Mario Tama

Investment thesis

While most companies are experiencing even serious slowdowns due to the current macroeconomic scenario, Apple Inc. (NASDAQ:AAPL), on the other hand, continues to break record after record. In Q3 2022, Apple’s revenues have never been higher, driven by the perennial growth in iPhone sales and especially Apple’s services segment. The competitive advantage of this company is unmatched, and people cannot deprive themselves of its products even during a recession. The future of this company is more solid than ever, and with Tim Cook as CEO it is reasonable to expect new records in the future. Moreover, Apple’s fair value calculated through a discounted cash flow model is $178.82, so the company is trading slightly at a discount.

The reason I consider Apple a hold is purely personal: I prefer to widen my margin of safety before buying it. However, I do not blame those who are building a long-term position at these prices.

Considerations on Q3 2022

Apple’s Q3 2022 results leave no doubt as to which is the best company in the world. The reason I state this is due to the resilience of this business, untouchable even in the current almost double-digit inflationary environment despite with the U.S. GDP showing a decrease for the second quarter in a row (practically facing a recession).

On this, these were the words of CFO Luca Maestri: “Our June quarter results continued to demonstrate our ability to manage our business effectively despite the challenging operating environment.” Since Apple sells some not-so-cheap products, personally I have to admit that I never expected such resilience in such a difficult economic environment, but the data speak for themselves.

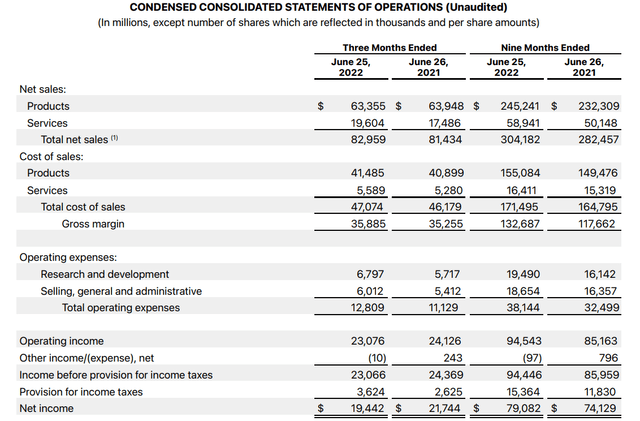

Income statement

Looking at the income statement, the most important aspects of this quarterly are mainly three.

Total net sales

Total net sales increased by $1.52 billion compared to Q3 2021, and by $21.7 billion if we also compare the other two quarters of the fiscal year. To achieve such revenue growth in this historic period is a strong sign of income strength. This Q3 even set an all-time record for Apple, and CEO Tim Cook also commented on this:

“This quarter’s record results speak to Apple’s constant efforts to innovate, to advance new possibilities, and to enrich the lives of our customers. As always, we are leading with our values, and expressing them in everything we build, from new features that are designed to protect user privacy and security, to tools that will enhance accessibility, part of our longstanding commitment to create products for everyone.”

It is clear from these words what the secret of Apple’s consistent successes is: utmost attention to customer needs through offering quality products that build customer loyalty. Tim Cook has proven to be a master at this and has made this company untouchable even in the face of a recession.

Net income

Net income decreased by $2.30 billion compared to Q3 2021, but increased by $4.95 billion if we also compare the previous two quarters. While there has been a deterioration on a quarterly basis, again I consider these figures to be positive overall as earnings for the full year 2022 are likely to be higher than in 2021. There is still one quarter left to affirm this, but based on this latest quarterly I think it is very likely to happen.

But why were profits in this Q3 down compared to Q3 2021? There are mainly three reasons:

- Provisions for income taxes increased by $999 million

- Total operating costs increased by $1.68 billion, driven by an increase in research and development costs of $1.08 billion.

- Cost of sales increased by $895 million, not even that much after all when we consider the countless problems the supply chain is experiencing.

Overall, I do not consider this slowdown in net income on a quarterly basis a problem at all, but simply a slight momentary slowdown. Considering fiscal year 2022 in full, net income is still expected to increase compared to fiscal year 2021.

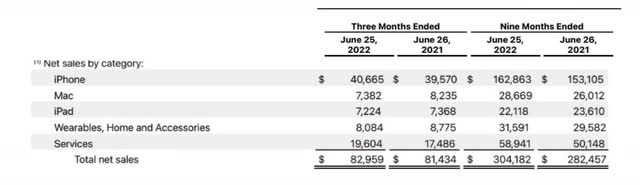

Services

What I consider the most surprising figure in this quarterly is the growth of the services segment, up $2.11 billion from Q3 2021.

This is a very positive result, especially when we also consider the growth this segment has had in the previous two quarters. As for the other sales segments, they have not had positive performance except for iPhone sales, but the growth in services is largely covering the losses.

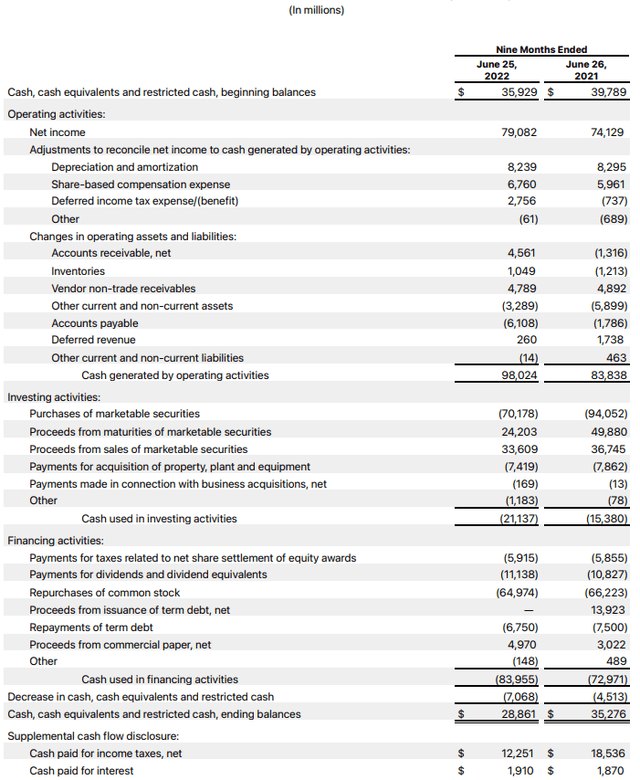

Cash flow Statement

The cash flow statement is in my opinion the most important financial document, as it gives us an overview of cash inflows and outflows. If a company is making profits, it is not necessarily generating operating cash inflows (Netflix is an example of this). The data regarding this quarter’s cash flow statement was as usual positive for Apple, which once again proved that it is a cash machine.

The most important aspects regarding this document were mainly three.

Cash from operations

Cash from operations is one of the most important figures for a company because it represents the company’s ability to generate cash flow through its operating activities. This value is used in the calculation of free cash flow; therefore, for the company’s fair value to be higher, it must also be high. In the 3 quarters of FY2022 Apple generated $98 billion, compared to $83.8 in FY2021, an increase of $14.2 billion with the last quarter still to be estimated. FY2022 was yet another success for Apple whose growth does not seem to stop yet.

Purchase of treasury stock

Since Apple is able to generate a huge amount of cash, the company can afford to carry out buyback policies that are also quite aggressive. In the last 3 quarters, treasury shares worth $64.97 billion have been purchased, which is very close to those purchased last year. The stake held by Apple shareholders thus increases year after year, and the company seems to want to continue this policy in the future.

Dividend

Probably not everyone knows this, but Apple also pays a dividend. This is obviously not a significant dividend, but in the future the company may consider increasing it. The dividends paid in the 3 quarters of FY2022 were $11.13 billion, higher than those issued last year ($10.82 billion). I venture to say that, in the not-too-distant future when the company stabilizes its growth rates, I expect Apple to issue a much higher dividend than it does now.

Overall, we can sum up the result of this cash flow statement through the words of CFO Luca Maestri:

“During the quarter, we generated nearly $23 billion in operating cash flow, returned over $28 billion to our shareholders, and continued to invest in our long-term growth plans.”

Customer loyalty

This paragraph will not refer to Apple’s quarterly results but will be used to put what has been said into context. How is it possible for Apple to produce more and more cash even during a recession? The answer lies in the loyalty of Apple customers and the social status this brand generates.

Maniacal care toward a better customer experience has made Apple one of the best companies in the world when it comes to customer loyalty rates. 90% of customers remain loyal to Apple, so it is almost certain that they will replace their iPhone with another iPhone. Those who buy one or more Apple products become part of an efficient ecosystem from which it is difficult to deviate once they have tried it. Using hyperbole, it almost seems that people are more willing to sacrifice their car instead of their iPhone.

The second reason Apple presents an unparalleled competitive advantage is the social status this brand brings. There is no question that Apple products are of high quality, but I think it is hypocritical not to consider that there are many other companies that offer very good products at a significantly lower price. An average teenager does not need a $1300 iPhone to scroll down the Instagram page, he or she could do it without problems even with a $400 one. The reason people prefer to pay much more for an iPhone is the social status this product offers within our society. Even with the same functionality people will always prefer an iPhone over another product, because by buying it they gain the knowledge that they are entering within that particular social status. Some people could not even afford it but prefer to go into debt to have it.

The culture that has been created behind this brand is in my opinion one of the greatest competitive advantages a company can achieve: being able to sell an expensive product to people who cannot afford it and who do not even need it. In the age of consumerism, Apple is certainly the epitome of this. It doesn’t matter if there is 40-year high inflation in the middle of a recession, people will find a way to buy the newly released iPhone.

To conclude this section, I would like to briefly discuss Apple CEO Tim Cook, as he has been one of the reasons for Apple’s success. It is true that Steve Jobs is often rightly praised, but Tim Cook also has great merits, such as proving to be the right leader after Steve Jobs’ passing. His ideas intersected perfectly with the Apple ecosystem, and it is under his leadership that this company became the first to reach a market cap of $3 trillion. Apple’s strength also lies in its CEO. Here is one of his most representative speeches to understand why Tim Cook was the perfect successor to Steve Jobs:

“There’s this thing in technology, almost a disease, where the definition of success is making the most. How many clicks did you get, how many active users do you have, how many units did you sell? Everybody in technology seems to want big numbers. Steve never got carried away with that. He focused on making the best.”

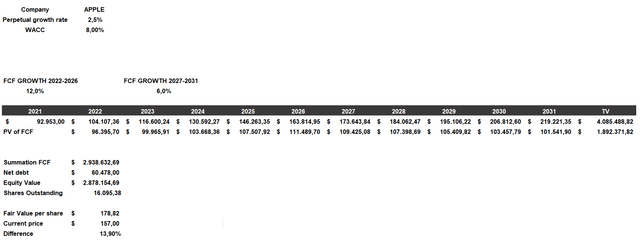

How much is Apple worth?

So far we have seen that Apple in terms of soundness is unmatched, but what is it worth? Even the best company in the world can be overvalued. Its fair value will be calculated through a discounted cash flow. This model will be constructed as follows:

- The cost of equity will be 8.25% and will include a beta of 1.19, a risk-free rate of 3%, a country market risk premium of 4.20%, and additional risks of 0.25%. The cost of debt will be 4.98%.

- The capital structure considered will be 90% equity and 10% debt, resulting in a WACC of 8%.

- Growth rates used will be 12% over the next 5 years and 6% over the following 5 years. The calculation will start from 2021 free cash flow. These growth rates are based on personal assumptions, as I believe Apple can grow in double digits for a few more years, then normalize as market capitalization increases.

According to these assumptions, Apple’s fair value is $178.82 per share; therefore, the company is undervalued since it is trading at $157. This is certainly not a strong undervaluation, but then again, it is unlikely that a company like Apple will be heavily discounted. Since the company has shown that it can generate cash flow even in an economically adverse environment, this might be a good time to start building a position. Personally, before buying any company I tend to consider a margin of safety, so I think it is fair to wait for a return to $145 per share before buying it. In any case, one thing is certain: I would never short Apple.

Be the first to comment