Nikada/iStock Unreleased via Getty Images

Following stellar F1Q22 results, we remain bullish on the stock and would be accumulating shares. As expected, Apple (AAPL) is executing very well on all aspects of its business. Apple is a safety stock with solid revenue, earnings, and cash flow with a reasonable valuation. The company also continues to buy back shares aggressively. We expect the company to announce additional buyback later this year, providing support for the stock. We expect Apple to announce AR/VR (Augment Reality/Virtual Reality) products in 2H of 2022. The AR/VR product launch should provide another leg of growth. We also expect the AR/VR products to trigger an upgrade cycle for newer iPhones and Mac devices, as the new functionality would need speedier processors and networking.

Solid results

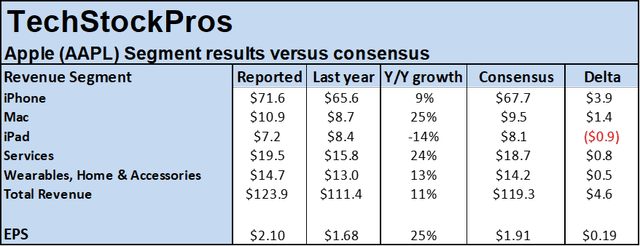

Apple reported solid F1Q22 results beating estimates on both revenue and EPS lines. Despite supply chain challenges impacting the company, revenue came ahead of estimates. Revenue grew 11% Y/Y, and EPS grew 25% Y/Y. EPS was better than expected, driven by higher revenue, higher-than-expected gross margin of 43.8%, and lower-than-expected operating expenses.

Segment revenue

Apple results were driven by better than expected iPhone, Mac, Services, and Wearables, Home & Accessories revenue. However, iPad revenue fell below estimates.

iPad:

iPad revenue was $7.2 billion, declined 14% Y/Y, and was about $900 million lower than expected. Apple noted that the supply chain impacted the availability of the iPad product while demand remained solid throughout the quarter.

iPhone:

iPhone revenue was $71.6 billion and was up 9% despite supply chain constraints that impacted some SKUs. We believe the lower-priced SKUs were not available in some geographies, which may have constrained the upside. Yet, iPhone revenue was about $3.9 billion, better than analyst expectations. Apple noted that sales were at record levels in developed and emerging markets.

Mac:

Mac revenue grew 25% Y/Y to about $10.9 billion and was about $1.4 billion better than analyst expectations. Mac sales were driven by the redesigned products powered by Apple’s own proprietary M1 processor chip. Apple noted M1-powered devices are driving the Mac upgrade cycle, and during the quarter, a majority of the Macs sold are powered by M1 chip-based systems. Many customers are upgrading their devices earlier than expected due to the better performance available via the M1 processor. The upgrade cycle propelled record Mac sales in each of the last six quarters. Apple noted that the sales would have been even higher if not for the chip shortage.

Wearables/Accessories:

Wearables, Home, and Accessories had another record quarter and was up 13% Y/Y to a record $14.7 billion. Apple noted that sales for Wearables were at record levels across the world. More importantly, more than 2/3rd of Apple Watch buyers are new to the device. The company also continues to be a magnet for subscriptions. Apple now has 785 million paid subscriptions, up from 620 million in the year-ago period.

Services:

Services revenue was up 24% Y/Y to $19.5 billion and was about $800 million better than analyst estimates. We expect Services revenue continue to drive growth for Apple. Services is also a higher-margin business. We expect Apple continues to provide more services tied to its device ecosystem. The gross margin was 43.8%, up 160bps, even with higher costs associated with inventory. Product gross margin was up 410bps Q/Q driven by leverage and mix to 38.4%. Services gross margin was 72.4%, up 190bps Q/Q, again driven by mix. Net Income was $34.6 billion, and EPS was $2.10 and was up 20% Y/Y. Operating cash flow was $47 billion and an all-time high. The company will likely announce a big share buyback later this year. And we believe share buybacks will continue to provide support for the stock. The following chart illustrates Apple’s results versus consensus estimates.

Qualitative guidance was provided

Apple did not provide explicit revenue guidance for the March quarter, citing economic/pandemic-related uncertainty. However, Apple provided some color on how to think about revenue. Apple expects revenue to grow Y/Y to record levels. Revenue is expected to decelerate Q/Q from the December levels. The currency headwind is expected to impact revenue by about 2-points. On a product level, Services are expected to grow double digits. Gross margins are expected to be in the 42.5-to-43.5% range, and OpEx is expected to be in the $12.5-to-12.7 billion range.

Valuation

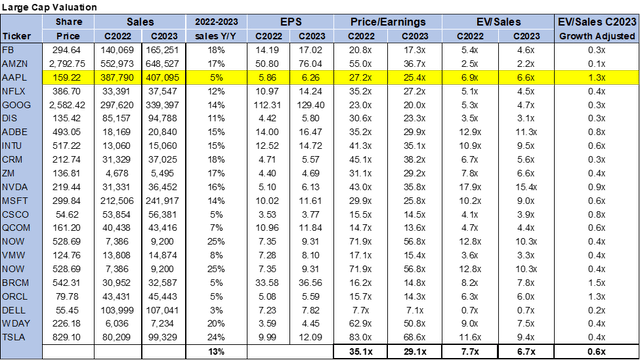

We value Apple on a Price to Earnings or P/E basis. Apple is one of the few companies in tech that is profitable on a GAAP basis. Apple continues to be relatively inexpensive when compared to the large-cap peer group. Apple is currently trading at a P/E multiple of 25.4x C2023 EPS of about $6.26. The large-cap peer group is currently trading at 29.1x. Investors look at Apple on a GAAP basis for valuation purposes, but many companies in the large-cap peer group are evaluated on a non-GAAP basis. Many of the companies in the peer group have high stock-based compensation expense that is excluded in calculating the EPS. Hence, Apple is cheaper than it appears compared to the rest of the peer group. In the current era of rising interest rates, and inflation, Apple is a high-quality safety stock we would hide until the volatility ebbs. The following chart illustrates Apple’s valuation.

What to do with the stock

We are bullish on Apple and would be buying shares on all dips. As we previously wrote on SA, Apple, as expected, reported stellar results. As expected, Mac shipments were solid, and iPhone shipments were also at record levels and better than estimated. Apple Watch continues to attract new customers and is in great demand. The iPhone, Apple Watch, Mac, and Apple TV stimulate high margin and stable services business flywheel. The more services customers consume, they have less incentive and more challenging it becomes to shift to Android. Therefore, we believe the Apple business will continue to grow as long as the company continues to launch new services. We expect this trend to continue for the next few years and possibly well into this decade. We are highly confident Apple will continue to innovate and consistently churn out desirable products and services. Apple is a reasonably priced safe haven to deploy cash during the current market volatility. We expect the stock to perform well in 2022, driven by solid beats, share buybacks, and improving margins. Therefore, we would be sticking with Apple stock through thick and thin.

Be the first to comment