Torsten Asmus

Apollo Commercial Real Estate Finance Inc. (NYSE:ARI) is a mortgage real estate investment trust with a 16.5% yield that comes with such high risks that investors should resist the temptation to buy the stock’s most recent drop.

The mortgage REIT pays out 100% of its distributable earnings, resulting in a high-risk dividend that will be reduced if the trust’s origination business suffers.

Despite the fact that the trust’s stock is trading at a significant discount to book value, I believe investors should avoid Apollo Commercial Real Estate Finance.

Portfolio

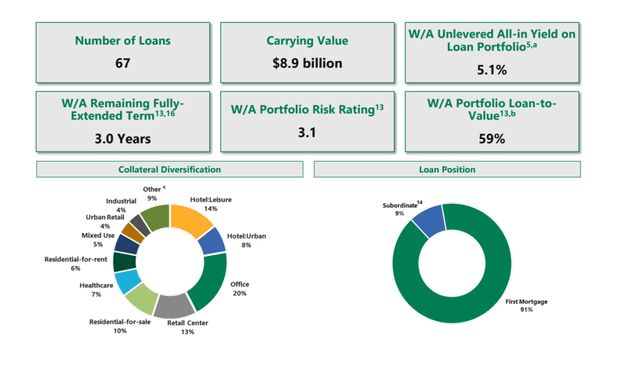

Apollo Commercial Real Estate Finance primarily invests in First Mortgages (91%), which are used to finance large commercial real estate construction projects. Approximately 9% of the trust’s loans are invested in subordinated loans, which have a higher risk but also offer a higher yield.

Apollo’s investment portfolio included 67 major commercial real estate loans totaling $8.9 billion in carrying value and a weighted average loan-to-value of 59%. The loan-to-value ratio is a risk ratio that indicates how much risk a real estate investor accepts by committing equity capital to specific real estate investments. Apollo’s loan-to-value ratio of 59% indicates a medium level of risk.

The core focus of Apollo Commercial Real Estate Finance’s portfolio is offices and hotels, which account for 42% of the trust’s total exposure. These assets have less predictable cash flows and are more volatile than residential real estate.

Portfolio Overview (Apollo Commercial Real Estate Finance)

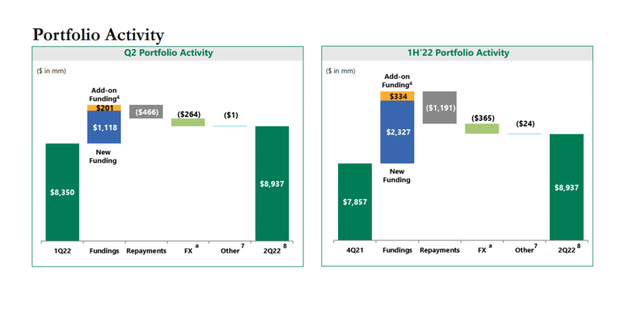

In the second quarter, Apollo Commercial Real Estate Finance raised $1.3 billion in new capital, bringing the portfolio value to $8.9 billion after deducting loan repayments and currency fluctuations. As the commercial real estate market continues to perform well, a similar amount of new funding can be expected in the third quarter.

Portfolio Activity (Apollo Commercial Real Estate Finance)

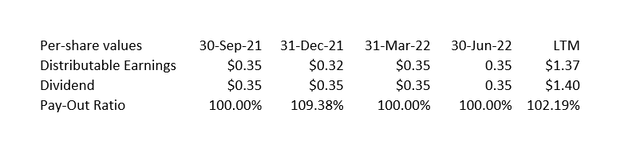

The Dividend Is Barely Covered

Despite new investment activity, the trust is barely covering its $0.35 per share per quarter dividend with distributable earnings, resulting in a very low margin of safety for investors.

The pay-out ratio in 2Q-22 was 100%, while the pay-out ratio over the previous twelve months was 102%. With such a low pay-out ratio, the stock is at risk of being cut, which is probably what the current high dividend yield reflects.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

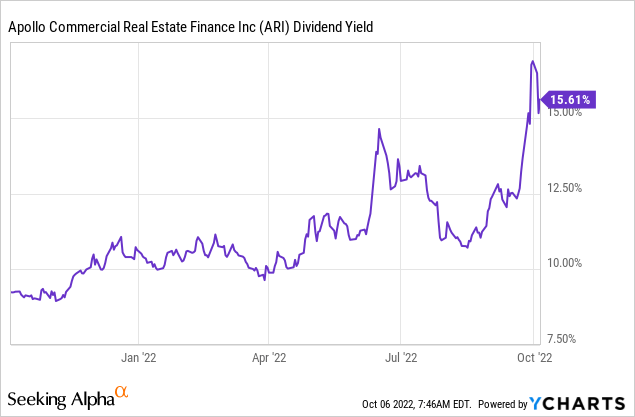

Based on a quarterly dividend of $0.35 per share, the trust currently has a dividend yield of 16.5%, which I believe will be difficult to maintain if the commercial real estate market in the United States experiences a downturn.

A slight deterioration in the market for First Mortgage originations could already tip ARI over the edge and necessitate a dividend adjustment.

Nearly 50% Discount To Book Value

The stock is trading at such a high discount to book value due to Apollo Commercial Real Estate Finance’s exposure to cyclical sectors of the commercial real estate market, as well as a 100% pay-out ratio.

Because of the dividend risk, I would advise against purchasing ARI’s most recent price drop, even if the stock appears to trade at a very high book value discount of 50%.

Starwood Property Trust Inc. (STWD) is a mortgage real estate investment trust that, in my opinion, is not only better managed than ARI but also offers investors a more stable and durable dividend and a more diversified business model.

Risks Outweigh Upside Potential

I believe the central bank’s recent interest rate actions will have an impact on the commercial real estate market in the United States, particularly on origination volumes. Higher interest rates mean higher capital costs for borrowers, which is expected to reduce origination volume in the sector.

If the mortgage origination market remains strong and Apollo Commercial Real Estate Finance continues to originate new projects, ARI could see a rebound.

My Conclusion

Net investment activity remained strong in the second quarter and is expected to remain so in the third.

Having said that, the risks are undeniably increasing, and this increased risk has been reflected in a much higher discount to book value, which does not appear to reflect a high margin of safety in this case.

Given that the stock of Apollo Commercial Real Estate Finance has recently dropped from $11 to $8, the yield has risen to 16.5%.

Given the 100% pay-out ratio, I believe ARI is a value trap, and investors should avoid buying the drop.

Be the first to comment