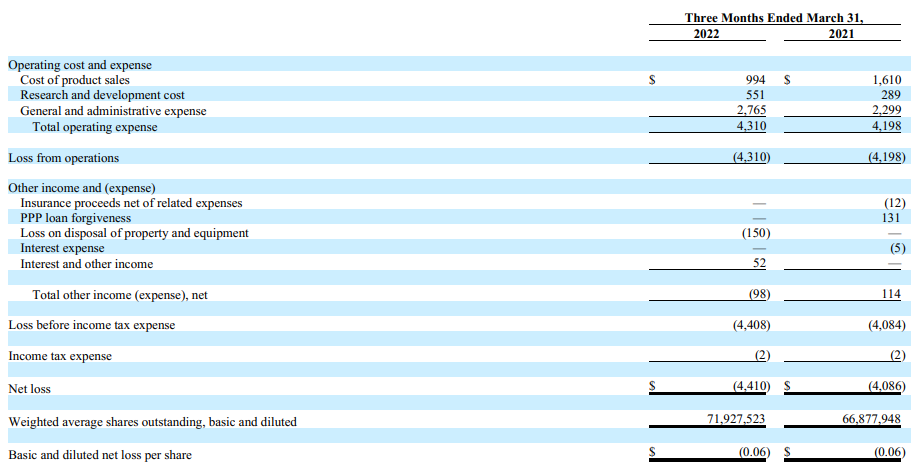

Aqua Metals has leased its own facility to LiNiCo and the latter plans to have a feedstock crushing capacity of over 35,000 tons by the second half of 2022. Here are some of the issues though. First, the companies plan to source the necessary lithium-ion feedstock from battery manufacturing scrap, but there are no announced suppliers. For comparison, Li-Cycle has already secured over 40 commercial contracts and off-take agreements through 2030. Second, LiNiCo plans to produce black mass which Aqua Metals will then process into e high purity metals including nickel and cobalt using the same technology which didn’t work for lead recycling. Third, I don’t think LiNiCo or Aqua Metals have the funding to pull it off. You see, Aqua Metals and Comstock paid for their stakes in LiNiCo using shares, and it’s unclear how much money the latter has left. Aqua Metals, in turn, had just $9 million in cash left as of March 2022 as most of that insurance money is now gone. At the moment, the company has a quarterly loss of just over $4 million.

Aqua Metals

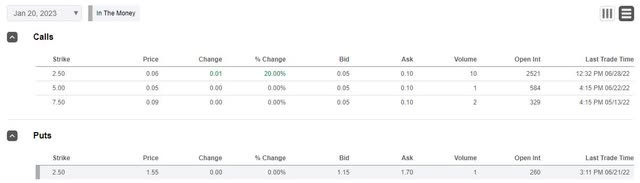

In my view, the future of Aqua Metals includes more of what we’ve seen over the past several years – underdelivering and stock dilution. Overall, I think that the business is close to worthless in its current form. So, how do you play this? Well, data from Fintel shows that the short borrow fee rate is 4.68% as of the time of writing, so short selling is a viable option. I think that it’s a good idea to hedge the risk with some call options, but unfortunately, the lowest available strike price here is $2.50.

This is an issue because the share prices of microcaps can soar without any news or catalysts and this can lead to significant losses for short sellers. Aqua Metals itself is a good example of this as its share price sextupled between November 2020 and February 2021.

Seeking Alpha

It could be a good idea to set a stop-loss price and its level depends on your risk tolerance. For me personally, it would be around $1.50 per share.

Investor takeaway

Back in 2015, it looked like Aqua Metals could take the lead recycling market by storm, but its technology didn’t live up to expectations. Now, it wants to combine this same technology to recycle lithium-ion batteries and its partner is a small company that claims that it has developed the only lithium-ion battery recycling tech that can produce 99.9% pure battery cathodes. On a shoestring budget at that. And unlike industry leaders like Li-Cycle, there are no feedstock supply deals with major automakers or lithium-ion battery companies.

I’m sorry, but it sounds too good to be true, and I’m skeptical in light of the unimpressive track record of Aqua Metals. I’m bearish and the short borrow fee rate is below 5%. However, there are no put options with a strike price of below $2.50 per share, so it could be best for risk-averse investors to avoid Aqua Metals.

Be the first to comment