fazon1/iStock Editorial via Getty Images

This article aims to provide a balanced view on whether Apple (NASDAQ:AAPL) is currently undervalued or overvalued. I have no intention to be bearish or bullish on Apple stock but instead hope to provide some views on how Apple might be currently undervalued or overvalued and hope my readers will gain a more holistic perspective about the Apple stock after reading this article.

Investment thesis

Over the past month, I have seen increasingly diverse views on Apple and particularly so on the valuations of Apple, which then affects the expected equity return in the near term at least.

In my view, Apple is an excellent company, with great products and a very strong brand. At a market capitalisation of $2.7 trillion, there is no doubt that the market agrees that it has strong competitive advantage and serves almost as a monopoly in the segments it operates in due to its branding. Furthermore, I continue to see Apple as a long term core holding for many portfolios due to its long run way for growth.

That said, after looking deeper into the valuations of the company and the uncertainties around supply chain disruption, weakening consumer demand and the zero covid policy in China, I am initiating Apple with a hold rating. This is to imply that I do not currently see much upside given the current valuation and uncertainties around the stock. That said, I reiterate that I am neither bearish on Apple nor am I bullish, and I aim to provide a balanced perspective on the valuation debate.

Overvalued based on P/E and PEG multiples

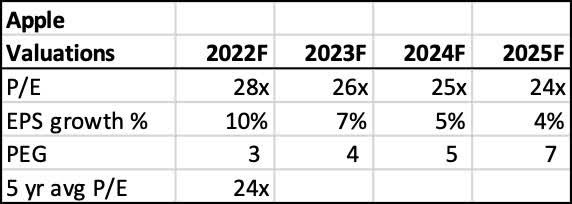

I pulled out the forward price to earnings ratio of Apple from 2022 to 2025 to see how does it look relative to EPS growth. As can be seen below, Apple currently trades at 28x 2022F earnings, while EPS growth of 10%.

At first glance, this does look relatively expensive, so I pulled out the 5 year average P/E ratios from 2017 to 2021, which showed that the 5 year average P/E was 24x. Bearing in mind the relatively faster growth during that 5 year period, the 2022F P/E does look relatively expensive.

Also, after extracting consensus estimates for Apple’s EPS growth from 2022F to 2025F, we can see that Apple’s average EPS growth during the period is 6%.

Lastly, the P/E ratios might look relatively expensive historically, but I think it is important to evaluate whether this is justified given either the growth profile of Apple or the perceived risk of Apple’s business. Here I evaluate P/E ratios based on Apple’s growth profile to derive the Price to earnings to growth (PEG) ratio of Apple and found it to be around 5 on average. Conventional finance theory suggests that anything below PEG ratio of 1 looks undervalued and PEG ratio above 1 suggests that the stock is overvalued. Thus, based on the growth profile of Apple from 2022F to 2025F, it does look relatively expensive when evaluating from an earnings growth perspective.

I will look into whether current P/E ratios are justified based on perceived risk of Apple’s business next.

Apple’s forward P/E valuation (Author generated)

Undervalued P/E based on riskiness of Apple’s business

Again, a relatively high P/E ratio can also be justified based on the perceived risk of a firm as financial theory suggests, and this shows up in a lower cost of equity.

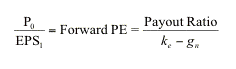

For the non-finance readers, as shown below, the forward P/E is determined by 1) Growth rate denoted by g, 2) Payout ratio, as well as 3) cost of equity, denoted by k, which measures the riskiness of a company. The less risky a company is perceived, the lower cost of equity and thus, a higher P/E can be justified.

Formula for P/E showing risk or cost of equity’s impact on P/E (NYU edu)

I would argue that Apple’s relatively high P/E ratio is justified by the perceived lower riskiness of its business. In fact, I think this is one of the key strengths that the market is pricing into Apple’s current valuation, that it is one of the less risky companies listed in the US or even globally.

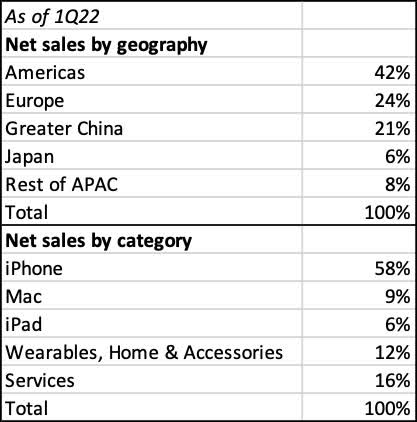

First, Apple’s diversified business provides the company with multiple sources of revenue from multiple markets. Apple’s sales by geography are relatively well diversified with no geography taking up more than 50%. Although by category, it does seem like revenues are not as well diversified due to the high revenue mix in iPhone. That said, the iPhone is where Apple has strong brand loyalty and strong product offering that enables it to have a strong competitive position, which will be elaborated next.

Business segment mix of Apple (Apple)

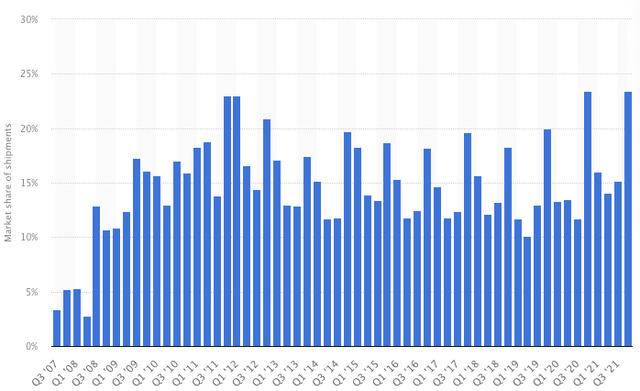

Second, Apple’s competitive position is also likely one of the reasons why the company is perceived to be less risky. As shown below, Apple’s key product, the iPhone has not seen its market share of global smartphone shipments dip below 10% since 2008. In fact, I would argue that Apple has an enviable position of being able to maintain a rather consistent and stable market share position over the past decade, with the exception of the 4th quarter seasonality effects. As such, I am of the view that this strong competitive position of iPhone in the global smartphone market, along with diversification of revenue streams into segments like wearables, home & accessories as well as services provide Apple’s business with the perceived lower risk that the market might have priced into its P/E multiple.

Apple’s iPhone global market share (Statista)

Third, Apple has an enormous cash balance of $37 billion, as well as marketable short term investments of $28 billion. Taken together, this $65 billion is huge and although it only makes up 2% of its market capitalisation, this $65 billion in cash and marketable securities is larger than 370 of the companies in the S&P 500. I would argue that this huge cash and marketable securities provides Apple with not just a robust fortress balance sheet, but also may enable Apple to use the cash to enrich shareholders by either distributing it as share dividends or share buybacks, or serve as further growth catalyst in the future should the cash be re-invested into the business or into opportunistic acquisitions.

Undervalued due to share repurchase program and dividend

When talking about Apple’s huge cash balance, it is then relevant to mention about its share repurchase program and dividends.

I think the market has come to appreciate the impact of Apple’s share repurchase program. This began in 2014, when Apple initiated a large capital return program and has stuck with it since.

Warren Buffett has commented on his investment in Apple several times in his annual letter, particularly on Apple’s share repurchase programme:

Berkshire’s investment in Apple vividly illustrates the power of repurchases,” the conglomerate said in its 2020 annual report. “Despite that sale [in 2020] – voila! – Berkshire now owns 5.4% of Apple. That increase was costless to us, coming about because Apple has continuously repurchased its shares, thereby substantially shrinking the number it now has outstanding.

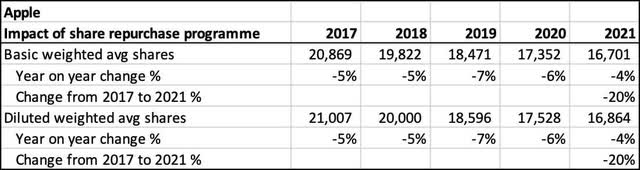

Below, I illustrate the power of Apple’s share repurchase program, as Apple has on average repurchased 5% of its outstanding shares over the past 5 years, amounting to a total of 20% of its outstanding shares having been repurchased since 2017. This then has direct impact to current shareholders of Apple, as they effectively have an increased ownership stake in the company and thus, more of its profits and dividends as well.

Apple share repurchase program (Author generated)

Another way Apple has redistributed its cash back to shareholders has been through its cash dividends distributed. The steady growth in dividend per share has provided Apple shareholders with steady cash flows over the years which provides it some valuation support when the economy heads for the worse. Over the past 5 years, Apple has managed to grow dividend by 10% on average, with cumulative dividend per share growth of 41%.

Apple’s dividend growth (Author generated)

To summarise on this point, Apple’s steady and solid dividend per share growth demonstrates its ability to return cash back to investors and at a growing pace, and its share repurchase program has effectively increased the ownership stakes of current Apple shareholders with no costs to them. These two points would suggest that Apple’s shares are currently undervalued given that it suggests Apple’s strong execution on the capital allocation and shareholder returns front. This will make Apple a very valuable company to own especially when the flight to quality mentality is dominant in 2022.

Mixed based on solid 1Q22 results and potential supply chain issues

Although I tend to take a long term view on stocks, I think that Apple’s 1Q22 results may provide an indication of whether there might be near term headwinds that might warrant a lower valuation due to increased uncertainties and risks.

Apple posted a strong quarter in 1Q22 as it continues to show its customers shows no signs of weakness in demand. This was despite worries of high base effect from the work from home demand for Apple’s products in the prior year 1Q21, as well as headwinds from supply chain issues and chip shortages as highlighted by Tim Cook.

That said, with the current Russia invasion of Ukraine upending supply chains and causing energy and inflation to be on the rise, as well as China’s zero COVID policy causing severe lockdowns in large parts of China including Shanghai, I would argue that the risks are rising on the supply side due to worsening supply chain disruptions and increasing inflation and energy prices, and potentially on the demand side, should higher energy prices and inflation cause lower demand for other goods and services, including Apple’s products and services.

Undervalued on Apple Car

I state this point with caution as I am clear that this is more of an optionality rather than a fact for Apple. The Apple Car is further out in the horizon somewhere in 2025 or beyond. What we currently know is that there are probably several hundred Apple employees working on the autonomous, electric Apple branded car for consumers. However, there has been some attrition issues as Bloomberg reported that Apple lost some of its top managers from its Apple Car unit. Yet, the Apple Car is still in the works and its 2025 target of launching a self driving electric car would of course then be dependent on the ability of the company to have a fully working, safe self driving system by then.

Although likely a very ambitious target, I would argue that this Apple Car opportunity is currently not priced into the current valuations, which makes Apple’s shares relatively undervalued when we consider the scenario should Apple Car indeed be able to launch by 2025. I see the Apple Car project as an ultimately value additive project that enables it to earn high returns on capital on the $65 billion cash pile that it has. Apple dominated the smartphone segment with not just the iPhone. It launched an ecosystem of products and services along with it, allowing Apple to leverage on its strong brand. Likewise, Apple is able to build a brand new ecosystem around the Apple Car which is likely to see deep integration with the iOS, and more importantly, into the highly lucrative and high margins software business. Given that Apple is working on an autonomous driving Apple Car, and its strong technology background, in my view, it will be one of the few companies that can rival Tesla’s (TSLA) current software advantage.

However, I think that the opportunity and addressable market that Apple Car brings is also under appreciated by the market. Although electric vehicles may be all the rage now and that competition is likely to be very intense by 2025, Apple’s strong brand can serve as a spring board for the launch of its own consumer car brand and if successful, Apple will not just be worth $2.7 trillion.

“… which makes Apple’s shares relatively undervalued when we consider the scenario should Apple Car indeed be able to launch by 2025.” Perhaps you could expand on why the Apple Car makes shares undervalued? E.g. why it will be value additive, versus a drag to the overall business.

Conclusion

Having made the following points on Apple’s valuation, I think that it is clear that whether Apple is currently overvalued or undervalued depends on the individual’s judgment and there are many uncertainties that impact this. Although Apple’s forward P/E multiple from 2022F to 2025F may seem expensive based on EPS growth rates in the respective years, this relatively higher P/E ratio may also be justified on the premise of perceived lower risk profile of Apple’s business. Furthermore, its execution of its share repurchase program and dividend policy continues to provide stable shareholder returns that makes it undervalued over time or at least provides some valuation support in times of uncertainty. On earnings, this quarter’s earnings were definitely strong but I think there are huge risks looming if supply chain disruptions or consumer demand weakens in the near term due to higher inflation and energy costs. Lastly, Apple Car is an optionality that is not yet priced in but in my view, could be a huge trillion dollar opportunity for Apple’s current $2.7 trillion market capitalisation.

Although I have a neutral rating for the stock, I reiterate that I am neither pessimistic nor bearish about Apple’s business model or prospects, but this reflects my view that valuations right now seem to be rather fair given the balanced undervaluation and overvaluation perspectives highlighted in the article.

Be the first to comment