DenisTangneyJr/E+ via Getty Images

What is Red Rock Resorts?

Red Rock Resorts (NASDAQ:RRR) is named for its picturesque surroundings seen in the photo above. Its namesake resort is about 30 minutes from The Strip; if you haven’t ventured this far when vacationing in Las Vegas. It’s definitely worth the trip. What a terrific change of pace.

The company has a portfolio of 16 properties, including the Station Casino and Wildfire brands, which predominantly serve the Las Vegas locals market. This market is much smaller than the Strip but larger than every other gambling market in the country, as shown below.

Red Rock Resorts with data from state gaming control boards and commissions

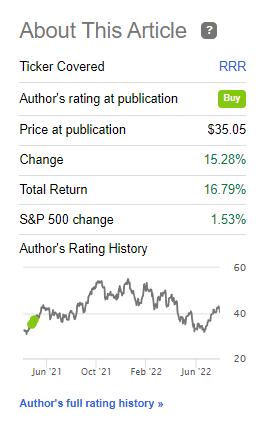

Incidentally, Red Rock was one of the first stocks I covered on Seeking Alpha when I began writing in 2021. Since then, it has quietly and handily outperformed the market, as shown below.

Seeking Alpha

The company also reinstated the dividend, which was paused during the uncertainty of COVID-19, and paid a special dividend of $3 per share in late 2021. The special dividend yielded about 6% when declared.

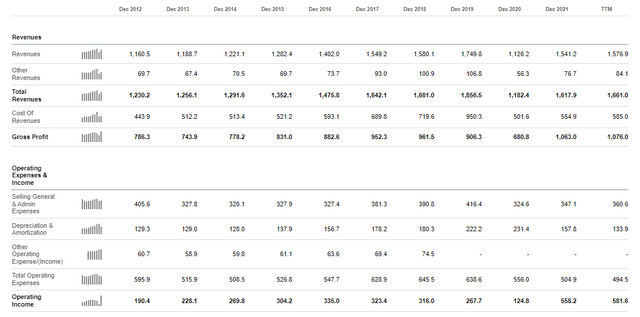

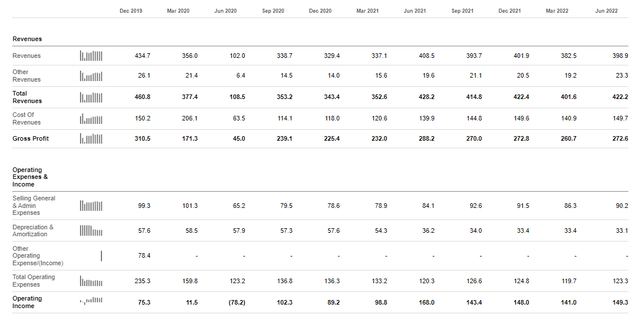

Revenue took a hit in 2020 as casinos state-wide were shuttered for months. However, Red Rock still managed to generate operating profits. 2021 was a boon to the company as stimulus payments and other economic fuel brought huge profits, as shown below.

Seeking Alpha (Operating income net of asset write-downs and sale of Palms)

In fact, operating profits hit a record $558 million on an impressive 35% margin in 2021. As shown below, the historical outperformance has continued in recent quarters, even as the stimulus has faded.

The revenue numbers are even more impressive considering three properties have remained closed since the pandemic. These three won’t be reopening – and this is leading Red Rock into the future. Here’s how.

The catalyst: Massive projects in growing, affluent, underserved areas

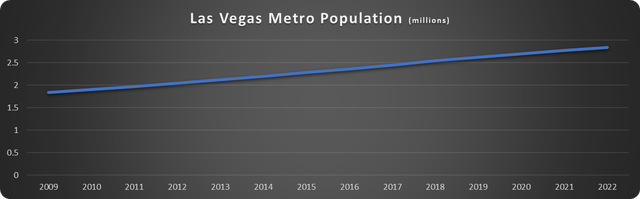

Las Vegas is the 5th fastest growing metro statistical area (MSA) in the U.S., as shown below.

Data source: Macrotrends. Chart by author.

More than 15% of the population is retirees who come to take advantage of the sunshine, and that Nevada has no state income tax.

Weekly earnings have risen for years among the population, and data suggests an additional $16.5 billion in household income will come to the city by 2026.

Many residents are settling in affluent neighborhoods like Summerlin, Green Valley, and Mountains Edge, which reside in the South and West of the city. And this is precisely where Red Rock has significant developments coming. The permanently closed properties mentioned above are in less desirable areas and would have required costly upgrades. Instead, the company is selling the land and pouring the funds into exciting projects.

The Durango Project

The highly-anticipated Durango Project will be located in the fastest-growing population center in the valley and a significantly underserved area. The area is full of new homes, so Red Rock will be the first to open a resort here. Red Rock reports that 250,000 adults live within a five-mile radius.

The project will cost $750 million and create a massive property including restaurants, meeting and banquet space, thousands of slot machines, and everything one expects at a high-end Las Vegas resort.

The project is expected to be complete near the end of 2023 and should be a serious shot in the arm to Red Rock’s profits.

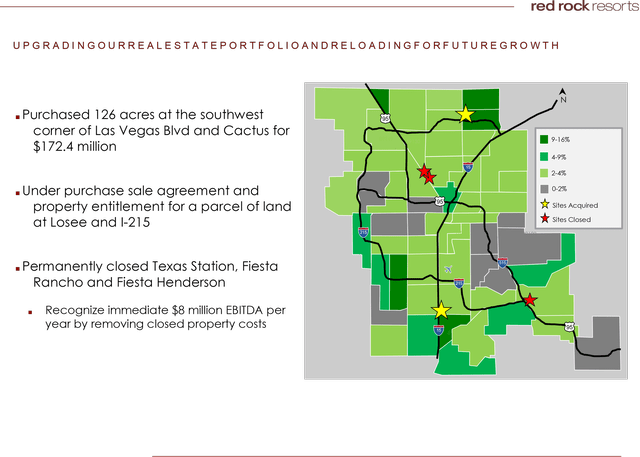

More land purchases

Red Rock has been quietly purchasing other very desirable parcels of land as well. One is in the South and the other in the North, both in areas experiencing 9-16% growth rates in population, as shown below.

Red Rock Resorts Investor Presentation

Both acquired properties are located in booming areas with well above-average household incomes, including the first master-planned community in North Las Vegas – The Villages at Tule Springs.

These sites will likely not sit idle for long, and their development will be another massive catalyst for growth.

Management has stated its goal is to double its portfolio by the end of the decade.

I think we want to get Durango open and see the operating results out of Durango. We’re very optimistic given the location, the demographics, the gaming supply in that area. But we want to get to Durango open, and then we’ll be ready to start on the next project after that. And we expect to basically double the size of the portfolio by 2030 is kind of what the plans are, and continue to roll out new properties one after the other.

Red Rock is strategic and opportunistic with its properties, and this catalyst should significantly benefit long-term shareholders.

A compelling valuation and shareholder-friendly model

Red Rock can purchase and develop these massive projects because the company generates plenty of cash. Management reports an adjusted EBITDA margin generally above 45% and produces terrific free cash flow. Red Rock has generated $226 million, $2.16 per share, in free cash flow through Q2 2022.

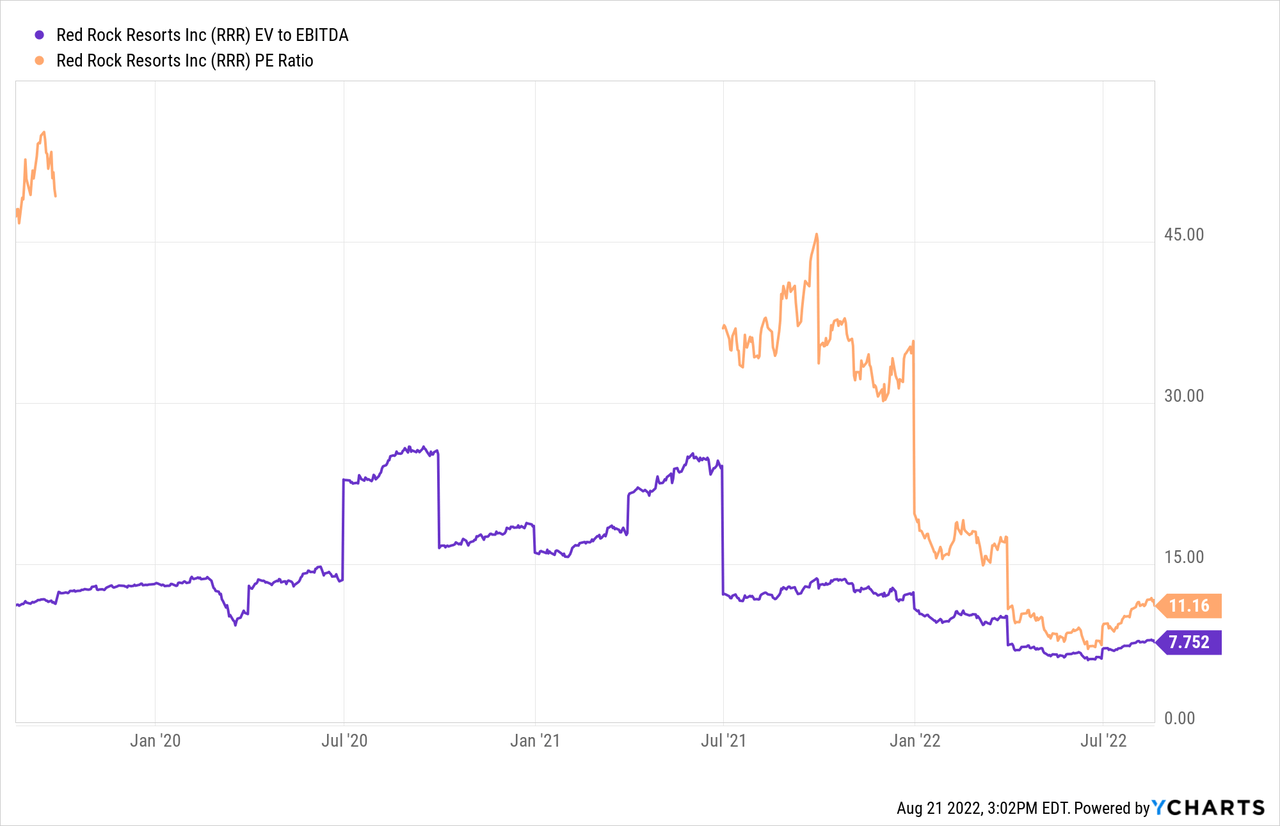

The company’s EV to EBITDA ratio is near its lowest level in the last few years, as shown below.

It is important to value the company this way as the price-to-earnings (P/E) ratio is skewed by non-cash items associated with closures and property sales during this transition.

The non-cash write-downs do have an advantage – tax savings. At the same time, they don’t hurt cash flow, lower net income; and keep the taxman at bay.

Red Rock also pays a dividend with a forward yield of 2.5% and has a robust share repurchase agreement. The company has repurchased over $620 million in shares since June 2020 and has $332 million remaining on the current plan. With a market cap of $4.2 billion, this is an impressive return of capital to shareholders. The remaining $332 million alone represents 8% of the market cap.

What are the risks?

Red Rock Resorts has risks just like any other stock. A prolonged or deep recession could significantly hurt operations in the short term. The company’s pandemic performance mitigates this risk, but each economic slowdown is different. A massive hit to cash flow would probably slow future development.

It’s also possible that the new casino resorts will not perform as the company projects. The company has solid plans and compelling reasons for the locations chosen; however, no plan is infallible.

Finally, Red Rock is not an investment for everyone. It isn’t a high-flying tech stock and is probably unsuitable for short-term investors or traders.

Investors should profit off Red Rock’s rejuvenation

Red Rock is a well-run company with enormous cash flow, hefty return of capital to shareholders, and exciting catalysts.

The last thing a casino and resort operator should be in the highly-competitive landscape of Las Vegas is complacent. Management has made the difficult decision to close some legacy properties to push into the best areas and elevate its facilities. These decisions should benefit the company and shareholders well into the future.

Red Rock’s plans are ambitious, impressive, and will drive long-term profits.

Be the first to comment