Share prices are going up in flames, but the fundamentals remain solid. Lower leasing spreads? We called that several quarters in advance. It’s time to start bargain hunting.

Collab Media/iStock via Getty Images

We purchased shares of Essex Property Trust (NYSE:ESS) today. I don’t usually send alerts out on the public side the same day, but I decided it would be appropriate this time. Sharing the occasional article right away is nice because it means my commentary and images will all still be perfectly up-to-date.

I’ll start by sharing our assessment from our Subscriber Portfolio Update (note: paywalled link).

Portfolio Update Commentary

I would like to add to our position in Essex Property Trust. I think shares got hit too hard lately. However, I’m also watching the sector momentum. We don’t have enough cash on hand to do more than 1 or 2 purchases (of meaningful size) and there are several bargains available with some big negative momentum throughout the apartment REITs.

However, the valuation from the fundamentals looks downright excellent. This is a cheap AFFO multiple on a REIT with a great management team that has done a solid job of producing wealth for shareholders over multiple decades. As it stands, at $209.29 ESS (while writing) is trading at 67% of the consensus NAV estimate. ESS doesn’t take on all that much debt, so movements to NAV shouldn’t be amplified much. Further, ESS has only minimal exposure to floating rate debt. The impact of higher interest expense should be minimal on their AFFO per share for the next several years. A recession could have a material impact, but interest expense should not.

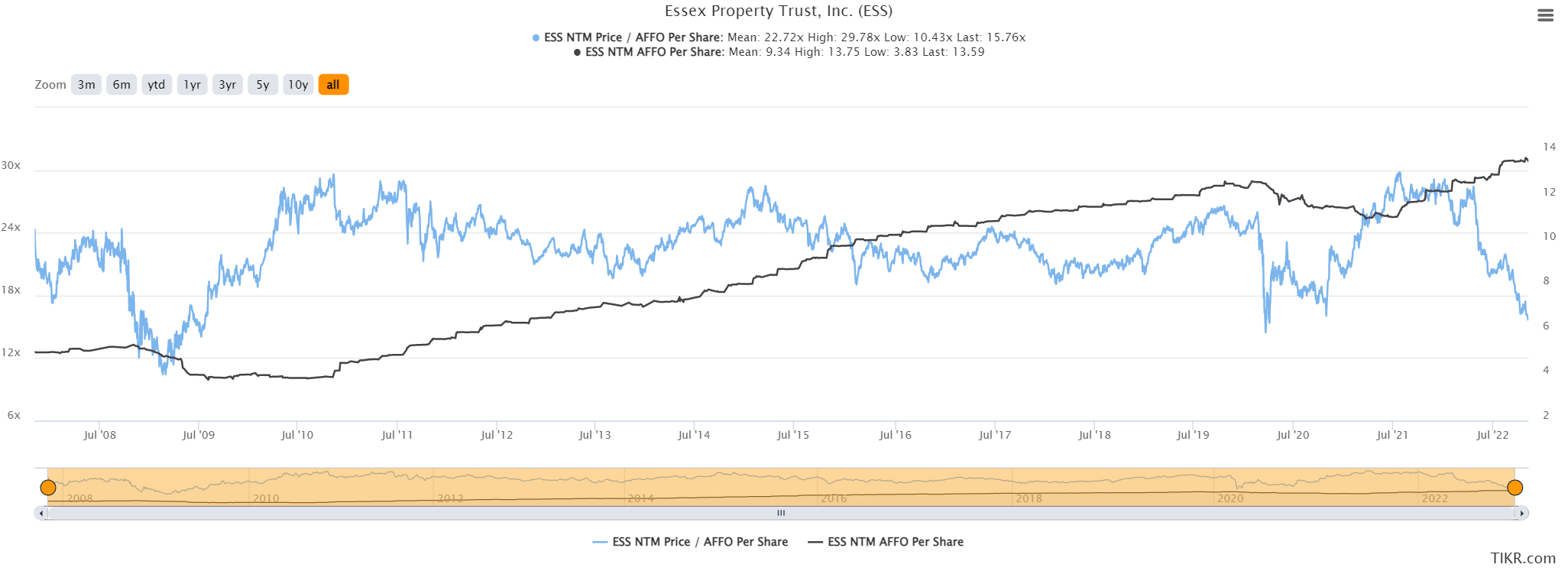

Currently, ESS trades at less than 16x forward projected AFFO. That’s cheap. Aside from the pandemic and the last few months, ESS did not trade below 19x AFFO in the last 10 years.

Aside from the pandemic and the last few months, the last time ESS traded below 18x AFFO was in early August 2009. That was a pretty bad time for apartments, as you may recall. With that in mind, I’m more concerned about waiting too long than moving too early.

TIKR.com

Buying Shares

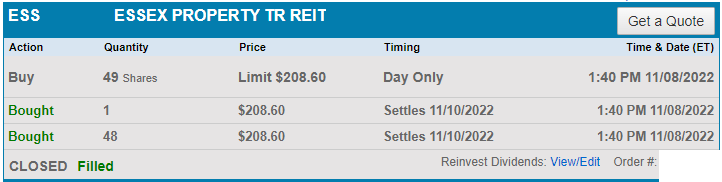

We followed up that article by increasing our position in ESS. Specifically, we purchased 49 shares of Essex Property Trust at $208.60.

The rest of this article is from the trade alert we sent out in real-time, which was earlier today.

ESS simply isn’t overly exposed to interest expense from rising rates and they should still be seeing at least moderate growth in revenue for the portfolio going into next year.

Shares being 20% below the buyback price from Q3 2022 and 25% below the buyback price from Q2 2022 also reinforces my belief that ESS sees the value in their own shares. Rather than ramping up leverage, ESS will sell off the occasional apartment building to fund a buyback because they believe it is a more effective route to generate wealth for shareholders.

We concur. Sometimes ESS should issue new shares (when prices are high), and sometimes they should buy them back.

The Chart

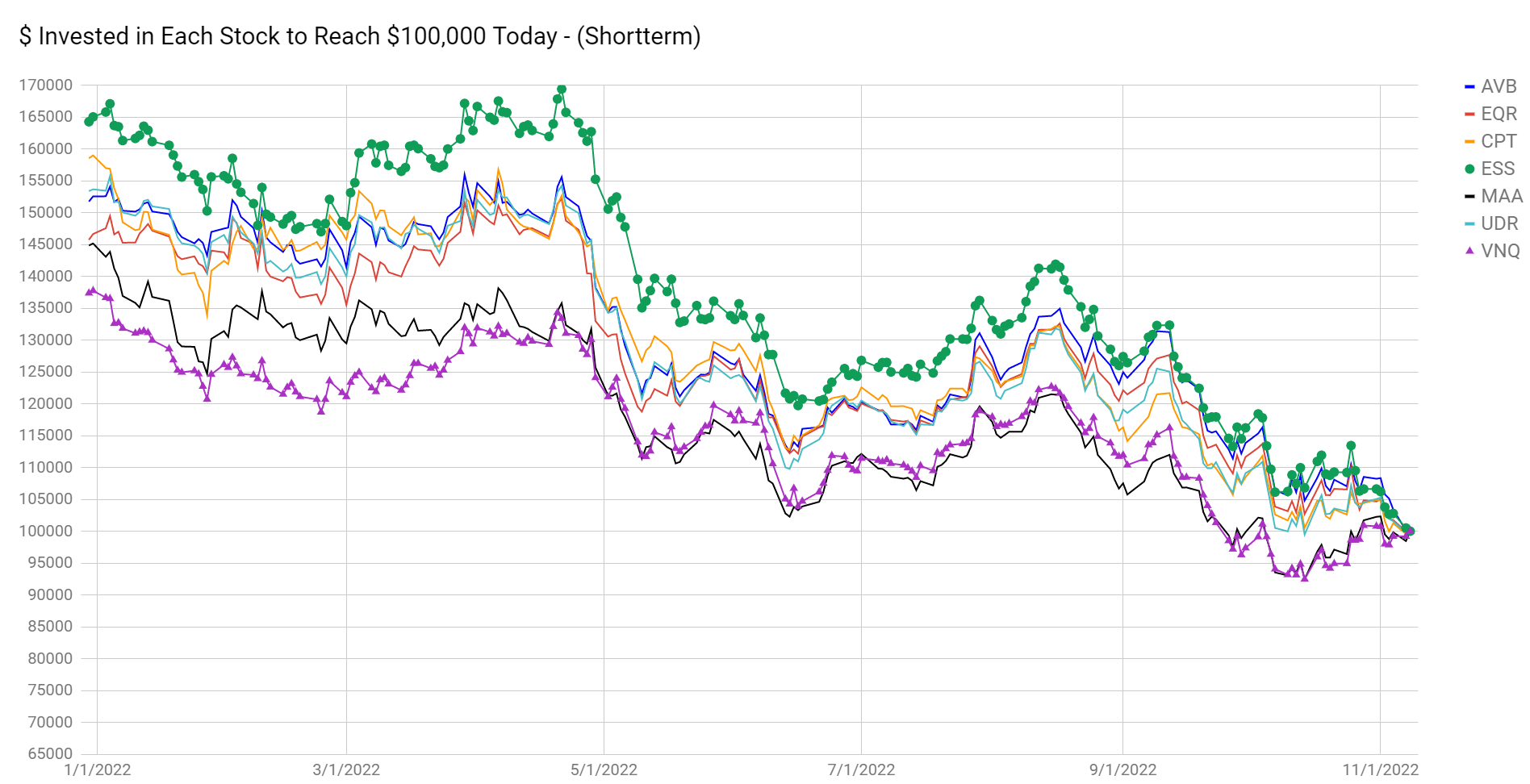

I’m using the $100K chart to compare the major apartment REITs and I’ve tossed in the Vanguard Equity Real Estate (VNQ) (the largest equity REIT ETF) for a comparison:

The REIT Forum

Note: This is a chart we regularly use for subscribers. It demonstrates how much needed to be invested on any prior day to reach $100k today. Because every line must end at $100k, it focuses the chart on today. Rather than focusing on a single arbitrary start date, it allows us to visualize performance from every possible start date within the measurement period.

VNQ, the purple line with triangles, appears as if it may have at least temporarily stopped falling. Likewise, Mid-America Apartment (MAA) has seen a bit of a bounce. However, the rest of the apartment REITs are still struggling to stabilize share prices.

We don’t expect fundamentals for ESS to be materially worse than peers over the next few years, despite their weaker guidance on revenue going into 2023. Understandably, some investors may want to wait to see prices bounce. I think we could see support strengthen by $200 simply due to the “round number effect” combined with the underperformance of ESS bringing them to historically cheap levels.

Round numbers shouldn’t matter. There is no fundamental basis for it. Yet we saw this play out with industrial REITs very recently. Look at the 52-week lows:

Note: The point here is that the values are so close to $50, $50, and $100.

I considered waiting to see if we could snipe these shares around $201, but decided I wouldn’t turn up my nose at ESS around 15.3x forward AFFO.

In a related sector, MH Park REITs have seen a respectable bounce. Sun Communities (SUI) is up over 14% from its lowest close and Equity Lifestyle (ELS) is up over 7% from its lowest close. It’s a small positive sign, but it still helps.

That Time We Sold ESS

In the interest of full disclosure, we did sell some shares of ESS a little over a year ago. On 9/10/2021, we sold off some shares at $324.37 (total value of $9,731.10). Today we spent $10,221.40 to buy 49 shares. Seems like a good deal to me.

Buying Into Weakness

Our prior times for purchasing ESS included early to mid-2018 when concerns about new supply and rising rates were weakening apartment REITs.

We also bought ESS in 2020. We bought when landlords were prohibited from evicting tenants, the economy was shut down, and investors decided BLM would make apartments unlivable for countless years to come. That was when we were buying apartment REITs over and over again.

This is precisely the kind of environment where we tend to get excited about buying apartment REITs. Plunging prices. Headwinds taking over the airwaves. Are apartments finally dead? I doubt it. People still like having a roof.

Execution

Trades went through Schwab:

Schwab

Conclusion

For some investors, this trade will feel too early. They will want to see ESS actually bounce first. There’s nothing wrong with investors taking that approach. Yet we’ve been quite successful with focusing on the fundamentals and evaluating which shares are getting unusually cheap.

It’s possible that ESS could continue to suffer. Yet shares already trade at a substantial discount to consensus NAV (though I expect that number to fall). The number I expect to see continuing to grow is AFFO per share. If the current recession (which I believe we have entered even if it hasn’t been declared) becomes much worse, then we could see results weaken temporarily. However, we’re seeing a 4.2% dividend yield with strong coverage (only a 65% payout ratio) coming from a REIT with a solid management team that is intent on driving value for shareholders.

With shares trading at about 15.3x AFFO while peers are in the 17.1x to 18.9x range, I think ESS has been sold off too hard.

Rent spreads should be the primary headwind referenced over and over for apartment REITs. That isn’t really a surprise. We warned investors about those headlines a long time ago. We were warning people even as the apartment REITs were moving toward setting record highs. For ESS, the highest close happened on 4/21/2022. In less than 7 months shares fell by about 43.3%. Adjusted for leverage at ESS, that would be akin to an apartment building falling by 30% to 35%.

Did apartments fall that way? No.

Are they likely to? No.

Do investors get a chance to buy ESS anywhere remotely close to a 30% discount to NAV on a regular basis? No.

Below 19x AFFO? No.

That’s why we’re starting to build our ESS position again.

Be the first to comment