gorodenkoff/iStock via Getty Images

Thesis

Aberdeen Total Dynamic Dividend Fund (NYSE:AOD) is an equities focused closed end fund. The vehicle was incorporated in October 2006 as a Delaware statutory trust and commenced operations in January 2007. As per the fund’s literature, AOD’s principal objective is current dividend income followed by long-term growth of capital.

AOD is a global equities fund, with the closest index comparison being Vanguard Total World Stock Index Fund ETF (VT). Ultimately AOD transforms global equities returns into monthly dividends. The fund has a de-minimis leverage ratio (sub 1%) and should represent an alpha generating vehicle versus the index. The fund has a robust Sharpe ratio of 0.48 and a standard deviation of 15.9 and has closely mirrored the index on a long term basis. The fund’s annualized returns for 5- and 10-year time frames sit at 6.6% and 8.74% respectively. The fund has the ability to write covered calls or buy puts on up to 10% of the portfolio:

In order to hedge against adverse market shifts, the Fund may utilize up to 10% of its total assets (in addition to the 10% limit applicable to options on stock indices described below) to purchase put and call options on securities. The Fund will also, in certain situations, augment its investment positions by purchasing call options, both on specific equity securities, as well as securities representing exposure to equity sectors or indices and fixed income indices. In addition, the Fund may seek to increase its income or may hedge a portion of its portfolio investments through writing (i.e., selling) covered put and call options

Currently the fund has no option positions in its portfolio.

AOD is trading at a very large -12.5% discount to NAV currently, but has exhibited this behavior during the past ten years. Even during the zero rates 2020-2021 period the fund did not have a premium to NAV. An investor should fully expect returns to come solely from the underlying equities performance. The fund has been solid in the past decade, closely mirroring the world index as reflected in the VT ETF, and has been able to generate a slight alpha to cover its fees. This vehicle is ultimately best suited for retail investors who are looking for monthly dividends from the global stock markets rather than capital appreciation sitting in their accounts. AOD has delivered on that front, and its future performance is dependent on global economic performance and overall stock market returns long term.

Analytics

AUM: $1.03 billion

Sharpe Ratio: 0.48

St Deviation: 15.9

Yield: 8.5%

Expense Ratio: 1.15%

5-year Annualized TR: 6.6%

10-year Annualized TR: 8.74%

Holdings

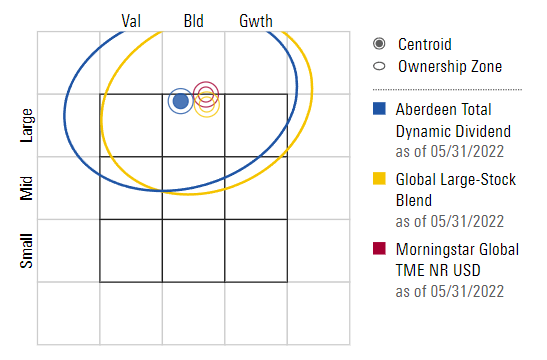

The fund falls in the Large Cap/Blend Morningstar box:

Style Box (Morningstar)

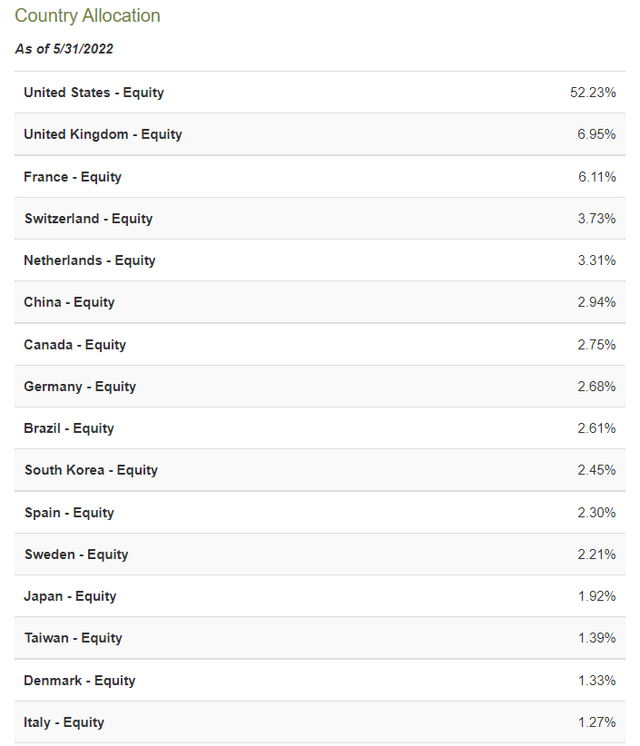

Only roughly half of the fund holdings are U.S. equities:

Country Allocation (CefConnect)

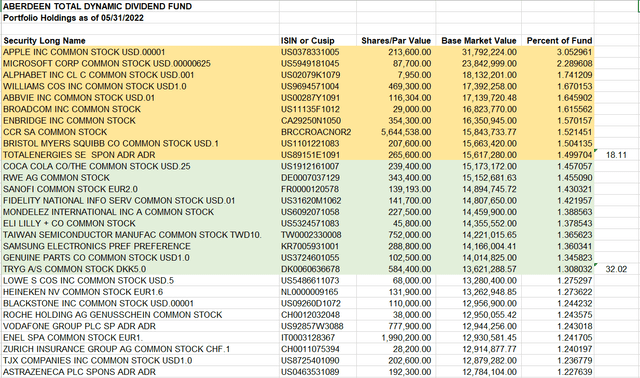

The top-10 portfolio holdings account for only 18% of the fund and they represent leading technology and energy companies:

We can see Apple (AAPL) and Microsoft (MSFT) as top holdings, as large tech representatives, but energy is also present through global companies such as Total (TTE), and names such as Enbridge (ENB).

The fund will ultimately try and generate alpha through its picks, and its global mandate ensures the Large Cap names it picks will have the best risk/reward metrics as determined by the fund managers.

Performance

The fund is down more than -18% year to date, in line with the world index:

YTD Performance (Seeking Alpha)

We can observe a similar “like-for-like” performance on a 5-year basis as well:

5-Year Total Returns (Seeking Alpha)

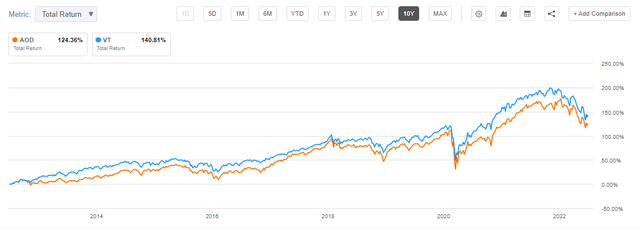

AOD is up roughly +39% while VT is up roughly +42%. We generally would like to see actively managed vehicles such as AOD generate “alpha”, or better said outperform the index on long term ranges, but given the wide dispersion of equity CEFs performance the AOD returns are very good, also considering the annual fee the fund has to cover via its performance.

Ultimately the only thing that the CEF structure achieves here is to take long term capital gains and transform them into monthly dividends and income. An investor who would have put capital into VT would have achieved roughly the same result after five years, the only difference being that said investor would sit on a long term capital gain while an investor into AOD would have received monthly distributions during said period.

The ten year performance paints a similar picture when comparing AOD to VT:

10-Year Performance (Seeking Alpha)

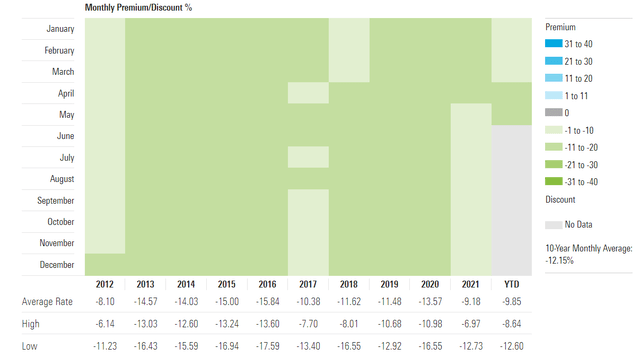

Premium/Discount to NAV

This is where things get interesting regarding an AOD investment. Currently the fund is trading at a substantial -12.5% discount to NAV:

Premium / Discount to NAV (Morningstar)

We can see that for 2022 the current discount is close to a record level, but when compared to historical averages it falls within median levels. Ultimately this fund tends to trade at discounts to NAV above -10%.

Unless the fund manager starts repurchasing shares or the fund is liquidated, then do expect for this discount to persist, although the collateral is extremely liquid. Very interestingly the fund did not experience a premium to NAV even during the zero rates 2020 – 2021 period.

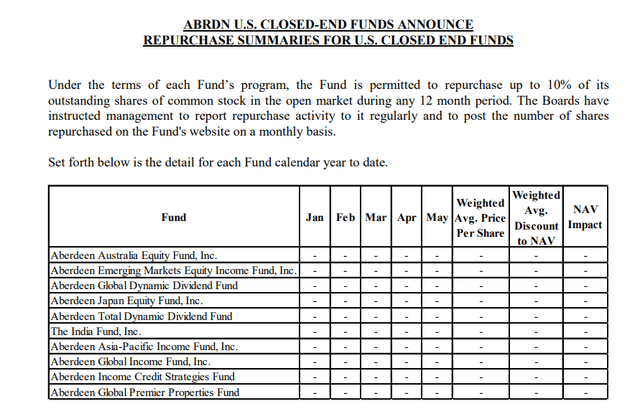

AOD does have the ability to repurchase shares as per its docs, but has not done so in the past year:

Share Repurchase (Fund Literature)

Conclusion

AOD is a good vehicle to transform global equities capital gains into monthly dividends. The fund has closely mirrored the Vanguard Total World Stock Index Fund ETF in the past decade and has successfully been able to generate a slight alpha to cover its fees. The vehicle is currently trading at a significant -12.5% discount to NAV, but has always displayed this type of behavior in the past decade. An investor looking for monthly income from the global capital markets should consider AOD, while individuals who are not bothered by capital gains can invest in the index outright.

Be the first to comment