Nikada/iStock Unreleased via Getty Images

On 11/24, news broke that Apple (NASDAQ:AAPL) was considering buying Manchester United (MANU) for $7 billion. This would place Manchester United as the most valuable club globally, surpassing Real Madrid and Barcelona. I think this is a fantastic idea, and Apple shouldn’t stop at Manchester United. Some may disagree, but I believe Apple should continue purchasing sports franchises every several years and immediately purchase Warner Bros. Discovery (WBD).

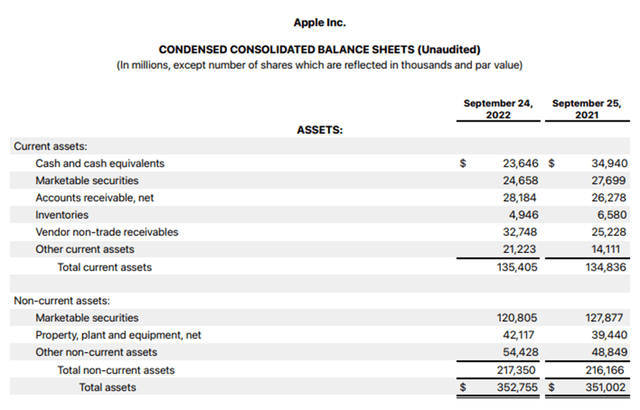

Apple finished 2022 generating $111 billion in FCF, and $99.8 billion in net income while returning $111.2 billion of capital back to shareholders, of which $90.2 billion was in the form of buybacks. AAPL has returned $715.2 billion of capital back to shareholders over the past decade and has been unsuccessful in reaching a net zero cash position. As a shareholder, I would rather see AAPL create a new basket for capital allocations and turn it into an entertainment holding company. AAPL has $23.65 billion in cash and another $24.66 billion in marketable securities under its short-term assets for a total of $48.3 billion in readily available liquidity with an additional $120.81 billion in marketable securities under long-term assets. AAPL should look toward the future and put this cash to use, especially with the amount of profits they are printing annually.

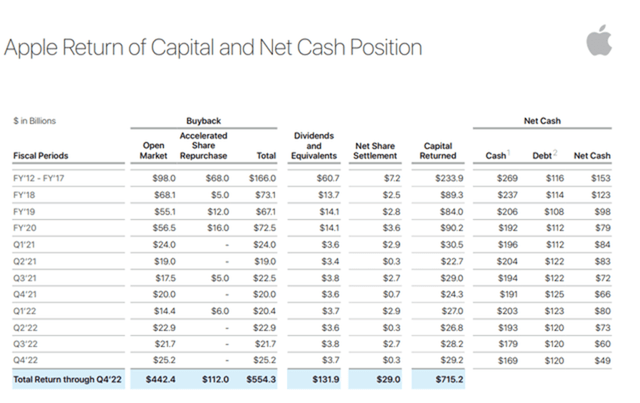

Apple’s return of capital in 2022 wasn’t a fluke and has established a long track record of rewarding shareholders

Looking at AAPL’s balance sheet, it has repurchased 36.85% of its common stock over the past decade, bringing its shares outstanding to 15.91 billion from 25.19 billion. AAPL has returned $715.2 billion of capital to its shareholders, repurchasing $554.3 billion worth of its own shares. $442.4 of their shares were repurchased on the open market, and $112 billion came from its accelerated share repurchase program. I love buybacks for many reasons. With every share AAPL repurchases, it increases the ownership equity the existing shares represent, and the earnings are divided among a smaller number of shares which helps its EPS grow.

The amount of capital returned through buybacks in 2022 wasn’t a fluke. AAPL returned $85.5 billion in 2021, $72.5 billion in 2020, $67.1 billion in 2019, $73.1 billion in 2018, and an average of $23.71 billion from 2012 – 2017. Over the past decade, AAPL has returned on average, $71.52 billion through buybacks annually while increasing its annual net income from $37.04 billion to $99.8 billion. If AAPL is really considering this purchase, I would like to see them cap buybacks at $40-$50 billion annually over the next 5 years and redirect at least $100 billion toward buying entertainment assets.

Why I want to see Apple redirect $100 billion of its buyback program toward buying entertainment assets over the next 5 years

Apple is in a wonderful situation, it can swing and miss. By the numbers, AAPL generated $99.8 billion in net income and $111 billion of FCF in 2022. AAPL has $169.11 billion of liquidity between its short and long-term assets. Over the past 2 years, AAPL has allocated an average of $27.21 billion of capital toward buybacks and dividends on a quarterly basis and still can’t get to a net zero cash position. Companies would love to be in the position AAPL is in. AAPL is generating so much in profits that it can give back over $25 billion quarterly and still replenish its cash position. Business is competition at its finest, as the free markets dictate outcomes. AAPL should go on the offensive and allocate $100 billion over the next 5 years toward buying entertainment assets. The best part about this is, if the strategy doesn’t work out, AAPL has the assets on the books and can divest them. Shareholders would still receive the dividend and roughly $40 – $50 billion of buybacks annually.

You may wonder why I want AAPL to allocate this amount of capital and what assets I envision. AAPL is the gold standard in consumer products, but at some point, there is a limit to how many phones, and computers can be sold. I want to see AAPL diversify quicker into services, and I believe they should deliver a destructive blow to Netflix (NFLX), Amazon (AMZN), and Disney (DIS).

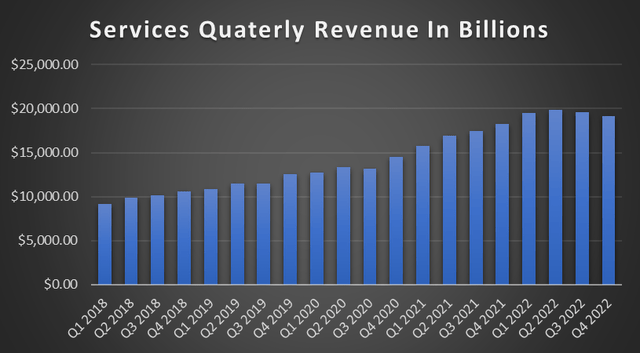

Services revenue is growing YoY but declining QoQ. In 2021, Services accounted for 18.7% of AAPL’s revenue ($68.43B / $365.82B), and in 2022 this percentage increased to 19.81% ($78.13B / $394.33B). The problem is that Services is stalling out, as we have seen the 2nd consecutive QoQ revenue decline in Q4 of 2022. Services topped out at $19.82 billion in Q2 and declined to $19.6 billion in Q3 and $19.19 billion in Q4. While there are many aspects to AAPL’s Services business segment, AAPL should focus on AAPL TV and put AMZN, NFLX, and DIS in a difficult position.

AAPL has already committed to AAPL TV and produces original content. Manchester United is a publicly-traded company with $709 million in revenue over the TTM. While it’s currently running in the red on a net income level (-$140.6 million), it’s FCF positive. The -$140 million can easily be absorbed by AAPL without blinking, and the added value it would bring could be tremendous. Sports franchises have increased in value over the years, and AAPL would have a crown jewel within its asset base. Over time, the appreciation in the MANU brand could make the deal worth it on its own. The real value for AAPL is putting MANU on Apple TV as its sole distribution or, depending on how that would impact revenue from TV distribution deals, having 1/4th of MANU’s games only on AAPL TV. The rumor is that $7 billion is the number AAPL would be paying which is more than double the current market cap. If $7 billion is the number, then it leaves $93 billion under my $100 billion investment into the entertainment industry.

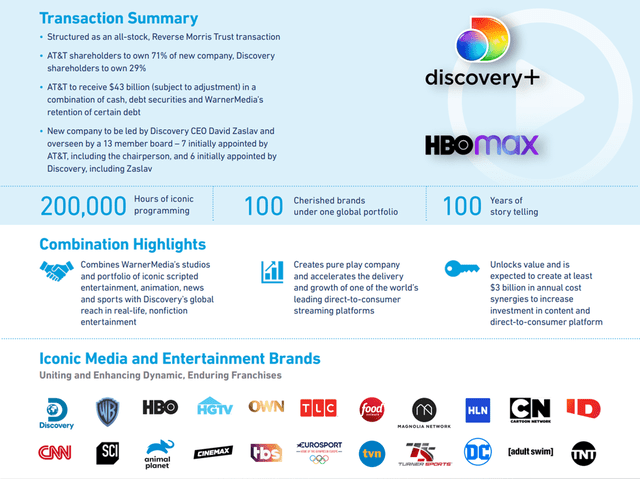

The next acquisition, after MANU, should be WBD. WBD has a market cap of $27.54 billion. Hypothetically, if AAPL paid $40 billion for it, this would be less than 40% of its 2022 FCF, and it would gain some of the most sought-after assets. AAPL would gain HBO, Discovery, Food Network, TBS, DC, TNT, TLC, and many other entities. There are over 100 brands in the portfolio with over 200,000 hours of programming. This would be a bolt-on acquisition, as all of the content could be easily integrated into Apple TV.

With roughly $50 billion left, AAPL could go after other sports franchises and several NFL, NBA, and MLB teams in large markets. World Wrestling Entertainment has a market cap of $5.98 billion and would come with a large backlog of content and a unique fanbase while being a profitable company. Entertainment isn’t going away, and humans will continue to spend hours upon hours watching TV, sports, and movies. Several large acquisitions and integrating the IP into Apple TV wouldn’t just make a statement; it would take pieces off the board and reduce content that could find its way onto other platforms. This would also make Apple TV more desirable and create an inflow of new members. The best part is nothing would be needed to be built from the ground up. Apple TV is already created, and the content from WBD and MANU would just need to be integrated.

Conclusion

The streaming wars are far from over, and Apple should lay the gauntlet down, utilize its cash position, and buy entertainment assets to build out Apple TV. With revenue from Services declining, it’s time for Apple to start acquiring IP entities. Apple isn’t going to become a software enterprise company, and their recurring revenue will be made through services. The downside is that this plan doesn’t work out the way I envision it, and Apple allocates less than 1 year of FCF to buying these assets. Investors will still get $40-$50 billion of capital allocated toward buybacks annually in addition to the dividend. Apple will still have these entities on the books, which can be sold in the future if need be.

Since Apple has committed to Apple TV, I think strengthening the brand and making them a real competitor to NFLX, AMZN, and DIS is the best course of action. This will take assets off the table and allow the free markets to decide which streaming subscription service is worth keeping. If Apple does buy MANU, there is no reason to stop there and build an entertainment powerhouse not just in its entities on the books but the best streaming service available to consumers.

Be the first to comment