Ivan-balvan

In my previous article for Apple (NASDAQ:AAPL), I warned that the demand for iPhone 14’s low-end models was weaker than expected, and this turned out to be true as mainstream media subsequently reported that Apple decided to reduce production numbers in the near term.

In this article, I provide an update to show that the demand for the newest iPhone 14 models continues to fall, even for the high-end models, and highlight the increasing worries for the company in the run-up to its next quarter’s earnings report.

Investment thesis

I continue to take the view that Apple has a great business model, excellent products with strong brand equity and run by a solid management team. However, I think that this is a challenging environment for Apple as there are increasing risks and uncertainties for the company. I think that the weakening demand for its newest iPhone 14 models is worrying as even the high-end models seem to have lost interest and demand continues to fall for these products. On the other hand, the weak low-end iPhone 14 models have been disappointing and could provide near-term headwinds to production unit numbers as Apple could revise the number downwards if demand falls.

Another concern that Apple investors need to consider is China, which saw smartphone shipments decline recently, along with weakening retail sales for the third quarter, as consumer sentiment continues to be weak given the tough covid policies taken by the Chinese authorities and the impact of the property and technology sectors on the Chinese economy.

All in all, I would advise investors to hold the course for Apple as it remains not a good time to be adding to the shares given that the risk-reward perspective is skewed more to the downside, in my view.

Demand for iPhones falling off after the initial strong response

According to the UBS Evidence Lab data, their analysis showed that the initial strong demand that we saw for the high-end iPhone Pro Max is starting to wane. The UBS Evidence Lab data looks at the availability for the iPhone across more than 30 countries and also analyzed the supply chains and wait times for the iPhones.

We have seen wait times continue to weaken in recent days relative to post-launch while the US is the only market that continues to be an outlier in terms of wait times. For the US, the wait time for the iPhone 14 Pro Max is now at 27 days, higher than that for China which is at 23 days and the rest of the world at 21 days. As a result, the US region’s strength has actually resulted in an almost 30% sell-through for the iPhone.

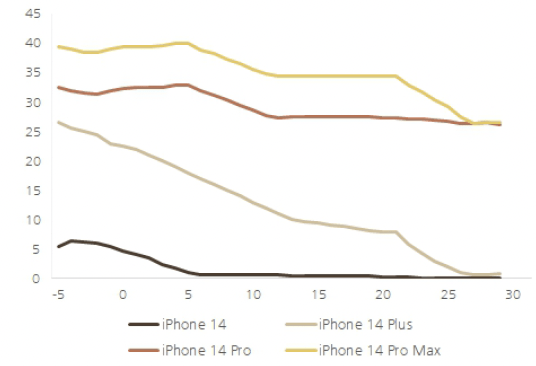

As can be seen below, the trends for the US remain that the iPhone 14 Pro and Pro Max are the two preferred by consumers, while the demand for the low-end models like iPhone 14 and iPhone 14 Plus is actually quite disappointing, in my view.

iPhone availability in the US (UBS)

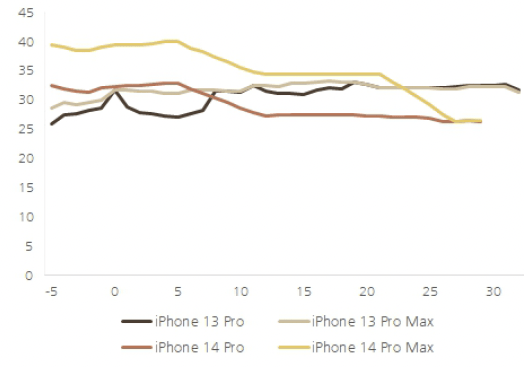

However, when we look at the relative trends for the iPhone 14 Pro and Pro Max, their demand has really declined over the past few weeks, while the iPhone 13 Pro and Pro Max held up their demand over the same period. This does indicate to me a worrying trend even for the high-end models as the demand does seem to be weaker than last year.

iPhone 14 Pro and Pro Max compared to iPhone 13 Pro and Pro Max in the US (UBS)

Declining demand and the implications for near-term results

As I have stated in my previous article that the low-end iPhone 14 demands have been rather weak, the demand for the iPhone 14 is heavily skewed towards to high-end iPhone 14 Pro and iPhone 14 Pro Max. While this does give a boost in terms of increasing the average selling price for the September as well as the December quarters, I think that the high availability of the low-end iPhones poses a risk to the second half of 2022 and 2023. This risk comes in the form of Apple missing on their units as they scale back production of the low-end models. In fact, just last month, Apple announced that they will be scaling back plans to increase production of the iPhone 14 by 6 million units. Instead, it will be producing a similar number of units as in the last year with an aim of 90 million handsets for the period.

While I think that Apple will likely shift production focus from the low-end handsets to the high-end handsets, there could be a further risk that the iPhone 14 low-end models continue to miss on the units sold, which could drive production numbers down further than expected.

As a result, I take the view that there is relatively low upside to the unit forecast of 48 million in September and 83 million in December as the early indicators are showing that we are seeing demand creeping downwards post-launch. In fact, there is a greater risk to the production consensus numbers for the second half of 2022 as well as for calendar year 2023, which is currently at 84 million and 244 million respectively, according to Visible Alpha. The bigger risk, in my view, will be the 244 million units for the calendar year 2023 as there is a risk that the low-end production could continue to be reduced in time to come as demand continues to weaken.

China weakness remains a near-term headwind

There are worrying trends for Apple’s iPhone business in China as the country is struggling with multiple troubles internally. The July smartphone shipments in China were down 31% in July. While this is partly attributable to the lack of new models, I think that the decline in smartphone shipments also signal increasing troubles for the iPhone demand in China, at least in the near term.

This is because China’s economy seems to be faltering, as Covid-19 restrictions and lockdowns in cities across China have dampened demand in July. In my view, this will likely continue to cause softness in the near term as China continues to take a zero covid policy approach. While the direct impact of the zero covid policy approach and lockdowns in the cities is that there is lower foot traffic in the malls and Apple stores, the indirect impact is resulting in a heavy toll on the Chinese economy.

Recently, retail sales in China weakened in the third quarter, which implies weakening consumer sentiment and for Apple, there could be a risk that this might imply lower demand for the high-end iPhone models.

Valuation

My 1-year target price for Apple is based on an equal weight of a P/E multiple method, as well as a DCF method. For the P/E multiple method, I apply a 25x P/E multiple to the average of Apple’s FY2023F and FY2024F earnings per share forecasts. While Apple is merely growing at 6% earnings per share CAGR over the next 2 years, I think that the 25x forward multiple is justified given the strong management team, solid brand reputation, as well as the competitive advantages that Apple will continue to enjoy in the future due to its leadership position in the industry. For the DCF method, I apply a terminal multiple of 20x and discount rate of 8%. I have taken into account the near-term weakness in my near-term financial forecasts for Apple as I incorporate in my forecasts some of the risks that arise from the weakening macroeconomic environment. That said, I have yet to price in a full recession scenario in my model for Apple.

Based on the two valuation methodologies, I arrived at a target price of $135 for Apple. This represents an 8% downside from current levels. While there is potential downside to come in the near term, as well as increasing risks that unit forecasts may miss expectations and demand from China may fall, I maintain my neutral rating for Apple as it continues to look good for the long-term. Apple continues to reap the benefits from the strong brand reputation, solid demand globally, stellar management execution and a long track record of success.

Risks

Weakening macroeconomic environment

The global macroeconomic environment is facing an increasingly uncertain and gloomy period as global growth seems to be stalling as central banks globally increase interest rates to tackle rising global inflation. The IMF continues to see global challenges that will challenge growth forecasts in the near term.

For Apple, while its products can be argued to be an essential good for the digital world we live in today, it is still not immune to a global macro slowdown. In particular, Apple could see consumers less willing to change handsets and holding on to current handsets for a longer time during weak economic periods, while also trading down from higher-priced and high-end iPhone models to lower-end models. If the demand for Apple’s products falls more than expected given further weakening of the global economy, this will result in downward revisions for the stock price.

China demand

As the next growth driver for Apple given the relatively lower penetration in the country as well as increasing affluence, China is an important market for Apple. As a result of tough covid 19 policies as well as the clampdown on the technology sector and the troubles facing the real estate sector, consumer sentiment in the country is rather weak at the current moment. As a result, I think that the demand in China poses one of the bigger risks for Apple as it may fall drastically as the economy worsens given the many challenges the country is facing today.

Market share loss in smartphone markets

I continue to take the view that Apple has one of the best and strongest competitive moats in the world given that they have a strong brand name globally and they continue to strive to be at the forefront of technological innovation. The risk remains that Apple needs to continue to innovate to maintain this leading position. While there are many other smartphone players in both the low-end and high-end markets, these players currently do not enjoy the same brand recognition and equity that Apple does. However, if its competitors are able to come up with better features or better software, this may undermine Apple’s current dominant position in the industry.

Conclusion

To sum things up, Apple continues to face near-term headwinds as uncertainties and risks mount for the company. The recently launched iPhone 14 models have seen demand waning, for both the low-end and high-end models. This might signal demand, in general, is falling as consumers become increasingly cost-sensitive as the global economic situation worsens. In particular, there is a risk that Apple may reduce its production numbers if the low-end iPhone 14 models continue to disappoint. In China, Apple has a risk that demand for its products may fall in the near term as the Chinese economy is hurt by the zero-covid policies as well as the impact of the technology and real estate sectors on the Chinese economy. My 1-year target price is $135 for Apple, implying an 8% downside from current levels. As such, I maintain my neutral rating as I continue to think that this is not yet the time to be adding to Apple.

Be the first to comment