PhonlamaiPhoto

Given the many developments in the world in the past 6 months, it makes sense to reevaluate the prospects and stock price of Applied Materials (NASDAQ:AMAT). If there is a global recession, demand will likely weaken until the recession ends. The new U.S. policy on refusing to supply China with cutting-edge semiconductor manufacturing equipment will hurt Applied. But going into this Applied had a significant backlog. Just a few months ago, Applied’s main problem was keeping up with demand. This article will go over the known trends, upside opportunity, and downside risks, then evaluate the stock price. I will start with fiscal Q3 2022 results. Then I will examine Applied’s lowered guidance for fiscal Q4. Results for Q4 2022, which ends on October 31, are scheduled to be reported on November 17.

Applied Materials Q3 2022 results

Fiscal Q3 2022 Applied Materials results were quite cheery. Revenue set a record of $6.52 billion, up 5% y/y. GAAP net income was not a record, but was a healthy $1.61 billion, resulting in GAAP EPS of $1.85. Non-GAAP results were a bit higher at $1.68 billion and $1.94 per share. The main theme was that Applied had a large backlog of orders and was somewhat constrained by supply chain issues from producing as much equipment as it would like to produce. Applied has new technologies solving problems caused by shrinking circuit sizes, and demand for the new equipment is high. Two acquisitions were made using $440 million in cash. Capital expenditures to expand production were $210 million. $225 million was paid out in dividends, and $1 billion was used to repurchase shares. Cash and equivalents ended at $5.60 billion but was balanced by about $5.46 billion in long-term debt.

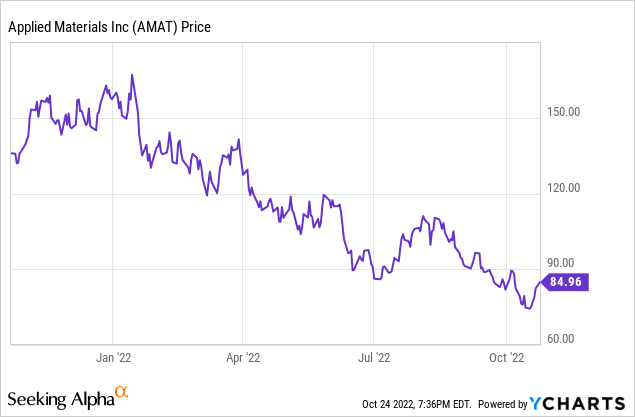

The main negative in the quarter was supply chain constraints. The main danger looking forward was the possibility of global macroeconomic issues. Some decrease in demand for memory chip equipment in 2023 was expected, but despite that Applied expected to be supply constrained for several quarters. The day after these results were reported, on August 18, 2022, AMAT closed at $108.27. But by October 24, 2022, AMAT closed at $84.94, and had meanwhile hit a 52-week low of $71.22. What went wrong?

Guidance Update

On October 12, 2022, Applied Materials revised Q4 guidance. Prior guidance for the quarter, which ends October 30, 2022, was for net sales to be approximately $6.65 billion, plus or minus $400 million, which included the expected impact of ongoing supply chain challenges. Non-GAAP adjusted diluted EPS was expected in the range of $1.82 to $2.18. At the middle of the revenue range another record would have been set.

Applied noted that on October 7, 2022, the U.S. announced new semiconductor technology export regulations for China. Applied estimated the new regulations will reduce its Q4 sales by approximately $250 to $550 million, with a midpoint of $6.4 billion. That is a broad range, so where in the range the results do land could have a significant effect on the stock price. At the upper end it is still possible to set a sales record in fiscal Q4. Non-GAAP EPS guidance was lowered to $1.54 to $1.78. Further, fiscal Q1 is likely to see the same negative impact. I assume all future quarters sales in China will be impacted by the ban. However, it appears China can still buy semiconductor manufacturing equipment, but only the older equipment for making less advanced devices.

China and U.S. policy

I see the new U.S. policy to be an economic negative for the U.S short-term, and an economic positive for China long-term. For Applied I see the policy as short-term negative, but long-term neutral. Less exports of advanced U.S. equipment to China will hurt the U.S. balance of payments. And, obviously, U.S. manufacturers’ sales and profits. But this will irritate China more than hurt it. It is a complicated task, but China will now focus science and engineering resources on developing their own advanced semiconductor manufacturing capabilities. It is hard to predict how long it will take for China to reach parity, but I would initially give it a 5- to 10-year time frame. Once China can export cutting-edge systems, or even use them to manufacture their own chips, the U.S. will have lost yet another industry to global competition. Also, U.S. companies will be hurt by the new advantages given to non-China equipment makers outside of the U.S., notably ASML (ASML).

Applied Materials will continue its own quest to keep ahead of all competitors in cutting-edge technologies. As discussed in the next section, I do not expect U.S. policy to have a significant impact on global demand for semiconductors or semiconductor manufacturing equipment. Therefore I suspect that whatever semiconductor equipment does not get sold to mainland China will simply be sold to manufacturers situated outside China. So once that process sorts itself out, it should be neutral for Applied Materials and other American makers of semiconductor manufacturing equipment.

Global Demand

I see no reason why global demand for semiconductor chips should decrease because of the new U.S. policy towards China. The trend towards incorporating more chips into nearly everything is far from over. For instance, the shift to electric vehicles will create far more demand for chips. Right now EV makers are building new factories and designing chips into new EV models, which require more chips than gasoline models. Keeping up with orders for those new chips will be the problem, not a lack of demand. Demand for PC chips may wane in 2023, but that is just the usual consumer cycle. Longer run, demand will continue to increase. Increased AI use will also accelerate demand for chips and the equipment needed to make them.

Aside from moving demand and production around, I expect semiconductor equipment sales to continue to increase. The need for technologies that address the problems of ever-larger numbers of transistors needed to accomplish modern and future computing tasks means production equipment will become more complicated and older nodes will become obsolete faster.

Conclusion

Assuming Applied hits the midrange of its new guidance, non-GAAP EPS for fiscal Q4 will be $1.66. In the year-earlier fiscal quarter it was $1.94. While that would color investor thinking about the stock negative, revenue at midpoint would be $6.4 billion, which would be up 4.6% y/y from $6.12 billion. The backlog should serve as a cushion for at least Q1 and Q2, unless a substantial number of orders get cancelled. The single overarching variable is macroeconomic. If China gets past its pandemic issues, global demand will grow in 2023. If China remains in a muddle and the Fed keeps raising interest rates, we will see a global recession, with lower semiconductor chip demand and likely order delays for semiconductor manufacturing equipment. While I like Applied Materials for the long run, for now I think of it as a Hold, at least until the price drops even lower, or we see signs that any recession will be shallow and brief.

Be the first to comment