TkKurikawa/iStock Editorial via Getty Images

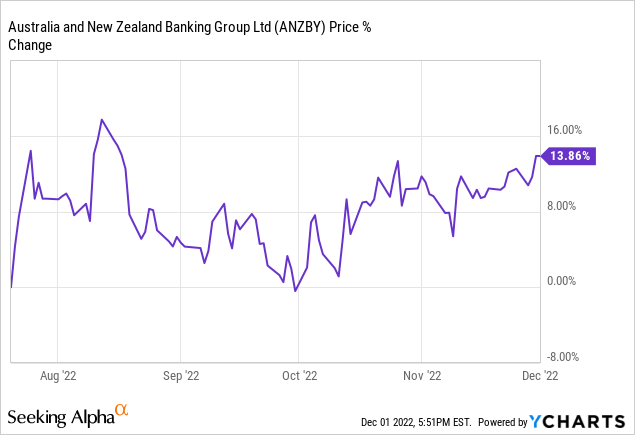

Up around 13.5% in the interim, shares of Australia and New Zealand Banking Group (OTCPK:ANZBY)(OTCPK:ANEWF)(“ANZ”) have done well since I first covered them with a ‘buy’ rating in the summer. To recap, the bullish thesis on this one was part structural – the oligopolistic nature of the Australian banking system being generally conducive to economic profit generation – and part value-based, with a valuation of just over tangible book value looking like a bargain given the bank’s potential to generate a through-the-cycle double-digit return on tangible equity.

Although it has only been a little over four months since that article, ANZ has released an encouraging set of full-year results in the meantime, with core profits up, expenses kept in check and credit quality remaining solid all things considered. While it’s not all rosy here – the economic outlook is souring and guidance on FY23 costs was a slight negative – ANZ should see the pop from higher interest rates continue to support earnings, and these shares still trade some way below my A$30 fair value estimate. Buy.

Higher Interest Rates Now Feeding Through

Interest rates are rising, and for a bank like ANZ (dependent on net interest income, with a strong core deposit franchise and relatively high share of variable rate loans) that often makes for a strong tailwind to income. The Reserve Bank of Australia has raised the cash rate seven times now in calendar 2022, and with all of those occurring in the back half of ANZ’s fiscal year that is unsurprisingly where growth showed up the strongest.

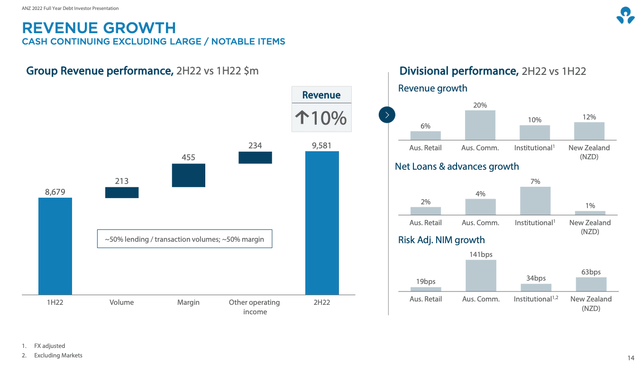

With that, net interest income (“NII”) was A$7.77B in H2, up 9% half-on-half. Non-NII income was relatively flat (including large notable items), but flat expenses led to positive jaws. Pre-provision operating income (“PPOP”) was thus up 16% half-on-half to just over AUD $4.8B, which management noted was the bank’s best sequential performance since the global financial crisis.

As mentioned, margins obviously played a big role in that, with the bank now reaping the benefits from higher rates on its loans and investment portfolio while funding cost increases lag. Net interest margin was 1.68% in H2 2022, 10bps higher than the prior period. Volumes, though, were also positive, contributing circa half of revenue growth and with net loans and advances up across all divisions.

Image Source: ANZ Banking Group FY22 Results Presentation

Credit quality remained robust, helping to support net income. The bank recorded a release of A$232m for the full year, while the second half in isolation saw a circa A$50m impairment charge. Clearly these figures remain well below through-the-cycle averages and are supporting profitability. Return on tangible equity (“ROTE”) was 10.7% in H2, up 70bps half-on-half.

The Outlook

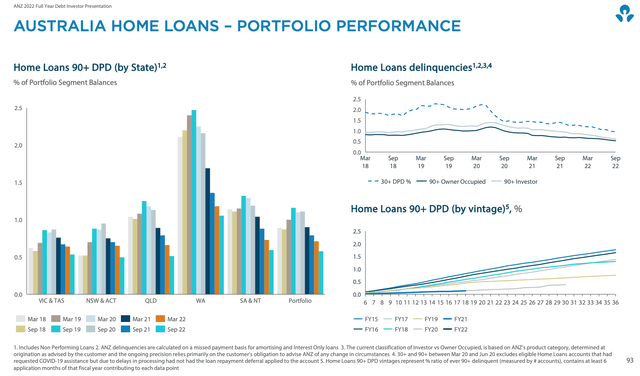

Credit quality definitely looks like a bright spot. Notwithstanding the souring economic outlook, the H2 impairment charge was only modestly higher than the ~A$75m release recorded a year ago. Gross impaired assets also continue to look benign, clocking in at circa A$1.45B (0.21% of the loan book) at the end of September versus A$ 1.97B (0.31% of gross loans) a year prior. Home loans 90-plus days past due also fell again in H2 and remain well below recent historical levels.

Image Source: ANZ Banking Group FY22 Results Presentation

Looking ahead, management remain fairly upbeat on the subject, citing relatively high household savings and robust employment figures among other factors that will help moderate negative factors like falling house prices. Credit quality weakening in 2023 is pretty much a slam dunk given the unsustainable baseline and the wider economic picture, but I’m cautiously optimistic that it will hold up better than I feared a few months ago. I’d also note that expected credit loss under the 100% ‘severe’ downside scenario (which includes a 40% peak-to-trough fall in residential real estate prices and double-digit peak unemployment) is still well below current levels of PPOP generation. Over the long run management continues to target a loss rate of circa 20bps.

Elsewhere, the impact of higher interest rates will continue to be a boon to revenue and PPOP. Management expects a more modest boost to NIM this fiscal year relative to the 2022 exit rate (1.8%), but vis-a-vis the year average (1.63%) there is obviously still a lot of scope for margin-driven growth. That, in turn, should drive healthy revenue growth this year.

On the flip side, credit growth looks set to be a headwind as demand weakens, while operating cost guidance of 5% year-on-year growth looks set to be a headwind to PPOP growth. Management does expect positive jaws, though, so even with higher impairments factored in I’m expecting at least stable net income this year.

Shares Remain Cheap

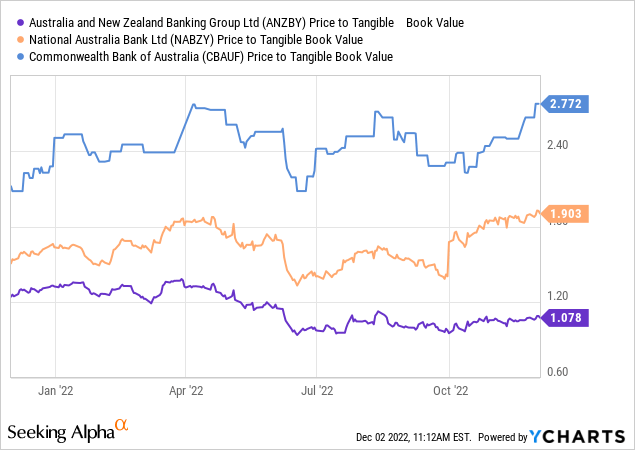

ANZ stock trades for circa A$24.65 as I type, putting them at around 1.2x tangible book value and just under 11x cash earnings per share. That continues to look cheap to me and it represents a steep discount to peers like CommBank (OTCPK:CBAUF) and National Australia Bank (OTCPK:NABZY).

ANZ has had its issues in the past – growth, particularly in retail banking, has lagged, for example – and valuations may differ on account of different ROTE profiles and so on. While I’m not arguing that these banks should all trade at the same P/TBV, the gap between them looks too wide, and I expect ANZ to outperform. I’m sticking with my fair value of A$30, which corresponds to just under 1.5x tangible book value against an across-the-cycle average ROTE in the low-teens. With implied upside of 20% these shares still look like a bargain, while the 2022 dividend of A$1.46 per share likewise corresponds to an attractive yield of almost 6%. Buy.

Be the first to comment