onurdongel/E+ via Getty Images

In the architectural building products and services market, one intriguing company for investors to keep an eye on is Apogee Enterprises (NASDAQ:APOG). Prior to the pandemic, management had done well to grow the enterprise. But revenue since then has suffered and profits and cash flows have been mixed. With the company due to report financial performance for the final quarter of its 2022 fiscal year in just a couple days, there’s a lot of information coming out that investors can use to re-evaluate how the company is performing and what its prospects might be moving forward. From a top line perspective, the business has resumed its expansion. But due to a combination of inflationary pressures, supply chain issues, and restructuring activities aimed at better positioning the company for the future, profits and cash flows have been under pressure. Due to this, relative to the company’s peers, it currently is trading at a rather lofty price. But on an absolute basis, shares are priced reasonably well at this time.

Assessing Apogee Enterprises today

The last time I wrote an article about Apogee Enterprises was in October 2021. At that time, I acknowledged that the company was experiencing something of a recovery. At a minimum, it was benefiting from a return to revenue growth after two consecutive years of sales declines. Having said that, I also mentioned the company’s mixed operating history, particularly struggling to grow profits and cash flows even during a time when revenue was on the rise. All of these factors combined led me to rate the company a “hold” prospect. Since then, the market has pushed shares of the business up quite a bit higher, with the stock generating a return for investors of 17.9%. That compares to a decline of 0.9% by the S&P 500 over the same window of time.

Given how the company performed, you might expect that fundamentals at the business rapidly improved. In some respects, this was the case. Since the time of my last article, we have only seen one extra quarter worth of data provided by management. And during that quarter, sales came in at $334.2 million. That represents an increase of 6.6% over the $313.6 million the company reported the same quarter one year earlier. As a result of this, overall sales for the first nine months of its 2022 fiscal year came in at $986 million. That’s up 6.9% from the $922.2 million generated one year earlier. Of course, this increase in sales was not across the board. For instance, the Architectural Glass segment actually saw revenue decline in the first nine months of its 2022 fiscal year, posting a year-over-year drop of 4.7%. But fortunately for investors, all of the other segments of the company continued to expand, with the strongest growth coming from the Large-Scale Optical segment. For the full nine-month window covered, sales there increased by 55.1%.

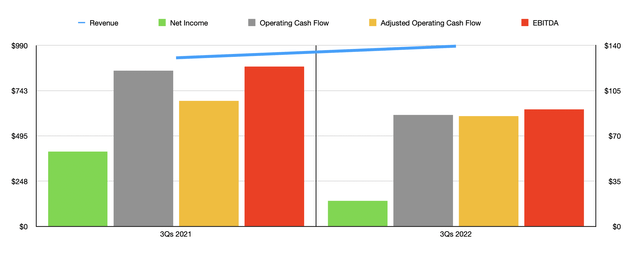

Author – SEC EDGAR Data

Unfortunately, this is where the good news runs out. Even as revenue increased, profits and cash flows for the company worsened. In the latest quarter, net income totaled just $11.1 million. That compares to the $37.3 million generated the same time one year earlier. This was not just a problem of a single quarter. For the full nine-month window covered, net income was just $19.8 million. That compares to the $57.8 million reported one year earlier. While the company did see some segments post stronger results year-over-year, the Architectural Glass and Large-Scale Optical segments declined. Having said that, some of the drop was due to the fact that, one year earlier, the Large-Scale Optical segment had reported a $19.3 million gain associated with the sale-leaseback of a building. Excluding this, the only segment that would have suffered was the Architectural Glass segment. Management attributed much of the company’s pain to a mixture of inflationary pressures, supply chain issues, and restructuring activities. The last of these cost the company, in the nine-month window covered, $24.2 million.

The good news for shareholders is that we might finally see some improvement now that management is due to report financial results for the final quarter of its 2022 fiscal year before the market opens on April 7. You see, for the full fiscal year, management expects earnings per share to be between $2.25 and $2.40. That implies net income for the full fiscal year of $57.8 million. That compares to the $15.4 million generated one year earlier. Some of this disparity can be explained by a $19 million pretax gain the company expects to report for the final quarter. But even so, that still leaves a nice improvement. Analysts, meanwhile, expect the company to report earnings per share of $0.98. On a normalized or adjusted basis, this figure should be $0.72 per share. Interestingly, these numbers do seem to be at odds compared to what management’s implied numbers show. For the final quarter, net income for the company should be about $38 million, or about $23 million excluding the gain on the aforementioned property sale if we assume a 21% effective tax rate. The number for analysts, meanwhile, is $24.4 million, or about $17.9 million on an adjusted basis.

Author – SEC EDGAR Data

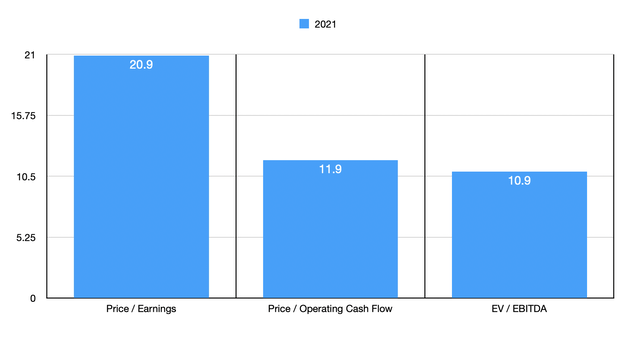

If we assume that management guidance for the year is accurate and that operating cash flows and EBITDA are annualized using data from the first nine months of the company’s 2022 fiscal year, shares are affordable on an absolute basis but pricey relative to similar firms. Based on my 2022 figures, the company should be trading at a price to earnings multiple of 20.9. While this particular multiple is lofty, the implied price to operating cash flow multiple is 11.9, while the EV to EBITDA multiple is 10.9. To put this in perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies range from a low of 4.7 to a high of 17.9. On a price to operating cash flow basis, the range was from 6.4 to 10.3. And on an EV to EBITDA basis, the range was from 4.1 to 10.5. In all three cases, Apogee Enterprises was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Apogee Enterprises | 20.9 | 11.9 | 10.9 |

| Builders FirstSource (BLDR) | 7.6 | 7.6 | 4.9 |

| Cornerstone Building Brands (CNR) | 4.7 | 8.1 | 4.1 |

| Tecnoglass (TGLS) | 17.9 | 10.3 | 10.5 |

| Owens Corning (OC) | 9.7 | 6.4 | 5.8 |

| UFP Industries (UFPI) | 9.2 | 9.3 | 5.8 |

Takeaway

Based on the data provided, it seems to me as though Apogee Enterprises is recovering from a revenue perspective but continues to experience pain on its bottom line. Some of this is due to the fact that management has undergone some restructuring activities aimed at improving the company. But other issues relate to inflation and supply chain problems. Eventually, these issues will come to pass and, as a result, shares might end up looking rather cheap on an absolute basis even though they are pricey relative to similar firms. At the end of the day, I still feel as though these positives and negatives balance out, leading me to rate the company a “hold” at this time. But investors who want to stay on top of things should definitely pay attention to earnings when management reports them soon. Because any information we get there could help to provide transparency into what the future might look like.

Be the first to comment