akinbostanci

Introduction

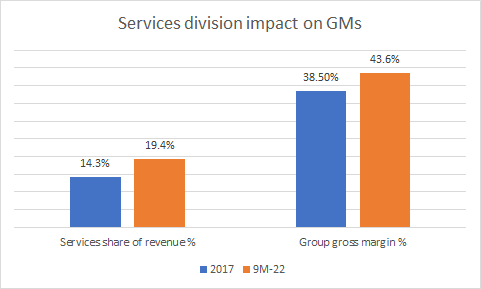

Apple Inc. (NASDAQ:AAPL) is predominantly noted for its expertise in the ‘products’ universe, but in recent years, a growing impetus towards the ‘services’ side of the broad portfolio has done a world of good for the company’s gross margins. Just for some context, nearly five years ago, the services division only contributed 14.3% of group sales; back then, the company’s overall gross margins stood at 38.5%. Now, as we inch closer to Apple’s reporting year-end in 2022 (September), the services share stands at 19.4%, even as the margins have improved by an identical figure of 510bps.

AAPL 10K, 10-Q

Of course, it would be disingenuous on my part to suggest that we have a strict 1:1 effect in play here, as there are quite a few other variables that impact the GMs (FX effects, the specific mix of both product and service sales during any particular period, etc.). However, given the superior gross margin differential (roughly 70% for services vs 35% for products) there’s little doubt that the growing influence of services-based revenue has been the most integral driver of gross margin expansion over the years.

Given the company’s deep installed base of around 1bn users, there is a massive opportunity to add even more subscription layers, or deepen existing ones, and expand the dollar contribution per user.

The business I’m about to cover in the next few sections is unlikely to move the dial overnight, but it’s something to be monitored, as it could play a very important part in growing Apple’s services share in the medium to long term.

How Much Of Apple’s Business Is Advertising?

Apple’s Ad business (various third-party licensing arrangements, and the company’s own advertising platforms mainly on the App Store) is yet another lever within the broad services pot, which also encompasses cloud services, digital content, payment services, and AppleCare. The likes of Bloomberg and Evercore ISI put the current revenue contribution of the ad business at anything between $4bn-$5bn per year. That is but a drop in the ocean, when you consider that annual group revenues this year are likely to be closer to the $400bn mark. Besides, as a proportion of services revenue, the ad business is only around the 5-6% mark currently.

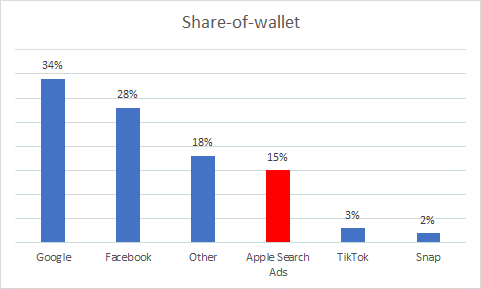

Even if you compare it to the two giants in the advertising space – Google (GOOGL) and Facebook (META), Apple has a long way to go, as both those companies saw annual ad sales to the tune of $210bn and $115bn respectively. Also note that when it comes to gauging the share-of-wallet, which is a useful proxy of customer loyalty, Apple Search Ads still lags these peers by some large percentage differentials.

Appsumer

Even if one scours some of the recent Apple earnings transcripts for any management commentary on the ad business, there’s hardly anything of note.

Is Apple’s Advertising Business Doing Well?

Given what I’ve written in the previous section, some of you may be sitting there thinking, “what’s the point?” Well, Apple may only have a few billion dollars of ad revenue to show so far, but there’s no doubt that it is gaining traction in the digital ad market at a rapid pace.

You could argue that much of this came on the back of launching its ATT (App Tracking Transparency) feature on its IOS last year which choked the business prospects of the likes of Facebook and to a lesser extent Google. ATT essentially turns on privacy features on your iPhone disabling the likes of Meta and GOOGL from gaining access to data that could be used to sell personalized ads. It is believed that Facebook lost something to the tune of $12bn on account of these privacy-inducing IOS changes. As surveillance capitalism becomes a more entrenched facet of the modern economy, there’s an argument to be made for advertisers to attach greater emphasis to Apple’s first-party data.

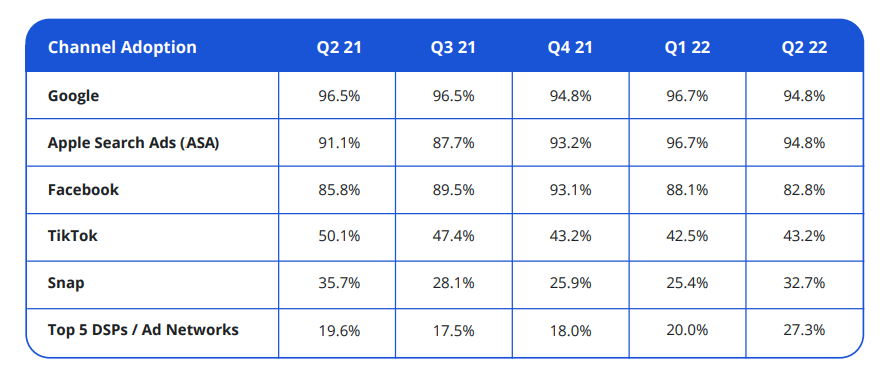

Nonetheless, a recent report from Appsumer shows that advertisers are adopting Apple Search Ads (ASA) at a more rapid pace, even as Facebook’s share has been shrinking. In Q3-21, ASA’s share only stood at 87.7%, but it has managed to gain over 700bps since then, even as Facebook’s share has plummeted by roughly the same level.

Appsumer

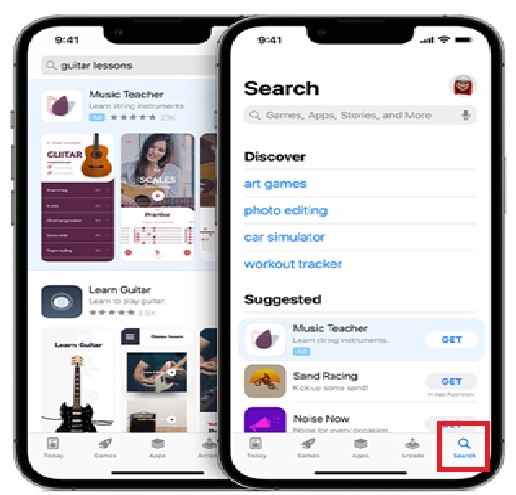

It now appears that AAPL is pulling out all the stops to deepen its impetus in this field. Recent reports suggest that the company is on the cusp of setting up a demand-side platform (DSP) which could increase the effectiveness of its ad platforms. In addition to that, some other reports also point to the company’s desire to quadruple the level of ad platform hiring seen a couple of years back (56 roles in late 2020, 216 additional roles currently). The App Store too is poised to attract more ad dollars; if you recollect, last year, Apple introduced an ad placement slot in the “search tab” of the App Store as seen in the image below.

Apple Search Ads

Now, they will be opening up room for ad placements even in the “Today” tab of the App Store, as seen in the image below.

9to5Mac

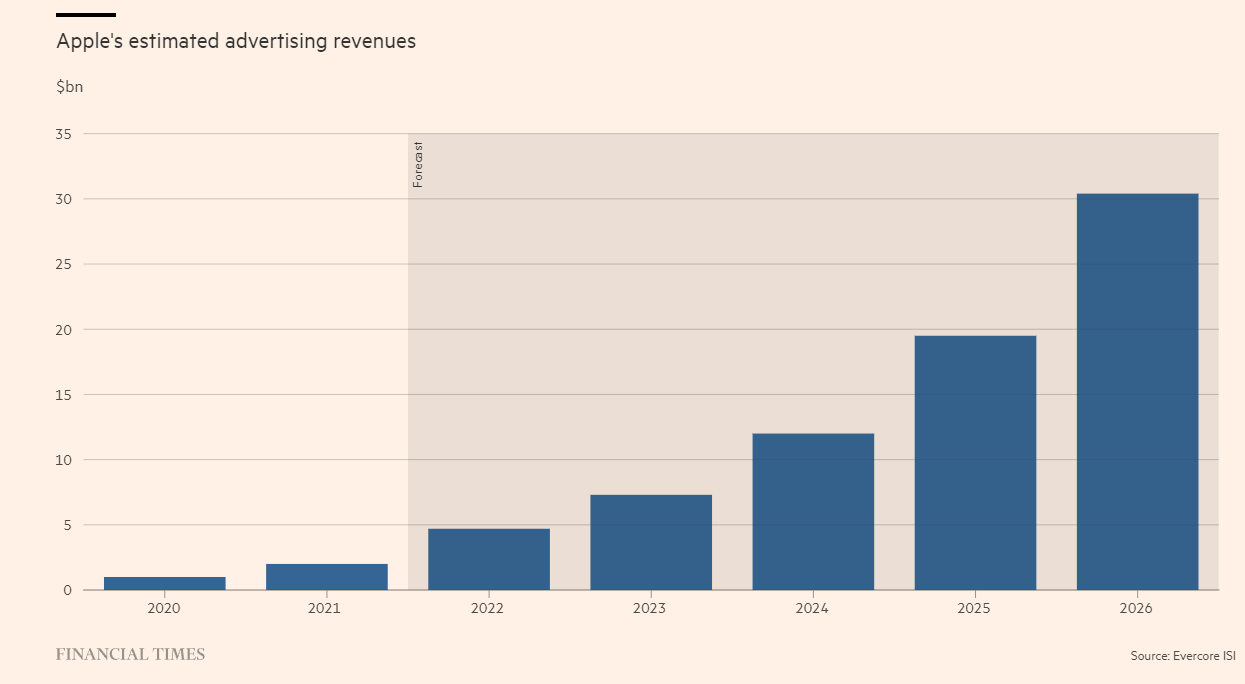

All in all, Evercore ISI believes that Apple’s ad business revenue could grow by 6x over the next four years, potentially hitting $30bn of sales by FY26!

FT

A Few Concerns

If all goes to plan, in a few years, Apple could give its more established ad business peers a run for their money, but there are a few issues that are still up in the air.

Firstly, it remains to be seen to what extent the prospective DSP could spread its tentacles; will the automation be limited only to the App Store universe, or could it be extended beyond that? Could additional ad inventory also be extracted from untapped areas such as Apple Maps, Apple TV, Podcasts, etc.? If it’s just the App Store, I do wonder how much traction we will see, as the searches will only be limited to the ‘Today’ and ‘Search’ tabs; that could limit this business, from really gaining scale.

One shouldn’t also dismiss potential legal retaliation from the likes of Facebook, who I imagine would experience a case of sour grapes if this proves to be a success, particularly given the billions of dollars it lost on account of Apple’s ATT feature. You could have fresh antitrust cases crop up, as Apple exempts itself from ATT (on grounds that it is not a third party), and can personalize ads based on data ranging from previous transactions, previous downloads, carrier data, browsing and reading history, basic demographics, etc.

Closing Thoughts – Is AAPL Stock A Buy, Sell, Or Hold?

Whilst it would be interesting to see Apple add some heft in the ad business over time, that is unlikely to be a major catalyst in the short term. Rather, when I look at some of the more pressing technical and valuation narratives, I don’t believe one can afford to be too bullish and a hold rating feels more suitable.

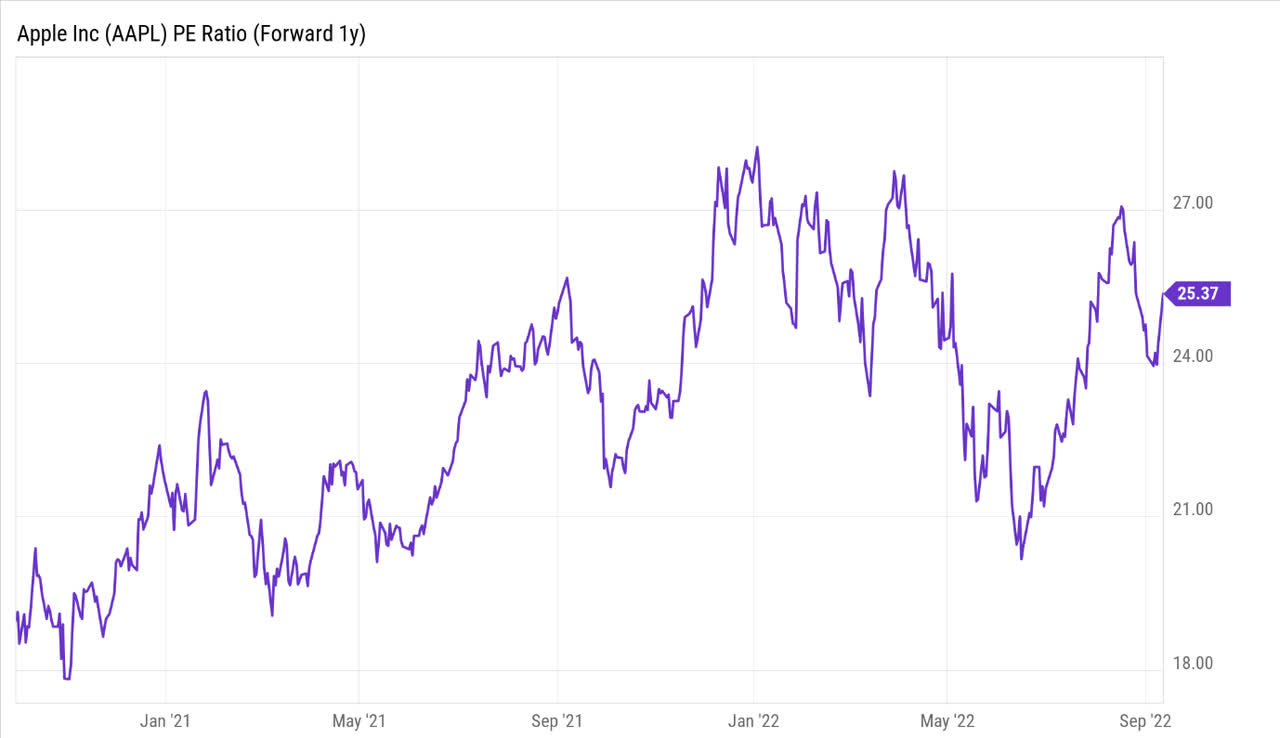

Firstly, forward valuations don’t look overly attractive at current price levels. Sell-side estimates imply that both revenue and EPS growth will slow next year by 200-300bps (revenue growth to slow from 7% in FY22 to 5% in FY23; EPS growth to slow from 9% in FY22 to 6% in FY23). In light of this slowdown, it doesn’t help that the stock currently trades at a premium forward P/E multiple of 25.4x (note that the 5-year average is 23x); that was not the case towards the end of Q2.

YCharts

If we consider AAPL’s weekly chart, we can see that the price has been forming something akin to a megaphone pattern; the $176-$183 levels tend to witness additional supply, and we’re not too far away from that zone, implying sub-optimal risk reward for a long position at current levels.

Investing

The unappealing risk-reward is substantiated even further, if you juxtapose the AAPL stock vs its tech peers in the S&P500, as represented by the Technology Select Sector ETF (XLK); we can see that this ratio looks quite overextended and is trading above its long-term ascending channel.

StockCharts

Be the first to comment