PhillDanze

To say Apple Inc. (NASDAQ:AAPL) is a bellwether is an understatement. Even in a terrible year for Nasdaq, many investors and funds have sought Apple’s relative safety, as the stock is down “only” about 16% YTD. Apple currently stands at 300 out of the 500 stocks on the S&P 500 index in terms of year-to-date performance. This is Apple’s worst in recent memory that we recall, but it is undeniable that the stock has held up remarkably well in comparison to its mega-cap peers that have lost between 30% and 75% this year.

But Apple has seen its share of weaknesses and bad news, the most recent one being the expected shortfall on iPhone production due to the protest in China related to further COVID lockdowns. Not surprisingly, the stock is down about 2% pre-market on this report and is already creating ripple effects on Apple’s suppliers as well. This article is intended to acknowledge the undeniable importance of China, but also to warn investors not to overreact to this news by dissecting the worst-case impact to the company’s quarterly and annual earnings per share.

Undeniable China Impact

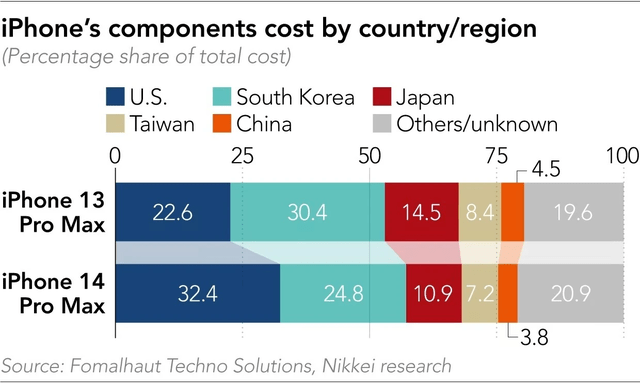

Despite recent headlines about Apple’s manufacturing/sourcing in India and Arizona, China still accounts for almost 98% of iPhones manufactured. China’s impact to the bottom line is further underscored by the chart below: despite accounting for 98% of iPhones manufactured, China’s components cost Apple a negligible percentage. Hence, it is no surprise that when China sneezes, Apple shudders.

Apple Cost by Country (www.phonearena.com)

What’s the Bottom Line?

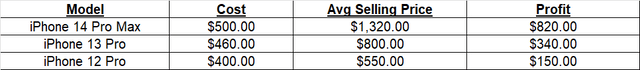

With data compiled from various sources, we arrived at the table below. Please note, we are underestimating the cost a little to see the worst-case impact on Apple with the recent shortfall reported. iPhone Pro 12 obviously cost the least at about $400, with iPhone 13 Pro costing $460 and iPhone 14 pro costing the most at $500 as reported here.

- Let’s assume the entire 6 Million shortage results in Apple selling 6 Million units with the highest profit/margin.

- Using the numbers above, that would mean a bottom-line impact of $4.92 Billion ($820 times 6 Million units).

- Apple has about 16 Billion shares outstanding.

- Hence, that works to an EPS impact of 30.75 cents. That is, $4.92 Billion divided by 16 Billion.

- The projected Q1 EPS currently stands at $2.04 with the full year projected to be at $6.25 per share. Let’s assume the short-term worst-case scenario that the entire 6M shortfall hits the current Q1 quarter. That would place the Q1 EPS at $1.73 and full year EPS at $5.94.

- We acknowledge that any supply issue is unlikely to be limited to just iPhones. Since iPhones still account for about 50% of the revenue but add more than that to the profit margin, let’s discount the Q1 and full year EPS by another 25%. That would place the Q1 EPS at $1.30 and full year’s at $4.45.

- Using the full year EPS arrived above ($4.45) under these extremely negative circumstances, at the current pre-market price of $145 per share, Apple will still be trading at a forward multiple of about 30. Let’s not forget that the current market sell-off has led to an imbalance where a company like The Clorox Company (CLX) sells at a forward multiple of 36.

- While a multiple of 30 is a bit too rich for our taste, given the 9%/yr projected growth rate for the next 5 years, it does not seem too outlandish for what remains the World’s most valuable brand that is a cash machine year after year.

- To reiterate, the numbers used above are extreme projections assuming supply chain issues persist throughout the current Fiscal Year and impact the highest profit margin units exclusively.

- Finally, the supply chain issues are nothing new. Apple’s production issues have already been speculated and reported as covered here by Seeking Alpha. To quote well-known Apple analyst Dan Ives from the article above:

“The zero Covid China shutdowns in Foxconn have been a major gut punch to Apple this quarter and we believe have taken roughly 5% of iPhone 14 units out of the supply chain and thus putting Cupertino in a ‘major shortage’ heading into the next month,” analyst Dan Ives wrote in a note to clients.“

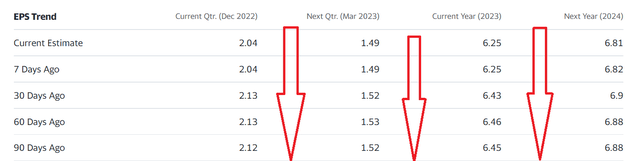

Hence, it is not surprising that Apple’s estimates have been continuously revised down as shown below.

AAPL Estimates (Yahoo Finance)

Conclusion

Additionally, Apple reportedly had strong Black Friday demand, and it is well known that all the current issues are just supply related and not demand-related. For a premium product, this may end up being good news in the medium to longer run, as the pent-up demand will send buyers into a frenzy when (it is not a question of “if”) the supply chain improves. Apple remains a buy-on-weakness stock, and we look forward to adding more on any unreasonable pullback in price.

Setting aside investments for a minute, it is easy to empathize with the Chinese protesters here. Years of being oppressively locked down, sometimes to death, is bound to send even the most patient citizens to their limits and beyond. As much as it hurts Apple, other companies, and their investors, anyone who is reading this article from an investment perspective should be thankful that we are dealing with first-world problems. Count your blessings, stay the course and don’t overreact in either direction. Good luck.

Be the first to comment