Sundry Photography

We’re bullish on Applied Materials (NASDAQ:AMAT). The semi-cap giant reported its 4Q22 earnings late last week, and unlike AMAT’s earlier 2022 quarters, the company beat expectations achieving revenue of $6.75B compared to expectations of $6.44B. AMAT has had a rough year with weaker consumer appetite causing over-supply in inventories and now trickling into WFE spending cuts in the semi-space. Our bullish sentiment on AMAT is based on our belief that WFE spending cuts are now priced into the stock providing AMAT with an attractive risk-reward profile.

The stock price does remain volatile in the near term, but we believe the current valuation provides an attractive entry point into a major semi-cap player. AMAT stock is trading at 15.6x C2023 on a P/E basis compared to the peer group average at 19.0x. With the WFE CAPEX cuts priced into the stock, we believe the company is better positioned to grow in 2023 and recommend investors buy the stock.

WFE spending cuts in time for the holidays

AMAT operates in the grunt of the Wafer Fab Equipment (WFE) market; our bullish sentiment is because we believe the worst of WFE spending cuts have been priced into the stock. The company is a major WFE vendor alongside Lam Research (LRCX). Previously, both companies faced significant downside risks due to the weakening consumer and memory demand, with AMAT particularly exposed to logic/foundry markets, making up 71% of the semiconductor systems sales in 4Q22. We’re more constructive on AMAT now because we expect the WFE spending cuts are playing out in 2023. We believe it was a matter of time before the WFE spending cuts materialized. Now that they have, we believe AMAT is better positioned to grow in 2023, as WFE is essential to the expansion of chip production. Intel (INTC) and the Taiwan Semiconductor Manufacturing Company (TSM) have heavily invested in expanding their chip production efforts onto U.S soil earlier this year with the approval of the CHIPS Act. We believe the expansion of global chip production will be a growth catalyst driving WFE demand. We expect AMAT to benefit from the upward trend in WFE spending, specifically as demand for advanced process nodes in DRAM and foundry increases.

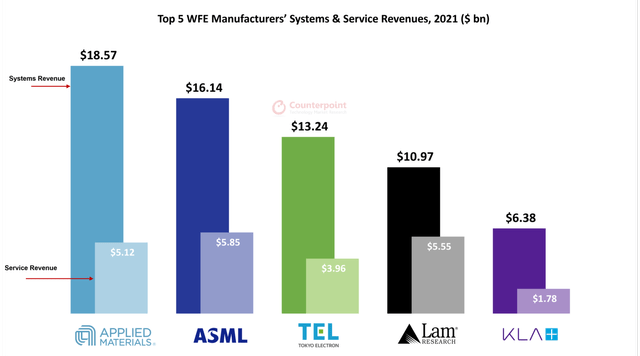

The following graph outlines the two 5 WFE manufacturers’ systems and services in 2021.

CounterPoint Research

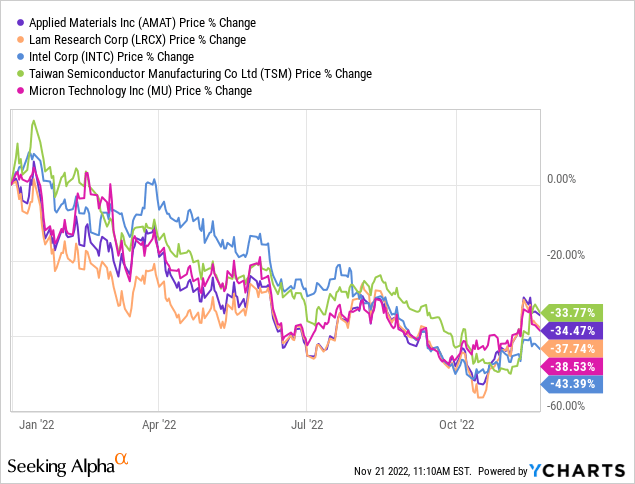

WFE spending cuts have not only impacted AMAT. Instead, they’ve affected the whole semiconductor industry. The WFE market as a whole lowered forecasted revenue for 2023 from $101.8B earlier this year to $96.7B. We believe AMAT’s drop of around 35% YTD is not the result of any company shortcomings but rather the result of the macroeconomic environment and weakened demand. Now that the market and semiconductor peer group are reacting to the weakened demand with collective WFE spending cuts, we’re more optimistic about AMAT’s growth outlook. U.S memory chip maker, Micron (MU) announced it would cut a further 20% of output on DRAM and NAND flash memories. MU had previously lowered capital expenditure forecasts for 2023 from $12B to $8B. TSMC also revised down for 2022 capital spending from around $40B at the start of 2022 to $36B, citing market slowdown and delays from customers. The same goes for INTC; in October, the company reported cutting costs by $3B for next year. The semiconductor industry took a hit, but we believe now that the WFE spending cuts are priced in, we will see growth resume for AMAT in 2023.

The following graph outlines AMAT’s stock performance compared to the semi-cap peer group.

TechStockPros

Still under pressure

While we’re bullish on AMAT’s long-term position in the WFE industry and believe the stock is relatively cheap, it is not without risk. AMAT’s 4Q22 earnings beat revenue expectations but guided down for 1Q23, estimating revenue to remain relatively flat at $6.7B plus or minus $400M. In the 4Q22 earnings transcript, the company’s primary concern going into FY2023 was the impact of the U.S export regulations on semiconductor shipments to China. In the call, Brice Hill, the CFO of AMAT, stated that the company “expect(s) that the unmitigated revenue impact of the new rules could be up to $2.5 billion in fiscal 2023.” We expect the U.S export regulations to take a bite out of AMAT’s revenue towards 1H23.

More specifically, we expect weakness in the company’s Applied Global Services segment (AGS), already expected to drop around 6% due to U.S export regulations on Chinese customers. Display-related sales were also expected to drop sequentially by 32% to the $170M range due to weakening consumer spending. We believe AMAT will grow meaningfully once the market recovers, but we recommend investors take advantage of the WFE spending cuts being priced into the stock and buy now instead of waiting for the market to recover and the stock to rally.

Valuation

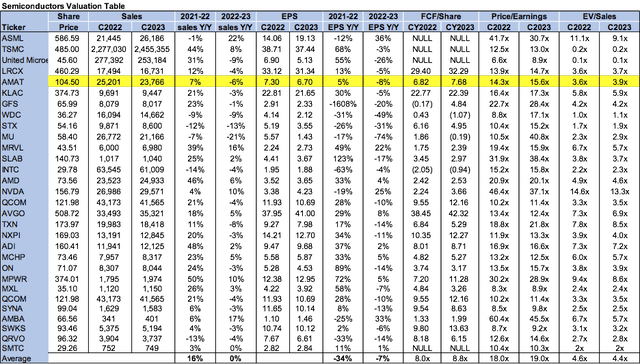

AMAT stock is relatively cheap, and we recommend investors buy the semi-cap giant at a discount. On a P/E basis, AMAT stock is trading at 15.6x C2023 EPS $6.70 compared to the peer group average at 19.0x. The stock is trading at 3.9x on EV/C2023 Sales versus the peer group average of 4.4x. We recommend investors buy the stock on weakness as we believe the WFE spending cuts have already played out, and the best days are ahead for AMAT.

The following graph outlines AMAT’s valuation compared to its peer group.

TechStockPros

Word on Wall Street

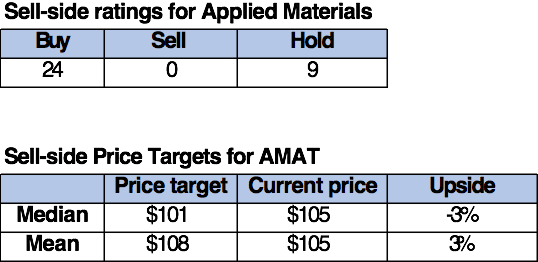

Wall Street shares our bullish rating on the stock. Of the 33 analysts covering the stock, 24 are buy-rated, and nine are hold-rated. The stock is trading at $105. The median price target is $101, and the mean price target is $108, with a potential -3% to 3% upside.

The following table outlines AMAT’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

Our bullish thesis on AMAT is based on two ideas. The first is that we believe AMAT will remain a leader in the WFE market and grow alongside the semiconductor industry, which is estimated to grow at a CAGR of 12.2% between 2022-2029. The second is that we believe the consumer weakness and macroeconomic headwinds in the post-pandemic environment have materialized into WFE spending cuts for 2023. We believe now is the time to buy a major semi-cap semi at a discount.

Be the first to comment